Bolivia Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), By Price (Premium, Mass), By Gender (Men, Women, Unisex), By Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), By Form (Creams/Gels, Lotions, Sprays, Solid, Others), By Nature (Organic, Inorganic), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Jan 2026

- VI0723

- 110

-

Bolivia Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

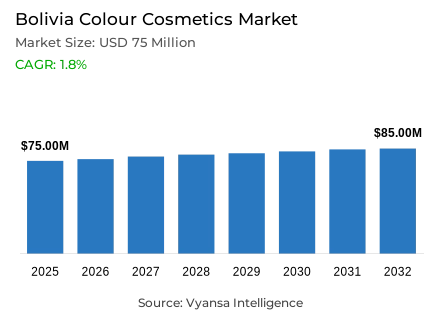

- Colour cosmetics in Bolivia is estimated at USD 75 million in 2025.

- The market size is expected to grow to USD 85 million by 2032.

- Market to register a cagr of around 1.8% during 2026-32.

- Category Shares

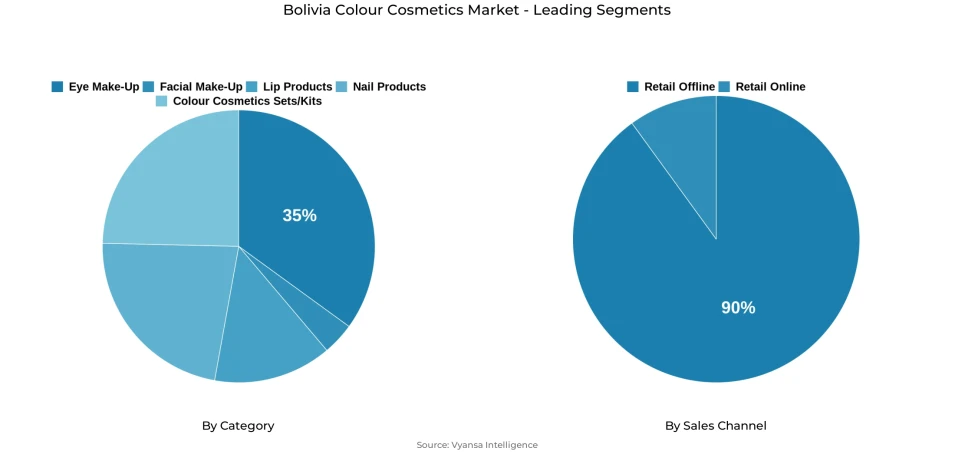

- Eye make-up grabbed market share of 35%.

- Competition

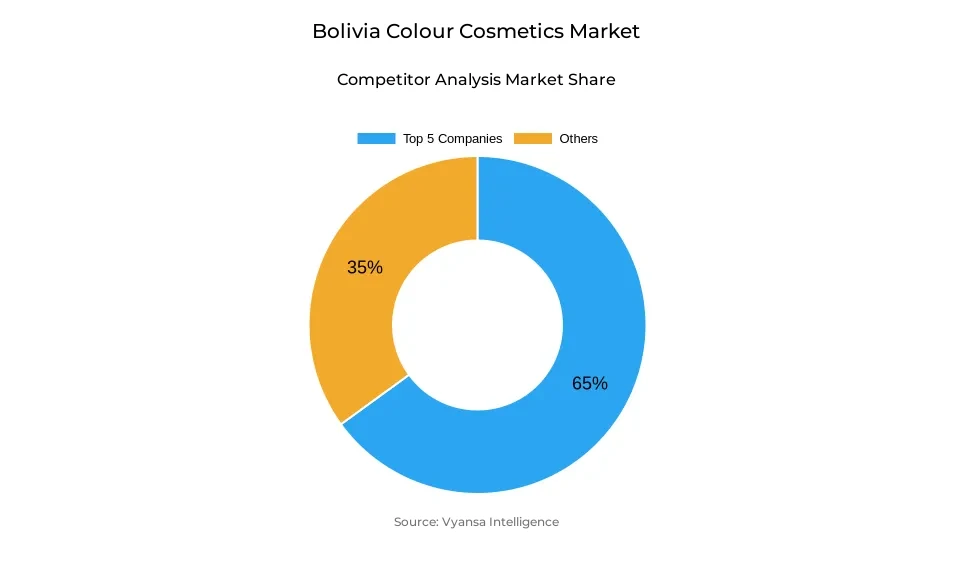

- More than 5 companies are actively engaged in producing colour cosmetics in Bolivia.

- Top 5 companies acquired around 65% of the market share.

- Omnilife de Bolivia SA; Megalabs Bolivia SRL; Alta Estética SRL; Yanbal Bolivia SA; Corporación Belcorp Bolivia etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 90% of the market.

Bolivia Colour Cosmetics Market Outlook

The Bolivia Colour Cosmetics Market is approximately valued at USD 75 million in 2025 and is expected to grow to USD 85 million by 2032, reflecting a CAGR of 1.8% over the forecast period. During the forecast period, though improvements will remain low as the market is under pressure because of an absence of foreign currency, imports have become expensive, and end users spending is prudent, nevertheless, it will remain dominated by eye make-up with about 35% market share because of regular use of mascaras, eye-lined products, and brow definers.

Lips products are expected to be one of the most prominent with an extremely positive performance as companies focus on enhancing their products with reparative, hydrating, and protecting ingredients. Since end users tend to extend the lifespan of non-essential products, the popularity of lipsticks with enhanced longevity and skincare properties such as collagen-enriched or moisture-locking formulas will increase. Direct selling giant Yanbal is expected to remain prominent with its functional and vegan-compliant product offerings and robust engagement with its customers, whereas value-oriented brands such as Essence continue gaining popularity.

Overall, retail offline distribution will continue to be widespread, maintaining a 90% level of sales, mainly through direct sales and the growth of modern retail distribution. Beauty expert and supermarket brands are also likely to make an appearance with a zone showing a selection of low and mid-priced brands. On the other hand, retai online are also set to increase, mainly through digital payment systems and a convenient delivery service, allowing discreet and easy access to a broader selection of color cosmetics.

Until the end of the forecasting period in 2032, market development is likely to be driven by affordability, innovation, and an increasing trend towards ethical beauty. Vegan-friendly, skin-friendly, or overall skin-nourishing products are likely to steadily gather increasing importance, irrespective of direct sales or mass market product ranges, as the need for skin nurturing surpasses every other criterion. Despite this, products combining diverse uses, trend positioning, and value for money are likely to have a leading edge.

Bolivia Colour Cosmetics Market Growth Driver

Innovation-Led Value Growth Through Enhanced Formulations

Bolivia colour cosmetics, the key driver is ingredient-based innovation, which enhances perceived value in a price-sensitive context. In 2024, lip products and eye make-up improved with hydrating, protective formulations containing hyaluronic acid, vitamin E, botanical extracts, and long-wear technologies. Such multifunctionality goes beyond just basic aesthetics, conferring nourishment, longevity, and skin-comfort improvements. Given that the majority of colour cosmetics are imported, such innovation offsets consumer resistance by justifying outlay despite rising import costs.

Bolivia's economic backdrop certainly consolidates this driver. According to the IMF, persistently higher external pressures and decreased foreign-currency reserves have impacted import-dependent categories. As elevated international payment difficulties raise prices, international brands offering benefit-driven, multifunctional cosmetics create strong purchase justification. This innovation-impelled approach keeps the market resilient and allows value-oriented growth, thus helping the brands to keep their end user engaged in consumer spending amidst macroeconomic headwinds and a high product cost.

Bolivia Colour Cosmetics Market Challenge

Foreign Currency Scarcity Driving Cost Inflation and Demand Softening

The biggest issue for the Bolivia color cosmetics industry, explains the study, is the severe shortages of foreign currencies, which drive up the cost of importing cosmetics, an issue worsened by growing intermediation charges and volatility of the foreign exchange rate. This increases the final cost of products on store shelves and reduces purchasing rates due to extended use cycles of the products, particularly for categories less integrated into buying habits. These categories include BB and CC creams and facial make-up.

The macroeconomic environment in Bolivia augments this. The World Bank indicates a GDP slowdown to about 3.1% in 2023, indicating a slowdown in economic activity and, by consequence, a reduced ability to make discretionary outlays. Under conditions of constrained wallet share, beauty becomes a treat to be enjoyed rather than a need. The economic crunch here is constant, thus inhibiting experimentation and penetration, and manufacturers' ability to shift costs without undercutting demand.

Bolivia Colour Cosmetics Market Trend

Social-Media-Driven Beauty Adoption and Influence-Led Product Discovery

A key trend that is definitely shaping Bolivia's color cosmetics market is the increasing dominance of social-media-driven beauty behavior, wherein product discovery, technique learning, and brand trust come mainly from influencer content. The consumer decision-making process in Bolivia has changed radically, particularly among younger demographics, with TikTok, Instagram, and YouTube commanding huge attention. Consumers increasingly use products demonstrated through real-time content such as mascara routines, eyeliner techniques, and multi-use stick applications featured by local creators, as brands invest strategically in influencer partnerships to drive preference at an accelerated rate.

Driving this trend dynamic is a rising national connectivity. According to the World Bank, Bolivia's internet usage reached over 67% of its population in 2022 and continues to grow. The wider digital access, the more influential influencer culture becomes because this is the main cultural driver for beauty habits. This development moves market demand toward expressive eye aesthetics, multifunctional colour products, and viral textures while placing social validation as a continuing influence on how this category will continue to change in the longer run.

Bolivia Colour Cosmetics Market Opportunity

Expansion of Vegan, Ethical, and Skin-Friendly Beauty Positioning

A significant market opportunity emerges from escalating demand for vegan, ethical, and skin-friendly colour cosmetics, driven by heightened ingredient safety awareness and lifestyle alignment. Consumers increasingly favour formulations free from animal-derived components and enriched with nourishing elements such as panthenol, hyaluronic acid, natural oils, and pro-vitamin B5. Ethical beauty positioning aligns strategically with wellness culture and perceived skin health benefits, enabling brands offering gentle, clean, plant-forward products to capture rising consumer interest, particularly among younger, values-driven demographics.

This opportunity aligns with global patterns documented by the UN Environment Programme (UNEP), which identifies strong consumer movement toward ethical and sustainable beauty products. As Bolivia's digital generation becomes increasingly ingredient-conscious, vegan and cruelty-free offerings gain aspirational value. Brands combining accessibility with authentic ethical identity—such as Yanbal, Natura, and Catrice—are strategically positioned to accelerate growth by aligning with this long-term shift toward health-aware and environmentally responsible beauty consumption.

Bolivia Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Eye Liner/Pencil

- Eye Shadow

- Mascara

- Others

- Facial Make-Up

- BB/CC Creams

- Blusher/Bronzer/Highlighter

- Foundation/Concealer

- Powder

- Others

- Lip Products

- Lip Gloss

- Lip Liner/Pencil

- Lipstick

- Others

- Nail Products

- Nail Polish

- Nail Treatments/Strengthener

- Polish Remover

- Others

- Colour Cosmetics Sets/Kits

The segment with highest market share under Category is eye make-up, with around 35% of the share. This category has consistently taken the lead due to the fact that mascaras, eye lining pencils, and eyebrow gels are essential in the daily make-up process for the majority of end users. The current trend of emphasizing more defined lashes and natural yet finished make-up looks is expected to contribute to the sustained demand for this category.

Eyeshadows are also made more effective by the innovation in the product offerings in the market and social media trends. New ideas in the market, like smudge-proof mascaras and colorful eye liners, have resonated well with product-conscious end users. Social influencer activity has ensured that eye care and eye-related product offerings are highly noticeable and leaders in the market as the country progresses through the forecast period.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channel is retail offline, with around 90% of share. The main sales channel in this category is direct sales. Many people are drawn to direct sales because they allow people to work as sales agents or even become business owners. There is also a good rapport between sales agents and consumers.

The role of beauty experts is important not only in online but even in offline strength, especially in major cities, where they provide expert consultation services, well-curated lines, and attractive pricing. Their mission of providing end users with easy access to affordable Asian and popular global brands attracts consumer traffic and improves the overall shopping experience. Even with online expansion, the retail offline remains the bedrock of the colour cosmetic market.

List of Companies Covered in Bolivia Colour Cosmetics Market

The companies listed below are highly influential in the Bolivia colour cosmetics market, with a significant market share and a strong impact on industry developments.

- Omnilife de Bolivia SA

- Megalabs Bolivia SRL

- Alta Estética SRL

- Yanbal Bolivia SA

- Corporación Belcorp Bolivia

- Elite Brands Srl

- Bellcos Bolivia SA

Competitive Landscape

Yanbal Bolivia remained the leading company in colour cosmetics in 2024, supported by its long-standing market presence, strong sales force and an omnichannel marketing strategy combining traditional outreach with active social media engagement. Its focus on multifunctional, vegan, and innovative products—highlighted by the “Mujer es Poder” campaign and the expansion of its Ya! line with multipurpose sticks and all-in-one shadows—helped reinforce its dominance. While Yanbal led overall, Elite Brands emerged as the most dynamic performer thanks to the rising popularity of Essence, which resonated strongly with Gen Z and young millennials seeking affordable, trend-driven options. Across the market, social media platforms such as TikTok, Instagram and YouTube significantly shaped brand visibility, with influencer-driven demonstrations boosting awareness and purchase intent, making digital engagement a critical competitive tool for both established players and newer entrants.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Bolivia Colour Cosmetics Market Policies, Regulations, and Standards

4. Bolivia Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Bolivia Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Bolivia Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Bolivia Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Bolivia Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Bolivia Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Bolivia Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Yanbal Bolivia SA

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Corporación Belcorp Bolivia

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Elite Brands Srl

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Bellcos Bolivia SA

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Alta Estética SRL

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Omnilife de Bolivia SA

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Megalabs Bolivia SRL

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.