Brazil Menstrual Care Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Pantyliners, Tampons (Applicator Tampons, Digital Tampons), Towels (Standard Towels (Standard Towels with Wings, Standard Towels Without Wings), Slim/Thin/Ultra-Thin Towels (Slim/Thin/Ultra-Thin Towels with Wings, Slim/Thin/Ultra-Thin Towels Without Wings)), Intimate Wipes, Menstrual Cups, Period Underwear), Nature (Disposable, Reusable), Age Group (Up to 18 Years, 19-30 Years, 31-40 Years, 40 Years and Above), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Dec 2025

- VI0649

- 115

-

Brazil Menstrual Care Market Statistics and Insights, 2026

- Market Size Statistics

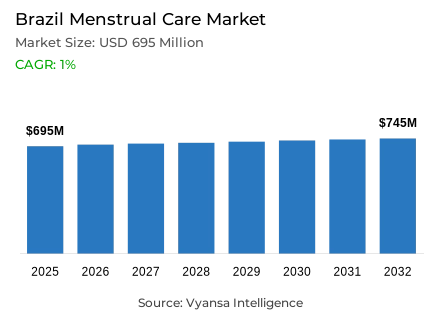

- Menstrual care in Brazil is estimated at USD 695 million.

- The market size is expected to grow to USD 745 million by 2032.

- Market to register a cagr of around 1% during 2026-32.

- Product Type Shares

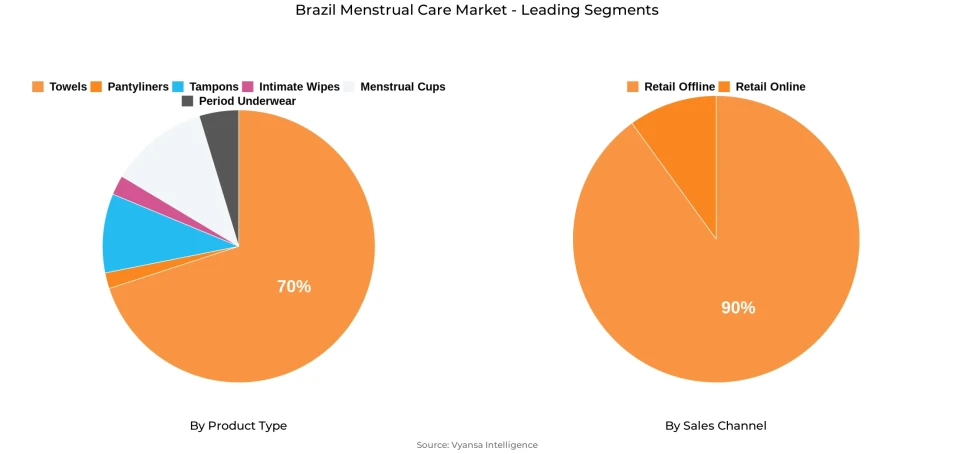

- Towels grabbed market share of 70%.

- Competition

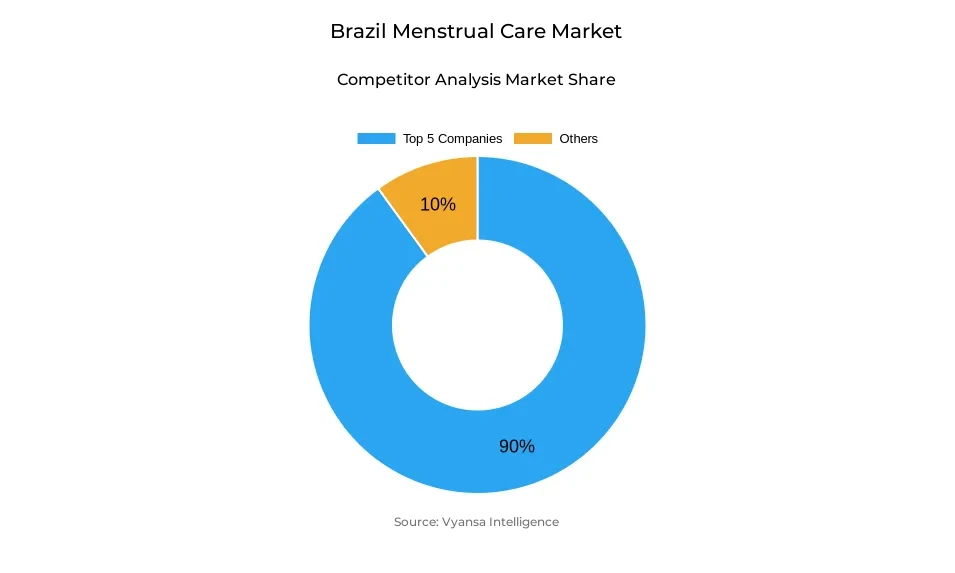

- More than 5 companies are actively engaged in producing menstrual care in Brazil.

- Top 5 companies acquired around 90% of the market share.

- Melhoramentos Papéis Ltda; Carrefour Comércio e Indústria Ltda; Johnson & Johnson do Brasil Indústria e Comércio de Produtos para Saúde Ltda; Kimberly-Clark Brasil Indústria e Comércio de Produtos de Higiene Ltda etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 90% of the market.

Brazil Menstrual Care Market Outlook

The menstrual care market was valued at approximately USD 695 million in 2025 and is anticipated to reach a value of about USD 745 million by 2032, while recording a CAGR of about 1% during 2026-2032. With strong brand loyalty and regular demand, the market will see stable growth in the future. By product type, towels dominate the market, holding about 70%, for reasons such as affordability, comfort, and availability. However, the segment of pantyliners is expected to show faster growth due to reasons including convenience, frequency of use, and innovative developments that make them more comfortable and hygienic.

Leading companies like Kimberly-Clark, Johnson & Johnson, and Essity will further cement their market positions through sustainable innovations and diversified offerings. Companies are investing in green production, reducing plastic usage, and using natural materials to develop their products to meet the increasing demand for sustainability. The increasing preference for premium features such as ultra-soft and hypoallergenic materials will lead to changes in purchase patterns. Small brands like Millie will increase their market share by offering eco-friendly options to end users who are looking for reusable or biodegradable menstrual products.

Retail distribution will still be dominated by offline channels, which would account for almost 90% of total market sales, driven by the strong performance of supermarkets, hypermarkets, and pharmacies. These benefit from their accessibility, variety of products, and frequent promotions therein. E-commerce is expected to grow steadily as younger consumers progressively move to online purchase methods for convenience and privacy. Major players are increasingly investing in digital platforms and subscription models as a means of maintaining engagement and expanding reach.

Sustainability will remain a key market driver throughout the forecast period. Companies are likely to focus on environmentally responsible packaging, efficient logistics, and reducing their carbon footprint. With increasing awareness related to personal health, convenience, and environmental impact, the menstrual care market in Brazil will see stable but slow growth, characterized by innovation, digital expansion, and responsible manufacturing practices.

Brazil Menstrual Care Market Growth Driver

Growing Demand for Pantyliners and Product Innovation to drive market growth.

Brazil menstrual care market has been growing steadily, with its fast growth due mostly to the increasing usage of pantyliners, which have emerged as a preference of women desiring convenience and hygiene on a daily basis. This is the segment that shows almost double-digit growth, as more and more end users opt for protection that is light and flexible, fitting the pace of modern lifestyles. Comfort and health safety are thus the important areas of innovation on which firms are investing. Johnson & Johnson Sempre Livre Conforto Noturno, for example, features hypoallergenic material and pH-equilibrium design to help improve intimate well-being. The World Bank estimated that women make up 51% of Brazil population, while UN Data reported that more than 87% of Brazilians lived in urban areas, expanding access to advanced hygiene products.

Consistent pricing strategies and evolving product portfolios have supported the market’s resilience despite economic fluctuations. The increasing demand for skin-friendly and multifunctional products also reflects a broader consumer shift toward comfort, value, and wellness. Steady demand underlines the menstrual care market in Brazil, which has grown stably and will continue doing so.

Brazil Menstrual Care Market Challenge

Market Maturity and Declining Tampon Use Limit Growth Potential

Brazil’s menstrual care market is relatively mature and, unlike some other feminine hygiene categories, is marked by limited diversity in product preferences. This stifles growth. Tampons continue to post negative results, as safety concerns and a perception of discomfort prevent consumers from using these products. High brand loyalty further contributes to a difficult environment for new entrants, increasing competition inside an already saturated market. For these reasons, volume growth tracks inflation levels. According to the IMF, inflation in Brazil averaged 4.3% in 2024, a pace equal to category growth, while the World Bank estimates household expenditure on personal care at less than 3% of total household consumption.

The fact that raw material costs, like cellulose and petroleum derivatives, remain high-even with some relief since the pandemic-means ongoing pressure on margins. Innovation does serve to underpin product premiumization, but this leaves price-sensitive consumers underserved and therefore limits longer-term growth opportunities. This maturity-driven stagnation is a challenge that continues to lie ahead for the menstrual care industry in Brazil.

Brazil Menstrual Care Market Trend

Going green, being eco-friendly - New product development redefined

Sustainability has become the central focus driving product development within the context of Brazil menstrual care market. Leading manufacturers such as Essity and Kimberly-Clark are increasingly adopting eco-friendly initiatives, from reducing plastic use and adopting recyclable packaging to other means. Essity has reached 100% of industrial waste management, enabling circular economy practices by optimizing waste recycling. This is in line with a UNDP Brazil finding that shows 74% of Brazilians are concerned about plastic pollution. At the same time, factories are investing in greener, more efficient production methods that reduce carbon footprints.

As concern for the environment increases, brands that can prove responsible production gain greater loyalty and a good reputation. Focus on sustainability will not only contribute to Brazil ecological objectives but also correspond to the UN Sustainable Development Goal 12 on responsible consumption. The integration of biodegradable packaging, ethical sourcing, and transparent communication reflects how sustainability is reshaping consumer expectations in Brazil menstrual care market.

Brazil Menstrual Care Market Opportunity

Growing Preference for Holistic and Multifunctional Products

Brazil menstrual care market will be a bright platform for holistic, multi-functional, and wellness-oriented products. With growing awareness of skin sensitivity and intimate health, key players are incorporating value additions like pH balance, natural fibers, and odor control to increase comfort. The success of Ever Green's Mods line, popular for its softness and odor management, testifies to the demand for such innovations. The World Health Organization reports that 62% of women in Brazil now prioritize health benefits in personal care product purchases, while UN Women reports ongoing hygiene-related national initiatives continue to bolster innovation.

In fact, increasing convenience and preference for sustainable options among end users has opened up new avenues of product diversification. Premium daily-use pantyliners and hybrid products designed for both menstrual and light incontinence needs may see demand rise. Rising comfort-driven demand for environmentally safe solutions will continue to expand opportunities for growth and modernization across Brazil menstrual care market.

Brazil Menstrual Care Market Segmentation Analysis

By Product Type

- Pantyliners

- Tampons

- Towels

- Intimate Wipes

- Menstrual Cups

- Period Underwear

The segment with highest market share under By product type,is towels, which accounted for about 70% of the Brazil menstrual care market. Towels remain dominant due to convenience, comfort, and their easy availability in both urban and rural areas. Their low prices and being suitable for day-to-day use make these products widely popular among women across different age groups in Brazil. The segment is further sustained by the demand for night variants, such as Sempre Livre Conforto Noturno by Johnson & Johnson, which has unique features that add to the absorption and comfort while providing more protection.

Despite emerging alternatives in the form of tampons and menstrual cups, towels remain the most trusted and frequently bought category. Innovations in material content-including hypoallergenic and biodegradable varieties-add further strength to their leading position. The emphasis on natural composition, softness, and skin-friendliness meets increasing consumer awareness about hygiene and comfort, thus retaining the popularity of towels through the forecast period.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channel is retail offline with around 90% share. Supermarkets, hypermarkets, and pharmacies are leading sales channels due to their easy accessibility, frequent promotional offers, and consumer confidence in traditional retail formats. Pharmacies, especially, are valued for their reliability and wide range of choices regarding menstrual products, backed by collaboration with local healthcare providers on discounting and counseling. Although e-commerce is steadily growing, offline retail remains the standard for menstrual care purchases in Brazil. Consumers still prefer brick-and-mortar stores for immediate access to touch and feel a product, especially when exploring new or sensitive-care products. Leading brands have maintained strong in-store visibility with attractive displays and in-person promotions. This enduring preference for offline shopping, therefore, coupled with Brazil extensive retail network, protects the segment's status as the primary distribution channel for menstrual care products.

List of Companies Covered in Brazil Menstrual Care Market

The companies listed below are highly influential in the Brazil menstrual care market, with a significant market share and a strong impact on industry developments.

- Melhoramentos Papéis Ltda

- Carrefour Comércio e Indústria Ltda

- Johnson & Johnson do Brasil Indústria e Comércio de Produtos para Saúde Ltda

- Kimberly-Clark Brasil Indústria e Comércio de Produtos de Higiene Ltda

- Procter & Gamble do Brasil SA

- Ever Green Indústria e Comércio Ltda

- Santher - Fábrica de Papel Santa Terezinha SA

Market News & Updates

- Johnson & Johnson do Brasil, 2023-2025:

Kenvue feminine-care brands remained present in Brazil with periodic product activations following the global spin-off

- Kimberly‑Clark Brasil, 2023-2025:

Kimberly‑Clark continued to refresh Kotex and Intimus SKUs with comfort and sustainability variants across 2023-2025

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Brazil Menstrual Care Market Policies, Regulations, and Standards

4. Brazil Menstrual Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Brazil Menstrual Care Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Pantyliners- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Applicator Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Digital Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Standard Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. Standard Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. Standard Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Slim/Thin/Ultra-Thin Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.1. Slim/Thin/Ultra-Thin Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.2. Slim/Thin/Ultra-Thin Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Intimate Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Menstrual Cups- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Period Underwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Nature

5.2.2.1. Disposable- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Reusable- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Age Group

5.2.3.1. Up to 18 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. 19-30 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. 31-40 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. 40 Years and Above- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Brazil Pantyliners Menstrual Care Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Brazil Tampons Menstrual Care Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Brazil Towels Menstrual Care Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Brazil Intimate Wipes Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Brazil Menstrual Cups Menstrual Care Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Brazil Period Underwear Menstrual Care Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Johnson & Johnson do Brasil Indústria e Comércio de Produtos para Saúde Ltda

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Kimberly-Clark Brasil Indústria e Comércio de Produtos de Higiene Ltda

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Procter & Gamble do Brasil SA

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Ever Green Indústria e Comércio Ltda

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Santher - Fábrica de Papel Santa Terezinha SA

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Melhoramentos Papéis Ltda

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Carrefour Comércio e Indústria Ltda

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Nature |

|

| By Age Group |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.