France Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0532

- 120

-

France Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

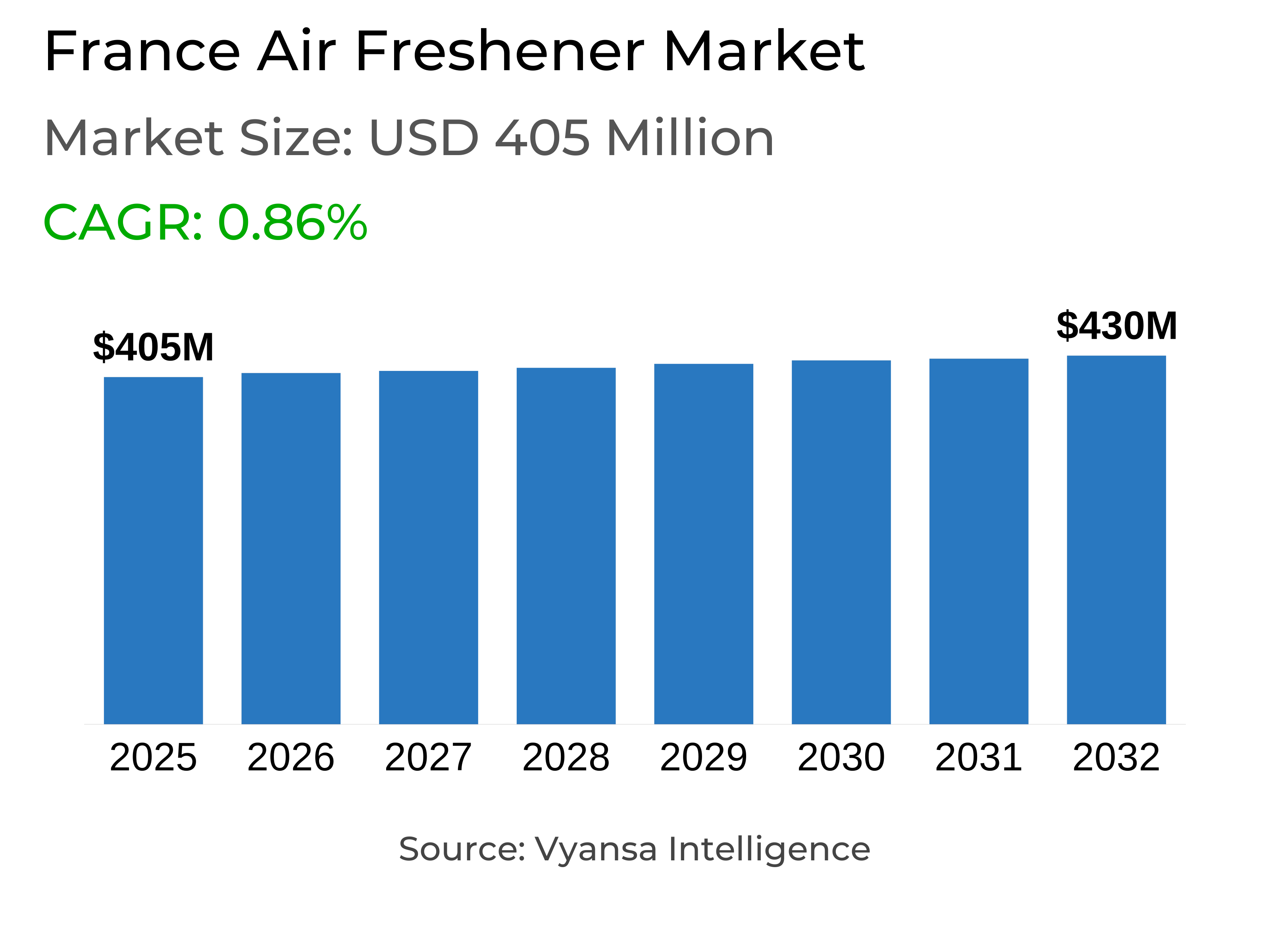

- Air Freshener in France is estimated at $ 405 Million.

- The market size is expected to grow to $ 430 Million by 2032.

- Market to register a CAGR of around 0.86% during 2026-32.

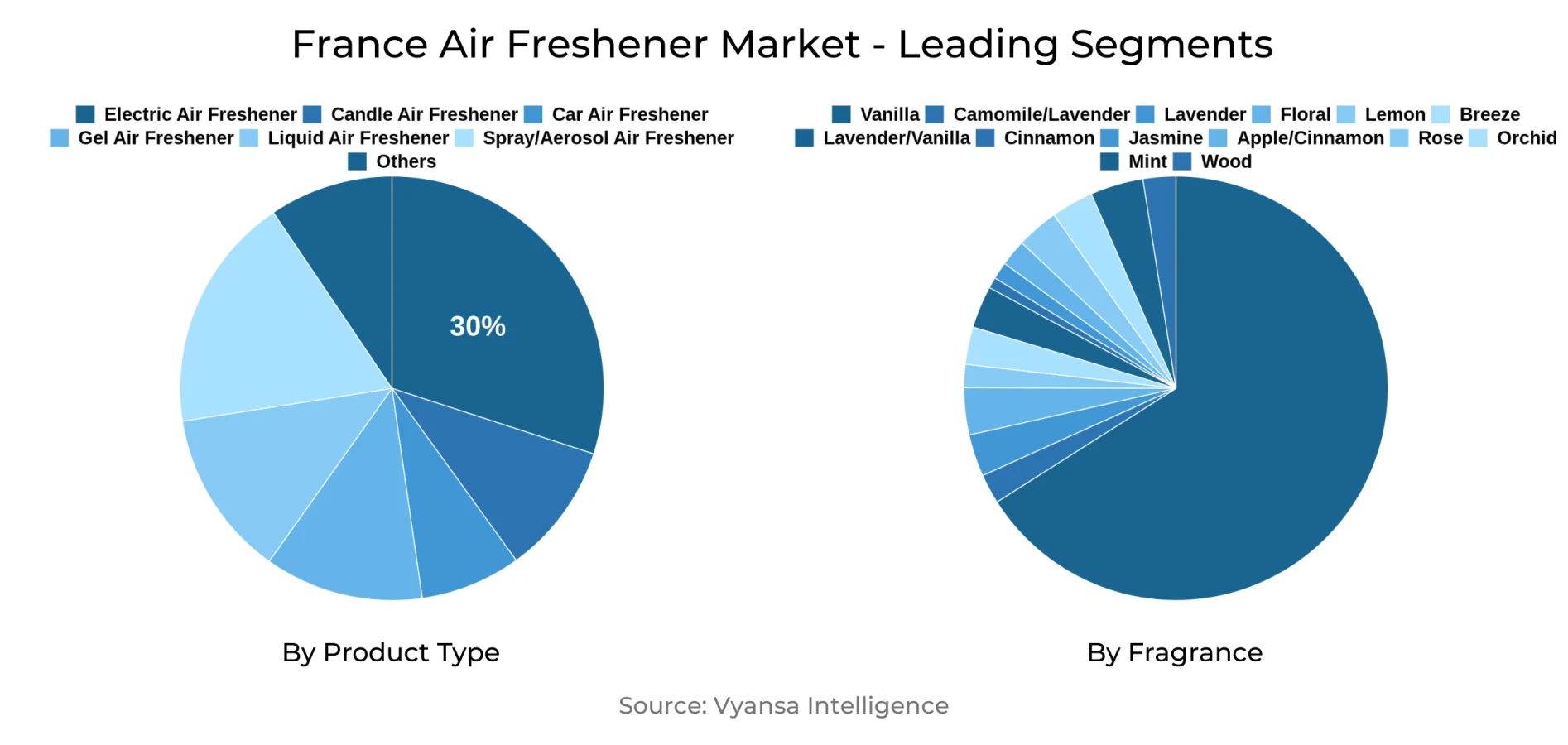

- Product Type Shares

- Electric Air Freshener grabbed market share of 30%.

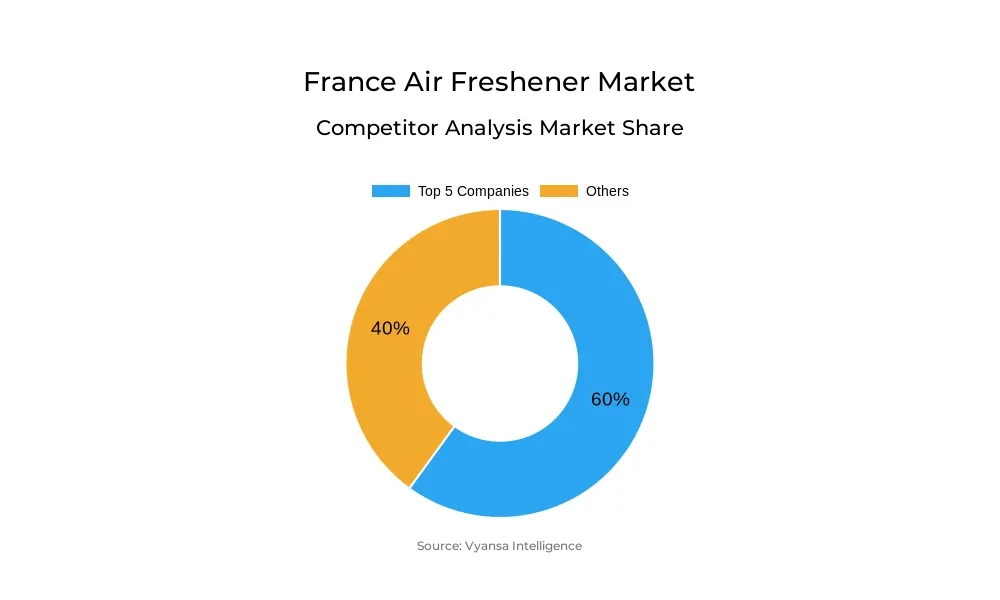

- Competition

- More than 15 companies are actively engaged in producing Air Freshener in France.

- Top 5 companies acquired around 60% of the market share.

- Yankee Candle Co (Europe) Ltd, Eau Écarlate SA, Durance SAS, Reckitt Benckiser France SA, SC Johnson SAS etc., are few of the top companies.

- Fragrance

- Vanilla continues to dominate the market.

France Air Freshener Market Outlook

The France air fresheners market is poised to grow modestly during the forecast period, rising from an estimated USD 405 million in 2025 to USD 430 million in 2032. Household consumption is set to remain guarded, with homes allocating budget to necessities ahead of discretionary items. Electric, automobile, and gel air fresheners are likely to also encounter continued declines because of their greater expense, health and safety issues, and limited sustainable appeal. Promotion-driven formats will also suffer under rules like the Descrozaille law, limiting in-your-face discounting strategies.

Candle air fresheners are predicted to be the most resilient segment, due to their dual role as decorations and gift items. The continuous cocooning factor, together with more innovative designs and better fragrances, will underpin demand for candles in retail channels. Private labels as well as home products specialists, such as Ikea and Zara Home, are likely to stimulate growth by producing high-quality low-priced alternatives, attractive to budget-conscious end users looking to improve the aesthetic of their homes.

Digitally native vertical brands (DNVBs) will come to dominate, with social media and internet marketing used to sell distinctive, aesthetic, and frequently handcrafted air care goods. Such brands are positioned to take advantage of style-driven end users who are willing to pay a premium for ecological and multifunctional options. Goods containing natural components and green packaging will increasingly gain attention as ecologically and health-conscious awareness grows.

Scent preferences will also continue to be stable, with vanilla still ruling the roost, backed by traditional and contemporary air care products. The overall market scenario, on the whole, indicates steady growth due to candles, eco-friendly products, and digitally native players, while traditional and promotion-based formats continue to struggle in a price-sensitive consumer landscape.

France Air Freshener Market Growth Driver

Growing Preference for Natural and Multifunctional Products

Demand for natural air care and multifunctional products from end users is one of the major trends driving the France Air Freshener Market. End users are increasingly looking for products that, in addition to eliminating odours, provide aesthetic appeal to the home, e.g., decorative candles. Products that use essential oils or natural ingredients attract health-oriented end users as they minimize chemical exposure while staying in tandem with eco-friendly lifestyles.

Sustainability factors also play a part in purchasing decisions, with eco-conscious improvements in packaging, refillable systems, and responsibly sourced ingredients appealing to end users today. Small, niche brands are the beneficiaries of this trend, providing innovative products that address these concerns. The appeal of natural, multifunctional, and sustainable air care products is directly driving innovation, product development, and category expansion in France.

France Air Freshener Market Trend

Expansion of Candle Air Fresheners and Digital-First Brands

Candle air fresheners are a leading trend in France, since they serve two purposes as decorations and as effective air care products. End users are more likely to use candles as budget luxuries that improve home surroundings, and excellent fragrance and unique designs improve sales. Seasonal sales and seasonal-themed fragrances also contribute to demand and repeat business.

Digitally native vertical brands (DNVBs) are surging with direct-to-consumer models and social media advertising. These brands emphasize design, sustainability, and niche appeal, which enables them to appeal to style-oriented and younger end users. Both candles and DNVBs portray the larger trend of air care products becoming lifestyle and aspirational products versus functional-only products.

France Air Freshener Market Opportunity

Expansion Through Home Specialists and Private Labels

France Air Freshener Market provides impressive opportunities through expansion in home product specialists and private labels. Retailers like Ikea and Zara Home can lead value growth by encouraging end users to spend money on their homes with premium quality candle air fresheners. They have the potential to harness premium segment demand nicely by developing aspirational buying experiences.

Private labels will also grow, taking advantage of competitive pricing, better designs, and seasonal buys to appeal to cost-conscious end users. Digitally native brands can also succeed online, appealing to niche audiences with sustainable and design-driven solutions. These will allow brands to capitalize on changing consumer sentiment toward green, multi-functioning, and fashionable air care solutions.

France Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

The segment with highest market share under Product Type is Electric Air Freshener, which accounts for approximately 30% of the market. Electric air fresheners are considerably in demand due to their feature of delivering continuous and regulated fragrance, thus being easy to use on a daily basis in the home.

The category is likely to continue steady growth as companies experiment with natural ingredients, multi-benefit properties, and upscale looks. Ongoing technological advancements in fragrance quality, eco-friendliness, and ease of use are supporting electric air fresheners popularity among end users. Therefore, this category is likely to continue being the market leader in the French air freshener market throughout the forecast period.

By Fragrance

- Camomile/Lavender

- Lavender

- Floral

- Vanilla

- Lemon

- Breeze

- Lavender/Vanilla

- Cinnamon

- Jasmine

- Apple/Cinnamon

- Rose

- Orchid

- Mint

- Wood

The segment with highest market share under Sales Channel is retail offline and has a market share of 55%. Hypermarkets, supermarkets, and home product specialists lead this channel because of their wide product range, competitive prices, and capacity to display premium and seasonal air care items. Offline retail remains attractive to end users desiring touch evaluation of fragrances and design features before making a purchase.

Offline retail growth is likely to be augmented by candle air fresheners and private label products, which are successful because they have decorative and gift-like popularity. Home furniture experts such as Ikea will drive high-ticket sales by offering themed promotions and aspirational shopping experiences. Although digital channels are expanding, offline retail is the primary channel for the purchase of air fresheners through convenience and extensive product options.

Top Companies in France Air Freshener Market

The top companies operating in the market include Yankee Candle Co (Europe) Ltd, Eau Écarlate SA, Durance SAS, Reckitt Benckiser France SA, SC Johnson SAS, Procter & Gamble France SNC, Little Trees Europe Ltd, Idéal SA, Galec - Centre Distributeur Edouard Leclerc, Système U Centrale Nationale SA, etc., are the top players operating in the France Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Air Freshener Market Policies, Regulations, and Standards

4. France Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. France Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. France Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. France Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. France Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. France Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. France Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Reckitt Benckiser France SA

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. SC Johnson SAS

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Procter & Gamble France SNC

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Little Trees Europe Ltd

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Idéal SA

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Yankee Candle Co (Europe) Ltd

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Eau Écarlate SA

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Durance SAS

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Galec - Centre Distributeur Edouard Leclerc

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Système U Centrale Nationale SA

12.1.10.1. Business Description

12.1.10.2. Product Portfolio

12.1.10.3. Collaborations & Alliances

12.1.10.4. Recent Developments

12.1.10.5. Financial Details

12.1.10.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.