Dominican Republic Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), By Price (Premium, Mass), By Gender (Men, Women, Unisex), By Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), By Form (Creams/Gels, Lotions, Sprays, Solid, Others), By Nature (Organic, Inorganic), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Jan 2026

- VI0962

- 120

-

Dominican Republic Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

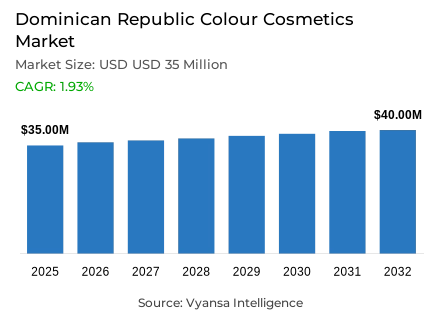

- Colour cosmetics in Dominican Republic is estimated at USD 35 million in 2025.

- The market size is expected to grow to USD 40 million by 2032.

- Market to register a cagr of around 1.93% during 2026-32.

- Category Shares

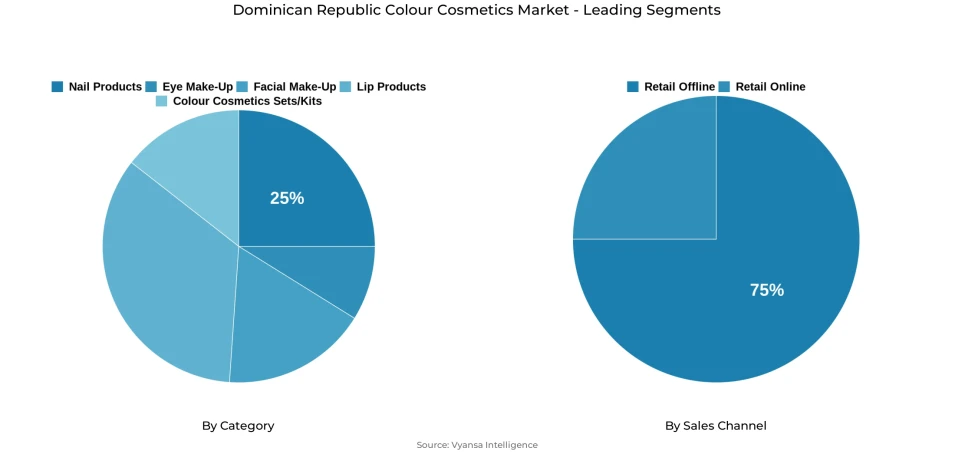

- Nail products grabbed market share of 25%.

- Competition

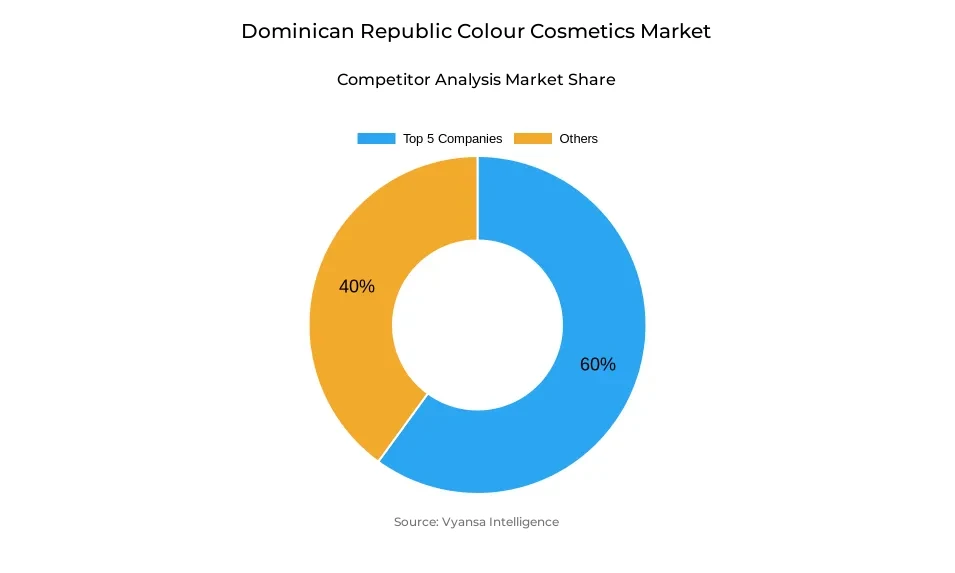

- More than 10 companies are actively engaged in producing colour cosmetics in Dominican Republic.

- Top 5 companies acquired around 60% of the market share.

- Farach SA; Wella AG; Amway Dominican Republic LLC; Grupo Transbel CA; Laboratorios Dr Collado CxA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Dominican Republic Colour Cosmetics Market Outlook

The Dominican Republic colour cosmetics market is expected to show a stable growth, increasing between USD 35 million in 2025 and USD 40 million in 2032, which is a compound annual growth rate of 1.93%. The market will grow, with the strong cultural practices supporting it, since Dominican women always keep the makeup use trends even in the times when the economy is tight. Nail products, with a 25% category share, will remain significant due to affordability attributes, widespread distribution presence, and changing tastes toward healthier-looking nail looks. Facial makeup is expected to continue to be the fastest-growing category, with the increase in end user interest in covering skin flaws and the growing number of inclusive shade-range portfolios that match a wide range of skin tones and humid weather conditions.

The major market players, such as Corporacion Belcorp and L’Oréal, are in a position to enhance competitive advantages by product innovation and differentiation strategies. The younger end user groups, especially Generation Z, will push the demand of multifunctional, extended-wear, and perspiration-resistant formulation technologies. Their high involvement in digital content platforms and influencer networks will also influence preferences towards natural ingredient compositions, vegan product claims, and new affordable brand options. These behavioural changes will keep boosting the facial and eye makeup categories, especially the product formats such as long-lasting foundation formulations and volumizing mascara technologies.

The retail offline distribution, which represents 75% of the market sales, will continue to dominate since the direct selling and pharmacy chain operations will play central roles. Direct selling will keep proving its high cultural relevance as a means of generating income, but the generational demographic changes can limit the growth opportunities. Pharmacy channels, in their turn, are expanding the range of cosmetic categories by providing specialized merchandising space and dermocosmetic zones, as end users are increasingly interested in science-based ingredient technologies. retail online will show slow but steady growth as Dominican end users will use TikTok and Instagram more to discover products and will be drawn to exclusive online pricing offers.

In the future, the younger generational cohorts will keep influencing the market direction with their inclination towards natural product claims, shade inclusivity, sustainability communication, and the expression of local cultural identity. With brands moving towards cleaner formulation and focusing on Dominican cultural aspects, the market is set to grow at a value-driven pace over the forcastperiod.

Dominican Republic Colour Cosmetics Market Growth DriverCultural Attachment to Beauty Strengthens Daily Usage

Colour cosmetics are still enjoying a lot of reinforcement by the ingrained cultural behaviours in the Dominican Republic, where the beauty rituals hold a lot of emotional and social importance across income demographic lines. Women of all age groups value daily makeup application as part of their established self-care routines and social identity expression, and the consistency of this behaviour is a sign of significant resilience even in times of economic stress. The Central Bank of the Dominican Republic and International Monetary Fund analytical data show that inflation slowed to about 3.3% in 2024, within the 4.0% target range of the central bank (tolerance band of 1%), and it is lower than in the past, which has brought more stability to household purchasing power. Beauty spending has shown significant resilience even in the earlier times of increased inflationary stress, which depicts the critical emotional and cultural functions that cosmetics play in the Dominican everyday life and social expression systems.

The younger female demographics also support this cultural driver because they are adopting makeup practices at earlier developmental stages and incorporating beauty practices into lifestyle identity constructions. This generational trend is greatly accelerated by high levels of digital interaction—according to DataReportal analytical data, internet penetration in the Dominican Republic was 88.6% of the population as of January 2025, largely due to mobile connectivity infrastructure, allowing high exposure to makeup tutorials, product review media, and influencer-driven distribution of beauty content. This online presence reinforces the formation of routine beauty habits and the normalisation of regular use of cosmetics in all face, eye, and lip product categories, maintaining a stable demand among all age groups and income demographic categories.

Dominican Republic Colour Cosmetics Market ChallengeHigh Informal Employment Limits Spending Power

The major challange that the Dominican Republic colour cosmetics market is facing is the limited population purchasing power, which is highly restricted by the high rates of informal employment in the labour-force structure. The Dominican Republic has a high level of informal employment, with 54.5% of total employment in the country being informal according to International Labour Organization statistical data, and with a strong regional disparity, 69.1% in rural and 56.9% in urban centres, leaving most workers without a regular source of income, formal employment agreements, and employer-provided benefits. This structural informality drastically limits the capacity of many end users to buy high-end product offerings and greatly increases price sensitivity even to moderate levels of price increase, compelling end users to mass-market item choice and generating a considerable opposition to premiumisation and uptake of higher-priced premium formulation options.

The demographic changes between generations are also an extra problem to direct selling, which has been the traditional Sales Channel mechanism in the market. According to the World Federation of Direct Selling Associations, direct selling in the Americas region has seen sales-force reduction of 11.2% between 2019 and 2023 with total regional sales reducing by 9.2% with younger end user groups losing interest in traditional direct-sales employment roles and seeking alternative income-generating and employment opportunities. This channel contraction diminishes geographic market coverage of direct-seller networks, undermines a distribution model that has historically been the backbone of beauty product sales, and restricts brand penetration efficacy into remote and lower-income demographic segments that have historically depended on direct-selling access points.

Dominican Republic Colour Cosmetics Market TrendRising Preference for Natural and Low-Toxin Formulations

A growing and accelerating trend towards cleaner, safer, and more natural ingredient-profile formulations is fundamentally redefining product innovation priorities and strategic positioning throughout the Dominican colour cosmetics market. Dominican end users, especially younger demographic groups, are increasingly sensitive to health-focused ingredient statements and product safety, which is consistent with the principles of the clean beauty movement and end user demands to know the formulation. Although end user perception often focuses on avoiding ingredients such as parabens and phthalates, regulatory bodies, such as the United States Food and Drug Administration and European Union, allow such ingredients at certain safe concentration levels, which is a scientific consensus on the safety of such ingredients at approved dosage levels. However, the dynamics of end user preference and market demand trends are still pushing innovation to vegan formula structures, botanical extract additions, SPF-enriched product structures, and reduced-chemical versions such as 9-free and 12-free nail polish formulation standards.

This trend additionally strongly encourages product transparency and ingredient disclosure practices, with end users increasingly seeking clarity regarding formulation composition details, ethical sourcing claims, and sustainability practice commitments. Premium and mass-market brands alike respond by systematically integrating performance-active ingredients including vitamins, natural oil extracts, hyaluronic acid, and mineral-based pigment technologies into formulation architectures. As emerging end user generations prioritize values-led beauty consumption patterns and ingredient integrity standards, natural-origin cosmetics and safety-focused innovation increasingly establish themselves as key brand differentiation mechanisms within an increasingly crowded and competitive marketplace environment, influencing both product development pipelines and marketing communication strategies.

Dominican Republic Colour Cosmetics Market OpportunityIncreasing Shade Diversity to Reflect Dominican Identity

The Dominican Republic's predominantly mixed-race and Afro-descendant population composition presents a substantial market opportunity for brands offering genuinely inclusive shade range portfolios and formulations engineered for diverse skin tones and undertone variations. Demographic statistical data indicate that 71.72% of the Dominican population identifies as mixed race (Mestizo/Mulatto/Indio), reflecting tri-racial ancestry from European, African, and Native American heritage sources, while 7.8% identify as fully or predominantly Afro-Dominican, emphasizing the diversity of skin tone profiles, undertone characteristics, and pigmentation variations across the population. Brands providing undertone-matched foundation formulations, extended-wear pigment technologies resistant to heat and humidity exposure, and perspiration-resistant formulation architectures demonstrate particularly strong end user appeal within the Dominican tropical climate environment where durability and performance under humidity conditions represent essential functional requirements.

Inclusive beauty positioning and identity-focused product development strategies align powerfully with rising cultural identity expression among younger Dominican end user cohorts who seek product offerings that authentically reflect and celebrate their heritage and aesthetic preference frameworks. Local and emerging niche brand operators are already capitalizing on this opportunity through designing products specifically tailored to Dominican skin type profiles, climate condition requirements, and beauty preference patterns, demonstrating strong end user loyalty potential and premium positioning opportunities. As global cosmetics corporations broaden and refine shade offering portfolios and develop formulations optimized for diverse skin profile characteristics, brands embracing identity-based product development and climate-responsive formulation engineering are positioned to earn substantial end user loyalty and significantly expand end user base penetration across generational and income demographic segments.

Dominican Republic Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Eye Liner/Pencil

- Eye Shadow

- Mascara

- Others

- Facial Make-Up

- BB/CC Creams

- Blusher/Bronzer/Highlighter

- Foundation/Concealer

- Powder

- Others

- Lip Products

- Lip Gloss

- Lip Liner/Pencil

- Lipstick

- Others

- Nail Products

- Nail Polish

- Nail Treatments/Strengthener

- Polish Remover

- Others

- Colour Cosmetics Sets/Kits

The dominant segment within product category classification is nail products, which commands 25% of the Dominican Republic colour cosmetics market. This leadership position is sustained by elevated market penetration, comprehensive distribution networks, and accessible price positioning that integrate nail items into everyday beauty habit routines. Dominican women traditionally favor bold, vibrant color tones reflecting Caribbean aesthetic preferences, while younger generational cohorts are migrating toward more neutral shade palettes and formulations that strengthen nail structure and prevent cracking damage. This combination of affordability characteristics, cultural preference alignment, and functional benefit delivery reinforces steady category adoption.

Throughout the forecast period, nail products are positioned to maintain segment leadership as demand expands for healthier-appearing nail aesthetics and treatment formulations incorporating protective or strengthening functional properties. The influence of social media trend dynamics and the emergence of ingredient-focused end user segments—seeking 9-free or 12-free formulation standards—will support further category expansion momentum. With both mass-market and premium market participants innovating across color portfolios and care-based feature integration, the segment remains strategically positioned to sustain strong market share throughout the forecast period.

By Sales Channel

- Retail Offline

- Retail Online

The dominant segment within Sales Channel classification is retail offline, which commands 75% of the Dominican Republic colour cosmetics market. Direct selling maintains its position as the dominant distribution force, supported by its functional role as an income generation mechanism within a labor market where 53.4% of workers operate within informal employment structures according to Central Bank ENCFT 2024 data. Its personalized selling approach methodology and strong legacy brand portfolios including Ésika, Cyzone, and Avon sustain elevated end user engagement, particularly among older demographic cohorts. Pharmacy channel operations additionally strengthen Retail offline positioning by expanding dedicated cosmetics merchandising sections and enhancing end user appeal through ingredient transparency disclosure and scientifically supported formulation positioning.

Throughout the forecast period, Retail offline is expected to retain channel leadership as cultural shopping habits, trust in sales representative relationships, and in-store product testing capabilities remain central to purchasing decision frameworks. While retail online will demonstrate growth as younger end users increasingly utilize TikTok and Instagram platforms for product discovery, offline channels continue offering immediacy advantages, broader shade availability presentations, and stronger brand familiarity associations. This combination ensures that physical retail formats preserve dominant market position even as digital adoption rates accelerate.

List of Companies Covered in Dominican Republic Colour Cosmetics Market

The companies listed below are highly influential in the Dominican Republic colour cosmetics market, with a significant market share and a strong impact on industry developments.

- Farach SA

- Wella AG

- Amway Dominican Republic LLC

- Grupo Transbel CA

- Laboratorios Dr Collado CxA

- J Gasso Gasso CxA

- Productos Avon SA

- Inversiones & Negocios SA

- Diperco CxA

- Daniel Espinal SAS

Competitive Landscape

The competitive landscape in Dominican Republic colour cosmetics is shaped by the strong presence of direct selling leaders, with Corporación Belcorp maintaining the top position through its Cyzone, Ésika and L’Bel lines, supported by multifunctional innovations such as Cyzone Studio Look, which appeals to younger women with moisturising and SPF20 claims. Belcorp’s focus on durability also aligns with the country’s high humidity, reinforcing relevance through long-lasting foundations. L’Oréal Groupe, distributed locally by Laboratorios Dr Collado CxA, remains one of the best-performing players, driven by Maybelline New York’s expansion from eye make-up into facial, lip and nail products, supported by launches like Instant Age Rewind featuring goji berry. While direct selling continues to dominate the market, pharmacy chains are strengthening their role by upgrading store design, expanding cosmetic assortments and leveraging the growing appeal of science-backed ingredients, while e-commerce gains traction as younger consumers rely on TikTok and Instagram for product discovery and online-exclusive pricing.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Dominican Republic Colour Cosmetics Market Policies, Regulations, and Standards

4. Dominican Republic Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Dominican Republic Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Dominican Republic Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Dominican Republic Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Dominican Republic Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Dominican Republic Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Dominican Republic Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Grupo Transbel CA

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Laboratorios Dr Collado CxA

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. J Gasso Gasso CxA

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Productos Avon SA

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Inversiones & Negocios SA

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Farach SA

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Wella AG

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Amway Dominican Republic LLC

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Diperco CxA

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Daniel Espinal SAS

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.