Brazil Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), By Price (Premium, Mass), By Gender (Men, Women, Unisex), By Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), By Form (Creams/Gels, Lotions, Sprays, Solid, Others), By Nature (Organic, Inorganic), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Jan 2026

- VI0721

- 115

-

Brazil Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

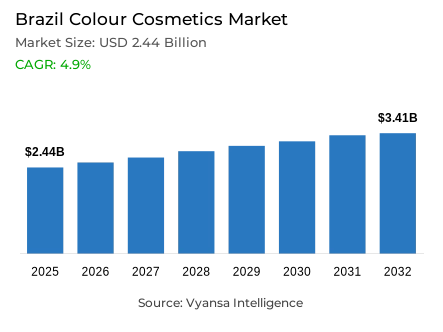

- Colour cosmetics in Brazil is estimated at USD 2.44 billion in 2025.

- The market size is expected to grow to USD 3.41 billion by 2032.

- Market to register a cagr of around 4.9% during 2026-32.

- Category Shares

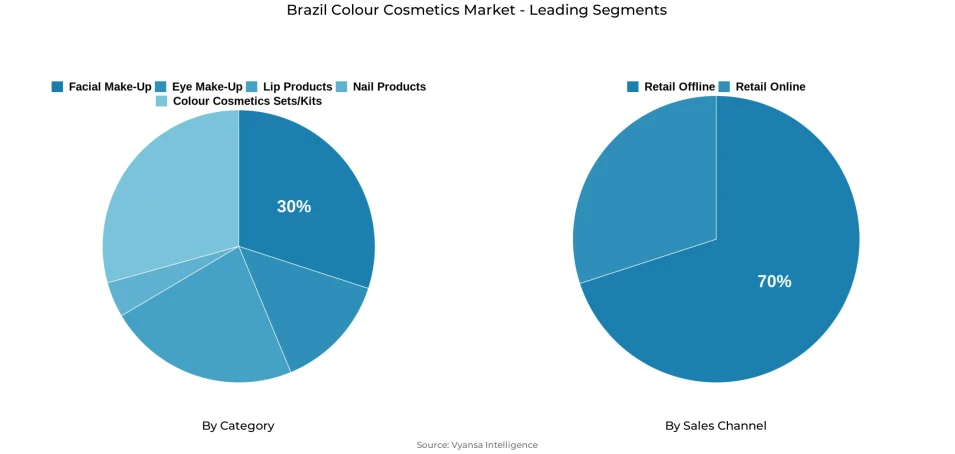

- Facial make-up grabbed market share of 30%.

- Competition

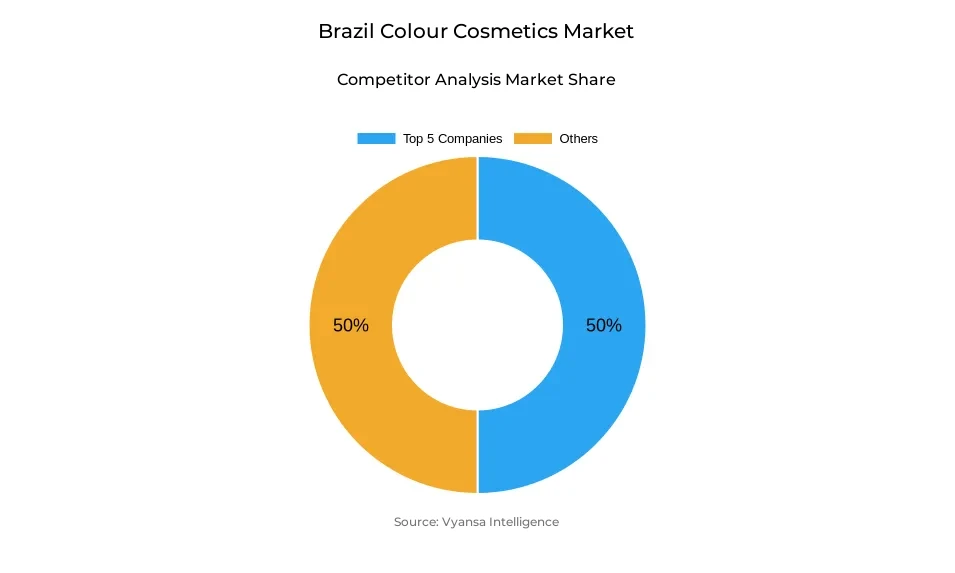

- More than 20 companies are actively engaged in producing colour cosmetics in Brazil.

- Top 5 companies acquired around 50% of the market share.

- Natura Cosméticos SA; Estée Lauder Brasil; Nelida do Brasil Comércio e Importação Ltda; Botica Comercial Farmacêutica Ltda; Mary Kay do Brasil Ltda etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Brazil Colour Cosmetics Market Outlook

The Brazil Colour Cosmetics Market values around USD 2.44 billion in 2025 and is expected to reach USD 3.41 billion by 2032, expanding at a CAGR of around 4.9%. Strong demand for lip products, surging hybrid formats, and the continued blurring with skin care and sun protection will be some of the factors driving market momentum. Facial make-up, holding a 30% share, will remain the largest category, supported by rising incomes, performance-focused innovation, and broader availability across both mass and premium ranges. However, hybrid sticks and multipurpose lip-and-cheek formats will increasingly compete for share as end users seek convenience and cost efficiency.

Lip products will keep on overperforming as brazil cross-generational appetite for glosses, lip oils, and hydrating balms keeps growing. At the helm of viral trends such as glazed lips and ombré effects, combined with active ingredients like vitamin E and squalane, will be driving frequent experimentation and repurchase. Innovations offering more-than-one functionality-SPF-rich lip colour, anti-ageing tints, and skincare-inspired glosses-will further cement the category's appeal. Eye make-up will underperform as a result of the preference for natural looks and the trend for all-in-one sticks that replace single-use items like eyeliners and shadows.

Retail offline will continue to dominate, with around 70% share, driven by beauty specialists, value-oriented multi-category retailers, and wide-reaching direct selling networks. Beauty specialists will remain popular with enthusiasts due to their experiential retail, wide range, and trend-oriented products, while supermarkets and large-format retailers continue to develop curated beauty aisles. Retail online will continue to become more relevant, particularly for influencer brands and hard to find international labels, but import taxes will make cross-border buying restrained and will keep many asian innovations in the premium brackets.

Through 2032, premiumisation, further brand fragmentation, and dynamic competition from influencer-led lines that strongly resonate with younger end users will underpin market growth. The intersection of skin health, performance-driven make-up, and emotive storytelling will continue to frame the next wave of launches. Those brands capable of effectively marrying multifunctionality with affordability and trend relevance, while implementing loyalty schemes and omnichannel initiatives, will be well-placed to capitalize on Brazil growing colour cosmetics demand.

Brazil Colour Cosmetics Market Growth Driver

Multifunctional Innovation Reinforcing Category Dynamism

The Brazil color cosmetics market grew faster than expected in 2023, driven by the rising demand for hybrid formulations that combine color with skin care and sun protection. Innovation in 2024 also focused strongly on lip and face products, including performance actives such as squalane, vitamin E, and passionfruit oil. These formulations strategically align with brazilian end user preferences for convenience, value optimization, and increased sensory experiences within daily beauty routines.

Brazil macroeconomic environment supports this innovation trajectory. According to World Bank data, the economy expanded by 2.9% in 2023, sustained income recovery, and end users demand reinforced for premium-positioned color cosmetic products. As purchasing power normalizes, multifunctional innovations remain the main growth driver, allowing brands to offer high-level performance within more affordable pricing strata and maintain strong volume growth across all income levels.

Brazil Colour Cosmetics Market Challenge

Shrinking Relevance of Traditional Eye Products due to Hybridization

Brazil colour cosmetics market is facing a key challenge in the form of a structural decline in demand for single-function, traditional eye products, such as basic eyeliners and conventional pencil formats. End users decisively moved to natural, minimal-makeup looks in 2024 and considerably reduced how often category-specific items of eye products were purchased. Meanwhile, multi-functional items—like versatile sticks functioning as blush, lipstick, and eyeshadow—are increasingly pulling spending away from traditional eye format products.

This is further heightened with demographic composition. According to the IBGE Census Demographics, Brazil's largest population cohorts are those within the 20–39 age brackets, representing about 30–31% of the total population. The younger end users have a disproportionate preference for versatile, efficiency-driven products and minimalist aesthetics they have been systematically reinforcing the decline of the single-function eye categories. The demographic structure significantly constrains the realistic growth potential of the conventional format of eye products in the medium term.

Brazil Colour Cosmetics Market Trend

Viral Beauty Culture Accelerating Demand for Expressive Lip and Face Formats

A key trend transforming Brazil’s colour cosmetics market is the growing impact of viral beauty culture, with social media platforms increasingly shaping product textures, finishes, and aesthetic preferences that gain market traction. Lip glosses experienced substantial adoption surge in 2024 as glazed and gradient looks dominated tiktok and instagram content. Similarly, high-performance complexion products emphasizing innovative textures and skin-like finishes benefited from accelerated content dissemination across digital beauty communities.

Brazil exceptional digital engagement amplifies this trend dynamic. High social media penetration enables rapid content diffusion, with end users frequently discovering products through short-form video content and influencer demonstrations. As digital aesthetics increasingly drive desirability and purchase motivation, viral formats—lip glosses, hydrating tints, multifunctional sticks—establish themselves as continuous category growth drivers, creating sustained innovation pressure and accelerated format rotation cycles within the market.

Brazil Colour Cosmetics Market Opportunity

Momentum Towards Vegan, Ethical, Skin-Friendly Colour Cosmetics

A significant market opportunity is expected to emerge from the growing mainstream demand for vegan, ethically produced, and skin-friendly colour cosmetic formulations. The Brazilian end user also shows a strengthened preference for formulations that include nourishing actives, botanical extracts, and clean beauty to support skin health in addition to aesthetic performance. Brands that incorporate collagen, castor oil, panthenol, and plant-derived ceramides-especially in lip and complexion formats-are tapping directly into rising end user preferences for health and wellness combined with ethical consumption values.

This strategic opportunity falls squarely within one of the main demographic trends. Compared with the older cohorts, Brazilian end user aged 20-39 years are the largest segment of the population and show significantly higher engagement with clean beauty and vegan formulations. Brazil strong influencer culture amplifies these values-driven purchasing preferences, rendering ethical colour cosmetics commercially viable across mass market and premium positioning. Companies genuinely capable of combining clean formulation science with multifunctional performance hold defensible long-term growth potential in Brazil dynamic colour cosmetics market.

Brazil Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Eye Liner/Pencil

- Eye Shadow

- Mascara

- Others

- Facial Make-Up

- BB/CC Creams

- Blusher/Bronzer/Highlighter

- Foundation/Concealer

- Powder

- Others

- Lip Products

- Lip Gloss

- Lip Liner/Pencil

- Lipstick

- Others

- Nail Products

- Nail Polish

- Nail Treatments/Strengthener

- Polish Remover

- Others

- Colour Cosmetics Sets/Kits

The segment with highest market share under category is facial make-up accounted for approximately 30% of the Brazil colour cosmetics market. In 2024, facial make-up continued to see stable growth, driven by increasing demands for strong performance, durability and better textures. More end users sought out foundations and multipurpose sticks offering smooth finishes, long wear and additional skincare-like benefits. Stronger affordability thanks to value brands further bolstered growth in this segment, particularly as competition grew more heated and face products on average saw lower prices.

Facial make-up is expected to stay central within the market as more brands innovate with hybrid formats that combine color, care, and sun protection. With end users being more exigent and incomes gradually rising, demand has continued to shift toward products offering strong cost-benefit value. This will continue to make facial makeup the leading segment through forcast period.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under sales channel is retail offline garnered about 70% of share. Retail offline still remains the dominant channel, as direct contact and the immediate availability of a product continue to be key advantages. Beauty specialist retailers have also been developing their assortment and value-for-money proposition, attracting a broad base of end user with affordable prices, wide brand options, and, above all, in-store experiences comprising the testing of various products and personalized consultations.

Large multi-category retailers and fixed-price beauty formats have also enhanced offline reach through convenience and affordability. Retail online continues to play an increasingly influential role, particularly in premium and hard-to-find brands, but retail offline remains the leading purchase point owing to its strong presence across major cities and smaller regions, with colour cosmetics well within the reach of a wide consumer base.

List of Companies Covered in Brazil Colour Cosmetics Market

The companies listed below are highly influential in the Brazil colour cosmetics market, with a significant market share and a strong impact on industry developments.

- Natura Cosméticos SA

- Estée Lauder Brasil

- Nelida do Brasil Comércio e Importação Ltda

- Botica Comercial Farmacêutica Ltda

- Mary Kay do Brasil Ltda

- Avon Cosméticos Ltda

- Coty Brasil Indústria e Comércio de Cosméticos Ltda

- Procosa Produtos de Beleza Ltda

- Vult Comércio de Cosméticos Ltda

- Laboratório Avamiller de Cosméticos Ltda

Competitive Landscape

The colour cosmetics competitive landscape in Brazil in 2024 was defined by rising fragmentation, with increased rivalry and the growing influence of influencer-led brands. Innovation led by lip products, multifunctional hybrids, and strong social media virality resettle brand hierarchies as both mass and premium players moved to keep pace with fast-changing consumer expectations. Influencer-backed labels like Bruna Tavares, Rare Beauty, Francine Ehlke, and Fenty Beauty gained notable traction online, benefiting from Brazil's young consumer base and high engagement with beauty creators. More niche players expanded via beauty specialists, such as Mia Make and Face Beautiful, while value brands enhanced their formulations to better compete against higher tiers. Loyalty will remain a strategic battleground-to wit, Botica's Beautybox programme boasts 25.7 million members-which reflects how incumbent players are trying to hold their share versus digital-first competitors and celebrity brands challenging them across channels.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Brazil Colour Cosmetics Market Policies, Regulations, and Standards

4. Brazil Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Brazil Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Brazil Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Brazil Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Brazil Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Brazil Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Brazil Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Botica Comercial Farmacêutica Ltda

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Mary Kay do Brasil Ltda

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Avon Cosméticos Ltda

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Coty Brasil Indústria e Comércio de Cosméticos Ltda

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Procosa Produtos de Beleza Ltda

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Natura Cosméticos SA

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Estée Lauder Brasil

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Nelida do Brasil Comércio e Importação Ltda

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Vult Comércio de Cosméticos Ltda

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Laboratório Avamiller de Cosméticos Ltda

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.