Canada Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0526

- 130

-

Canada Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

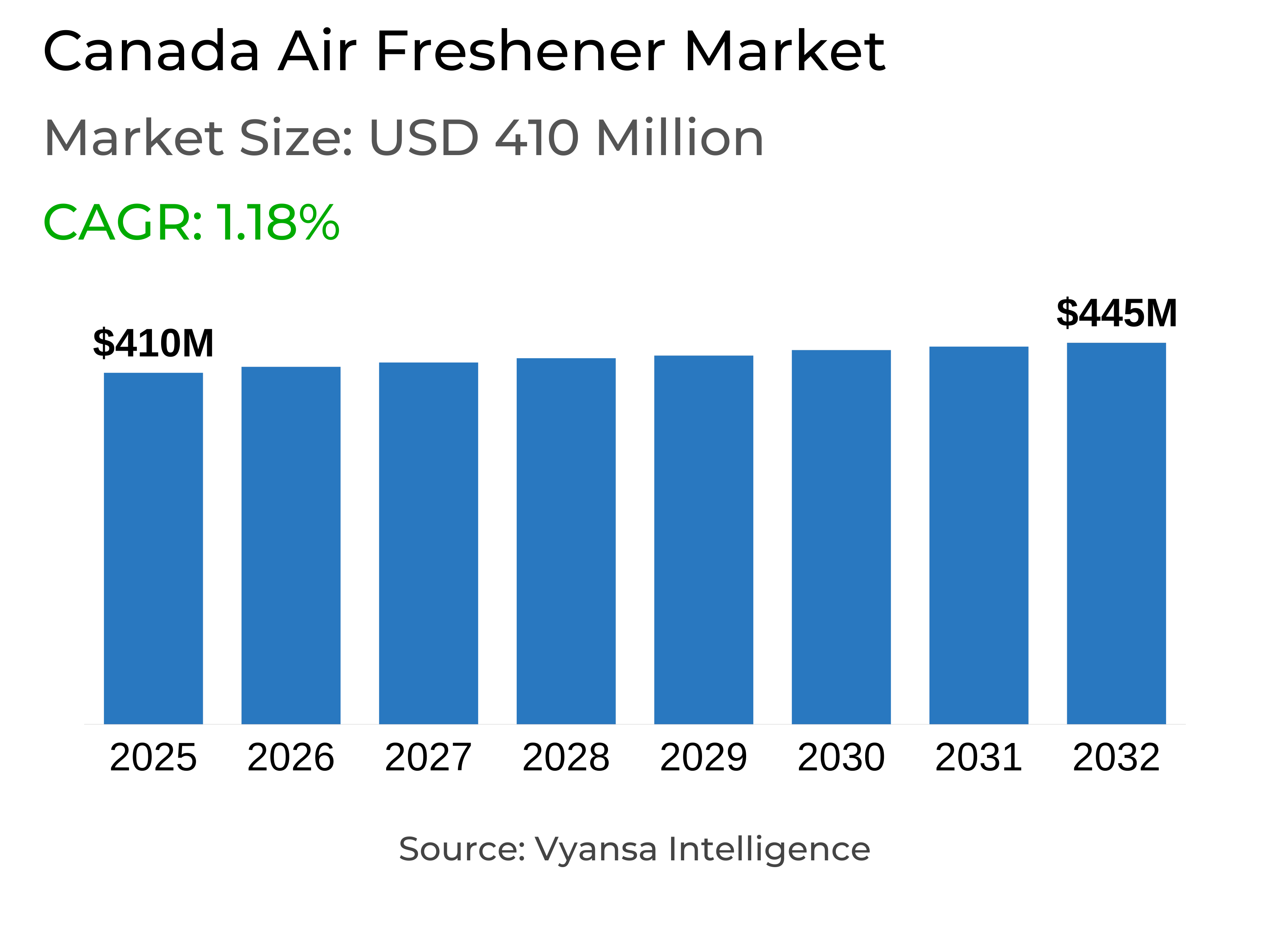

- Air Freshener in Canada is estimated at $ 410 Million.

- The market size is expected to grow to $ 445 Million by 2032.

- Market to register a CAGR of around 1.18% during 2026-32.

- Product Type Shares

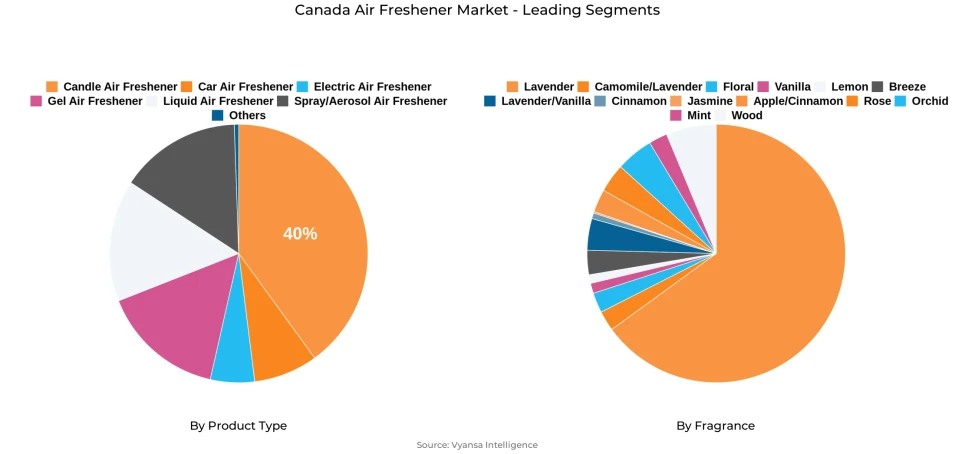

- Candle Air Freshener grabbed market share of 40%.

- Competition

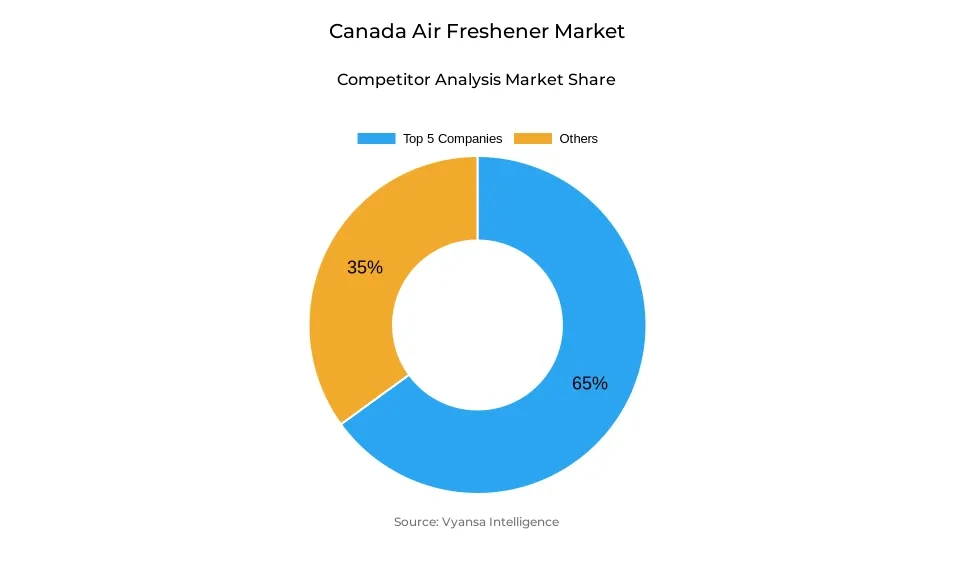

- More than 10 companies are actively engaged in producing Air Freshener in Canada.

- Top 5 companies acquired around 65% of the market share.

- Church & Dwight Ltd, Car-Freshner Corp, Armaly Brands Inc., Reckitt Benckiser Canada Inc, SC Johnson & Son Ltd etc., are few of the top companies.

- Fragrance

- Lavender continues to dominate the market.

Canada Air Freshener Market Outlook

The Canada Air Freshener Market is estimated at about USD 410 million in the year 2025 and is expected to reach USD 445 million by 2032, owing to growing concern for wellness and emotional well-being. Fragrances are currently known to have an impact on mood, stress reduction, and improving indoor spaces. During the pandemic, end users under lock-down depended greatly on air freshener products, increasing short-term sales, and even though there has been growth normalization since then, the demand is sustained by the desire for fragrances that aid relaxation. The most preferred fragrance is still lavender, an indication of end users' preference for soothing and calming scents.

Economic constraints have kept air freshener uptake at bay, with increased costs of living in Canada forcing households to invest in essentials over discretionary items. Spray and aerosol formats are more impacted by increased cost per application and reduced perceived wellness benefit when contrasted with candles and diffusers. In spite of these limitations, candle air fresheners have a dominant market share of 40% in 2025, appreciated for their dual role as fragrance diffusers and aesthetic additions that create ambiance and contribute to emotional well-being.

Product innovation is redefining the market, with companies launching distinctive aromas and various delivery forms to address changing end-user tastes. For instance, Bath & Body Works' "Perfect in Pink" line combines cherries, pink camellia, and whipped almond crème, providing a unique sensory experience. Innovations of this nature increase interaction, strengthen brand loyalty, and become part of everyday routines, even amidst competitive forces. Strategic investment, for example, in SC Johnson & Son's CAD50 million Brantford plant expansion, reflects faith in the market's potential for growth and its alignment with end users trends centered on wellness.

Offline retail channels continue to be leaders as a result of high in-store visibility, opportunities to smell scents, and strong brand presence within leading grocery retailers. Branded offerings continue to dominate private labels as end users value emotional relevance and distinct fragrances over saving money. Despite merchandising expenditure and lifestyle-driven demand, the offline retail channel is expected to continue its leadership, providing the steady growth of the Canada Air Freshener Market to 2032.

Canada Air Freshener Market Challenge

Rising Costs and Shifts in Essential Spending

Financial pressures have limited the adoption of air freshener, since the category is largely discretionary as opposed to necessities for the household. Increasing living expenses throughout Canada have pushed end users to focus on staples at the expense of others like air fresheners. Successive decreases in value and volume sales were witnessed in 2023 and 2024, which mirror the change in household priorities.

Spray and aerosol forms have been disproportionately affected by their relatively higher cost per use. End users also perceive these products as less closely linked to emotional or wellness benefits compared to candles or diffusers, thus further reducing demand. This combination of high expense and lower perceived value has limited expansion, pointing to the category's sensitivity to changes in household budgets.

Canada Air Freshener Market Trend

Expanding Variety and Sensory Innovation

Product innovation continues to drive the Canada air freshener market, as companies launch distinctive scents that differentiate themselves in a busy retail landscape and meet end users' desire for products that contribute to emotional health. For instance, Bath & Body Works introduced its "Perfect in Pink" scent line in 2024, combining cherries, pink camellia, and whipped almond crème, creating a unique sensory experience. These product launches underscore the continuing pattern of differentiation and personalization in the category.

Extension to several product forms mirrors end users' increased desire for varied fragrance delivery modes. Those forms are added into daily life more and more, increasing participation and supporting brand loyalty. In responding to end users' changing desires for both sensory usage and lifestyle incorporation, these developments remain relevant and enable long-term consumption in the face of competitive forces in the marketplace.

Canada Air Freshener Market Opportunity

Investment and Long-Term Market Recovery Potential

Investment by market leaders highlights the optimism in the future prospects of the Canada air freshener category. SC Johnson & Son, for instance, invested CAD50 million in expanding its factory at Brantford, boosting production capacity for Glade PlugIns Scented Oil and other brands, in addition to warehousing and distribution activities. The move demonstrates the company's interest in capturing market share and underscores the underlying potential of the category.

Recovery in the market is complemented by increased end users participation in stress-reduction activities, where products based on scent act in a supporting capacity. In 2024, 18% of survey respondents participated in stress-reduction activities every week, compared to 13% in 2023, as evidence mounts of rising focus on wellness. These trends indicate that investment in production, innovation, and distribution takes into account the changing priorities of end users and will lead to consistent value growth during the forecasting period.

Canada Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

Candle air fresheners lead the Canada market in 2025 with 40% share. Their dominance is rooted in their positioning as relaxation and emotional wellness, offering end users an engaging and lifestyle-driven experience. Unlike sprays, where functionality is perceived, candles are used to enrich ambiance and reduce stress, enhancing their premium positioning.

Candle versatility adds to market leadership. They serve as both fragrance diffusers and decorations, pleasing end users who appreciate style in addition to sensory benefit. Crossover appeal through aesthetic value and emotional wellbeing positioning positions candles as the favorite product type. Through increased emphasis on individual wellbeing and lifestyle consumption, candle air fresheners are predicted to stay in leadership during the forecast period.

By Fragrance

- Camomile/Lavender

- Lavender

- Floral

- Vanilla

- Lemon

- Breeze

- Lavender/Vanilla

- Cinnamon

- Jasmine

- Apple/Cinnamon

- Rose

- Orchid

- Mint

- Wood

Retail Offline channel holds the greatest market share because of high in-store visibility and brand presence. Prolific players like Glade, Febreze, and Air Wick have the maximum shelf presence in leading grocery retailers like Walmart and Loblaws, and hence their products are readily available. Physical stores provide end users with the ability to test fragrances, a crucial consideration since purchase decisions are based on sensory considerations.

Private label products have limited penetration, competing mainly on price with the result of equivalent scent quantity and quality, but not dominating. end users value distinctiveness and emotional attachment over price, maintaining market share for branded products. In spite of merchandising expenditures, retail offline segments are forecasted to continue providing market leadership in air freshener distribution up to 2032.

Top Companies in Canada Air Freshener Market

The top companies operating in the market include Church & Dwight Ltd, Car-Freshner Corp, Armaly Brands Inc., Reckitt Benckiser Canada Inc, SC Johnson & Son Ltd, Limited Brands Canada, Procter & Gamble Inc, Henkel Canada Corp, Energizer Holdings, Inc., S.T. Corporation, etc., are the top players operating in the Canada Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Canada Air Freshener Market Policies, Regulations, and Standards

4. Canada Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Canada Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Canada Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Canada Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Canada Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Canada Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Canada Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Canada Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Reckitt Benckiser Canada Inc

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. SC Johnson & Son Ltd

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Limited Brands Canada

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Procter & Gamble Inc

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Henkel Canada Corp

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Church & Dwight Ltd

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Car-Freshner Corp

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Armaly Brands Inc.

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Energizer Holdings, Inc.

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. S.T. Corporation

12.1.10.1. Business Description

12.1.10.2. Product Portfolio

12.1.10.3. Collaborations & Alliances

12.1.10.4. Recent Developments

12.1.10.5. Financial Details

12.1.10.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.