China Bags and Luggage Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Bags (Cross Body Bags, Bags and Backpacks, Business Bags, Duffle Bags, Clutches, Others), Luggage (Soft Luggage, Hard Luggage, Wheeled Luggage, Non-Wheeled Luggage)), By Sales Channel (Retail Offline, Retail Online), By Material Type (Soft Case (Nylon, Polyester, Ballistic Nylon), Hard Case (Polycarbonate, ABS (Acrylonitrile Butadiene Styrene), Polypropylene)), By Price Category (Luxury, Mass/Economy, Premium), By Application (Travel, Business), By Region (North, East, Southwest, Northwest, North East, South)

|

Major Players

|

China Bags and Luggage Market Statistics and Insights, 2026

- Market Size Statistics

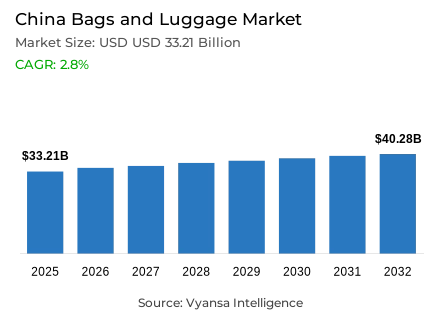

- Bags and luggage in China is estimated at USD 33.21 billion in 2025.

- The market size is expected to grow to USD 40.28 billion by 2032.

- Market to register a cagr of around 2.8% during 2026-32.

- Category Shares

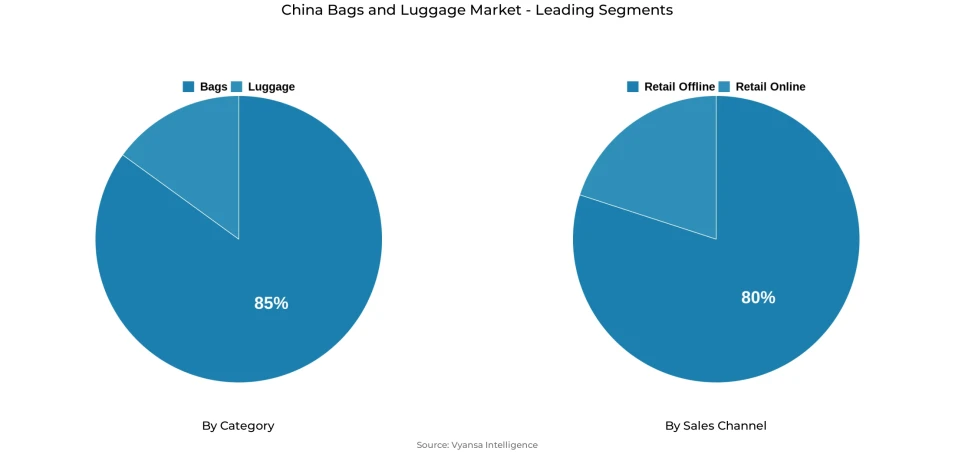

- Bags grabbed market share of 85%.

- Competition

- More than 20 companies are actively engaged in producing bags and luggage in China.

- Top 5 companies acquired around 20% of the market share.

- Gucci (China) Trading Ltd; Prada Trading Shanghai Co Ltd; Samsonite China; LVMH Fashion (Shanghai) Trading Co Ltd; Hermès (Shanghai) Trade Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

China Bags and Luggage Market Outlook

The China bags and luggage market predicted moderate but consistent growth in the period of 2026-32 following a poor performance in the year 2024, that is characterized by a low level of end users expenditure and reduction in demands of non-essential goods. The bags and luggage in China are estimated to be 33.21 billion and expected to be at 40.28 billion in the year 2025 and 2032 respectively with a compound annual growth rate of about 2.8% over the forecast period. The retail volume growth will be moderate, but the retail current value growth will be greater, with the help of premium pricing and slow buildup of end users confidence.

Bags will keep on dominating the overall demand but the market structure is likely to be polarised. The recovery of luxury handbags will be the most successful with the domestic consumption being stabilised and the overseas luxury shopping less appealing. Middle-class buyers are projected to revert to local buying as the exchange-rate benefits in neighbouring markets become relaxed. Conversely, luggage is projected to recover more slowly, and value growth will increase more slowly with the recovery of travel, and volume sales will be structurally weaker than they were at the pre-pandemic level.

Bags based on sports and lifestyle will become a significant development prospect. The growing engagement in such sports like tennis, as well as the growing popularity of outdoor activities, is motivating the demand of functional sports bags which also can be regarded as compatible with ordinary fashion. Sports bags are becoming part of everyday life by younger end users, especially because they are a symbol of healthy and active lifestyle.

In terms of channel, retail offline takes about 80% of sales, which is backed by shopping centres and experience retail. Nevertheless, the involvement of e-commerce is likely to increase, fuelled by interest-based social media and live-streaming. All in all, the market perspective is optimistic yet stable in terms of growth, influenced by luxury recovery, sport-based demand, and slower transition to digital interaction.

China Bags and Luggage Market Growth DriverGradual Macroeconomic Stabilisation Supporting Discretionary Recovery

China’s macroeconomic environment is gradually stabilising, creating supportive conditions for a recovery in discretionary consumption. The National Bureau of Statistics of China reported that real gross domestic product increased by 5.2% in 2023, indicating stable economic normalisation after the disruptions caused by the pandemic. Such stabilisation will decrease uncertainty among household and stimulate the careful recovery of discretionary expenditure, such as spending on personal accessories.

Meanwhile, the monetary environment is favorable. In its 2024 Monetary Policy Report, the People’s Bank of China confirms that the overall liquidity situation is relatively comfortable, which contributes to stabilising the household expectations. Decreased macro volatility favors confidence-based expenditures as opposed to necessity-based consumption.

China Bags and Luggage Market ChallengeSubdued Domestic Demand Amid Cautious Consumer Spending

Macro stabilisation has not yet been able to boost domestic demand because of the reserved consumer mood. According to the National Bureau of Statistics of China, per-capita consumption spending grew by 9.2% in nominal terms in 2023, indicating that the discretionary spending is being contained due to the uncertainty of income. The households also focus on the spending on necessities and postpone the buying of non-necessary goods like handbags.

This is cautioned by the dynamics of labour-markets. The urban surveyed unemployment rate is 5.2 on average in 2024 which shows that there are still adjustments in employment. Such a climate constrains the number of purchases of discretionary accessories and holds demand hostage to confidence and not aspirational drivers.

Unlock Market Intelligence

Explore the market potential with our data-driven report

China Bags and Luggage Market TrendIncreasing popularity of innovative, young-focused luxury brands.

The shift in preferences among the younger end users influence the demand trend in the discretionary fashion category. According to the China Internet Network Information Center (CNNIC), there are 1.07 billion internet users in 2024, and short-video and lifestyle platforms are the most popular online platforms. Such platforms boost the demand of products that are more expressive and design-led as opposed to a luxury that is driven by heritage.

This tendency is supported by demographic data. The National Bureau of Statistics of China states that the population aged 2039 makes up more than 28% of the urban population, which is a significant group with an influential impact on the fashion and luxury consumption standards. They are becoming more and more inclined towards originality, creativity and brand individuality.

China Bags and Luggage Market OpportunityRebound of luxury handbag demand within the country.

A structural reorientation toward domestic luxury consumption is emerging as reliance on external shopping incentives gradually moderates. According to the Ministry of Commerce of China, the total retail sales of consumer goods increased by 7.2% in 2023, which is a sign of a new willingness to spend in the country instead of postponing purchases in foreign markets. This augers the recovery in high-value discretionary classes.

Simultaneously, outbound travel is still lower than it was before the pandemic. The Ministry of Culture and Tourism of China confirms that outbound trips in 2023 do not fully recover to 2019 levels, and exceptional overseas shopping leakage is reduced. This is a favorable climate that reinforces the chances of domestic luxury purchase of handbags in order to recover market in China.

Unlock Market Intelligence

Explore the market potential with our data-driven report

China Bags and Luggage Market Segmentation Analysis

By Category

- Bags

- Cross Body Bags

- Bags and Backpacks

- Business Bags

- Duffle Bags

- Clutches

- Others

- Luggage

- Soft Luggage

- Hard Luggage

- Wheeled Luggage

- Non-Wheeled Luggage

The segment with highest market share under Category is bags, which occupies about 85% of the overall market share. This dominance is an indication of the wide general application of bags in workplace, recreational and life contexts, as opposed to luggage, which is more directly associated with the frequency of travel. The handbags, backpacks, and sport related bags have been in the spotlight of end users demand even during times of economic uncertainty.

Bags will remain the market leaders over the forecast period due to a recovery in luxury handbags and an increase in demand of functional lifestyle and sports bags. Whereas luxury handbags will enjoy the rising domestic mood, younger end users who are looking to purchase expressive and design-focused products will also boost the growth. Consequently, the bags segment will probably continue to be the value driver of the China bags and luggage market until 2026-32.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel is retail offline, holding around 80% of the China bags and luggage market. Physical retail remains important for bags and luggage, particularly for premium and luxury products, as end users prefer to assess quality, craftsmanship, and brand image in person. Shopping centres continue to gain importance, gradually replacing traditional department stores as key retail destinations.

Although retail e-commerce is expanding rapidly through platforms that combine social media and live-streaming, offline channels are expected to maintain their dominance over the forecast period. Instead of being replaced, physical retail is increasingly complemented by digital touchpoints. Overall, retail offline is expected to remain the leading channel, while e-commerce plays a growing supporting role in discovery, engagement, and conversion.

List of Companies Covered in China Bags and Luggage Market

The companies listed below are highly influential in the China bags and luggage market, with a significant market share and a strong impact on industry developments.

- Gucci (China) Trading Ltd

- Prada Trading Shanghai Co Ltd

- Samsonite China

- LVMH Fashion (Shanghai) Trading Co Ltd

- Hermès (Shanghai) Trade Co Ltd

- Chanel (China) Trading Co Ltd

- Tapestry Inc

- Kering (China) Enterprise Management Ltd

- VF Asia Ltd

- Capri Holdings Ltd

Competitive Landscape

China bags and luggage market in 2024 remains highly competitive but is under clear pressure from weak domestic demand and shifting luxury consumption patterns. Leading luxury groups such as LVMH, Chanel, Kering, and Gucci continue to dominate in value terms, although most are experiencing double-digit declines as consumers reduce discretionary spending and redirect purchases overseas. Hermès stands out as a key exception, demonstrating resilience through its ultra-luxury positioning, product scarcity, and strong focus on very important clients, which supports higher transaction values despite lower footfall. Meanwhile, Miu Miu has emerged as the most dynamic brand, driven by strong resonance with younger Chinese consumers seeking creative, expressive designs. Overall, the competitive landscape is shaped by polarisation between ultra-luxury resilience, youth-driven niche growth, and broad-based softness across mainstream luxury players.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. China Bags and Luggage Market Policies, Regulations, and Standards

4. China Bags and Luggage Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. China Bags and Luggage Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Thousand Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Cross Body Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Bags and Backpacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Business Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Duffle Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.5. Clutches- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Soft Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Hard Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Non-Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Material Type

5.2.3.1. Soft Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.1. Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.2. Polyester- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.3. Ballistic Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Hard Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1. Polycarbonate- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2. ABS (Acrylonitrile Butadiene Styrene)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.3. Polypropylene- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Price Category

5.2.4.1. Luxury- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Mass/Economy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Application

5.2.5.1. Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Business- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Region

5.2.6.1. North

5.2.6.2. East

5.2.6.3. Southwest

5.2.6.4. Northwest

5.2.6.5. North East

5.2.6.6. South

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. China Bags Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Thousand Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Region- Market Insights and Forecast 2022-2032, USD Million

7. China Luggage Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Thousand Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Region- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.LVMH Fashion (Shanghai) Trading Co Ltd

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Hermès (Shanghai) Trade Co Ltd

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Chanel (China) Trading Co Ltd

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Tapestry Inc

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Kering (China) Enterprise Management Ltd

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Gucci (China) Trading Ltd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Prada Trading Shanghai Co Ltd

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Samsonite China

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.VF Asia Ltd

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Capri Holdings Ltd

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Sales Channel |

|

| By Material Type |

|

| By Price Category |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.