Cameroon Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0525

- 115

-

Cameroon Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

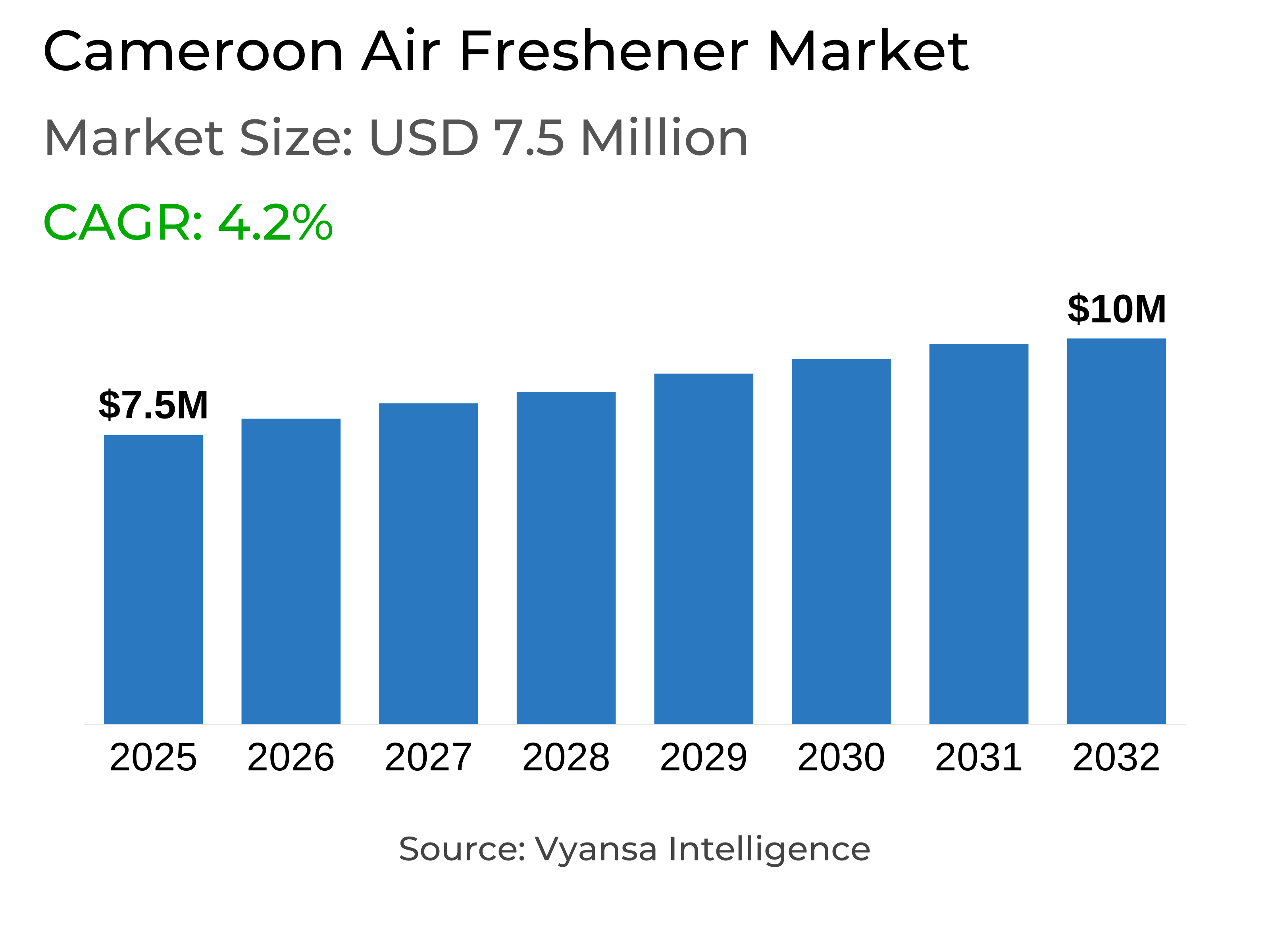

- Air Freshener in Cameroon is estimated at $ 7.5 Million.

- The market size is expected to grow to $ 10 Million by 2032.

- Market to register a CAGR of around 4.2% during 2026-32.

- Product Type Shares

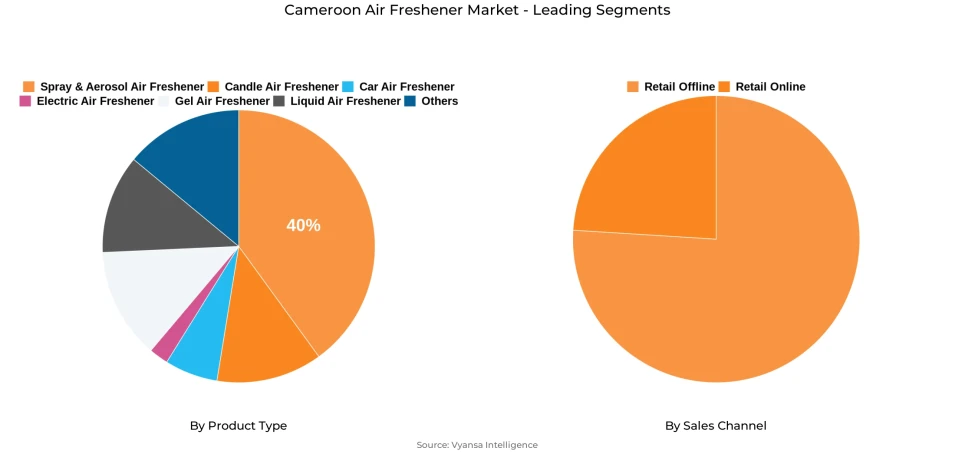

- Spray/Aerosol Air Freshener grabbed market share of 40%.

- Competition

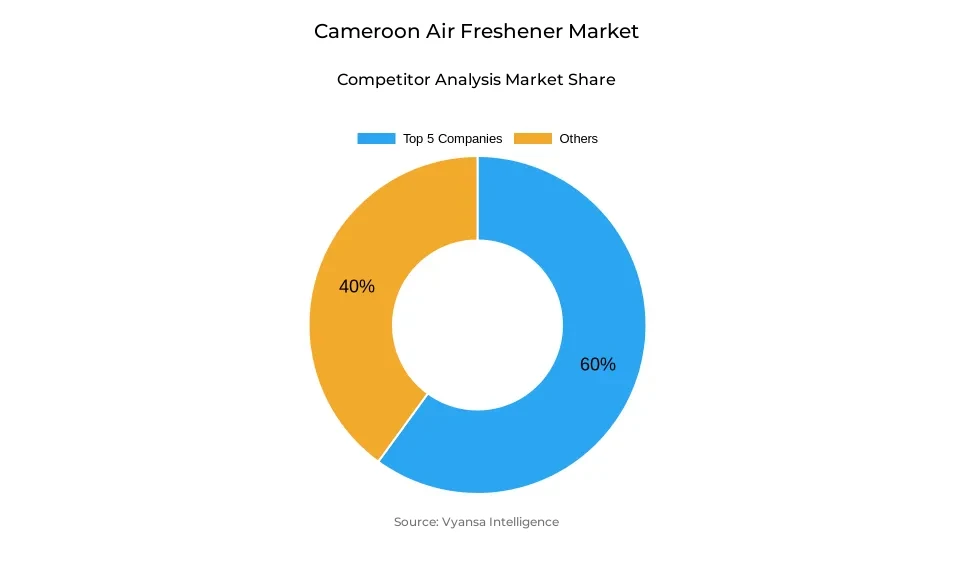

- More than 10 companies are actively engaged in producing Air Freshener in Cameroon.

- Top 5 companies acquired around 60% of the market share.

- Henkel AG & Co KGaA, McBride Plc, Church & Dwight Co. Inc., SC Johnson & Son Inc, Reckitt Benckiser Group Plc (RB) etc., are few of the top companies.

- Sales Channel

- Retail Offline continues to dominate the market.

Cameroon Air Freshener Market Outlook

The Cameroon Air Freshener Market, worth USD 7.5 million in 2025, is anticipated to grow to USD 10 million by 2032, showing consistent growth despite affordability issues. The fast pace of urbanisation, inefficient waste management, and urban congestion have propelled end users towards using air fresheners to create comfortable living conditions. Growing car ownership has also elevated demand for motor vehicle air fresheners, with westernisation and social media exposure impacting younger segments to move towards decorative and premium forms like scented candles and reed diffusers. These items are attractive on both the fragrance and aesthetic fronts, following international lifestyle trends.

Nonetheless, price is still one major limit on market access. High-value products, like electric air fresheners costing about XAF12,000, are out of reach to the majority of households, leaving air fresheners largely within the purview of middle- and high-income earners. Other than that, pirated imports, like spray/aerosol products from Nigeria, sold for as little as XAF1,000, continue to pour into informal channels. It causes unrealistic price perceptions and dampens well-established brands, constraining their ability to grow profitably in formal retail.

A significant change is the increasing demand for multi-functional products where fragrance is mixed with insect-repellent or sanitising advantage. These products are designed to serve low- and middle-income households where cost-effectiveness and functional value are desired, making air fresheners move from luxury lifestyle products to functional household tools. This development is forcing companies to innovate and reposition themselves to address new expectations, thus reconfiguring the competitive environment.

In the product category, spray/aerosol air fresheners lead with 40% market share because of price points and availability through both formal and informal channels. In contrast, decorative forms such as candles are slowly narrowing the gap, and gel air fresheners are picking up in car usage. In distribution, retail offline is the biggest channel, with the help of supermarkets, hypermarkets, and direct selling networks that provide product visibility and credibility. Online channels remain limited due to low digital adoption, reinforcing offline retail as the market’s backbone.

Cameroon Air Freshener Market Growth Driver

Rising Urbanisation and Lifestyle Shifts Supporting Market Expansion

Urbanisation and lifestyle are revolutionising demand for air fresheners in Cameroon. Rising rural-to-urban migration has led to clogged cities with poor waste disposal and drainage facilities, which are often responsible for foul smells in residential neighborhoods. This has fueled increasing dependence on air fresheners to provide a more pleasant indoor atmosphere. Growth in motor vehicle ownership, especially in urban areas, has also contributed significantly to increased consumption of car air fresheners.

Concurrently, westernisation, particularly among youth groups like students in universities, is affecting product choice. Social media and exposure to global lifestyles have fueled a desire for premium and decorative air freshener formats. Consequently, reed diffusers and scented candles are attracting attention not just because of their scent but also due to their appearance, allowing end users to customize homes according to global fashion.

Cameroon Air Freshener Market Challenge

Affordability Pressures and Counterfeit Proliferation Limiting Growth

In spite of growing interest, affordability is a strong barrier to air freshener penetration in Cameroon. Offerings like electric air fresheners, retailing at approximately XAF12,000 for each unit, are far beyond the majority of end users. Even comparatively low-value categories are non-discretionary and are mainly confined to middle- and high-income groups. This income-based restriction has maintained total demand in check and curbed the development path of the market.

Moreover, the general availability of contraband and counterfeit products has hugely hurt formal retail circuits. Nigerian importation of contraband spray/aerosol air fresheners is offered at unrealistically low prices, mostly between XAF1,000 per unit, generating unrealistic expectations regarding end-user prices. The informal imports overflood traditional and direct sales channels, destroying created brands and constraining their potential for price increases. This ongoing shadow economy keeps limiting the formal sector's profitability and growth prospects.

Cameroon Air Freshener Market Trend

Preference for Multi-Functional Air Fresheners

In Cameroon, end users are now more demanding of air fresheners that have more than one function, which is indicative of a move away from single-function fragrance products to more functional solutions. Products with pleasant fragrances incorporated with insect-repellent or sanitising functions are on the rise, especially in homes where practicality and affordability matter. This transformation indicates how air fresheners are no longer considered just luxury lifestyle products but functional home essentials.

The preference for multi-functional formats signifies a prolonged shift in consumer aspirations. Lower- and middle-income end users prefer products that deliver maximum utility per unit expenditure. This tendency is increasingly affecting product innovation and promotional efforts, as manufacturers emphasize additional benefits aside from scent. Eventually, this will redefine category positioning by broadening the functional remit of Cameroonian air fresheners.

Cameroon Air Freshener Market Opportunity

Emerging Prospects for Decorative and Sanitising Products

The market trend is further influenced by prospects for premium and functional air freshener markets. Decorative products like scented candles and reed diffusers are poised to meet demand from young, urban end users who prefer westernised lifestyles. Their two-way application as both fragrance improvers and decor articles has significant growth potential. Framing the products as aspirational lifestyle products may enable brands to establish a differentiated market position.

Also, Cameroon's low waste collection efficiency and poor air quality present opportunities for air fresheners that extend sanitizing or purifying benefits. Options like essential oil diffusers, air purifiers, and disinfectant sprays would likely ring particularly well, particularly in urban communities beset by odors and pollution. These products might find a niche by solving both wellness and scent demands, thus expanding the functional value of air fresheners and stimulating new category consumption.

Cameroon Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

Within the product type segment, spray/aerosol air fresheners hold the largest share at 40%. Their dominance is supported by affordability, familiarity, and widespread accessibility across both formal and informal sales channels. These products have a longstanding cultural presence in Cameroonian households, where direct sales practices, including door-to-door distribution, have reinforced their visibility. As such, spray/aerosols remain the default choice for many end users.

In contrast, candle air fresheners, although closing the gap over recent years due to aesthetic and durable appeal, encounter indicators of category maturity. Gel air fresheners, especially in automotive applications, are experiencing increasing popularity owing to their durability and easy-to-use nature. In contrast, electric and liquid-based air fresheners are niche products owing to high prices and poor shelf visibility. Nevertheless, electric-based formats are slowly finding acceptance in contemporary retail stores, suggesting future growth opportunities.

By Sales Channel

- Retail Online

- Retail Offline

Retail Offline channel have the biggest share under the sales channel. Supermarkets, hypermarkets, and convenience stores continue to be essential points of access for end users, providing familiar brands and instant product availability. Moreover, traditional trade and direct sales channels bring products to local households, particularly spray/aerosols. Offline retail also enables in-store promotion and visual merchandising, which have significant roles in shaping purchasing decisions.

There are still limited online retail channels, considering lower internet and digital payment adoption levels. Offline channels also offer a perception of certainty over product genuineness, which is imperative in a market plagued by counterfeit imports. The desire for physically checking products prior to purchase also makes offline retail the most prominent channel for air fresheners in Cameroon.

Top Companies in Cameroon Air Freshener Market

The top companies operating in the market include Henkel AG & Co KGaA, McBride Plc, Church & Dwight Co. Inc., SC Johnson & Son Inc, Reckitt Benckiser Group Plc (RB), Procter & Gamble Co, The, Abro Industries Inc, Car-Freshner Corp, Godrej Household Products Ltd., Air Delights Inc., etc., are the top players operating in the Cameroon Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Cameroon Air Freshener Market Policies, Regulations, and Standards

4. Cameroon Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Cameroon Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Cameroon Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Cameroon Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Cameroon Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Cameroon Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Cameroon Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Cameroon Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. SC Johnson & Son Inc

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Reckitt Benckiser Group Plc (RB)

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Procter & Gamble Co, The

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Abro Industries Inc

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Car-Freshner Corp

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Henkel AG & Co KGaA

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. McBride Plc

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Church & Dwight Co. Inc.

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Godrej Household Products Ltd.

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Air Delights Inc.

12.1.10.1. Business Description

12.1.10.2. Product Portfolio

12.1.10.3. Collaborations & Alliances

12.1.10.4. Recent Developments

12.1.10.5. Financial Details

12.1.10.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.