Ecuador Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), By Price (Premium, Mass), By Gender (Men, Women, Unisex), By Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), By Form (Creams/Gels, Lotions, Sprays, Solid, Others), By Nature (Organic, Inorganic), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Jan 2026

- VI0963

- 120

-

Ecuador Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

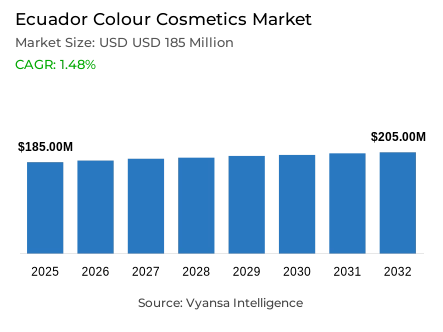

- Colour cosmetics in Ecuador is estimated at USD 185 million in 2025.

- The market size is expected to grow to USD 205 million by 2032.

- Market to register a cagr of around 1.48% during 2026-32.

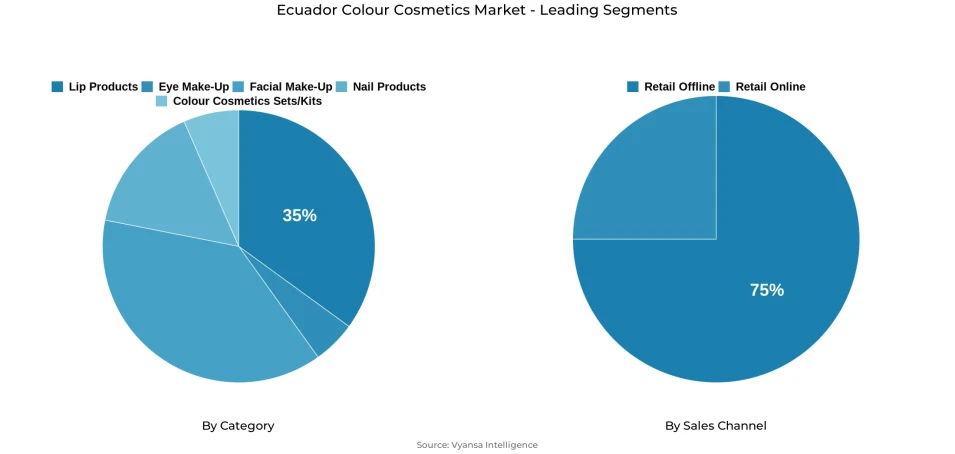

- Category Shares

- Lip products grabbed market share of 35%.

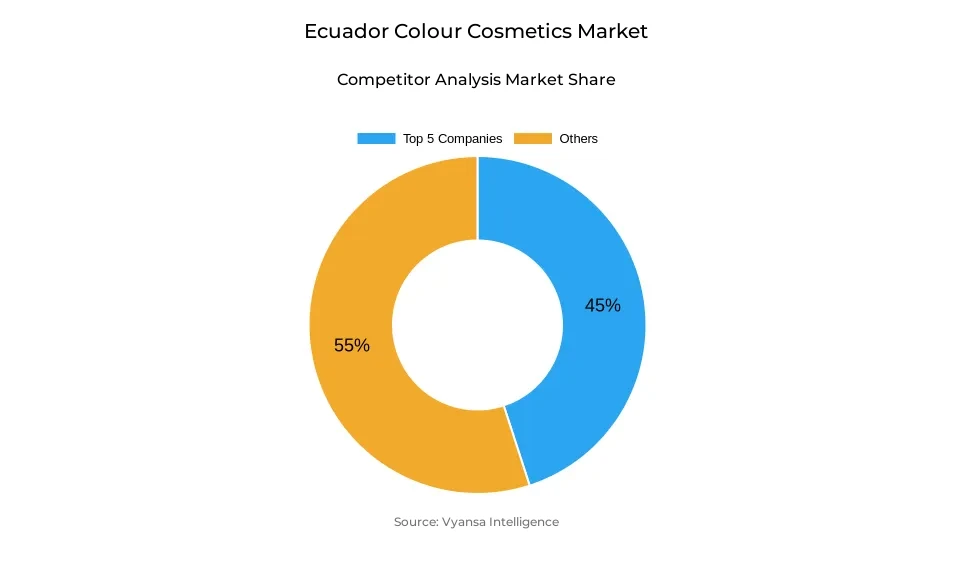

- Competition

- More than 10 companies are actively engaged in producing colour cosmetics in Ecuador.

- Top 5 companies acquired around 45% of the market share.

- Oriflame del Ecuador SA; Omnilife del Ecuador SA; Hinode Ecuador Cia Ltda; Grupo Transbel SA; Yanbal Ecuador SA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Ecuador Colour Cosmetics Market Outlook

The Ecuador colour cosmetics market is expected to have a stable growth pattern, with an increase in the market size of USD 185 million in 2025 to USD 205 million in 2032, which translates to a compound annual growth rate of 1.48%. The market growth is anticipated to be supported by an increasing end user focus on personal appearance and self-care behaviour, despite the existing macroeconomic headwinds. Lip products, which have a 35% market share, are expected to maintain their position as the main category driver during the forecast period. The availability of lip products in various retail formats such as bazaars, local stores, and specialty beauty stores makes it accessible to all income groups. The strong post-pandemic recovery trend of the category, combined with increased end user focus on self-expression, sets lip products on a path of long-term demand growth.

The strategic efforts by major players in the market such as Grupo Transbel, Yanbal, 360 Corp and Asertia Comercial are also supporting market development, as they are investing significant resources in in-store activations, influencer marketing campaigns and improved point-of-sale merchandising. The development of the retail channel, especially the growth of the special cosmetics stores of Fybeca Beauty, is enhancing the presence of both international and local brands. Retail offlineing, which is 75% of the total sales volume, is expected to maintain market leadership due to end user preference to physically test the products and the lingering fear of insecurity of online payment and fraud.

The forecast period is defined by a high momentum in lip gloss and other lip product subcategories due to a renewed interest in gloss finishes, hydrating formulations, and social-media-inspired beauty trends. The low cost and versatility of lip products makes this category a key growth driver in a wide range of end user groups. Cross-market retail integration is a new opportunity, and retailers in related industries, such as apparel and home goods, are expected to integrate cosmetics offerings to take advantage of cross-selling opportunities and increase distribution coverage.

The next big market opportunity lies in the further integration of skincare and colour cosmetics. The products with sun protection factor (SPF), moisturising and skin-treating active ingredients are likely to have a significant market penetration, especially considering that Ecuador has a high-ultraviolet exposure environment. Brands that exhibit innovation in the development of hybrid formulations, compliance with dermatological guidelines, and the use of sustainable packaging solutions are well-positioned to seize the new end user demand.

Ecuador Colour Cosmetics Market Growth DriverYouthful Demographics Reinforce Everyday Make-Up Adoption

The demographic structure of Ecuador, which is marked by a significant presence of younger age groups, remains the basis of growing interest in colour cosmetics as the beauty practices become a core element of self-identification and identity formation. The country has a comparatively young demographic profile, and there is a high level of concentration among the younger population groups that are more receptive to the beauty culture, social media, and international cosmetic innovations. This end user base contributes to high rates of experimentation with colour palettes, product textures, and aesthetic displays, especially in the facial and lip categories that are consistent with everyday expressive use and social interaction scenarios.

This new focus on civic participation collides with the rising household buying power to finance discretionary spending on cosmetic items. In 2023, the growth of private household consumption in Ecuador was 2.1% and is an indicator of slow economic recovery and increased willingness to spend resources on small discretionary goods like colour cosmetics that improve personal appearance and build confidence in social settings. The combination of these forces, including the young demographic base, the re-emerging social activity trends, and the low consumption growth rates, keeps the colour cosmetics category in positive motion and contributes to the further demand at various price ranges and product categories.

Ecuador Colour Cosmetics Market ChallengeEconomic Pressure Intensifies Price Sensitivity

The current economic instability and high inflationary pressure in Ecuador still limit the demand of non-essential beauty products, which encourages greater household caution in relation to discretionary spending. In 2023, end user price inflation stood at 2.2%, indicating a continued cost squeeze in key areas of consumption, such as food and utilities, that squeeze household disposable income to buy cosmetic products. With inflationary pressures limiting end user spending, end user buying behavior towards cosmetic products is subjected to a stricter appraisal process, and end users often delay category upgrades and switch products only when absolutely needed, which puts downward pressure on volume demand but leaves category value relatively stable.

The dynamics of income inequality also exacerbate the conservative purchasing behaviour patterns and limit the potential of premium segment expansion. In 2023, the Gini Index of Ecuador is 44.60, which indicates high and chronic differences in purchasing power among population groups. In the colour cosmetics market, this income-inequality framework leads to a high level of end user segment concentration around low-priced, value-based product offerings, which significantly restricts the ability to penetrate the premium category and brand growth at higher prices. Budgetary limitations also lower end user readiness to experiment with new products or more costly innovations, slowing the rate of adoption of new formulations or higher-end trend segments and limiting growth opportunities in prestige and luxury market segments.

Ecuador Colour Cosmetics Market TrendStrong Shift Toward Health-Forward, Skin-Enhancing Formulations

The end users in Ecuador are showing a growing interest in colour cosmetics with built-in skincare properties, which are indicative of a wider emerging interest in skin protection, dermatological health and management of long-term skin conditions. This market trend is consistent with the global public health awareness that has placed ultraviolet radiation as a leading cause of premature ageing and skin damage, which has driven high end user demand of SPF-integrated foundations, BB creams, hybrid moisturiser-makeup products, and lip formulations that combine cosmetic functionality with proven sun protection and skin care effects. These hybrid product formats are highly attractive to end users who want simplicity, efficiency, and multifunctionality in single-application formats, which essentially minimizes the number of products needed in everyday life.

The geographical location of Ecuador close to the equator exposes the population to the high levels of ultraviolet exposure all year round, which promotes the high level of end user awareness of the effects of the sun on the skin, photoageing effects, and the need to use full-time protection against ultraviolet radiation. This climatic fact supports end user demand of product formulations that are fortified with hydrating, soothing and barrier-strengthening ingredients that respond to equatorial climatic issues such as high temperatures, humidity and intense exposure to sunlight. As a result, hybrid formulations that incorporate cosmetic coverage with skincare active ingredients, including antioxidants, hydrating agents, and photoprotective compounds, are becoming more common in product innovation development pipelines and are shaping purchasing decision frameworks throughout the colour cosmetics market, especially in foundation, complexion, and lip product categories.

Ecuador Colour Cosmetics Market OpportunityRising Demand for Clean Beauty and Low-Toxin Formulations

Ecuador colour cosmetics market is strategically positioned to capitalise on the substantial and accelerating global transition toward cleaner, low-toxin formulation standards, particularly among younger, health-conscious, and digitally engaged end user segments. Market research indicates that 63–76% of end users, with particular concentration among Generation Z and younger demographic cohorts, actively prioritise clean beauty products featuring safer, naturally derived ingredients, reflecting robust demand for ingredient transparency, safety validation, and reduced chemical exposure. Within the Ecuadorian market context, this global trend demonstrates strong alignment with local end user preferences for natural-appearance cosmetic outcomes and gentle formulations suitable for diverse skin types and tropical climate conditions requiring enhanced durability and perspiration resistance.

This substantial market opportunity is significantly amplified by Ecuador's expanding digital connectivity and exposure to global beauty standards emphasising sustainability principles and reduced chemical composition. Internet penetration reaches approximately 80% of Ecuador's population, predominantly through mobile connectivity infrastructure, facilitating widespread access to international clean beauty trend information, influencer recommendations, and ingredient education resources. Brands offering vegan, paraben-free, hypoallergenic, or clinically validated skin-nourishing compositions can effectively establish product differentiation within an increasingly competitive market landscape and capture emerging demand from health-conscious end user segments, particularly within facial and lip product categories where ingredient concerns and safety perceptions exercise the most substantial influence on purchasing decisions. This clean beauty opportunity represents a high-growth potential market segment for brands capable of communicating transparent formulation benefits and achieving alignment with end user values regarding health and environmental sustainability.

Ecuador Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Eye Liner/Pencil

- Eye Shadow

- Mascara

- Others

- Facial Make-Up

- BB/CC Creams

- Blusher/Bronzer/Highlighter

- Foundation/Concealer

- Powder

- Others

- Lip Products

- Lip Gloss

- Lip Liner/Pencil

- Lipstick

- Others

- Nail Products

- Nail Polish

- Nail Treatments/Strengthener

- Polish Remover

- Others

- Colour Cosmetics Sets/Kits

Lip products represent the dominant category within Ecuador's colour cosmetics market, commanding a 35% market share. This leadership position reflects the category's widespread availability across formal and informal retail Sales Channels, particularly bazaars and neighbourhood retail establishments offering highly accessible price points. Lipsticks, glosses, and lip liners have become integral components of daily beauty routines, supported by an extensive price spectrum that ensures category accessibility across all income segments. The category's accelerated post-pandemic recovery trajectory further reinforces its strong cultural significance and emotional relevance among Ecuadorian end users.

Throughout the forecast period, lip products are projected to maintain category leadership as demand accelerates for hydrating, glossy, and skincare-integrated formulations. The resurgent trend toward natural, luminous finishes, combined with the influential role of beauty content creators across social media platforms, will continue driving end user experimentation with colour palettes and product textures. As brands expand into moisturising, long-wear, and SPF-integrated lip product formats, the category is positioned to benefit from both formulation innovation and sustained mass-market distribution reach, ensuring maintenance of its leading market share throughout the forecast horizon.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline channels represent the dominant sales channel within Ecuador's colour cosmetics market, accounting for 75% of total market value. Direct selling constitutes the most influential driver within offline channels, supported by extensive networks of independent consultants operating under major market participants including Grupo Transbel and Yanbal. These personalised selling relationships, reinforced by strong brand recognition and end user trust dynamics, sustain robust offline engagement patterns. Expansion within health and beauty specialist retailers—particularly Fybeca Beauty—has further enhanced access to international brand portfolios and elevated in-store shopping experiences.

Throughout the forecast period, Retail offline channels are projected to maintain market leadership as Ecuadorian end users continue demonstrating preference for physical product evaluation, particularly for foundations, lip colours, and eye makeup formulations. Limited end user confidence in online payment security systems and reluctance to incur delivery charges reinforce offline channel dominance. As pharmacy retailers and multi-category retail operators expand their beauty product assortments and refine in-store merchandising approaches, offline channels will retain their position as the primary purchasing route, notwithstanding gradual expansion in retail online penetration at the market periphery.

List of Companies Covered in Ecuador Colour Cosmetics Market

The companies listed below are highly influential in the Ecuador colour cosmetics market, with a significant market share and a strong impact on industry developments.

- Oriflame del Ecuador SA

- Omnilife del Ecuador SA

- Hinode Ecuador Cia Ltda

- Grupo Transbel SA

- Yanbal Ecuador SA

- 360Corp SA

- Asertia Comercial SA

- Productos Avon Ecuador SA

- Alvarez Barba SA

- N&Co Ecuador SAS

Competitive Landscape

Ecuador colour cosmetics market is competitive and fragmented, with multiple players expanding simultaneously across direct selling and modern retail. Grupo Transbel leads the category through its brands Ésika, L’Bel, and Cyzone, leveraging a strong network of independent beauty consultants to drive reach and loyalty. Yanbal remains a key rival, maintaining visibility through sustained marketing investments. 360 Corp recorded rapid growth in 2024, supported by strong placement of Essence and Catrice within Fybeca Beauty, which has emerged as an influential specialist channel. Asertia Comercial also strengthened its position through Maybelline, using high-impact in-store displays in supermarkets and pharmacies. Overall competition is shaped by lip-product-led demand, expanding specialist retail, and strong trade marketing execution.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Ecuador Colour Cosmetics Market Policies, Regulations, and Standards

4. Ecuador Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Ecuador Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Ecuador Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Ecuador Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Ecuador Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Ecuador Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Ecuador Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Grupo Transbel SA

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Yanbal Ecuador SA

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. 360Corp SA

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Asertia Comercial SA

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Productos Avon Ecuador SA

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Oriflame del Ecuador SA

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Omnilife del Ecuador SA

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Hinode Ecuador Cia Ltda

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Alvarez Barba SA

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. N&Co Ecuador SAS

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.