Brazil Bags and Luggage Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Bags (Cross Body Bags, Bags and Backpacks, Business Bags, Duffle Bags, Clutches, Others), Luggage (Soft Luggage, Hard Luggage, Wheeled Luggage, Non-Wheeled Luggage)), By Sales Channel (Retail Offline, Retail Online), By Material Type (Soft Case (Nylon, Polyester, Ballistic Nylon), Hard Case (Polycarbonate, ABS (Acrylonitrile Butadiene Styrene), Polypropylene)), By Price Category (Luxury, Mass/Economy, Premium), By Application (Travel, Business), By Region (North, Center-West, Northeast, Southeast, South)

|

Major Players

|

Brazil Bags and Luggage Market Statistics and Insights, 2026

- Market Size Statistics

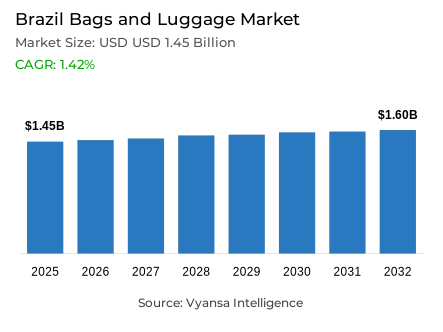

- Bags and luggage in Brazil is estimated at USD 1.45 billion in 2025.

- The market size is expected to grow to USD 1.6 billion by 2032.

- Market to register a cagr of around 1.42% during 2026-32.

- Category Shares

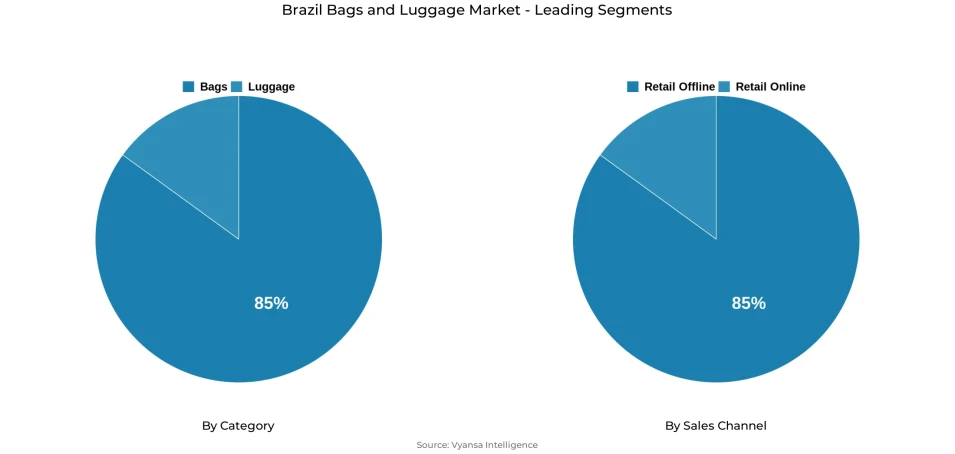

- Bags grabbed market share of 85%.

- Competition

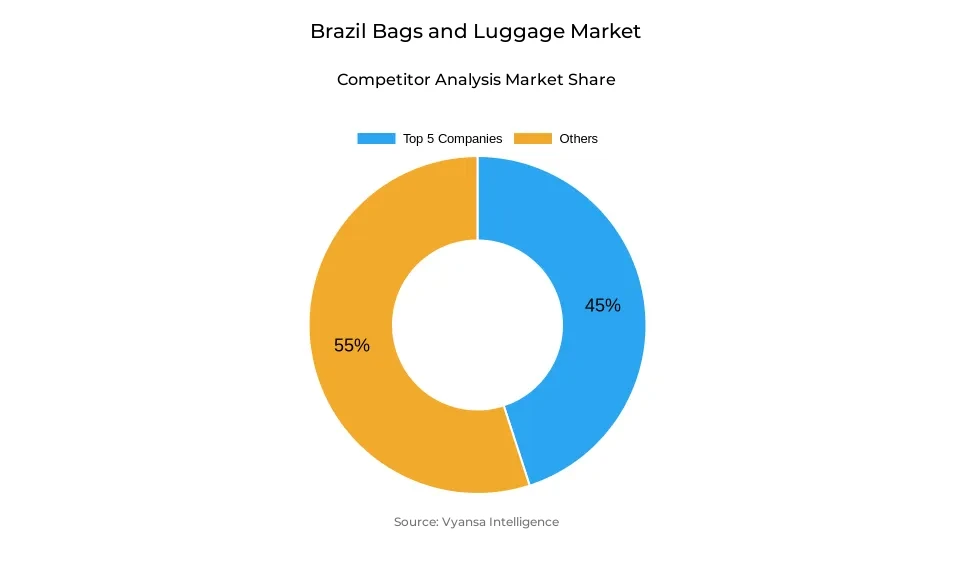

- More than 20 companies are actively engaged in producing bags and luggage in Brazil.

- Top 5 companies acquired around 45% of the market share.

- Bagaggio Artefatos em Couro Ltda; Victor Hugo Artefatos de Couro Ltda; Kering SA; Arezzo Indústria & Comércio SA; Fisia Comercio de Produtos Esportivos Ltda etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Brazil Bags and Luggage Market Outlook

The Brazil bags and luggage market will continue to grow steadily throughout the forecast period, as the, on the one hand, tourism recovery, on the other hand, premiumisation trends, and on the other hand, varying end user tastes and preferences support its growth. Bags and luggage in Brazil are estimated to have USD 1.45 billion in 2025 and project to have USD 1.6 billion in 2032 with a compound annual growth rate of about 1.42 billion % at the period of forecast. Despite the economic challenges of inflation, currency volatility and increased cost of living, which is likely to influence purchasing behaviour, stable employment and an active workforce is likely to provide a base level of demand.

The bags market is still supported by bags that are both practical and fashionable accessories. Bags are now seen by Brazilian end users as a continuation of personal style, and this supports the demand of multifunctional backpacks, crossbody bags, and leather handbags that can easily move between work, leisure, and social environments. The percentage of bags to the total market is about 85, since their usage is more than that of luggage. At the same time, national brands also enjoy great value attached to locally produced leather goods, workmanship and unique design.

Luggage is likely to show consistent growth, which will be underpinned by ongoing trends in domestic and international tourism. This segment is being influenced by premiumisation with end users now more prepared to spend on longlasting, quality and innovative suitcases as longterm buys. Categories are also supposed to be strengthened by collaborations, sustainabilityoriented collections, and wellnessoriented applications, like bags matching fitness lifestyles.

This is based on the distribution in which retail offline has a market share of about 85% since physical stores are still favoured by the end users to evaluate the quality, materials, and design features in their products. Although retail retail online helps to price compare and conveniently, especially amongst younger buyers, retail offline is likely to be the key part of the purchase decisions. Comprehensively, the market perspective indicates low yet steady growth, with the recovering of the tourism, the emphasis on the premium positioning and increasing selfexpression of bags and luggage.

Brazil Bags and Luggage Market Growth Driver

Strong Labor Force and Increasing Disposable Income Favor Consumer Demand

The main force in the Brazil bags and luggage market is the rising labour market, which determines the level of household income and the purchasing power of end users. Official statistics shared by the Brazilian Institute of Geography and Statistics (IBGE) show that in 2024 the unemployment rate in Brazil was 6.6% on average, which is the lowest since the series started in 2012, which speaks of a general positive shift in the employment situation that supports the confidence of end users.

With this robust labor market there is an added disposable income to most Brazilians leading to discretionary spending on higherquality bags and travel accessories. With the recovery in the level of the formal employment and the higher pay rates, the end users can afford to spend more money on the goods that are not perishable and the clothes that can be combined in functionality and design, thus creating the stable retail sales of the bag and the luggage regardless of the broader economic cycles.

Brazil Bags and Luggage Market Challenge

End user Priorities are Impacted by Inflation and CostofLiving Pressures

The major challange that the Brazilian bags and luggage market is facing is still a high rate of inflation and costofliving pressures which limits the end user spending on nonessential items. Inflation in Brazil has been over the tolerable levels in the long run in recent years, which is an indication that the prices of goods and services continue to pressurize the economy.

High costs on basic commodities like food, housing, and transportation minimise discretionary income that can be used to make lifestyle purchases, such as bags and luggage. These pressures impact particularly budgetconscious end users, who focus on value oriented and price sensitive products instead of premium or fashion oriented products. Therefore, middle and massmarket segments have headwinds to market growth in the time when the risk of inflation is high.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Brazil Bags and Luggage Market Trend

International Tourism Recovery Enhances Market Exposure

The trend that has been very strong in the Brazilian bags and luggage market is the current revival in global tourism which increases the demand of travel related goods. The authoritative statistics show that international tourist expenditures in Brazil stood at USD 823 million in February 2025, which is 22% higher than the February 2024, owing to high numbers of visitors.

The increasing involvement by foreign tourists is not only favouring the luggage sales among travellers who wish to update or change the travel accessories, but also allows increased exposure to the fashiondriven handbags and accessories. Since tourism is still in the process of regeneration to and above the prepandemic levels, product diversification with travel products and crosscategory purchases related to travel experiences are stimulated by the integration of travel and fashion.

Brazil Bags and Luggage Market Opportunity

Green and Sustainable Products will lead to the Demand of Premium products

A favorable opportunity in the Brazil bags and luggage market lies in the rising emphasis on sustainability and eco-innovation, supported by increasing societal awareness of environmental concerns. Recent extreme weather developments, like the 2024 floods in Rio Grande do Sul, have increased the attention to environmental responsibility among the population and companies, making ecofriendly practices more relevant to the customer.

Such a change is an opening to brands with sustainable products, like bags made of recycled, responsibly sourced, or biomaterials, to make a difference and be valued by end users who put environmental impact on the same level as style and functionality. With sustainability an increasingly important purchase factor, those brands that incorporate ecoinnovation and clear sourcing policies into their product offerings will be in a better place to reap the benefits of environmentally aware buyers.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Brazil Bags and Luggage Market Segmentation Analysis

By Category

- Bags

- Cross Body Bags

- Bags and Backpacks

- Business Bags

- Duffle Bags

- Clutches

- Others

- Luggage

- Soft Luggage

- Hard Luggage

- Wheeled Luggage

- Non-Wheeled Luggage

Bags constitute the segment with the highest share in the Brazil bags and luggage market, accounting for approximately 85% of total market share. This dominance highlights the everyday relevance of bags across professional, social, and leisure use, compared to luggage, which is more closely associated with travel frequency. In Brazil, bags have increasingly evolved into fashion and lifestyle statements, supporting consistent demand even during periods of economic uncertainty.

Within this segment, backpacks, crossbody bags, and handbags benefit from their versatility and ability to align functionality with stylistic appeal. Local brands have successfully captured this demand by offering distinctive designs, collaborations with artists or media platforms, and the utilisation of alternative or sustainable materials. Throughout the forecast period, bags are expected to remain the primary growth driver, supported by premiumisation trends, personal expression dynamics, and continued innovation in materials and design.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline represents the segment with the highest share within the sales channel category, maintaining approximately 85% of the Brazil bags and luggage market. Physical retail establishments remain crucial, as end users prefer to see, touch, and compare products before purchasing, particularly for leather goods, premium bags, and luggage. Shopping centres, brandowned stores, and specialist retailers continue to anchor end user trust and brand visibility.

retail offline additionally fulfills a key role in showcasing collaborations, limited editions, and premium collections, which benefit from curated instore experiences. While retail retail online is expanding and supports convenience, promotional activities, and price comparison, it has not displaced the importance of physical stores. Throughout the forecast period, retail offline is expected to maintain its dominant position, increasingly supported by omnichannel strategies that combine instore engagement with digital touchpoints.

List of Companies Covered in Brazil Bags and Luggage Market

The companies listed below are highly influential in the Brazil bags and luggage market, with a significant market share and a strong impact on industry developments.

- Bagaggio Artefatos em Couro Ltda

- Victor Hugo Artefatos de Couro Ltda

- Kering SA

- Arezzo Indústria & Comércio SA

- Fisia Comercio de Produtos Esportivos Ltda

- LVMH Fashion Group Brasil Ltda

- JHSF Participações SA

- Sestini Mercantil Ltda

- Samsonite Brasil Ltda

- adidas do Brasil Ltda

Competitive Landscape

Brazil bags and luggage market is characterised by strong domestic players, rising premiumisation, and increasing strategic consolidation. Leading local brands such as Arezzo (under Arezzo Indústria & Comércio SA), Sestini, Primícia, Bagaggio, and Le Postiche dominate through extensive retail networks, brand recognition, and products aligned with local tastes. Arezzo strengthened its competitive position through its merger with Grupo Soma, enhancing scale, portfolio synergies, and multi-channel reach across handbags and accessories. Brands like Sestini and Primícia have gained traction with bold designs, artist collaborations, and sustainable product lines, appealing to younger and eco-conscious consumers. At the premium end, players such as Osklen and Ryzí differentiate through luxury positioning, sustainability, and high-profile collaborations. Overall, competition is increasingly shaped by premium craftsmanship, sustainability credentials, digital engagement, and alignment with travel, wellness, and lifestyle trends.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Brazil Bags and Luggage Market Policies, Regulations, and Standards

4. Brazil Bags and Luggage Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Brazil Bags and Luggage Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Thousand Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Cross Body Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Bags and Backpacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Business Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Duffle Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.5. Clutches- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Soft Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Hard Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Non-Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Material Type

5.2.3.1. Soft Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.1. Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.2. Polyester- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.3. Ballistic Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Hard Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1. Polycarbonate- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2. ABS (Acrylonitrile Butadiene Styrene)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.3. Polypropylene- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Price Category

5.2.4.1. Luxury- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Mass/Economy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Application

5.2.5.1. Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Business- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Region

5.2.6.1. North

5.2.6.2. Center-West

5.2.6.3. Northeast

5.2.6.4. Southeast

5.2.6.5. South

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Brazil Bags Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Thousand Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Region- Market Insights and Forecast 2022-2032, USD Million

7. Brazil Luggage Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Thousand Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Region- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Arezzo Indústria & Comércio SA

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Fisia Comercio de Produtos Esportivos Ltda

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.LVMH Fashion Group Brasil Ltda

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.JHSF Participações SA

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Sestini Mercantil Ltda

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Bagaggio Artefatos em Couro Ltda

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Victor Hugo Artefatos de Couro Ltda

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Kering SA

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Samsonite Brasil Ltda

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. adidas do Brasil Ltda

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Sales Channel |

|

| By Material Type |

|

| By Price Category |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.