France Advanced Fighter Jets Market Report: Trends, Growth and Forecast (2026-2032)

By Generation (4th Generation, 5th Generation), By Aircraft Type (Multi-Role Fighters, Air-Superiority Fighters, Trainer Fighters), By Technology (Stealth Capability, Sensor Fusion, AI Integration, Electronic Warfare), By Propulsion (Single Engine, Twin Engine)

- Aerospace & Defense

- Nov 2025

- VI0411

- 110

-

France Advanced Fighter Jets Market Statistics and Insights, 2026

- Market Size Statistics

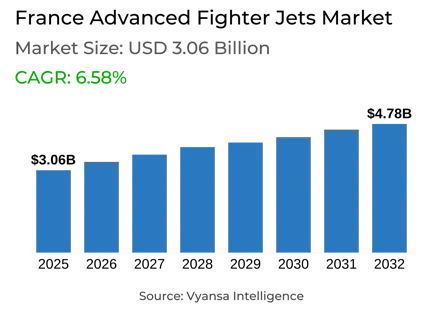

- Advanced Fighter Jets in France is estimated at $ 3.06 Billion.

- The market size is expected to grow to $ 4.78 Billion by 2032.

- Market to register a CAGR of around 6.58% during 2026-32.

- Aircraft Type Shares

- Multi-Role Fighters grabbed market share of 65%.

- Competition

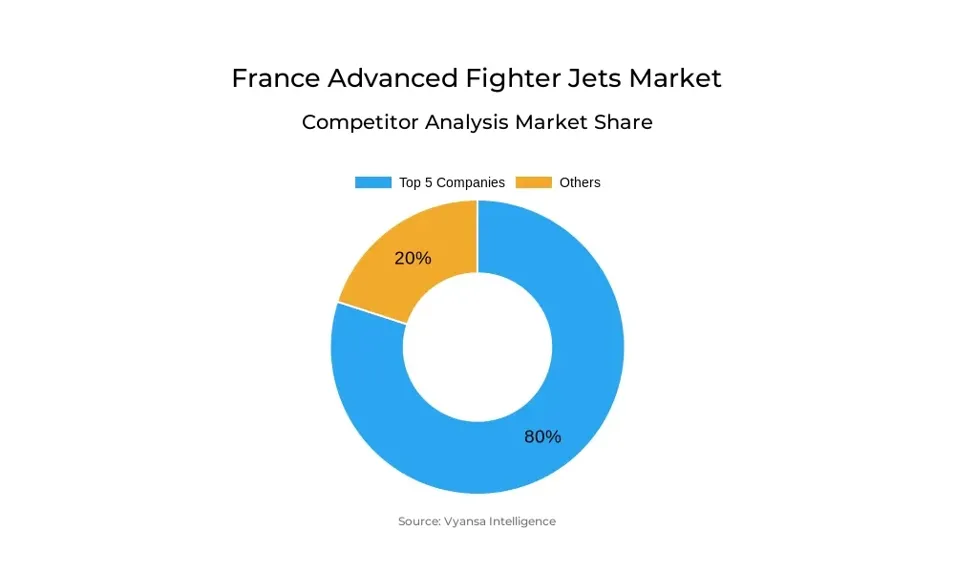

- More than 10 companies are actively engaged in producing Advanced Fighter Jets in France.

- Top 5 companies acquired 80% of the market share.

- Tata Advanced Systems Limited, Lockheed Martin, General Electric Aerospace, Dassault Aviation, Safran Group etc., are few of the top companies.

- Propulsion

- Twin Engine grabbed 70% of the market.

France Advanced Fighter Jets Market Outlook

France Advanced Fighter Jets Market is a key component of the defense industry in France, valued at $3.06 Billion in 2025. The market is dominated by the modernization of the French Air Force fleet consisting of multirole, air-superiority, and trainer aircraft. The need to replace aging aircraft and maximize operational capabilities has generated high demand for advanced jets with excellent performance, reliability, and flexible mission capacity.

By 2032, the market is likely to expand to $4.78 Billion, a representation of greater procurement, upgrades, and integration of next-generation technologies. The market is very concentrated, with the leading five companies commanding 80% of the overall share, a demonstration of intense dominance by major players like Dassault Aviation, Thales, Safran, Airbus, and MBDA. The companies are utilizing their technology-driven capabilities to provide multirole and air-superiority aircraft with improved avionics, electronic warfare capabilities, and weapons integration.

With regard to propulsion, twin-engine planes have the lion's share of 70% of the total. The planes are chosen for their greater thrust, operating range, and mission versatility, which qualify them for both internal defense and foreign export programs. Single-engine jets, though less in proportion, still have significant roles in pilot training and light combat sorties.

Generally, France's advanced fighter jet market outlook is healthy with steady growth fueled by fleet modernization, technology advancement, and strategic exports. The focus of top companies guarantees a competitive environment in which innovation and capability development is key to maintaining market leadership.

France Advanced Fighter Jets Market Growth Driver

Modernization of the French Aircraft Fleet Driving Demand

The modernization of the French aircraft fleet is one of the primary market drivers for advanced fighter aircraft since it entails the purchase of new and advanced planes to substitute outdated ones. In 2025, the French defense budget was approximately USD 55 billion, an 8% increase from the previous year. This massive investment indicates the country's commitment to enhancing its military capabilities, such as procuring advanced fighter jets to support national defense and assert technological superiority.

Additionally, a best example of this drive for modernization is the France-India agreement to buy 26 Rafale Marine aircraft for approximately USD 7.5 billion. Not only does this deal strengthen bilateral defense ties, but also reflects international demand for advanced fighter planes. Also, the purchase by Croatia of 12 Rafale fighter aircraft to replace the Soviet MiG-21s again demonstrates this air force modernization trend with advanced French fighters. These happenings are indicative of a widening market for technologically advanced fighter jets driven by the need to replace aged fleets with newer, technologically sophisticated, and more advanced airplanes.

France Advanced Fighter Jets Market Challenge

Export License Restrictions and Approval Delays Impeding Growth

Export license restrictions and approval delays are major obstacles in France's advanced fighter jet industry. The strict export control laws of France, as determined by national laws and international obligations, mandate detailed evaluations prior to the issuing of export licenses for military hardware. These strict processes may create lengthy approval times, which negatively influence timely fighter jet deliveries to overseas clients. For example, the French Ministry of Armed Forces has placed strong emphasis on complying with these export controls to meet national security requirements and commitments at the international level.

Delays in this regard can affect the competitiveness of French manufacturers in the global defence market. Prospective buyers may look elsewhere for other suppliers with a more responsive approval process, potentially losing contracts to French manufacturers. In addition, uncertainty over export clearances can make production planning more difficult and put a strain on relations with foreign partners. So, although export controls are necessary for protecting security and compliance, they pose difficulties that will get in the way of the development and competitiveness of France's advanced fighter aircraft industry.

France Advanced Fighter Jets Market Trend

Integration of Advanced Electronic Warfare & Cyber Capabilities Shaping Market Dynamics

The convergence of next-generation electronic warfare (EW) and cyber technologies is having a significant impact on the French advanced fighter aircraft sector, as manufacturers retrofit aircraft to counter new threats. For example, Rafale arrives equipped with the SPECTRA EW suite, which is manufactured by Thales and MBDA. The system offers complete defense by detecting and recognizing most forms of threats while countering radar, infrared, and laser-guided missiles. The SPECTRA system is continuously being improved upon to counter evolving threats so that the Rafale becomes effective in modern battle spaces.

In addition, the French Ministry of Armed Forces is investing in the training of cybersecurity professionals to support defense against cyber attacks. Airbus Defence and Space has been commissioned to train cybersecurity professionals on behalf of the Ministry to make France's defense establishment more resilient. Such a focus on cyber capabilities supports the physical advancements of fighter aircraft to ensure a comprehensive strategy for warfare in modern times. Through the incorporation of these sophisticated EW and cyber capabilities, French producers are placing their aircraft in a position to address the needs of modern battlefields, thus driving market forces among advanced fighter aircraft in France. The progress of next-generation program aircraft poses a major opportunity for industry players in the French advanced fighter plane industry.

France Advanced Fighter Jets Market Opportunity

Next-Generation Aircraft Programs Offering Lucrative Opportunity

The development of next-generation aircraft projects represents a big business opportunity for players in the French advanced fighter jet market. The Future Combat Air System (FCAS) is a joint program between France, Germany, and Spain to replace current fleets with a sixth-generation fighter jet by 2040. The project is valued at more than USD 117 billion, reflecting its potential implications for the defense sector. Firms such as Dassault Aviation, Thales, and Safran are fully engaged in the FCAS program and working on developing cutting-edge technologies that will define the future of air combat.

Besides the FCAS, the United Kingdom, Italy, and Japan-led Global Combat Air Programme (GCAP) offers additional opportunities for market growth and cooperation. The program seeks to build a sixth-generation fighter aircraft with possibilities for sales to other nations in the future. French businesses, especially those that are into avionics, propulsion, and stealth technology, can use their knowledge to join these international projects. Through these next-generation aircraft projects, industry players can advance their technological prowess, boost their market share, and obtain long-term contracts, becoming leaders in the new global defense scene.

France Advanced Fighter Jets Market Segmentation Analysis

By Aircraft Type

- Multi-Role Fighters

- Air-Superiority Fighters

- Trainer Fighters

The most popular segment by market share in the France Advanced Fighter Jets Market by aircraft type is Multi-Role Fighters, holding 65% of the market. The French Air Force prefers these aircraft because they can undertake a variety of missions such as air-to-air combat, ground attack, and reconnaissance, due to their versatility. The demand for multirole fighters is high due to fleet modernization programs and demands for combat flexibility.

The rest 35% of the aircraft type segment is divided between Air-Superiority Fighters and Trainer Fighters. Air-superiority fighters are mostly dedicated to dominating the air and defending the French air space, whereas trainer fighters are required for pilot training and the development of skills. While their share of the market is lower than that of multirole fighters, these types of aircraft are essential to operational readiness and having the French Air Force properly capable of deploying and operating advanced fighter aircraft in all mission areas.

By Propulsion

- Single Engine

- Twin Engine

The most dominant segment under propulsion type in the France Advanced Fighter Jets Market is Twin-Engine aircraft, which holds a market share of 70%. The French Air Force favors these aircraft because they offer increased performance, reliability, and compatibility with complicated missions like long-range attacks, air superiority, and multi-role operations. Twin-engine jets ensure more safety and endurance and are thus best suited for advanced combat missions and foreign export programs.

The other 30% of the propulsion share lies with Single-Engine aircraft, used mostly for training and light combat missions. As small as their share is, single-engine jets are affordable and less expensive to maintain, backing pilot training schemes and tactical missions where agility and operational thrift matter. Combined, these propulsion classes serve to ensure that France has a balanced and effective fighter force across all operations.

Top Companies in France Advanced Fighter Jets Market

The top companies operating in the market include Tata Advanced Systems Limited, Lockheed Martin, General Electric Aerospace, Dassault Aviation, Safran Group, Thales Group, Airbus Defence and Space, MBDA, Leonardo S.p.A., Northrop Grumman, etc., are the top players operating in the France Advanced Fighter Jets Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Advanced Fighter Jets Market Policies, Regulations, and Standards

4. France Advanced Fighter Jets Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Advanced Fighter Jets Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Generation

5.2.1.1. 4th Generation- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. 5th Generation- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Aircraft Type

5.2.2.1. Multi-Role Fighters- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Air-Superiority Fighters- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Trainer Fighters- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Technology

5.2.3.1. Stealth Capability- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Sensor Fusion- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. AI Integration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Electronic Warfare- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Propulsion

5.2.4.1. Single Engine- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Twin Engine- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

1.1.1.1. Competition Characteristics

1.1.1.2. Market Share & Analysis

6. France 4th Generation Advanced Fighter Jets Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Aircraft Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Technology- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Propulsion- Market Insights and Forecast 2022-2032, USD Million

7. France 5th Generation Advanced Fighter Jets Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Aircraft Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Technology- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Propulsion- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Dassault Aviation

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Safran Group

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Thales Group

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Airbus Defence and Space

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.MBDA

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Tata Advanced Systems Limited

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Lockheed Martin

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.General Electric Aerospace

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Leonardo S.p.A.

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Northrop Grumman

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Generation |

|

| By Aircraft Type |

|

| By Technology |

|

| By Propulsion |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.