Egypt Footwear Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Children's Footwear (Infants (0-9 Months) Foot Length (CM) (8.3-8.9, 9.2-9.5, 10.1-10.5), Toddlers (9 Months - 4 Years) Foot Length (CM) (10.8, 11.4-11.7, 12.1-12.7, 13.0-13.3, 14.0-14.3, 14.6-15.2, 15.6-15.9, 16.5), Little Kids (4-7 Years) Foot Length (CM) (16.8, 17.1-17.8, 18.1-18.4, 19.1-19.4, 19.7-20.6, 21.0-21.6), Big Kids (7-12 Years) Foot Length (CM) (21.9, 22.2-23.5, 24.1-24.8)), Women's Footwear (Foot Length (CM) (20.8, 21.3-21.6, 22.2-22.5, 23.0-23.8, 24.1-24.6, 25.1-25.9, 26.2-26.7, 27.6)), Men's Footwear (Foot Length (CM) (23.5, 24.1-24.8, 25.4-25.7, 26.0-26.7, 27.0-27.9, 28.3-28.6, 29.4, 30.2, 31.0-31.8))), By Product Type (Casual, Athletic/Sports, Formal, Others), By Sales Channel (Retail Online, Retail Offline), By Material (Leather, Textile, Rubber, Synthetic, Canvas), By Price (Mass, Premium), By Footwear Type (Shoes (Sneakers, Boots), Sandals & Slippers (Flip-Flops)), By Application (Conventional Footwear (Daily Wear, Work/Office Wear, Outdoor & Adventure, Sports & Fitness, Party/Occasion Wear), Functional/Therapeutic Footwear (Therapeutic/Orthopedic, Medicated Slippers, Acupressure Slippers)), By Region (Cairo, Alexandria, Others)

- FMCG

- Jan 2026

- VI0964

- 130

-

Egypt Footwear Market Statistics and Insights, 2026

- Market Size Statistics

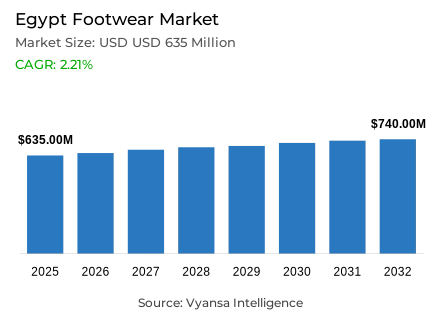

- Footwear in Egypt is estimated at USD 635 million in 2025.

- The market size is expected to grow to USD 740 million by 2032.

- Market to register a cagr of around 2.21% during 2026-32.

- Category Shares

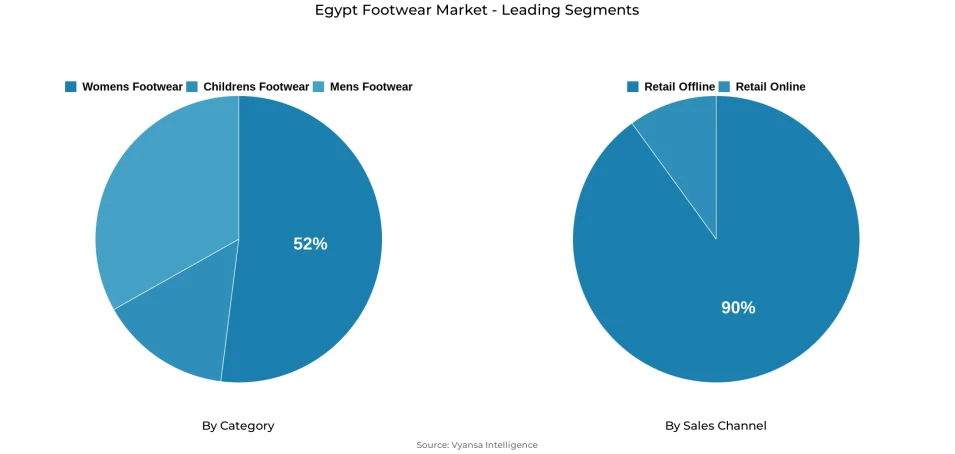

- Women's footwear grabbed market share of 52%.

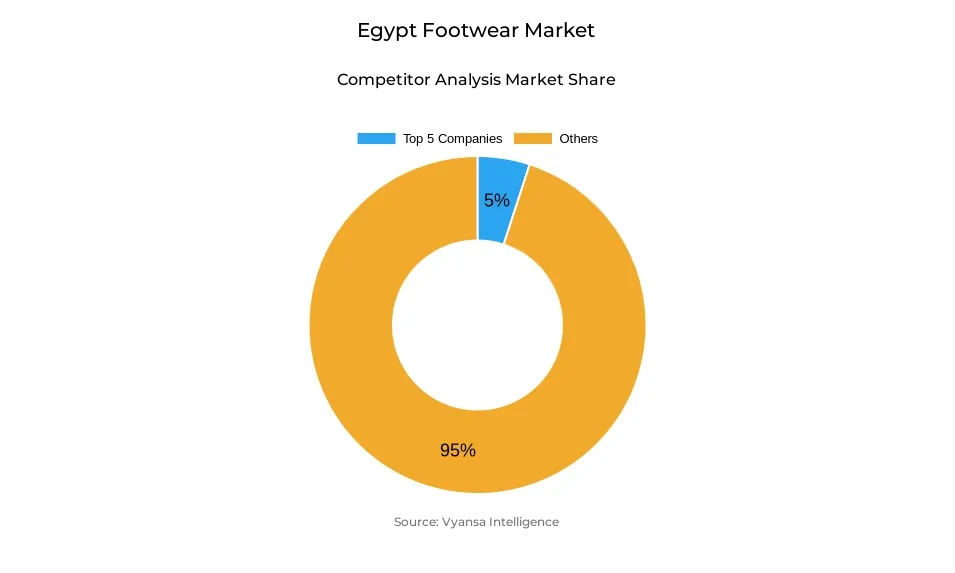

- Competition

- More than 20 companies are actively engaged in producing footwear in Egypt.

- Top 5 companies acquired around 5% of the market share.

- Club Aldo Store; Oxygen Trading Co; Alshaya Co; adidas Group; Allied Trading & Consultancy etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 90% of the market.

Egypt Footwear Market Outlook

Egypt footwear market is anticipated to expand modestly in the forcastperiod. As per estimate, the current size of the Egyp footwear market in 2025 stands around USD 635 million, and is anticipated to reach USD 740 million in 2032, thereby registering a CAGR of approximate 2.21%. Here, the chief contribution to the market would be in terms of value sales, given the prices, which stand high owing to high inflation, devaluation, and rising material costs.

The women's footwear segment is leading in terms of market share, accounting for approximately 52%, driven by demands in work, casual, and formal footwear requirements. However, consumer purchasing patterns are changing in this category. Consumers are gradually moving away from costly leather footwear to more casual footwear like sport shoes and loafers. Designs with no frills in sober colors are in good demand because such footwear can be worn to casual as well as semi-formal places. Fashion in footwear is being fueled by social media networks.

Locally owned labels are gaining popularity in terms of value-for-money offers. Egyptian local labels like DejaVu, Shoe Room, and Pixie are also starting to offer more products in trend designs at affordable prices. The promotion of Egyptian products is also gaining popularity because of certain tensions in the region. However, high-end footwear is slowly regaining popularity after two years of difficulty due to the lack of foreign exchange. High-end labels Ego and Beymen are restocking their stores after two years.

Foreign labels like Dior and Birkenstock are set to enter the Egyptian market because of the promotion of foreign investment in the country. In terms of distribution, retail offline accounts for over 90% in the Egyptian market as customers remain in favor of shopping in physical stores in order to try the footwear products. But with the emergence of online shopping platforms like Amazon and Jumia in the Egyptian market and the provision of decent discounts and instalment facilities, the Egyptian footwear market will see the boost of online shopping in the coming years. The Egyptian footwear market will remain aided by the country's rising footwear production and the return of premium brands in the forcastperiod.

Egypt Footwear Market Growth Driver

Youth Demographics Supporting Long-Term Consumption

The footwear demand in Egypt is strongly supported by the country large youth population. This is one of the largest and most consumption-driven demographic groups since Egypt end user between 18–29 years old constituted approximately 19.9% of the entire population according to CAPMAS. This is the main segment in the demand component of casual, low-priced, and fashionable footwear including sneakers and loafers.

Schools, social networks, and digital platforms expose young end users to fashion a great deal. Their living lifestyle embraces the aspect of changing their shoes regularly and trying out new designs. This group is also buying everyday footwear, work and social footwear even under economic stress which stabilises the market base demand and provides the long term continuity.

Egypt Footwear Market Challenge

Erosion of Consumer Purchasing Power

The Egypt footwear market faces pressure from low purchasing power, driven by the country high inflation rate. World Bank predicts that the annual end user inflation in Egypt was approximately 28.3% in 2024, which is exerting a harsh burden on the household budget and real income.

end users are forcing footwear companies to delay purchases, purchase fewer footwear, or move towards low-cost and informal products as prices are increasing at a rate exceeding wage increases. This specifically impacts mid range and high end shoe markets and compels retailers to extensively use promotion efforts. The stability in profits and the affordability of prices are even more challenging to maintain and hence inflation is one of the formidable structural resistance to market expansion.

Egypt Footwear Market Trend

Digital Influence on Buying Behaviour

The growing influence of online platforms is reshaping how footwear products are discovered and evaluated in Egypt. The internet penetration in Egypt was estimated to be nearly 81.9% in 2025 according to International Trade Administration which shows that digital access is broadly available.

Most shoes are typically bought in physical stores, but end users are starting to shop online to compare prices and compare influencers, browse and choose designs, and keep track of promotions to visit stores. Brand perception and purchased decisions are now being influenced through social media and retail online platforms. It is a trend that is compelling footwear companies to invest more in online marketing, collaboration with influencers, and online presence despite stores being finalized by physical shops.

Egypt Footwear Market Opportunity

Expansion of Domestic Production and E-Commerce

The domestic footwear market is well positioned to expand manufacturing capacity, as currency pressures have increased the cost of imported products, improving the competitiveness of locally produced alternatives. World Bank shows that manufacturing in Egypt helps the economy of the country since manufacturing plays a significant role in its GDP, which consists of approximately 14%. Industrial localisation and exports policies by the government also encourage the local footwear manufacturing.

Simultaneously, digital access is high leading to enhanced retail online potential. As MCIT confirms, approximately 81.9% of the Egyptian populace has access to the internet, which will enable the fast development of digital selling platforms. Retail online can help local footwear brands to access new end users, promote selectively, and also pursue export opportunities. Digital sales channels coupled with increased domestic production constitute a definite way of expanding the market despite inflation and other import restrictions.

Egypt Footwear Market Segmentation Analysis

By Category

- Children's Footwear

- Infants (0-9 Months) Foot Length (CM)

- 8.3-8.9

- 9.2-9.5

- 10.1-10.5

- Infants (0-9 Months) Foot Length (CM)

- Toddlers (9 Months - 4 Years) Foot Length (CM)

- 10.8

- 11.4-11.7

- 12.1-12.7

- 13.0-13.3

- 14.0-14.3

- 14.6-15.2

- 15.6-15.9

- 16.5

- 10.8

- Little Kids (4-7 Years) Foot Length (CM)

- 16.8

- 17.1-17.8

- 18.1-18.4

- 19.1-19.4

- 19.7-20.6

- 21.0-21.6

- 16.8

- Big Kids (7-12 Years) Foot Length (CM)

- 21.9

- 22.2-23.5

- 24.1-24.8

- 21.9

- Women's Footwear

- Foot Length (CM)

- 20.8

- 21.3-21.6

- 22.2-22.5

- 23.0-23.8

- 24.1-24.6

- 25.1-25.9

- 26.2-26.7

- 27.6

- 20.8

- Foot Length (CM)

- Men's Footwear

- Foot Length (CM)

- 23.5

- 24.1-24.8

- 25.4-25.7

- 26.0-26.7

- 27.0-27.9

- 28.3-28.6

- 29.4

- 30.2

- 31.0-31.8

- 23.5

- Foot Length (CM)

Women’s Footwear is the largest category, accounting for around 52% of the Egypt footwear market. This dominance is driven by wide usage occasions, ranging from everyday casual wear to trend-focused styles that match evolving preferences. Sneakers and loafers are particularly popular as they combine comfort with style.

Retailers actively promote women’s collections through seasonal launches, in-store campaigns, and targeted marketing. The blend of functional and aesthetic demand keeps women’s footwear as the main value driver despite economic pressure.

By Sales Channel

- Retail Online

- Retail Offline

Retail Offline holds the highest share under the sales channel, capturing around 90% of total footwear sales in Egypt. Physical stores, local markets, and brand outlets remain dominant as end users prefer in-person fitting, quality checks, and immediate product access.

Retail offline is strengthened by seasonal promotions, back-to-school campaigns, and frequent discounting that drives strong footfall. Although digital platforms increasingly influence discovery and comparison, most purchases still occur through physical stores, keeping Retail Offline as the backbone of footwear distribution.

List of Companies Covered in Egypt Footwear Market

The companies listed below are highly influential in the Egypt footwear market, with a significant market share and a strong impact on industry developments.

- Club Aldo Store

- Oxygen Trading Co

- Alshaya Co

- adidas Group

- Allied Trading & Consultancy

- Skechers

- Ra Sport Co

- Al Asala Group

- MCLT Co

- Under Armour Inc

Competitive Landscape

Egypt’s footwear market is increasingly shaped by the contrast between affordable local brands and resilient international sportswear leaders. Local players such as DejaVu, Shoe Room, and Pixie are gaining strong traction by offering trendy yet affordable designs, benefiting from lower production costs and growing consumer preference for locally made goods. Their visibility has also improved through fashion bazaars and frequent discounting. At the same time, adidas Group remains the leading international player, supported by a wide distribution network, strong online presence, and flexible payment options. Strategic promotions, football club partnerships, and iconic models like Samba and Gazelle have helped adidas defend its position despite inflationary pressures and currency challenges.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Egypt Footwear Market Policies, Regulations, and Standards

4. Egypt Footwear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Egypt Footwear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Thousand Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Children's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Infants (0-9 Months) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. 8.3-8.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. 9.2-9.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.3. 10.1-10.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Toddlers (9 Months - 4 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. 10.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. 11.4-11.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.3. 12.1-12.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.4. 13.0-13.3- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.5. 14.0-14.3- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.6. 14.6-15.2- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.7. 15.6-15.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.8. 16.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Little Kids (4-7 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. 16.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. 17.1-17.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. 18.1-18.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.4. 19.1-19.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.5. 19.7-20.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.6. 21.0-21.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Big Kids (7-12 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.1. 21.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.2. 22.2-23.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.3. 24.1-24.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Women's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.1. 20.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.2. 21.3-21.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.3. 22.2-22.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.4. 23.0-23.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.5. 24.1-24.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.6. 25.1-25.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.7. 26.2-26.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.8. 27.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Men's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. 23.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. 24.1-24.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.3. 25.4-25.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.4. 26.0-26.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.5. 27.0-27.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.6. 28.3-28.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.7. 29.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.8. 30.2- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.9. 31.0-31.8- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Product Type

5.2.2.1. Casual- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Athletic/Sports- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Formal- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material

5.2.4.1. Leather- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Textile- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Rubber- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Synthetic- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Canvas- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Price

5.2.5.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Footwear Type

5.2.6.1. Shoes- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.1. Sneakers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.2. Boots- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Sandals & Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.1. Flip-Flops- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Application

5.2.7.1. Conventional Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Daily Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Work/Office Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.3. Outdoor & Adventure- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.4. Sports & Fitness- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.5. Party/Occasion Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Functional/Therapeutic Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.1. Therapeutic/Orthopedic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.2. Medicated Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.3. Acupressure Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Region

5.2.8.1. Cairo

5.2.8.2. Alexandria

5.2.8.3. Others

5.2.9.By Competitors

5.2.9.1. Competition Characteristics

5.2.9.2. Market Share & Analysis

6. Egypt Children's Footwear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Thousand Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.8.By Region- Market Insights and Forecast 2022-2032, USD Million

7. Egypt Women's Footwear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Thousand Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.8.By Region- Market Insights and Forecast 2022-2032, USD Million

8. Egypt Men's Footwear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold in Thousand Units

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.8.By Region- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.adidas Group

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Allied Trading & Consultancy

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.S Skechers

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Ra Sport Co

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Al Asala Group For Trade & Industry

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Club Aldo Store

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.OXYGEN Trading Co

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.M H Alshaya Co

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.MCLT Co

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Under Armour Inc

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Product Type |

|

| By Sales Channel |

|

| By Material |

|

| By Price |

|

| By Footwear Type |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.