Chile Wearable Electronics Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Activity Wearables, Smart Wearables), By Application (Healthcare, Entertainment, Industrial, Others), By Sales Channel (Offline, Online)

|

Major Players

|

Chile Wearable Electronics Market Statistics, 2025

- Market Size Statistics

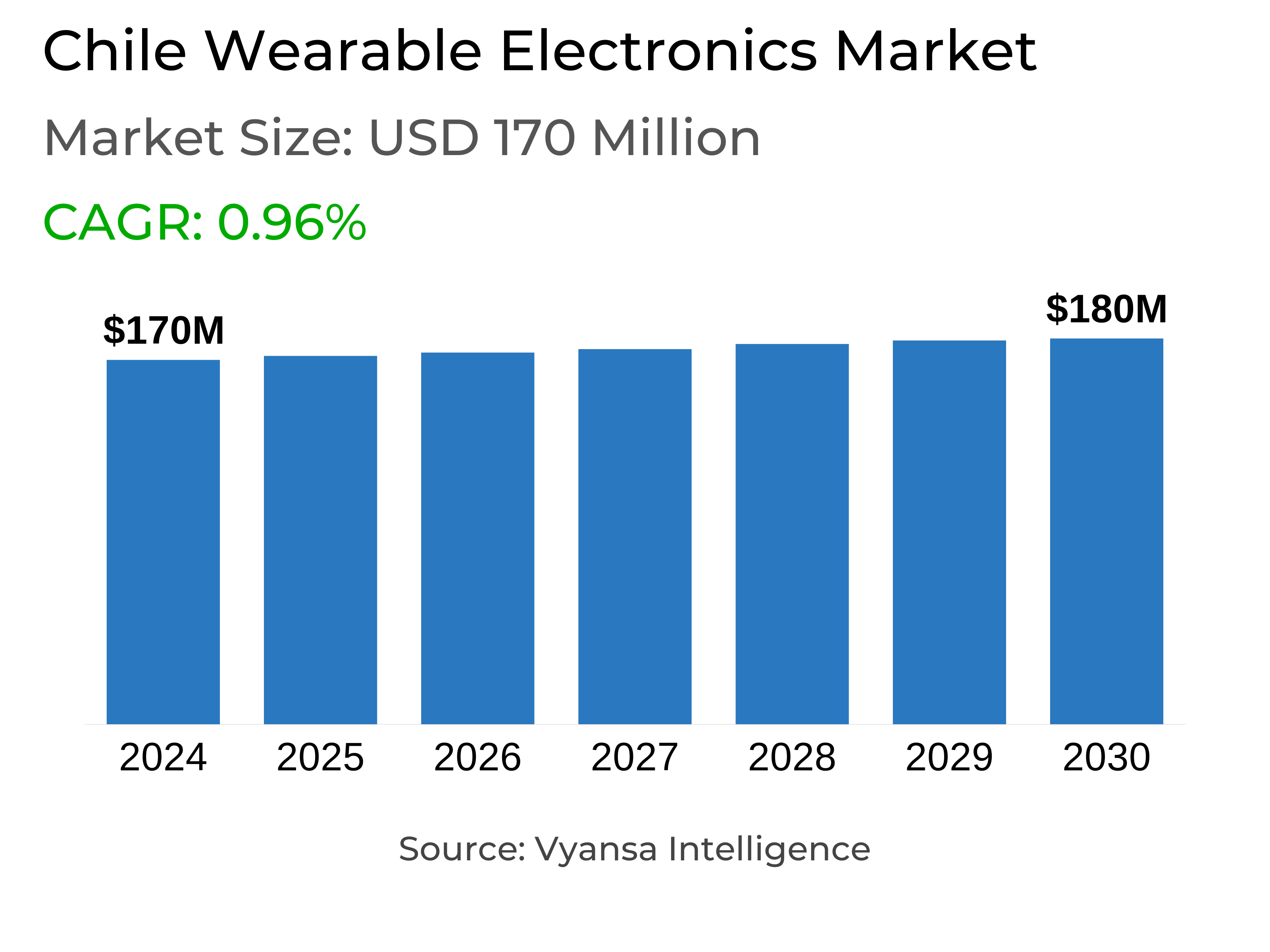

- Wearable Electronics in Chile is estimated at $ 170 Million.

- The market size is expected to grow to $ 180 Million by 2030.

- Market to register a CAGR of around 0.96% during 2025-30.

- Product Shares

- Smart Wearables grabbed market share of 85%.

- Smart Wearables to witness a volume CAGR of around 3.2%.

- Competition

- More than 5 companies are actively engaged in producing Wearable Electronics in Chile.

- Top 5 companies acquired 60% of the market share.

- Apple Inc, Fitbit Inc, Nike Inc, Samsung Electronics Chile Ltda, Xiaomi Chile SA etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 75% of the market.

Chile Wearable Electronics Market Outlook

Wearable electronics in Chile will experience steady expansion from 2025–30, fueled mainly by increased health awareness and consumers' growing demand for exercise and well-being. Having recovered in 2024, the market will continue to gain traction driven by enduring demand for training and health monitoring devices. Smart wearables will spearhead the growth, particularly as consumers move away from plain activity bands to digital activity watches and display-enabled smartwatches.

Technology development will continue to be central to this evolution. Products with higher functionalities, like those from Samsung, Xiaomi, and Apple, will dominate over basic devices. The introduction of medical-feature smartwatches such as Apple Watch Series 10 with blood glucose and pressure tracking will appeal to consumers seeking feature-packed smartwatches. On the other hand, the rapid expansion of Xiaomi backed by value-for-money pricing demonstrates market potential for value-conscious brands.

Smartwatches will also be increasingly regarded as fashion accessories rather than mere health companions. Buyers will appreciate both design and functionality, leading brands to innovate both in terms of form and function. As smart wearables move deeper into the Chilean marketplace, price-conscious shoppers will make it possible for new and upstart brands to make inroads based on promotional tactics and affordable prices.

E-commerce will remain an important driver for distribution. Despite a temporary decline in 2023, sales via the internet have continued well above their pre-pandemic levels. With consumers increasingly becoming at ease with shopping online and the pervasive availability of the internet, e-commerce is anticipated to be a leading growth factor for wearable electronics in the future.

Chile Wearable Electronics Market Growth Driver

Increasing demand for personal fitness and health is fueling demand for wearable electronics in Chile. Following a dip in volume sales last year, 2024 has seen the market recover, with key growth coming from consumers employing wearable devices for training and wellness. There is a diverse range of brands available that have made these electronics more affordable, with premium and niche brands gaining traction in the high-end market.

At the same time, technology advancements are also instrumental in revolutionizing consumer decisions. There is an evident transition from simple activity bands without screens to smart activity watches with sophisticated functions. This transition is being facilitated by the release of cost-effective smartwatches by Samsung, Xiaomi, and other Chinese brands, making it possible for more customers to opt for display-equipped, multi-functional devices instead of mere trackers.

Chile Wearable Electronics Market Trend

Wearable technology will be even more beneficial to health-aware consumers when new features supporting improved health monitoring are launched. The future of smartwatches will bring a system for monitoring blood glucose levels, which represents a major advancement in the field of health technology. As an added feature, consumers will also have the ability to track their blood pressure, enhancing overall wearability value as constant health companions.

The glucose-tracking feature will not provide precise readings but indicate a trend of blood sugar levels and alert users to sharp rises or falls. It can prompt users to take necessary action to remain within healthy boundaries in time. These developments are especially beneficial for diabetics, who can do without frequent pricks on the fingers. These developments are likely to fuel the increasing demand for wearables in the years to come.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Chile Wearable Electronics Market Opportunity

Emerging brands also have a good chance of expansion in the market by basing their business on the price aspect of consumers' purchasing decisions. Most new entrants are able to exploit the price difference between them and established brands to capture the market and get more buyers. Xiaomi is one such example, having established a good place in the category through competitive pricing and promotion.

This price-sensitive strategy has benefited many other brands in the same sector. Emerging brands can successfully target price-sensitive consumers by making appealing offers and promotions. This not only enhances their market coverage but also establishes brand awareness in a price-sensitive market.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 170 Million |

| USD Value 2030 | $ 180 Million |

| CAGR 2025-2030 | 0.96% |

| Largest Category | Smart Wearables segment leads with 85% market share |

| Top Drivers | Rising Fitness Awareness and Shift Toward Smart Devices Fueling Demand |

| Top Trends | Advancement in Health Monitoring Features Driving Adoption |

| Top Opportunities | Competitive Edge Through Strategic Pricing |

| Key Players | Apple Inc, Fitbit Inc, Nike Inc, Samsung Electronics Chile Ltda, Xiaomi Chile SA, Garmin Chile Ltda, Quintec Distribucion SA, Huawei Chile SA and Others. |

Unlock Market Intelligence

Explore the market potential with our data-driven report

Chile Wearable Electronics Market Segmentation Analysis

The most market-leading segment in Chile Wearable Electronics Market throughout 2025-30 is smart wearables. The latter are anticipated to lead the overall industry growth as users continue to prefer high-end features and better design. While digital activity watches did well in 2024, their sales are anticipated to slow down over the years and yet stay over pre-pandemic levels. This transformation comes because the consumers are replacing activity bands with better though low-priced smart wearables, which will contribute to overall value growth in the market.

Smart wearables have space for greater penetration in Chile. Functionality and design are being improved by brands to engage consumers, which is likely to have a positive effect on value sales. With smartwatches becoming increasingly prevalent, design is taking a larger part in terms of consumer purchase decisions, with many now seeing them as both practical devices and fashion items. The fusion of function and fashion will strengthen the category in the future.

Top Companies in Chile Wearable Electronics Market

The top companies operating in the market include Apple Inc, Fitbit Inc, Nike Inc, Samsung Electronics Chile Ltda, Xiaomi Chile SA, Garmin Chile Ltda, Quintec Distribucion SA, Huawei Chile SA, etc., are the top players operating in the Chile Wearable Electronics Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Chile Wearable Electronics Market Policies, Regulations, and Standards

4. Chile Wearable Electronics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Chile Wearable Electronics Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Unit Sold (Thousand Units)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Activity Wearables- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Activity Bands- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. Activity Watch- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2.1. Analogue- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2.2. Digital- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Smart Wearables- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.1. Eye Wear- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.2. Body Wear- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Application

5.2.2.1. Healthcare- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Entertainment- Market Insights and Forecast 2020-2030, USD Million

5.2.2.3. Industrial- Market Insights and Forecast 2020-2030, USD Million

5.2.2.4. Others- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Sales Channel

5.2.3.1. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Chile Activity Wearable Electronics Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Unit Sold (Thousand Units)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Application- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Chile Smart Wearable Electronics Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Unit Sold (Thousand Units)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Application- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Samsung Electronics Chile Ltda

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Xiaomi Chile SA

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Garmin Chile Ltda

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Quintec Distribucion SA

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Huawei Chile SA

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Apple Inc

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Fitbit Inc

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Nike Inc

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Company 9

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Company 10

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Application |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.