Chile Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0527

- 120

-

Chile Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

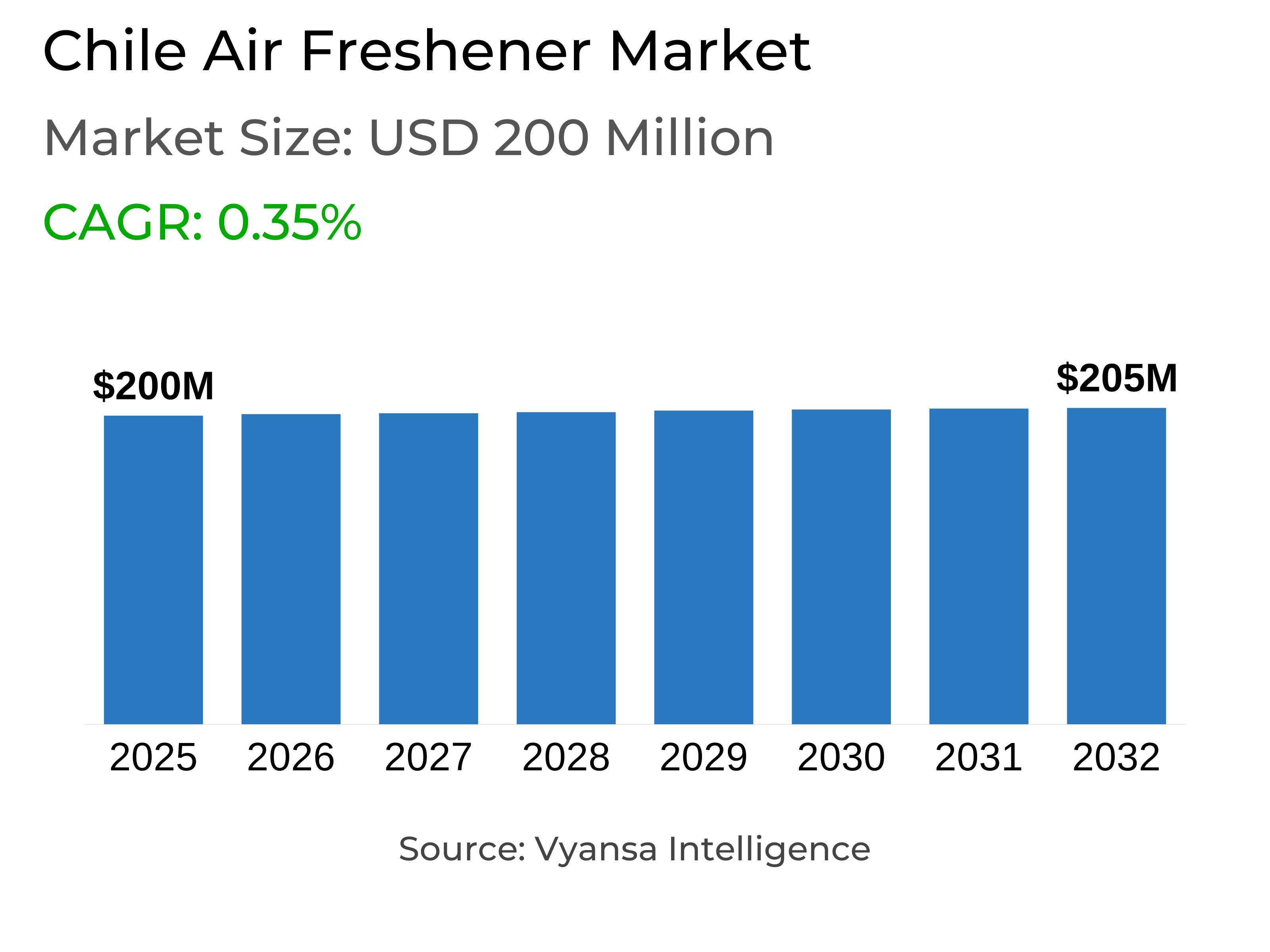

- Air Freshener in Chile is estimated at $ 200 Million.

- The market size is expected to grow to $ 205 Million by 2032.

- Market to register a CAGR of around 0.35% during 2026-32.

- Product Type Shares

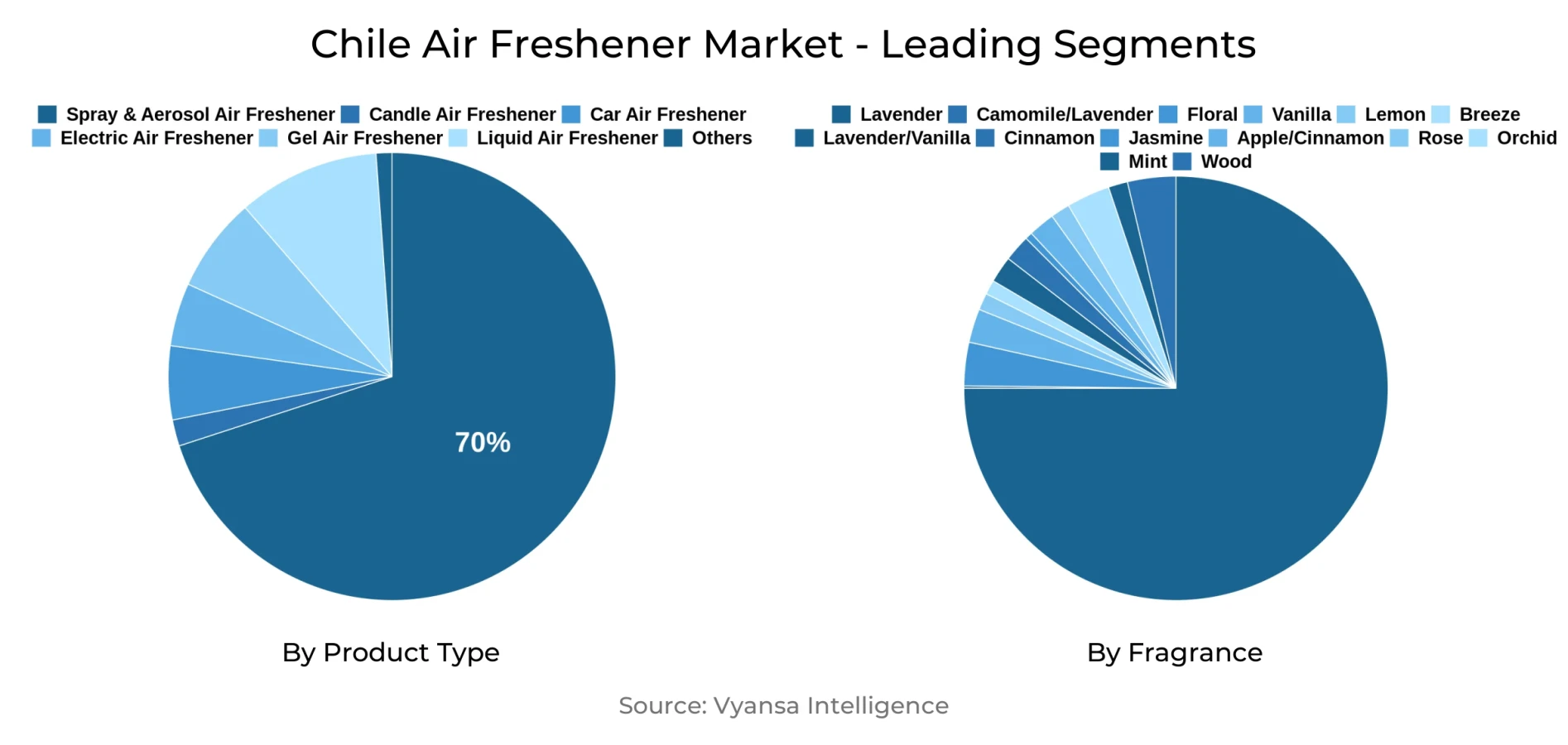

- Spray/Aerosol Air Freshener grabbed market share of 70%.

- Competition

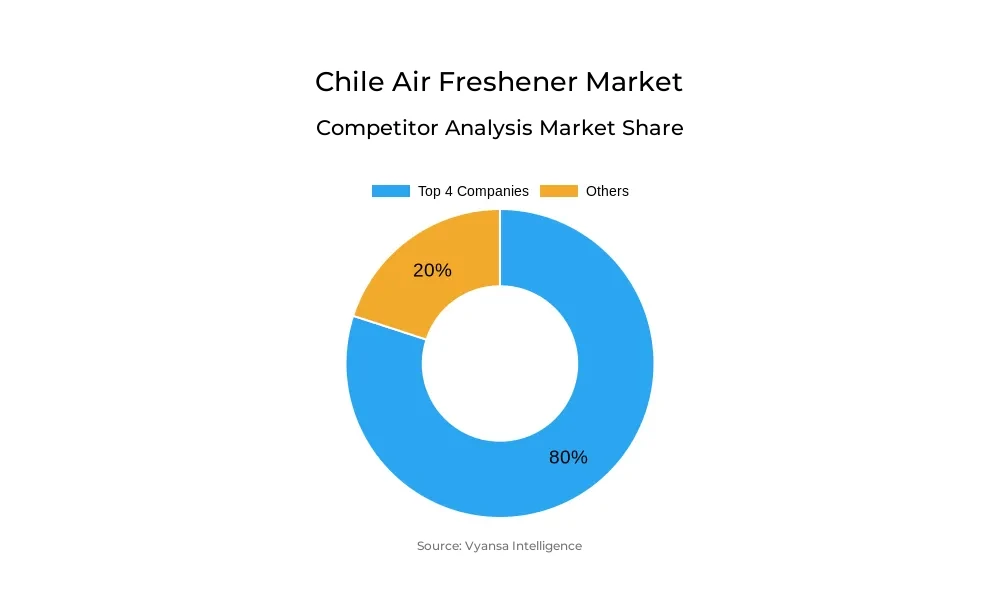

- More than 5 companies are actively engaged in producing Air Freshener in Chile.

- Top 4 companies acquired around 80% of the market share.

- SC Johnson & Son Chile Ltda, Empresas Demaria SA etc., are few of the top companies.

- Fragrance

- Lavender continues to dominate the market.

Chile Air Freshener Market Outlook

The Chile Air Freshener Market is valued at USD 200 million and is expected to grow to USD 205 million in 2032, a steady increase fueled by end users' ongoing desire to beautify indoor environments with pleasant odors. Even with slower buying frequency and retail volume decreases in 2024, demand was strong as end users tried out various scents and multi-fragrance sets. Limited seasonal and seasonal-only releases promoted further product discovery, ensuring habitual use and reaffirming air fresheners as a necessary part of home care routines. Lavender is still the favorite fragrance, continuing to dominate because it is widely accepted and highly versatile.

End users' spending habits were affected by economic uncertainty, which led to frugal spending and favor toward inexpensive formats. Price-conscious segments valued spray/aerosol products, which lead the market with 70% share because of their convenience, low maintenance, and broad range of scents. Value-maximizing promotional tools, such as multi-refill packs, economy packs, and gift inclusion, enabled end users to optimize value while maintaining activity. Low-maintenance formats like sprays and aerosols were preferred over higher-cost or more maintenance-intensive options like electric air fresheners, underscoring the significance of functional convenience and cost-effectiveness.

Upscale versions, such as fragranced candles and electric air fresheners, caught on among more affluent end consumers interested in richer sensory experiences. Companies countered with differentiated fragrance portfolios, holiday-season offerings, and limited-edition products to create interest and enforce the allure of diversity. Major players used promotion campaigns and several formats to maintain consumer engagement, highlighting convenience and home atmosphere enhancement. This strategy serves to prove that innovation, fragrances diversity, and premium positioning are essential for driving market expansion.

Offline retail channels maintain the highest share in light of accessibility, on-shelf immediacy, and consumer confidence, enabling end users to experiment with scents and make impulse purchases. Supermarkets, hypermarkets, and convenience stores facilitate promotion programs like multi-refill packs and seasonal variants, driving experimentation and repeat purchases. Online retail channels are also increasingly significant, especially for promotional occasions, providing convenience and broader assortment. Collectively, these trends guarantee constant expansion and regular participation in Chile's air freshener industry between 2026 and 2032.

Chile Air Freshener Market Growth Driver

Sustained Interest in Home Fragrance Enhances Market Demand

Total demand for air fresheners in Chile was robust in 2024, even in the face of slower frequency of purchase and retail volume declines. End users persisted in the pursuit of pleasant odors to satisfy indoor environments, showing market resilience. Most tried various fragrances and bought multi-scent packs, indicating an interest in variety and smell exploration at home. This consistent practice made companies innovate and introduce new version products, making the market stay relevant even in the face of wider economic challenges.

End users' propensity to try new scents and spend money on multi-scent packs reinforces sustained product adoption and leads brands to build out their portfolios. Seasonal and limited releases also drive interest, and the resulting steady engagement comes despite reduced frequency of purchase. The synergy of experimentation, variety, and innovation points to the primary driver of sustained market activity and establishes air fresheners as a necessary component of end users' daily home life.

Chile Air Freshener Market Challenge

Economic Uncertainty Influences Purchasing Patterns

End users' consumption behavior during 2024 was driven by economic doubt, resulting in prudent buying and lower buying rates. Value-conscious segments favored cheaper formats, and premium offerings saw managed demand. As a way to maintain connectivity, manufacturers used promotional tactics like multi-refill packs, economy sets, and gift inclusion, which allowed end users to extract maximum value for money without sacrificing usage.

Frugal consumption also restricted trial with more expensive or maintenance-based products, like electric air fresheners. Consumers preferred products with low maintenance and accommodating use, emphasizing the necessity of functional convenience and affordability. Marketing efforts effectively offset consumption restraint, keeping market share and brand loyalty steady under economic stress.

Chile Air Freshener Market Trend

Growing Demand for Premium and Fragrance-Focused Offerings

End consumers more and more looked for high-end air freshener solutions, such as electric versions and scented candles, indicating a need for heightened home sensory experiences. Manufacturers reacted by launching seasonal lines, special editions, and more extensive fragrance ranges, appealing to better-off demographic segments prepared to pay a premium for complex products. Multi-scent offers invited exploration and emphasized the significance of fragrance assortment in brand engagement.

For example, leaders like SC Johnson & Son utilized advertising campaigns and diversified packaging to maintain leadership. Convenience was provided by options like automatic sprays, 3-wick candles, and scented oil refills, while adding to the home environment. This trend illustrates how innovation, variety, and premium positioning drive market growth by appealing to end consumers' changing expectations for elevated and flexible air freshener experiences.

Chile Air Freshener Market Opportunity

Expansion Potential Through Online Retail Channels

Online sales channels became more significant through activities like Cyber Days and Black Friday, providing end users with convenience, wider range of offerings, and promotions. Firms invested in online presence, website upgrades, and delivery capabilities to fulfill increasing online demand, pointing to the channel's growth potential. E-commerce supports time-saving product access and is consistent with end users' desire for efficient shopping alternatives.

Market-leading supermarket chains Lider, Tottus, Jumbo, and Unimarc solidified brand partnerships to offer focused promotions and pack bundling. These efforts increased interaction with price-conscious as well as convenience-oriented end consumers. The channel's capacity for timely access, appealing offers, and assortment makes online retail a leading channel for the capture of incremental market share in Chile's air freshener market.

Chile Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

Spray/aerosol air fresheners command the largest market share of 70% due to their convenience, price affordability, and wide variety of scents. Consumers appreciate the low-maintenance and functionality-expressiveness of the format that enables them to continue using them with regularity without additional effort or expense. The functionality to provide multi-scent and seasonal packs further encourages consumer participation and exploration, further consolidating the format's market leadership.

Affordability and convenience enable spray/aerosol products to reach various end-user segments. Marketing efforts, including super refill packs and economy packs, increase perceived value and repeat purchase. This blend of versatility, convenience, and affordability guarantees spray/aerosol air fresheners as the format of choice in the chile market, maintaining their lead position in product type segmentation.

By Fragrance

- Camomile/Lavender

- Lavender

- Floral

- Vanilla

- Lemon

- Breeze

- Lavender/Vanilla

- Cinnamon

- Jasmine

- Apple/Cinnamon

- Rose

- Orchid

- Mint

- Wood

Retail Offline channels hold the greatest market share because of their ubiquitous presence, instant availability of products, and established customer loyalty. Supermarkets, hypermarkets, and convenience stores enable end consumers to smell, compare, and make on-the-spot buying decisions, substantiating the channel's ongoing importance in spite of increased online options.

In-store promotional infrastructure in the form of multi-refill packs, seasonal flavors, and special points of display further stimulates experimentation and trial. Retail offline stores support quick pickup of new product launches and guarantee high exposure across target segments. The synergy between availability, promotion support, and consumer confidence cements offline retail as the top sales channels for air fresheners in Chile.

Top Companies in Chile Air Freshener Market

The top companies operating in the market include SC Johnson & Son Chile Ltda, Empresas Demaria SA, Reckitt Benckiser Chile SA, Clorox Chile SA, etc., are the top players operating in the Chile Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Chile Air Freshener Market Policies, Regulations, and Standards

4. Chile Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Chile Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Chile Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Chile Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Chile Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Chile Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Chile Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Chile Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. SC Johnson & Son Chile Ltda

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Empresas Demaria SA

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Reckitt Benckiser Chile SA

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Clorox Chile SA

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.