Denmark Footwear Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Children's Footwear (Infants (0-9 Months) Foot Length (CM) (8.3-8.9, 9.2-9.5, 10.1-10.5), Toddlers (9 Months - 4 Years) Foot Length (CM) (10.8, 11.4-11.7, 12.1-12.7, 13.0-13.3, 14.0-14.3, 14.6-15.2, 15.6-15.9, 16.5), Little Kids (4-7 Years) Foot Length (CM) (16.8, 17.1-17.8, 18.1-18.4, 19.1-19.4, 19.7-20.6, 21.0-21.6), Big Kids (7-12 Years) Foot Length (CM) (21.9, 22.2-23.5, 24.1-24.8)), Women's Footwear (Foot Length (CM) (20.8, 21.3-21.6, 22.2-22.5, 23.0-23.8, 24.1-24.6, 25.1-25.9, 26.2-26.7, 27.6)), Men's Footwear (Foot Length (CM) (23.5, 24.1-24.8, 25.4-25.7, 26.0-26.7, 27.0-27.9, 28.3-28.6, 29.4, 30.2, 31.0-31.8))), By Product Type (Casual, Athletic/Sports, Formal, Others), By Sales Channel (Retail Online, Retail Offline), By Material (Leather, Textile, Rubber, Synthetic, Canvas), By Price (Mass, Premium), By Footwear Type (Shoes (Sneakers, Boots), Sandals & Slippers (Flip-Flops)), By Application (Conventional Footwear (Daily Wear, Work/Office Wear, Outdoor & Adventure, Sports & Fitness, Party/Occasion Wear), Functional/Therapeutic Footwear (Therapeutic/Orthopedic, Medicated Slippers, Acupressure Slippers))

- FMCG

- Jan 2026

- VI0961

- 130

-

Denmark Footwear Market Statistics and Insights, 2026

- Market Size Statistics

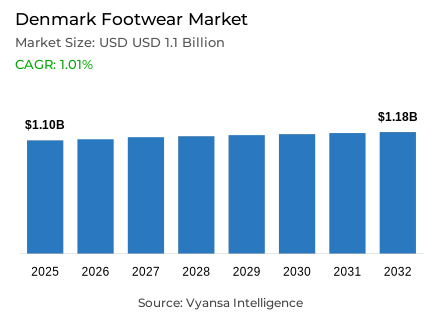

- Footwear in Denmark is estimated at USD 1.1 billion in 2025.

- The market size is expected to grow to USD 1.18 billion by 2032.

- Market to register a cagr of around 1.01% during 2026-32.

- Category Shares

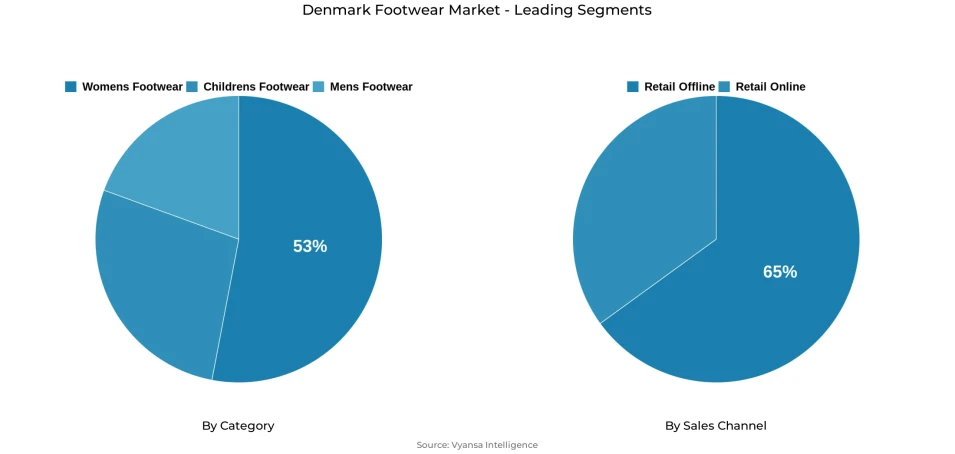

- Women's footwear grabbed market share of 53%.

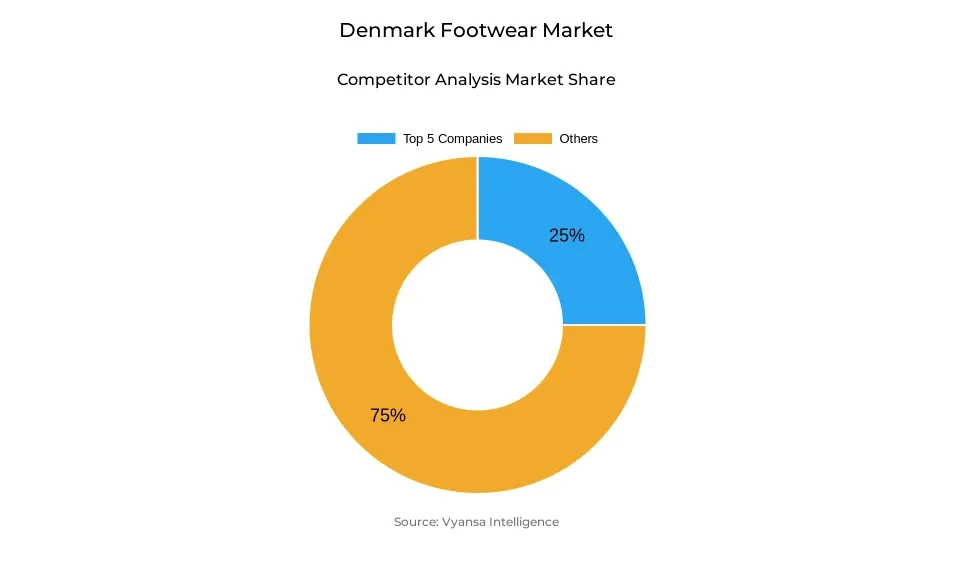

- Competition

- More than 20 companies are actively engaged in producing footwear in Denmark.

- Top 5 companies acquired around 25% of the market share.

- Bianco Footwear A/S; Shoe-d-vision Amba; New Balance Denmark; Nike Denmark ApS; adidas Danmark A/S etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 65% of the market.

Denmark Footwear Market Outlook

Denmark footwear market will increase at a slow pace by 2026-2032 as people will be back to their normalised activities after years of inflation. The market is estimated to be USD 1.1 billion in 2025 with improved volume sales in 2025 with people getting back to active lifestyles out of the home. The cost-of-living crisis had restricted rebounds in 2022 and 2023 previously by limiting household spending, but better economic conditions have made footwear volumes go positive once again.

Footwear that is sport related is central in this recovery. The shift in preferences towards sneakers and casual wear is accelerated by the comfort requirements and the loosening of the office dress code. The success of the global brands like Nike and adidas is ample under this change as it has got the support of the extensive networks of distribution channels, and brand loyalty in Denmark.

Meanwhile, brand reputation and ethical positioning continue to increase their role in the buying decision-making process. The still ongoing boycott of Ecco after the company chose not to close down in Russia after the war in Ukraine proves that Danish people are ready to shift their purchasing behaviour depending on the ethical factor. The forces which have transformed the competitive environment in the market are the retailers who took Ecco off the shelves and national institutions which distanced themselves.

In the future, this market will gain momentum to USD 1.18 billion by 2032 with a CAGR of approximately 1.01% in the period between 2026-2032. Expansion will be facilitated by an increase in demand of high-quality shoes, sustainability-oriented decisions, and the continuous development of online platforms. The women footwear category still takes the first position with the share of 53 and the retail offline still dominates with the distribution of approximately 65%.

Denmark Footwear Market Growth Driver

End user Purchasing Power Recovery

Denmark is experiencing improvement in purchasing power, which is promoting the demand of the footwear. Since cost-of-living crisis, inflation has plummeted to give end users the confidence to spend discretionally. In Denmark, the inflation level of end user prices reached approximately 1.4% in 2024, much lower than the highs of 2022 and relieved the households budgets.

Meanwhile, employment rates are good and wage increase has reinforced to sustain stable income streams. Since families experience reduced pressure on the prices of basic goods, they are gradually ready to pay more on the non-essential goods like shoes. Such improvement in the purchasing power directly underpins volume expansion especially in the casual and sports-inspired segments, which are consistent with daily lifestyle requirements.

Denmark Footwear Market Challenge

Intimidated end userism Wary of Spending

Denmark end users are also reserved, even though the inflation is subsiding, following several years of economic instability. Household consumption is growing at a low rate, which means that the majority of households are prioritising savings and compulsory spending. In 2024, the growth of household final consumption in Denmark remained less than 1% indicating subdued demand in the discretionary categories.

This prudent attitude restrains the rate of growth of footwear sales especially in the high end and fashion dominated markets. End users can postpone the replacement of footwear unless it is essential and buy less of them. The difficulties are to inspire demand with the help of value, quality, and relevance without providing too much discounting that may affect profitability in the long run among brands and retailers.

Denmark Footwear Market Trend

Move to Online Shoes Shopping

Retail online is gaining relevance in Denmark even in footwear. Denmark is one of the most digitally connected nations in the world, and approximately 98% of the nation uses the internet in 2023. This retail online is fast growing because of this high degree of digital access. In 2023, over 90% of Danes aged 16-74 years old had made at least one online purchase, and the most common categories of purchase were clothing and sports goods.

Footwear retail online is directly influenced by this digital behaviour since the footwear is closely connected with the fashion and sportswear. Online end users appreciate convenience, a broader product range, and competitive pricing, and great digital capabilities are the key to footwear brands.

Denmark Footwear Market Opportunity

Premium and Sustainable Footwear

The Denmark footwear market has a good chance of premiumisation and sustainability. Danish end users are very environmental and approximately 86% of the population believes that climate change is a serious problem. Such a consciousness stimulates the need to buy durable, quality, and environmentally sound footwear instead of the cheap fast-fashion products.

end users are more attracted to products that can be used to save even though they cost more in the initial stages. With economic conditions stabilised, increasing numbers of buyers are ready to spend on buying up to premium footwear which is in line with ethical and environmental values. The brands which specialize in longlasting materials, recycled materials and open production procedures are quite in a good position to enjoy this change towards conscious consumption.

Denmark Footwear Market Segmentation Analysis

By Category

- Children's Footwear

- Infants (0-9 Months) Foot Length (CM)

- 8.3-8.9

- 9.2-9.5

- 10.1-10.5

- Infants (0-9 Months) Foot Length (CM)

- Toddlers (9 Months - 4 Years) Foot Length (CM)

- 10.8

- 11.4-11.7

- 12.1-12.7

- 13.0-13.3

- 14.0-14.3

- 14.6-15.2

- 15.6-15.9

- 16.5

- 10.8

- Little Kids (4-7 Years) Foot Length (CM)

- 16.8

- 17.1-17.8

- 18.1-18.4

- 19.1-19.4

- 19.7-20.6

- 21.0-21.6

- 16.8

- Big Kids (7-12 Years) Foot Length (CM)

- 21.9

- 22.2-23.5

- 24.1-24.8

- 21.9

- Women's Footwear

- Foot Length (CM)

- 20.8

- 21.3-21.6

- 22.2-22.5

- 23.0-23.8

- 24.1-24.6

- 25.1-25.9

- 26.2-26.7

- 27.6

- 20.8

- Foot Length (CM)

- Men's Footwear

- Foot Length (CM)

- 23.5

- 24.1-24.8

- 25.4-25.7

- 26.0-26.7

- 27.0-27.9

- 28.3-28.6

- 29.4

- 30.2

- 31.0-31.8

- 23.5

- Foot Length (CM)

Women’s Footwear represents the largest category segment, accounting for around 53% of the Denmark footwear market. This leadership is driven by frequent purchasing and wide usage occasions, including casual wear, work, sports-inspired styles, and fashion footwear. Women typically purchase multiple pairs for different needs, which supports higher overall demand.

The segment also benefits strongly from casualisation and sports-inspired trends. Sneakers, hybrid shoes, and comfort-focused designs appeal to women balancing professional, social, and active lifestyles. As fashion and comfort increasingly merge, women’s footwear continues to generate the largest share of market value.

By Sales Channel

- Retail Online

- Retail Offline

Retail Offline holds the highest share within the sales-channel structure, accounting for about 65% of footwear sales in Denmark. Physical stores remain important because end users prefer to try footwear for fit, comfort, and quality before purchase.

Retail Offline benefits from strong local store networks, brand outlets, and shopping centres where end users can compare products directly. Although e-commerce is growing rapidly, store-based retail continues to dominate because footwear is highly sensitive to sizing and comfort, making in-person shopping especially valuable for Danish buyers.

List of Companies Covered in Denmark Footwear Market

The companies listed below are highly influential in the Denmark footwear market, with a significant market share and a strong impact on industry developments.

- Bianco Footwear A/S

- Shoe-d-vision Amba

- New Balance Denmark

- Nike Denmark ApS

- adidas Danmark A/S

- Bestseller A/S

- H&M Danmark

- Asics Danmark A/S

- hummel A/S

- Deichmann Sko ApS

Competitive Landscape

Denmark’s footwear market in 2024 is led by global brands Nike, adidas, and H&M, which benefit from strong brand recognition and wide distribution. Nike and adidas strengthened their positions as demand for sports-inspired footwear rose, supported by casualisation of workwear and renewed interest in exercise. In contrast, Danish brand Ecco lost value share due to a widespread consumer boycott linked to its continued operations in Russia, with several major retailers removing the brand from shelves. This significantly weakened its domestic standing. Overall, competition is shaped by international sportswear leaders gaining ground, fast fashion maintaining visibility through scale, and local brands facing reputational risks that directly influence consumer loyalty and retail partnerships.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Denmark Footwear Market Policies, Regulations, and Standards

4. Denmark Footwear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Denmark Footwear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Thousand Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Children's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Infants (0-9 Months) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. 8.3-8.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. 9.2-9.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.3. 10.1-10.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Toddlers (9 Months - 4 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. 10.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. 11.4-11.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.3. 12.1-12.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.4. 13.0-13.3- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.5. 14.0-14.3- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.6. 14.6-15.2- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.7. 15.6-15.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.8. 16.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Little Kids (4-7 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. 16.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. 17.1-17.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. 18.1-18.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.4. 19.1-19.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.5. 19.7-20.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.6. 21.0-21.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Big Kids (7-12 Years) Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.1. 21.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.2. 22.2-23.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.3. 24.1-24.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Women's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.1. 20.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.2. 21.3-21.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.3. 22.2-22.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.4. 23.0-23.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.5. 24.1-24.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.6. 25.1-25.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.7. 26.2-26.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1.8. 27.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Men's Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Foot Length (CM)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. 23.5- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. 24.1-24.8- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.3. 25.4-25.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.4. 26.0-26.7- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.5. 27.0-27.9- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.6. 28.3-28.6- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.7. 29.4- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.8. 30.2- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.9. 31.0-31.8- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Product Type

5.2.2.1. Casual- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Athletic/Sports- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Formal- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material

5.2.4.1. Leather- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Textile- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Rubber- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Synthetic- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Canvas- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Price

5.2.5.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Footwear Type

5.2.6.1. Shoes- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.1. Sneakers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.2. Boots- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Sandals & Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.1. Flip-Flops- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Application

5.2.7.1. Conventional Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Daily Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Work/Office Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.3. Outdoor & Adventure- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.4. Sports & Fitness- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.5. Party/Occasion Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Functional/Therapeutic Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.1. Therapeutic/Orthopedic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.2. Medicated Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2.3. Acupressure Slippers- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Denmark Children's Footwear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Thousand Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

7. Denmark Women's Footwear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Thousand Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

8. Denmark Men's Footwear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold in Thousand Units

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Material- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Footwear Type- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Application- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Nike Denmark ApS

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.adidas Danmark A/S

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Bestseller A/S

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.H&M Hennes & Mauritz A/S

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Asics Danmark A/S

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Bianco Footwear A/S

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Shoe-d-vision Amba

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.New Balance Denmark ApS

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.hummel A/S

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Deichmann Sko ApS

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Product Type |

|

| By Sales Channel |

|

| By Material |

|

| By Price |

|

| By Footwear Type |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.