Brazil Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0524

- 125

-

Brazil Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

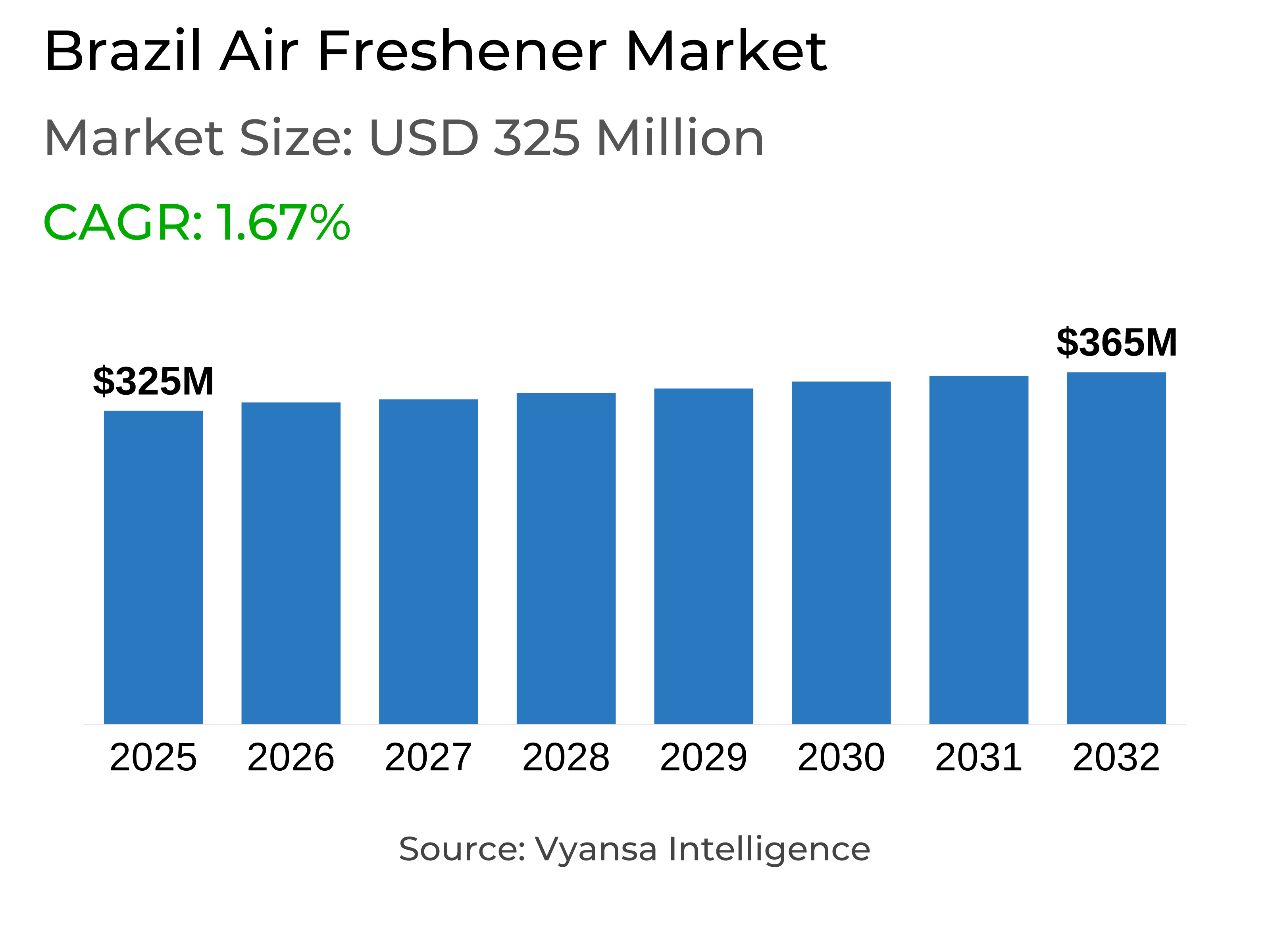

- Air Freshener in Brazil is estimated at $ 325 Million.

- The market size is expected to grow to $ 365 Million by 2032.

- Market to register a CAGR of around 1.67% during 2026-32.

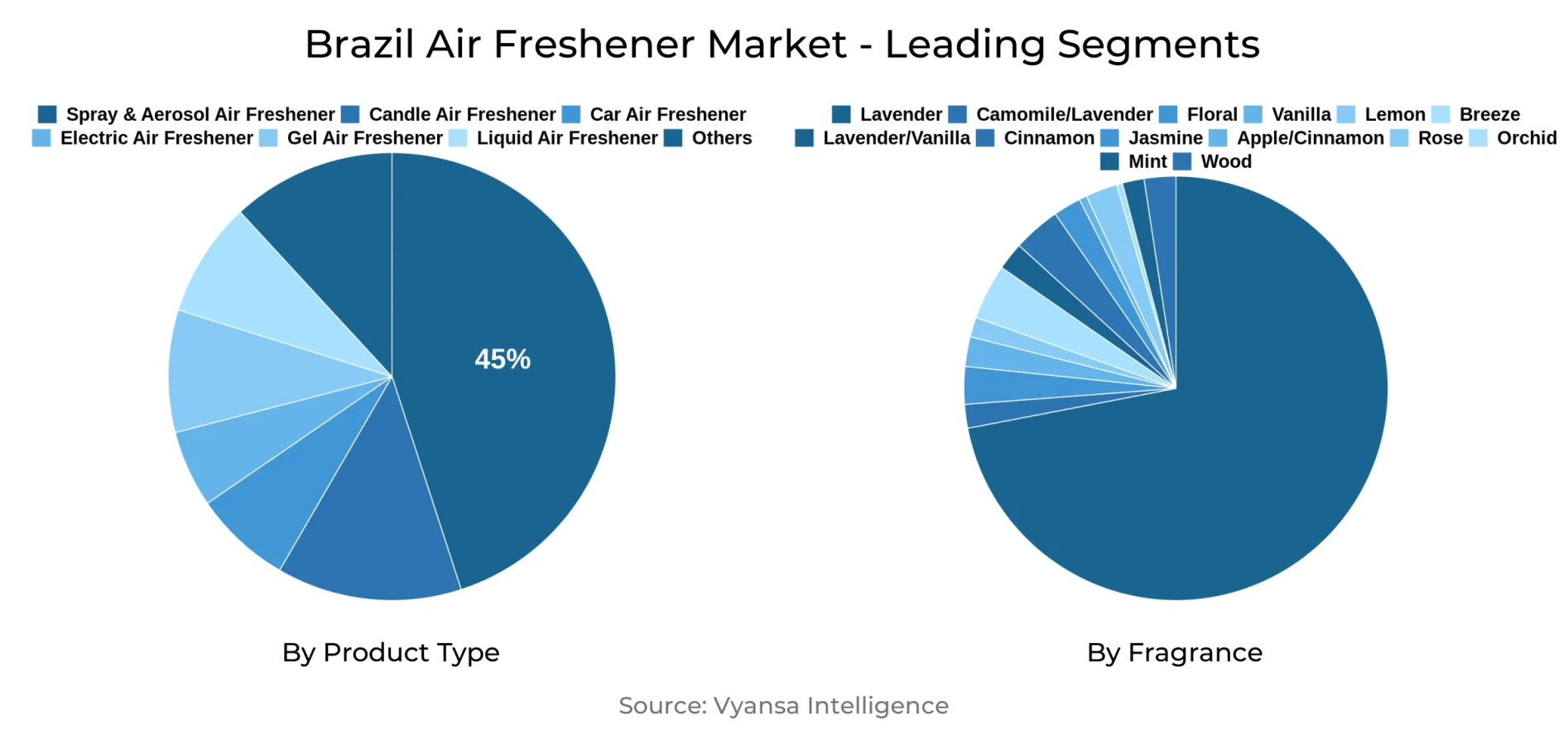

- Product Type Shares

- Spray/Aerosol Air Freshener grabbed market share of 45%.

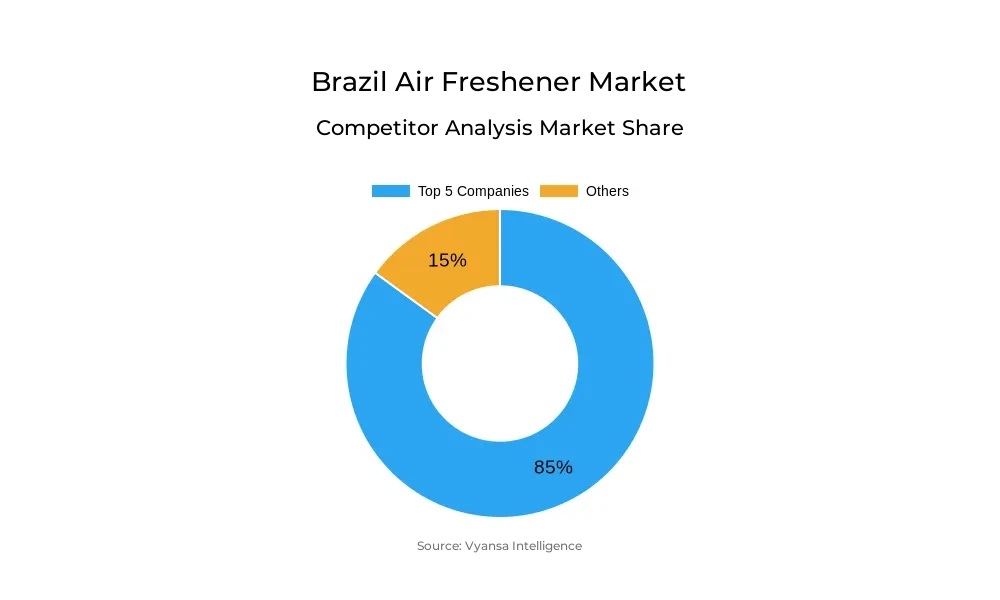

- Competition

- More than 10 companies are actively engaged in producing Air Freshener in Brazil.

- Top 5 companies acquired around 85% of the market share.

- Interbrilho Higiene e Limpeza Ltda, SOIN Sociedade Industrial Importação e Exportação Ltda, Bombril SA, Ceras Johnson Ltda, Reckitt Benckiser (Brasil) Ltda etc., are few of the top companies.

- Fragrance

- Lavender continues to dominate the market.

Brazil Air Freshener Market Outlook

The Brazil Air Freshener Market is valued at $325 million in 2025 and is expected to grow to $365 million in 2032, driven by increased household consciousness and consumption that is lifestyle-oriented. The lingering impact of the pandemic has caused end users, especially younger working adults aged 25–40, to stay at home more and focus on personalising their homes with favoured scents. Socioeconomic B and C segments drive the category, since air fresheners, while not a necessity, are being perceived more and more as products used to increase comfort, relaxation, and individual expression. Odour-neutralising products' popularity has stretched from conventional areas like toilets to vehicles, trash cans, and pet areas, supporting repeat buys through convenience and innovation.

Spray/aerosol air fresheners command the largest market share at 45%, thanks to their convenience in application, instant diffusion of fragrance, and ease of use in any space within the home. The functional benefits of odour neutralisation and aromatherapy advantages attract end users who desire practicality as well as sensory pleasure. Scent preference still dominates, and most preferred is still lavender, which is the leading scent in the marketplace, as end users continue to express trust and demand for the same. Personalised and lifestyle-driven fragrance choices such as tutti frutti also encourage experimentation and interaction, especially amongst digitally savvy younger end users.

Offline channels of retail control distribution with their high level of accessibility, in-store promotions, and product sampling. Supermarkets, hypermarkets, and convenience stores are still pivotal in establishing trust in brands and facilitating repeat purchasing. As e-commerce and online marketplaces such as MercadoLibre and Shopee become increasingly relevant, with a portfolio of offerings and convenience for technologically adept end users, offline retail is still delivering direct product trial, instant availability, and experiential value, securing its position as the leading channel.

Overall, the Brazil Air Freshener Market is likely to grow steadily, with the help of increasing lifestyle and wellness awareness, the sustained popularity of spray/aerosols, and reliable offline channels. The synergy of convenience, scent innovation, and experience retail guarantees continued demand, with end users increasingly looking for products that add to household comfort and represent personal preferences.

Brazil Air Freshener Market Growth Driver

Rising Household Priorities and Post-Pandemic Lifestyle Driving the Market Growth

The residual effects of the pandemic have caused Brazilian end users to further appreciate their home environments, driving growth for air freshener products in retail volume and current value in 2024. With hybrid work models still common, end users spend more time indoors, especially young adults aged 25–40, who concentrate on personalizing their homes with desired scents. Socioeconomic B and C segments are the volume drivers, since air fresheners are essentially non-essential items, but these segments' changes in behaviour have established persistent demand. This change in lifestyle has made end users look at air fresheners as a means to add comfort, relaxation, and personal expression to their homes.

Increased awareness of odour neutralisers has further driven the category's growth. They are nowadays utilized outside of the conventional places like toilets to other places including the car, the bins, and the areas where pets dwell. End-users, who in most cases are also the ones who buy, are ready to pay extra for items that satisfy both lifestyle and functional requirements. Personalisation and experimentation, particularly in younger end users, have taken centre stage in the customer experience, with new and innovative fragrance variants such as tutti frutti driving purchase frequency and encouraging repurchase.

Brazil Air Freshener Market Trend

Adoption of Aromatherapy and Fragrance Personalisation Trends

Aromatherapy is gathering pace in Brazil with end users more and more looking for air fresheners that have emotional and wellbeing benefits. Products containing essential oils solve problems like stress, insomnia, lack of focus, and breathing discomfort, presenting an alternative or complement to conventional measures. Brands highlight natural ingredients and aromatherapy advantages on electric devices, spray/aerosols, and other forms. Items such as Secar's "Rosemary from Sicily" and "Lavender from Paris" demonstrate how fragrances are positioned to convey intangible benefits including tranquillity, enthusiasm, and motivation. Social media campaigns are used to convey these emotional and functional benefits to younger, digitally active end users.

The movement towards lifestyle-based fragrance experience has impacted product innovation, prompting brands to cater to individualised scent offerings. Younger end users, in fact, are trying out varied scent products to suit their individual tastes. The emphasis on personalised experiences justifies greater interaction and loyalty, leading to repeat business. The trend is part of a larger trend from purely utilitarian air fresheners to products that combine emotional and sensory value, which places air fresheners in the position of a lifestyle upgrade instead of a basic household item.

Brazil Air Freshener Market Opportunity

Expanding Reach Through Online Marketplaces and Retail Online Channels

E-commerce websites and online marketplaces are increasingly significant for air freshener retailing in Brazil. Distribution channels like MercadoLibre and Shopee provide large SKU ranges, ranging from many kinds of fragrances and product formats, to end users in search of specific or specialist items. Digital channels are especially enticing for smaller unit-sized products with lower prices, for price-conscious younger end users who are familiar with online shopping. The convenience of comparison and easy access to information about products online further facilitates expansion, allowing end users to make educated decisions and find new scents at their fingertips.

Retail e-commerce maintains differentiation over warehouse clubs serving value-conscious end users by offering access to a wider portfolio of technologically sophisticated and fragrance-rich products. The convenience, flexibility, and product assortment offered by online marketplaces have solidified their relevance and made them a favored channel for end users looking for distinctive or high-end air fresheners. These online channels complement physical retail, enabling brands to stay in the face of customers and serve changing consumer behavior trends in the Brazilian market.

Brazil Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

Spray/aerosol air fresheners dominate the Brazil Air Freshener Market 2025 with a 45% stake in the product type category. They are popular due to convenience, ease of application, and instant fragrance distribution into the air, which makes them appropriate for most rooms around the house, such as toilets, kitchens, living rooms, and car interiors. The packaging is most appealing to young end users in need of speedy, mobile, and versatile solutions for personalizing their own spaces, while the wide variety of fragrances facilitates experimentation and way of life expression. The ease of availability in retail locations also yields high adoption.

Brands increasingly add functional benefit to spray/aerosol products, including odour neutralisation and aromatherapy, further establishing market leadership. The convenience and targeted application and instant effect of spray/aerosols make them attractive to end-users who prioritize practicality and sensory experience. Convenience, variety, and functional benefit combined guarantee the preeminence of spray/aerosol as the market leading format for Brazilian air fresheners, satisfactorily meeting both established preferences and nascent lifestyle trends.

By Fragrance

- Camomile/Lavender

- Lavender

- Floral

- Vanilla

- Lemon

- Breeze

- Lavender/Vanilla

- Cinnamon

- Jasmine

- Apple/Cinnamon

- Rose

- Orchid

- Mint

- Wood

Retail offlines possess the largest market share in the Brazil Air Freshener Market 2025, indicating their well-established presence and availability throughout the country. Hypermarkets, supermarkets, and convenience stores continue to be the purchase points for end users interested in purchasing reliable brands and having the product readily available. Offline retail offers a platform for visual merchandising, in-store promotion, and sampling of products, which are essential in end users' consideration of new fragrances or sizes. Pioneering chains like Carrefour and Pão de Açúcar keep investing in presentation and strategic positioning, building end user confidence and encouraging repeat business.

The offline retail dominance is also supported by end user behavior, wherein physical shopping provides direct access to products, instant examination of packaging and scent, and effortless bundling with other household items. Even with the increasing presence of e-commerce, offline channels retain their competitiveness based on experiential advantages, physical access to products, and brand prominence. Offline retailing is thus the leading channel of sales in the Brazilian air freshener market, especially for segments which value quality, trust, and convenience.

Top Companies in Brazil Air Freshener Market

The top companies operating in the market include Interbrilho Higiene e Limpeza Ltda, SOIN Sociedade Industrial Importação e Exportação Ltda, Bombril SA, Ceras Johnson Ltda, Reckitt Benckiser (Brasil) Ltda, Studio D'essences Comercio, Fabricacao, Importacao E Exportacao De Cosmeticos Ltda, Luxcar Produtos Automotivos Ltda, Windauto Industria e Comercio Eireli, SC Johnson, Procter & Gamble, etc., are the top players operating in the Brazil Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Brazil Air Freshener Market Policies, Regulations, and Standards

4. Brazil Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Brazil Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Brazil Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Brazil Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Brazil Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Brazil Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Brazil Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Brazil Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Ceras Johnson Ltda

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Reckitt Benckiser (Brasil) Ltda

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Studio D'essences Comercio, Fabricacao, Importacao E Exportacao De Cosmeticos Ltda

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Luxcar Produtos Automotivos Ltda

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Windauto Industria e Comercio Eireli

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Interbrilho Higiene e Limpeza Ltda

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. SOIN Sociedade Industrial Importação e Exportação Ltda

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Bombril SA

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. SC Johnson

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Procter & Gamble

12.1.10.1. Business Description

12.1.10.2. Product Portfolio

12.1.10.3. Collaborations & Alliances

12.1.10.4. Recent Developments

12.1.10.5. Financial Details

12.1.10.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.