China Menstrual Care Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Pantyliners, Tampons (Applicator Tampons, Digital Tampons), Towels (Standard Towels (Standard Towels with Wings, Standard Towels Without Wings), Slim/Thin/Ultra-Thin Towels (Slim/Thin/Ultra-Thin Towels with Wings, Slim/Thin/Ultra-Thin Towels Without Wings)), Intimate Wipes, Menstrual Cups, Period Underwear), Nature (Disposable, Reusable), Age Group (Up to 18 Years, 19-30 Years, 31-40 Years, 40 Years and Above), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Dec 2025

- VI0667

- 115

-

China Menstrual Care Market Statistics and Insights, 2026

- Market Size Statistics

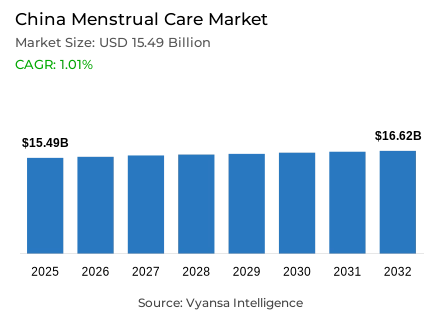

- Menstrual care in China is estimated at USD 15.49 billion.

- The market size is expected to grow to USD 16.62 billion by 2032.

- Market to register a cagr of around 1.01% during 2026-32.

- Product Type Shares

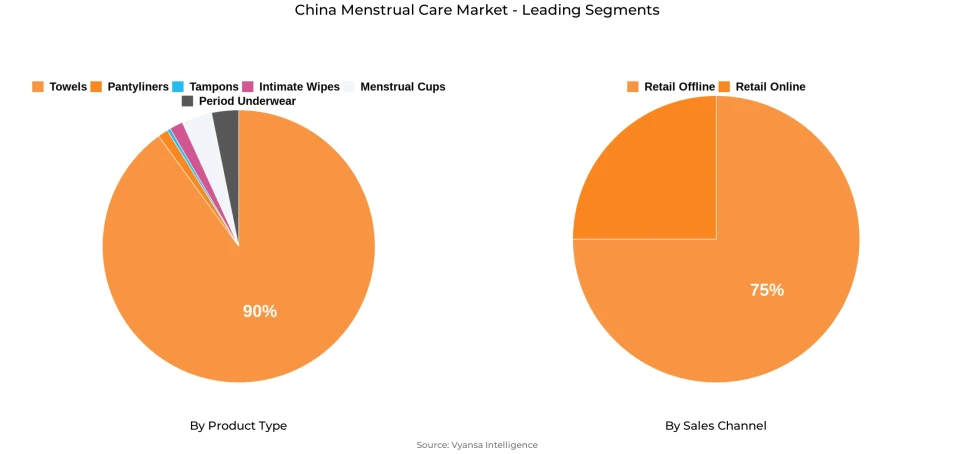

- Towels grabbed market share of 90%.

- Competition

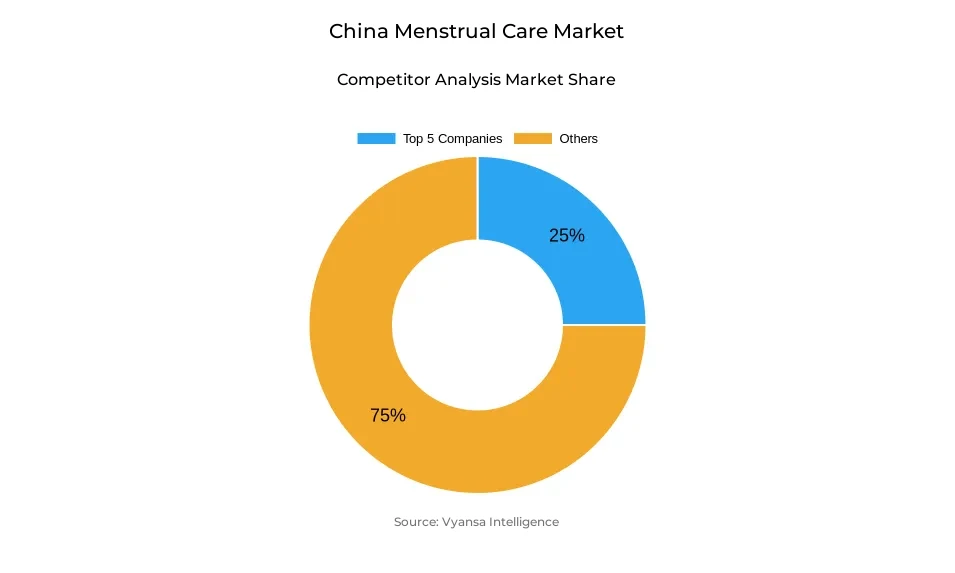

- More than 15 companies are actively engaged in producing menstrual care in China.

- Top 5 companies acquired around 25% of the market share.

- Chongqing Baiya Sanitary Products Co Ltd; Kao (China) Holding Co Ltd; C-Bons Group; Shanghai Uni-Charm Co Ltd; Hengan Fujian Holding Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

China Menstrual Care Market Outlook

The China Menstrual Care Market was valued at USD 15.49 billion in 2025 and is expected to reach a value of USD 16.43 billion by 2032, recording a CAGR of about 1.01% during 2026-2032. Though the category will see a moderate growth rate, the market will continue being resilient because menstrual products are necessities and hygiene and health awareness among women is on the rise. Overall retail volume will remain stable, but current value growth will be sustained in the coming years with a rising preference for premium, safe, and comfortable products.

Towels have continued to dominate China’s menstrual care market, with close to 90% of total value sales. Slim, thin, and ultra-thin towels are expected to remain the key growth driver within this category, reflecting consumers’ preference for lightweight, breathable, and discreet options. The adoption of towels in pant format is likely to increase further, supported by innovations focused on comfort, flexibility, and affordability. Products such as Sofy Morning Pants and upgraded disposable pants from Whisper extend use beyond nighttime into everyday scenarios of work and travel, reinforcing this subcategory’s rapid expansion.

While tampons and pantyliners will remain the smaller segments of the market in the future, tampons are expected to see gradual growth as younger, urban women increasingly adopt international trends and extra comfort features. At the same time, private-label products in menstrual care are attracting more attention for their affordable price without sacrificing safety or quality. Many retailers, such as Aldi and Miniso, are quickly expanding their private-label product lines in response to increasing consumer demand, although branded products still comprise the majority due to strong trust among end consumers.

Offline retailing will continue to dominate the distribution share, accounting for approximately 75% of the total sales, thanks to supermarkets and pharmacies. Meanwhile, e-commerce will further grow, driven by product variety, discounts, and convenience. As health awareness increases, and with the implementation of stricter national safety standards in 2025, manufacturers are likely to further prioritize safer materials, complying with regulations for quality assurance, thereby driving the change in China's menstrual care market

China Menstrual Care Market Growth Driver

Increasing Demand for Slim and Ultra-Thin Towels Bolsters Market Growth

China's menstrual care market has grown steadily, backed by increasing demand for slim, thin, and ultra-thin towels that prioritize comfort, breathability, and lightness. It is resilient even against the slow post-pandemic recovery in China's economy because products for menstrual care are necessity goods. This still reflects in consistent value growth as consumers will not cut back on menstrual hygiene as they might do on other discretionary purchases. These factors are bolstered by the ever-growing trend toward using towels in pant format, valued for their superior fit and convenience.

The segment is undergirded by a large base of women in reproductive age, accounting for about 35% of the country's total female population according to the World Bank. At the same time, increasing disposable incomes, up 5.8% year-on-year in 2024 according to the National Bureau of Statistics of China, allow consumers to invest in high-quality and innovative menstrual products. Together, these factors keep slim- and pant-format menstrual towels in high demand within this market.

China Menstrual Care Market Challenge

Market Fragmentation and Increased Competition

Although developing consistently, China's menstrual care market remains highly fragmented, with the top five brands combining for less than 30% of total value sales. This reflects very strong competition, with numerous regional players in the category using e-commerce platforms as a key means of gaining market share. While Shanghai Uni-Charm and Hengan Fujian Holding retain leading positions, newer players such as Chongqing Baiya Sanitary Products are gaining rapid attention for their reasonable prices and innovative products targeting younger consumers.

This is further exacerbated by the rise of China's e-commerce ecosystem, which involves more than 884 million active online shoppers, according to the Ministry of Commerce of China. A very low consumer goods inflation rate, amounting to 0.6% in 2024, according to the World Bank, has raised price pressures, which have compelled companies to resort to differentiation by way of innovation and quality to ensure profitability in this highly fragmented landscape.

China Menstrual Care Market Trend

Premiumisation Driven by Quality and Safety Concerns

Chinese end-users are increasingly inclined towards menstrual care products that stress safety and quality. Gradually increasing awareness of health and hygiene issues is driving up demand for medically certified or "medical grade" towels that can ensure the most stringent standards for bacterial control, pH balance, and absence of fluorescent substances. Premiumization by material innovation and safety assurance is being increasingly embraced by manufacturers. Nice Princess is setting benchmarks by maintaining its offerings aligned to advanced medical-grade standards.

According to the Standardization Administration of China, the new national standard on menstrual products effective from July 2025 will enforce more stringent restrictions on the harmful ingredients of formaldehyde and fluorescent brighteners. According to UN Women China, 83% of Chinese women now consider hygiene and safety as a key factor when making purchases. This indicates a clear trend toward high-end and safety-certified menstrual products in the Chinese market. Sources: Standardization Administration of China; UN Women China 2024

China Menstrual Care Market Opportunity

Private Label Expansion to Meet Value-Based Demand

Going forward, the increasing emphasis on value-for-money will continue to improve prospects for private label menstrual care products in China. Chained retailers like Aldi and Miniso have introduced private label product lines at affordable prices with reliable quality compared to branded products. Such offerings are slowly gaining traction among price-conscious urban consumers who are looking for practical solutions with no perceived compromise on quality, especially as spending becomes more cautious post-pandemic.

At over 66% in 2024, according to the National Bureau of Statistics of China, the rate of urbanization reflects the growing demand within the urban market. The IMF further reports that household saving is 29.7%, indicating a conservative expenditure habit that favors frugal choices. With a growing number of retailers realizing this prospect, private label menstrual care products will increase affordability and access, thus fortifying their position in China's evolving hygiene market.

China Menstrual Care Market Segmentation Analysis

By Product Type

- Pantyliners

- Tampons

- Towels

- Intimate Wipes

- Menstrual Cups

- Period Underwear

The segment with the highest share under Product Type is towels, which captured nearly 90% of the China menstrual care market. Towels continue to dominate due to their long-standing familiarity, comfort, and convenience among Chinese end users. Within this category, slim, thin, and ultra-thin formats remain the leading growth drivers, reflecting the strong preference for breathable, lightweight, and skin-friendly materials. Pant-format towels, in particular, have seen rising adoption due to their suitability for both day and night use, as well as their affordability supported by intensified competition in e-commerce channels.

While alternative products such as tampons and menstrual cups are slowly gaining traction, their shares remain minimal compared to towels. Continuous innovations in softness, flexibility, and fit-alongside the growing popularity of medical-grade and probiotic-infused options-are reinforcing consumer trust and ensuring that towels remain the cornerstone of menstrual care in China throughout the forecast period.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under Sales Channel is retail offline, accounting for about 75% of the China menstrual care market. Supermarkets, hypermarkets, and pharmacies remain the main distribution points, providing convenient access and trusted product variety. Their dominance is supported by the essential nature of menstrual products, which encourages frequent in-store purchases. Strong partnerships between brands and major retail chains have also helped maintain visibility and affordability through promotional campaigns and bundle offers.

Although e-commerce is expanding rapidly, especially among younger consumers seeking convenience and better pricing, retail offline continues to lead due to its reliability and immediate product availability. In particular, the growing focus on product safety and authenticity drives consumers to purchase from recognised physical outlets. Thus, retail offline is expected to remain the most influential and trusted distribution channel for menstrual care in China over the forecast period.

List of Companies Covered in China Menstrual Care Market

The companies listed below are highly influential in the China menstrual care market, with a significant market share and a strong impact on industry developments.

- Chongqing Baiya Sanitary Products Co Ltd

- Kao (China) Holding Co Ltd

- C-Bons Group

- Shanghai Uni-Charm Co Ltd

- Hengan Fujian Holding Co Ltd

- Procter & Gamble (Guangzhou) Ltd

- Kimberly-Clark (China) Investment Co Ltd

- Kingdom Healthcare Holdings Ltd, Guangdong

- Vinda International Holdings Ltd

- Winner Medical Co Ltd

Market News & Updates

- Shanghai Uni‑Charm Co Ltd, 2023-2025:

Unicharm continued regional new-product activity, educational programs, and environmental efforts for feminine-care products in 2023-2025

- Hengan / Kao, 2022-2025:

Domestic manufacturers introduced new formats and emphasised sustainability and comfort innovations, with ongoing updates from 2022-2025

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. China Menstrual Care Market Policies, Regulations, and Standards

4. China Menstrual Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. China Menstrual Care Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Pantyliners- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Applicator Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Digital Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Standard Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. Standard Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. Standard Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Slim/Thin/Ultra-Thin Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.1. Slim/Thin/Ultra-Thin Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.2. Slim/Thin/Ultra-Thin Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Intimate Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Menstrual Cups- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Period Underwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Nature

5.2.2.1. Disposable- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Reusable- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Age Group

5.2.3.1. Up to 18 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. 19-30 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. 31-40 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. 40 Years and Above- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. China Pantyliners Menstrual Care Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. China Tampons Menstrual Care Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. China Towels Menstrual Care Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. China Intimate Wipes Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. China Menstrual Cups Menstrual Care Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. China Period Underwear Menstrual Care Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Shanghai Uni-Charm Co Ltd

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Hengan Fujian Holding Co Ltd

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Procter & Gamble (Guangzhou) Ltd

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Kimberly-Clark (China) Investment Co Ltd

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Kingdom Healthcare Holdings Ltd, Guangdong

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Chongqing Baiya Sanitary Products Co Ltd

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Kao (China) Holding Co Ltd

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. C-Bons Group

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Vinda International Holdings Ltd

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Winner Medical Co Ltd

12.1.10.1.Business Description

12.1.10.2.Product Portfolio

12.1.10.3.Collaborations & Alliances

12.1.10.4.Recent Developments

12.1.10.5.Financial Details

12.1.10.6.Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Nature |

|

| By Age Group |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.