China Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0528

- 110

-

China Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

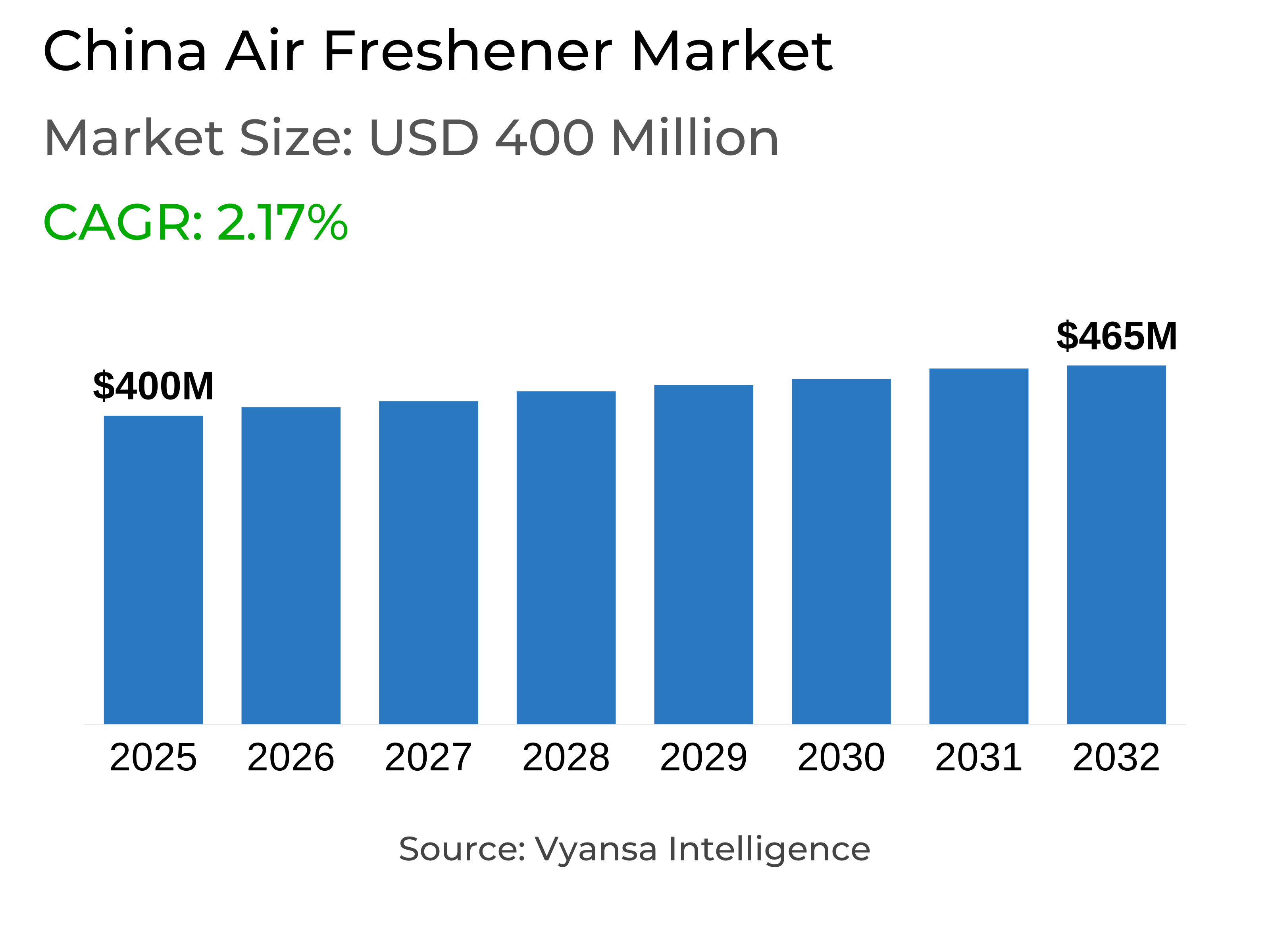

- Air Freshener in China is estimated at $ 400 Million.

- The market size is expected to grow to $ 465 Million by 2032.

- Market to register a CAGR of around 2.17% during 2026-32.

- Product Type Shares

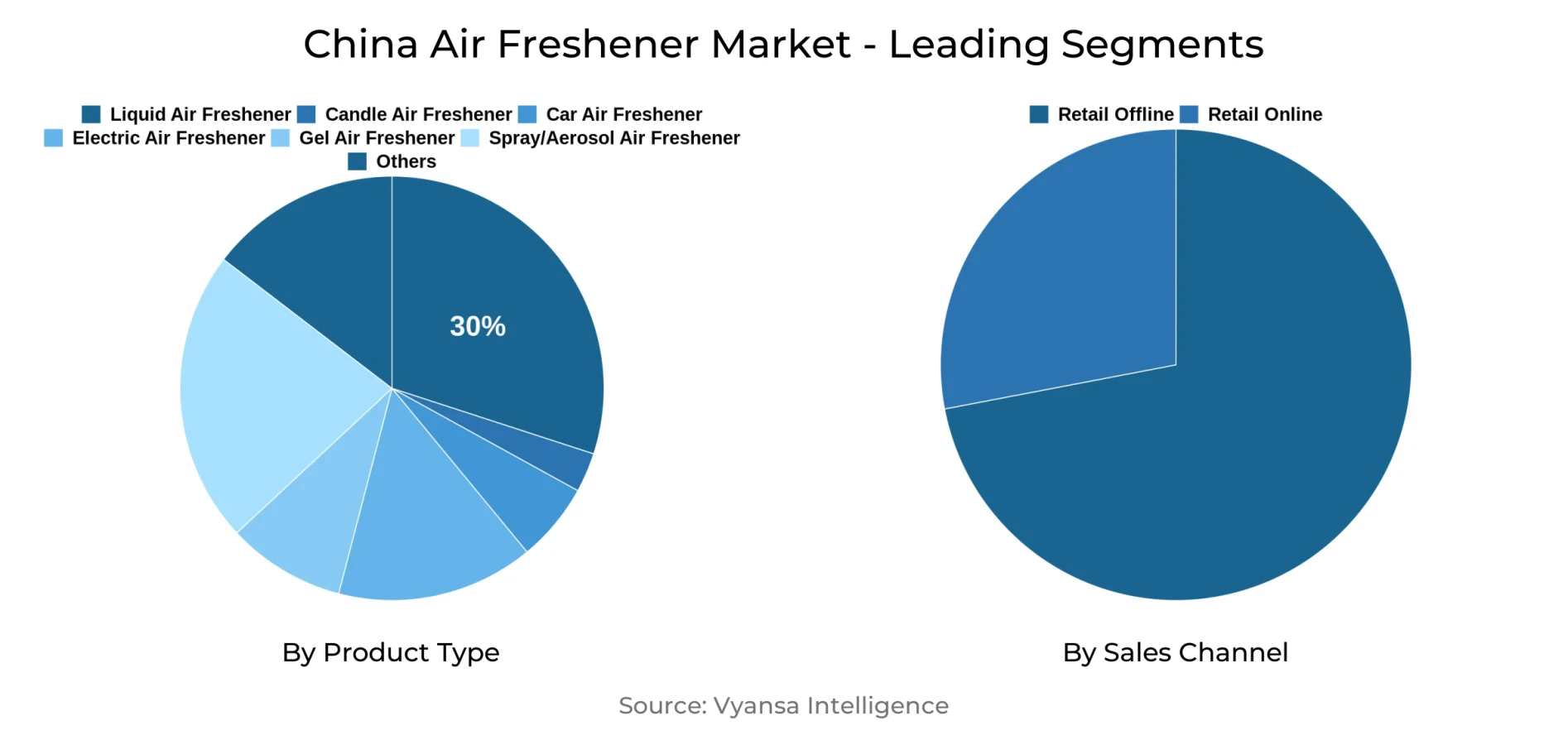

- Liquid Air Freshener grabbed market share of 30%.

- Competition

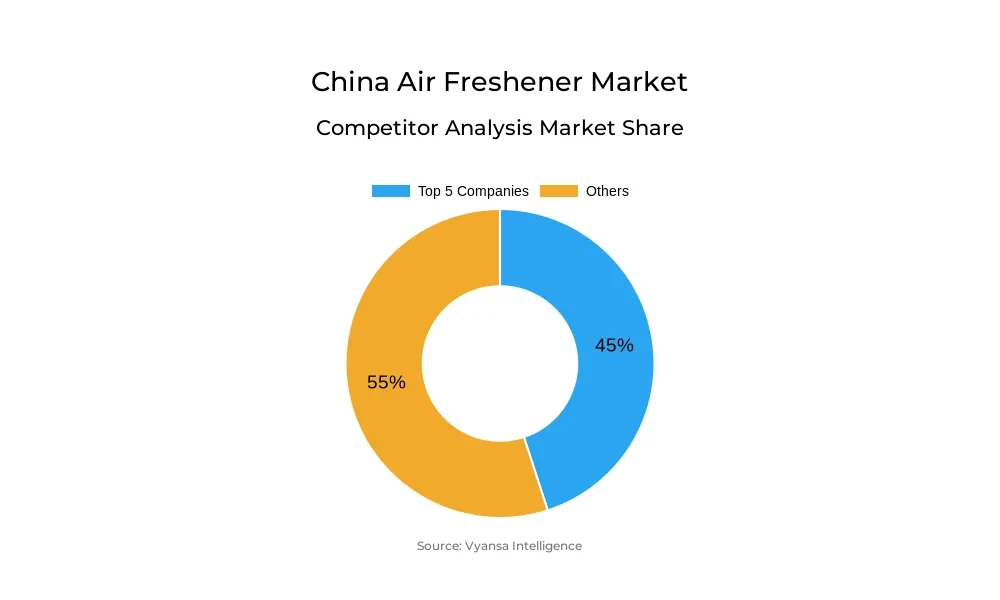

- More than 10 companies are actively engaged in producing Air Freshener in China.

- Top 5 companies acquired around 45% of the market share.

- Guangdong Xiangbainian Holding Group Co Ltd, Aestar (Zhongshan) Co Ltd, Amway (China) Co Ltd, Shanghai Johnson Ltd, Jiangsu Johnson Tongda Co Ltd etc., are few of the top companies.

- By Sales Channel

- Retail Offline continues to dominate the market.

China Air Freshener Market Outlook

China Air Freshener Market, with an approximate value of USD 400 million in 2025, is expected to grow consistently and reach almost USD 465 million by 2032. It is facilitated by the increasing role of the "scent economy," where fragrance is linked with emotional value, well-being, and lifestyle improvement. While luxury fragrance players like Jo Malone and local players like Scent Library are building presence with wellness-led positioning, most end users are value-hungry, seeking to balance desire for premium storytelling against the need for economic solutions.

Car fresheners are one of the most resilient-performing categories, fueled by expanded car ownership and social media buzz surrounding the "stinky car" trend. Brands like Carori have gained double-digit shares by providing fashionable, affordable solutions for battling bad odors. In addition to this, liquid fresheners have the largest value share at around 30% because they are versatile, deliver longer-lasting fragrance, and are applicable to both household and automotive uses.

Cultural associations also influence end user behavior, with fragrances such as aloeswood, agarwood, and pine-cypress gaining popularity for their neutral scent and cultural heritage. Brands like Timing Box emphasize cultural identity by associating products with 24 solar terms, while AI technology from firms like Huabao presents customized scent design via biometric-based AI perfumers. This harmony of tradition and technological innovation is further enhancing product diversity and market participation.

Offline retail channels are still the major sales channel, since end customers prefer to experience fragrances in-store before buying. Collaborations, as represented by Air Funk's deal with Sam's Club, demonstrate the power of physical retail to drive product diversity, in-virtual experiences, and higher brand loyalty. This long-standing preference holds market accessibility based on off-line retail in place while newer marketing types like blind-box releases engage young end users.

China Air Freshener Market Growth Driver

Rising End User Demand and Scent Economy Development

Air freshener items maintained stable retail volume and current value development in China during 2024 with the help of the rising "scent economy" that has a promising outlook with increased competition from premium fragrance ranges. Overlapping functionalities between air fresheners and fragrances in terms of air purification and scenting have become more prevalent, as growing fragrance companies have entered the market with offerings that focus on emotional value and mental health.

Significant global players like Jo Malone, in addition to local players like Documents and Scent Library, have been making strides in the air freshener segment, building strong stories behind their products to drive premiumization. The growing car ownership has been especially fueling demand for car air fresheners, with the "stinky car" issue going viral on social media websites like Douyin, as passengers posted complaints, leading brands to market car air fresheners as key products for better driving experiences.

China Air Freshener Market Challenge

Economic Pressures and Premium Product Accessibility

The economic climate has created reluctance on the part of numerous end users to invest in expensive products from premium brands, and they prefer to opt for low-cost substitutes like Xilan and Carori. Even with premium products available from perfume companies, high price hikes are not expected with end users still looking for value-based solutions without compromising on quality requirements.

While luxury fragrance brands have moved into the market with strong stories on emotional value and mental well-being, the economic environment has produced a preference gap where the end consumers value premium positioning but prefer to buy affordable choices. This economic limitation has caused brands to walk the tightrope between premium positioning and competitive pricing strategies in order to keep the market accessible and reach wider end user bases across various income levels.

China Air Freshener Market Trend

Cultural Integration and AI-Powered Innovation

Common air freshener fragrances include international favorites like lemon, lavender, and fruit/floral, but culturally meaningful fragrances like aloeswood, agarwood, and pine-cypress wood have become popular because of their neutral smell and background in traditional Chinese culture. The companies more and more entice broad end user groups using traditional Chinese cultural symbols, with examples such as Timing Box designing products around traditional Chinese 24 solar terms, linking products with history.

The quick growth of the fragrance economy is revolutionizing air fresheners as AI combines science and art to design custom fragrances, with companies such as Liby and raw materials players like Huabao making major investments in the space. The AI perfumer Arobot, created by Huabao, combines classic perfumery and AI and neural fragrance studies, allowing quick generation of customized fragrances on the basis of biometric data and end user choice to create new scent profiles within under three minutes.

China Air Freshener Market Opportunity

Market Expansion and Product Development Potential

Substantial business prospects lie in the development of air freshener products with multifunctional characteristics and competitive price margins, with new brands such as Leleland introducing universal "one drop for all" air fresheners appropriate for multiple uses while adopting "blind box" marketing schemes to attract young end usres. Air Funk has established strong networks with Sam's Club in supporting complete product lines consisting of both gel and liquid air fresheners at competitive prices.

Air freshener goods that can effectively provide relief from stress, improve the quality of sleep, and synthesize cultural tales – especially those based on traditional Chinese medicine – are expected to become increasingly pertinent for end users who pursue holistic wellness options. Luxury brands are integrating scientific knowledge into their offerings, while niche brands emphasize wellness-focused fragrances for relaxation and enhanced sleep quality, offering various market opportunities based on varying positioning strategies.

China Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

Liquid air fresheners capture the highest market share of around 30% of the total market. Their popularity is due to general appeal, flexibility, and capacity to be used in multiple applications, such as both domestic and automotive usage. Liquids offer a large range of fragrances, from universally common types to culturally specific traditional aromas, providing end users with the flexibility of choice to match personal or cultural aspects. Their role in stress relief and air cleansing further enhances their importance for wellness-oriented families.

Competitive market pricing and innovative refill programs also fortify the market position of liquid air fresheners. Multi-scent pack and adaptive solution brands tend to promote and encourage repeat buys and extended use. By combining functionality with value, and continuing to provide premium-feel experiences, liquid formats remain the category leader. The synergy between functionality, flexibility, and price accessibility positions liquid air fresheners as the most dominant segment driving overall market growth.

By Sales Channel

- Retail Online

- Retail Offline

Offline retail channels retain the largest market share in the sales channel category because end users prefer to sample scents prior to purchase and can analyze scent profiles and product quality themselves. The physicality of air freshener shopping, where fragrance evaluation is important to determine purchasing choices, is more conducive to bricks-and-mortar store settings where end users can contrast alternatives and gain instant access to products.

Conventional retail collaborations, including Air Funk's deal with Sam's Club, confirm the efficacy of offline retail methodologies in promoting full product lines and establishing brand recognition through presence. Offline mediums give brands a platform to deliver immersive scent experiences, offer in-store product demonstrations, and build direct end user relationships that generate brand loyalty and repeat purchases, especially valuable for culturally-themed items that gain from narrative and experiential marketing strategies.

Top Companies in China Air Freshener Market

The top companies operating in the market include Guangdong Xiangbainian Holding Group Co Ltd, Aestar (Zhongshan) Co Ltd, Amway (China) Co Ltd, Shanghai Johnson Ltd, Jiangsu Johnson Tongda Co Ltd, Shanghai Kobayashi Daily Chemicals Co Ltd, Cheerwin Group Co Ltd, Farcent (Xiamen) Daily Chemical Co Ltd, Suryamas Daily Chemical (Tianjin) Co Ltd, Guangzhou Comebest Industry Co Ltd, etc., are the top players operating in the China Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. China Air Freshener Market Policies, Regulations, and Standards

4. China Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. China Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. China Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. China Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. China Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. China Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. China Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. China Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Shanghai Johnson Ltd

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Jiangsu Johnson Tongda Co Ltd

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Shanghai Kobayashi Daily Chemicals Co Ltd

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Cheerwin Group Co Ltd

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Farcent (Xiamen) Daily Chemical Co Ltd

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Guangdong Xiangbainian Holding Group Co Ltd

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Aestar (Zhongshan) Co Ltd

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Amway (China) Co Ltd

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Suryamas Daily Chemical (Tianjin) Co Ltd

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Guangzhou Comebest Industry Co Ltd

12.1.10.1. Business Description

12.1.10.2. Product Portfolio

12.1.10.3. Collaborations & Alliances

12.1.10.4. Recent Developments

12.1.10.5. Financial Details

12.1.10.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.