Egypt Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0531

- 130

-

Egypt Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

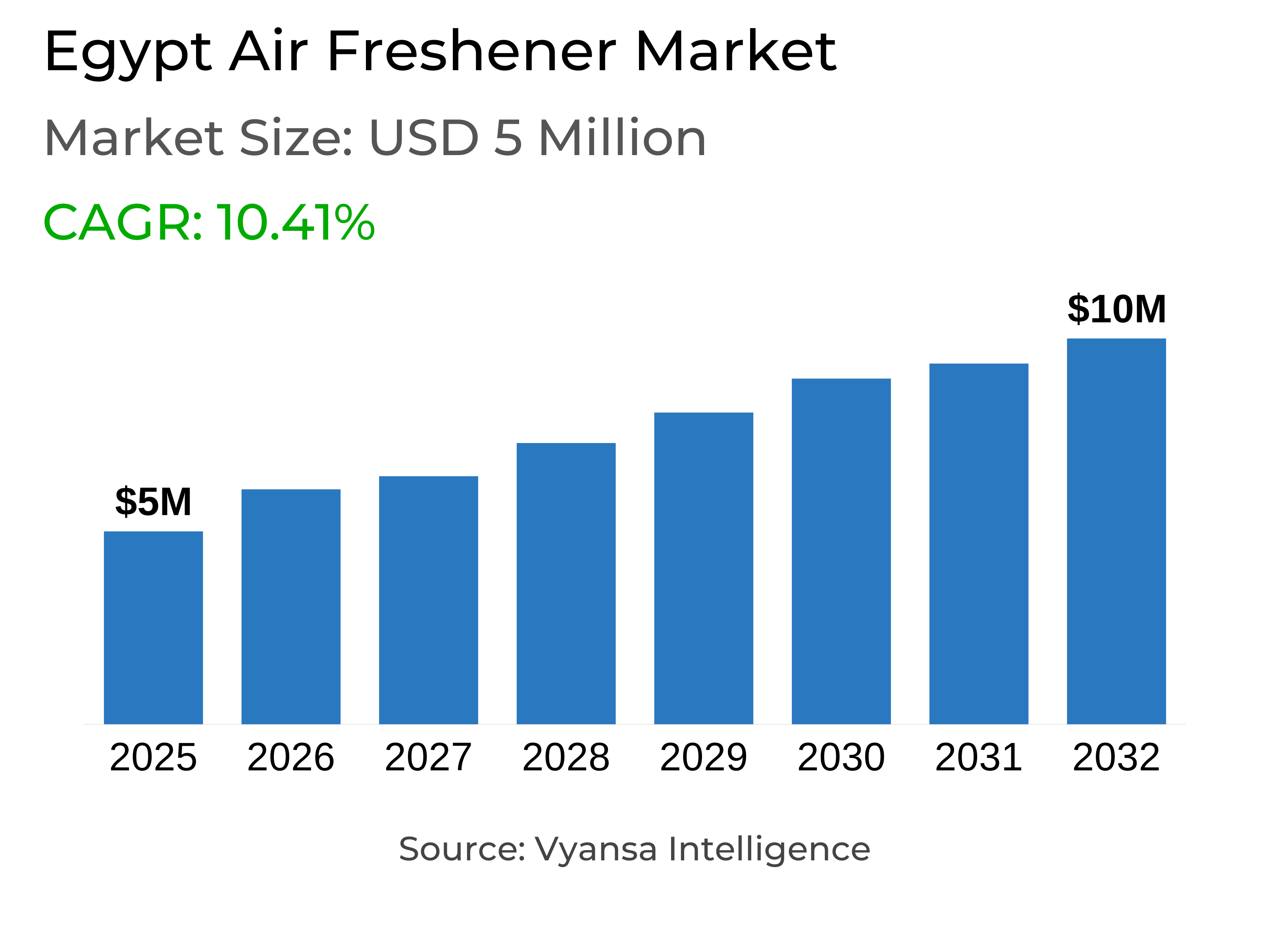

- Air Freshener in Egypt is estimated at $ 5 Million.

- The market size is expected to grow to $ 10 Million by 2032.

- Market to register a CAGR of around 10.41% during 2026-32.

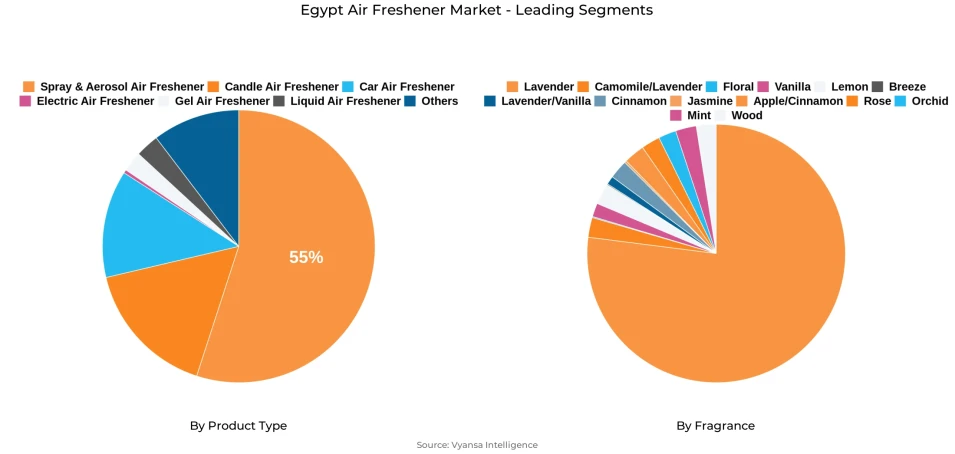

- Product Type Shares

- Spray/Aerosol Air Freshener grabbed market share of 55%.

- Competition

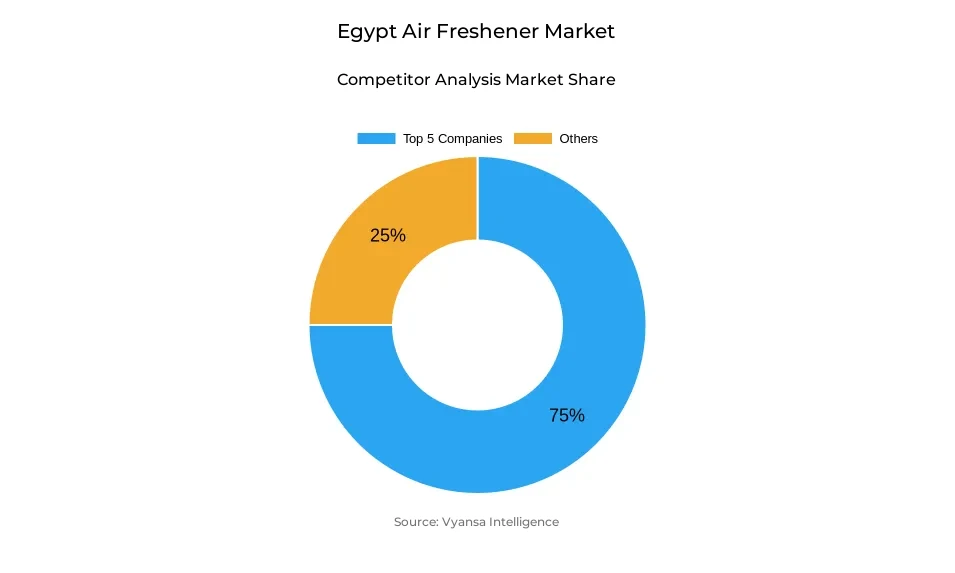

- More than 15 companies are actively engaged in producing Air Freshener in Egypt.

- Top 5 companies acquired around 75% of the market share.

- Fresh Up Co, Roseraie Co, Vini Egypt Ltd, Johnson Wax (Egypt) Co, Fridal Co etc., are few of the top companies.

- Fragrance

- Lavender continues to dominate the market.

Egypt Air Freshener Market Outlook

Egypt air freshener market is estimated at $5 million in 2025 and expected to reach $10 million by 2032. Economic recovery, population growth, and rising number of households in urban areas will drive growth. With congested cities and growing aspirations to enhance home atmosphere, air freshener demand will increasingly pick up. Spray/aerosols will be the best-selling format, despite ongoing concerns regarding quality and environmental issues. Lavender continues to be the leading fragrance, maintaining robust End users appeal throughout homes.

Local brands are becoming stronger as boycotts against Western goods spur End users to purchase local substitutes. More and more new players are using online sales and social media successfully to reduce costs and bypass wholesalers while reaching End users directly. These local brands are changing the shape of competition by providing affordable products, while larger overseas players use promotions and price discounts to hold share.

Innovation will be a significant factor during the forecast period. Electric air fresheners will gain more End users based on convenience and perceived effectiveness, and concentrated spray/aerosols may gain popularity if concerns about the environment drive demand for environmentally friendly products. Government moves towards the environment can also drive this segment further, though End users awareness is still low.

Meanwhile, a niche for natural, toxin-free air fresheners is small but growing. But the cost will be high—almost a factor of ten for chemical-based products—so take-up will be confined to an affluent section of society. Nevertheless, the market overall for air fresheners will see healthy growth as urbanisation increases, sprays become more affordable, and interest in improving indoor spaces continues among End users.

Egypt Air Freshener Market Growth Driver

Population Growth and Urbanisation

The steady increase in the number of households in Egypt serves as a key driver for the growth of the air freshener market. With increasing families coming together to form a home, there is a heightened urge to enhance ambience and make living conditions better. This is complemented by increased urbanisation, which results in congested cities where air care products serve as a convenient means to enhance comfort at home.

With such trends, air fresheners are more and more considered a household essential as opposed to a luxury. Spray and aerosol product forms especially appreciate being inexpensive and readily available. As urbanization keeps growing, the demand for air care products continues to increase steadily, guaranteeing the long-term growth of the market and making air fresheners a necessary component in the lives of Egypt homes.

Egypt Air Freshener Market Challenge

Geopolitical Tensions Impacting Brand Performance

The market for air fresheners in Egypt is challenged by existing geopolitical tensions within the region. Political conflicts like the Israel–Hamas conflict drive End users buying behavior, with most End users preferring local brands over global ones. This change affects the value share of well-established global brands as they are compelled to give discounts and promotions in order to stay competitive in the market.

Besides, End users boycotts bring uncertainty for foreign brands seeking to grow in Egypt. While domestic brands enjoy higher preference and loyalty, foreign players struggle to maintain growth and brand equity. Avoiding these political and social sensitivities continues to be a core challenge facing firms operating in the air care segment.

Egypt Air Freshener Market Trend

Increased Demand for Natural Air Fresheners

End users in Egypt interest in the safety and chemical composition of air fresheners is fueling demand for natural substitutes. There is growing awareness among households about possible health hazards due to artificial fragrances, thus providing a niche market for 100% natural, toxin-free products. The trend aligns with a move toward cleaner and safer alternatives, albeit with limited adoption so far.

But affordability is still a major impediment, with natural air fresheners costing roughly ten times as much as traditional chemical-based products. The market is being served by very few local new brands in this niche segment only, limiting their market share. In spite of that, increased End users inclination toward natural and chemical-free products does point to a long-term trend toward healthier, safer air care solutions in Egypt, suggesting scope for gradual expansion as awareness and willingness to pay grow.

Egypt Air Freshener Market Opportunity

Expansion of Concentrated Spray/Aerosol Air Fresheners

Concentrated spray/aerosol air fresheners are a developing opportunity in Egypt despite End users concerns over quality and environmental effects. Traditional spray/aerosols continue to be popular because of their low cost, but the concentrated varieties have the potential to win over eco-friendly End users who prefer cleaner and more efficient products. Their use is held back by poor awareness and lack of government action on green initiatives.

With the government making greater efforts on environmental policy, value-style spray/aerosol air fresheners will be a winner. By projecting these as green and effective, producers and retailers can unlock new growth channels, targeting both cost issues and greening. This trend enables players to differentiate their brand, capture changing End users, and gain market share in Egypt air freshener market during the forecast period.

Egypt Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

The segment with the highest market share under Product Type is Spray/Aerosol Air Freshener, which grabbed a market share of 55%. This segment remains the most preferred among consumers due to its affordability and easy availability. Spray/aerosols continue to benefit from strong marketing campaigns, in-store promotions, and a wide range of choices from leading brands like Glade and Fridal Co. Private labels and local brands also contribute to the segment’s popularity by offering cost-effective alternatives, attracting price-sensitive consumers. The format’s convenience and ability to quickly enhance home ambience make it a key driver of overall air care market growth.

Electric Air Fresheners are emerging as a high-growth segment. Consumers are increasingly drawn to plug-in variants for their long-lasting fragrance, efficiency, and environmentally friendly appeal. While currently less competitive, the entry of local and affordable brands, along with stabilising prices, is expected to drive volume growth and expand this segment’s presence in the market over the forecast period.

By Fragrance

- Camomile/Lavender

- Lavender

- Floral

- Vanilla

- Lemon

- Breeze

- Lavender/Vanilla

- Cinnamon

- Jasmine

- Apple/Cinnamon

- Rose

- Orchid

- Mint

- Wood

The segment with highest market share under sales channel in Egypt Air Freshener Market. This channel includes supermarkets, hypermarkets, and convenience stores, where air fresheners are mostly purchased by End users because they are easily accessible and available for instant purchase. Retail offline stores are well distributed in Egypt, reaching both urban and rural End users. These stores lead in every recent survey, consistently capturing most of the air freshener sales to rank as the market leader by share.

Yet, retail online is increasing as well and continues to be the mainstay of the online market. More people are experimenting with digital platforms, enticed by discount offers and the advantage of home delivery. Retail online is especially favored among young, technology-literate Egypts and is predicted to perform even better in the coming few years, further helping overall market growth by a survey.

Top Companies in Egypt Air Freshener Market

The top companies operating in the market include Fresh Up Co, Roseraie Co, Vini Egypt Ltd, Johnson Wax (Egypt) Co, Fridal Co, Car-Freshner Corp, Alexandria Detergents & Chemicals Co SAE, Misr Pyramids Group, Exotica Fresheners Co, Kaline Cosmetics Co, etc., are the top players operating in the Egypt Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Egypt Air Freshener Market Policies, Regulations, and Standards

4. Egypt Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Egypt Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Egypt Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Egypt Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Egypt Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Egypt Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Egypt Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Egypt Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Johnson Wax (Egypt) Co

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Fridal Co

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Car-Freshner Corp

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Alexandria Detergents & Chemicals Co SAE

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Misr Pyramids Group

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Fresh Up Co

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Roseraie Co

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Vini Egypt Ltd

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Exotica Fresheners Co

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Kaline Cosmetics Co

12.1.10.1. Business Description

12.1.10.2. Product Portfolio

12.1.10.3. Collaborations & Alliances

12.1.10.4. Recent Developments

12.1.10.5. Financial Details

12.1.10.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.