Bolivia Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0523

- 110

-

Bolivia Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

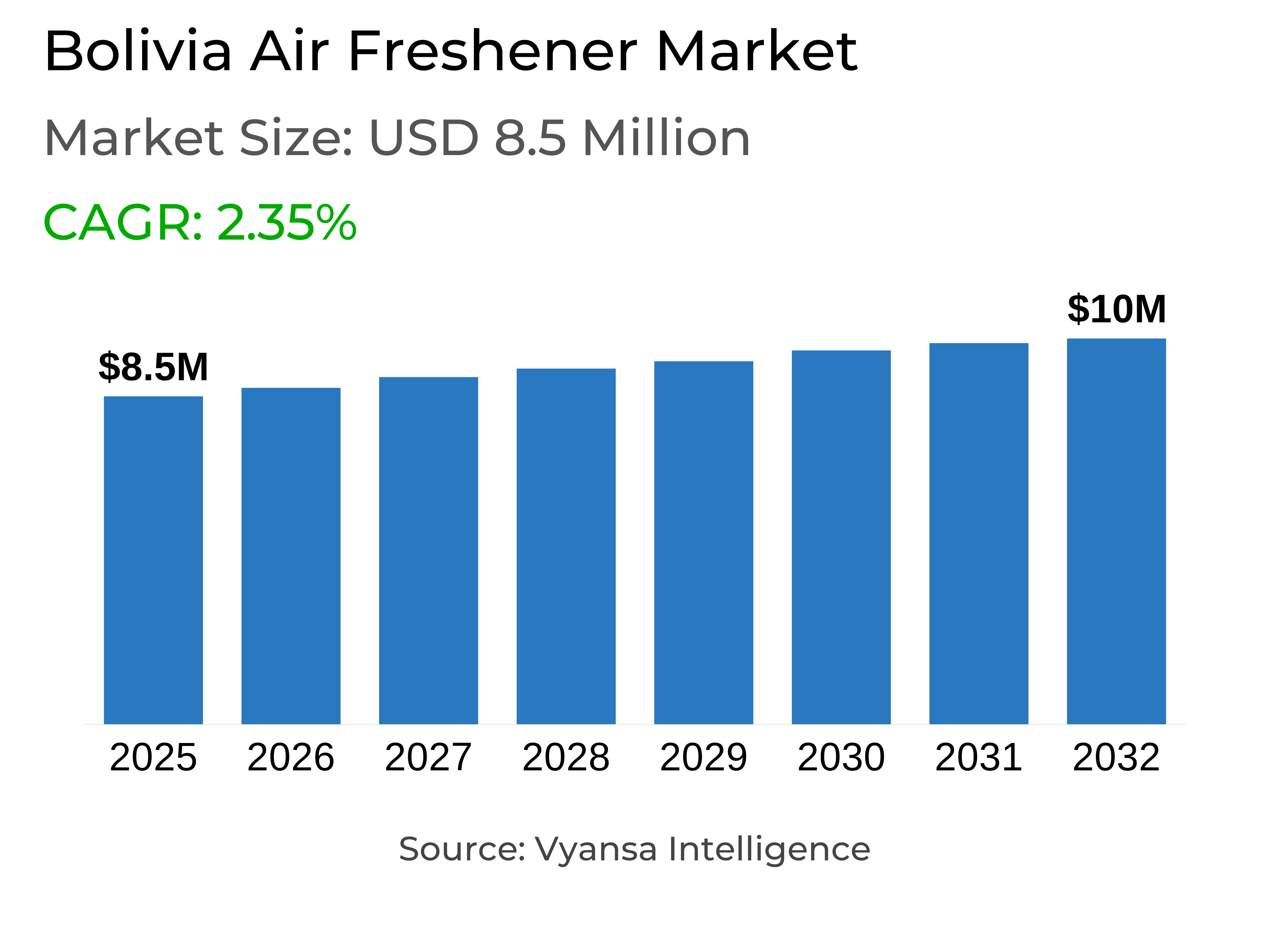

- Air Freshener in Bolivia is estimated at $ 8.5 Million.

- The market size is expected to grow to $ 10 Million by 2032.

- Market to register a CAGR of around 2.35% during 2026-32.

- Product Type Shares

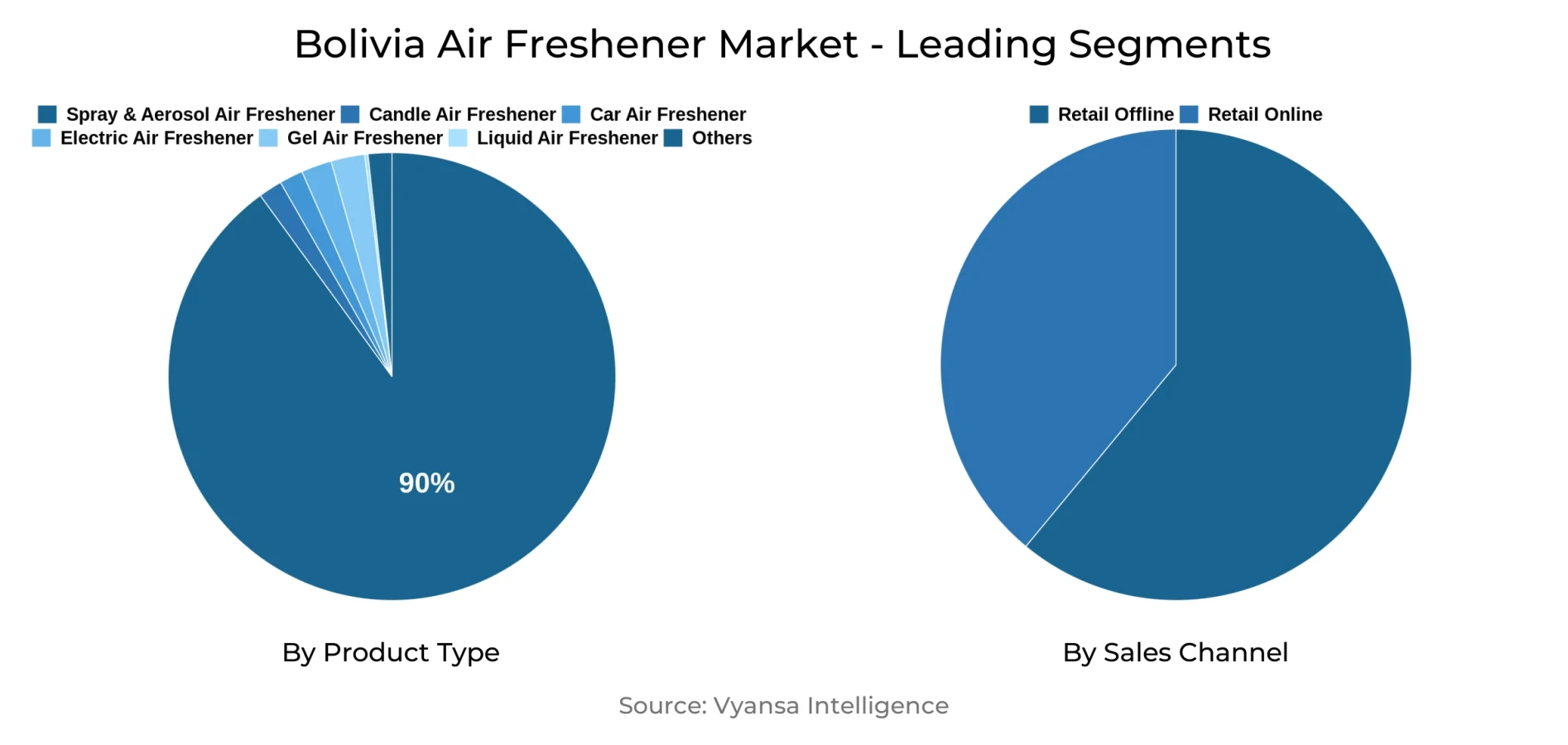

- Spray/Aerosol Air Freshener grabbed market share of 90%.

- Competition

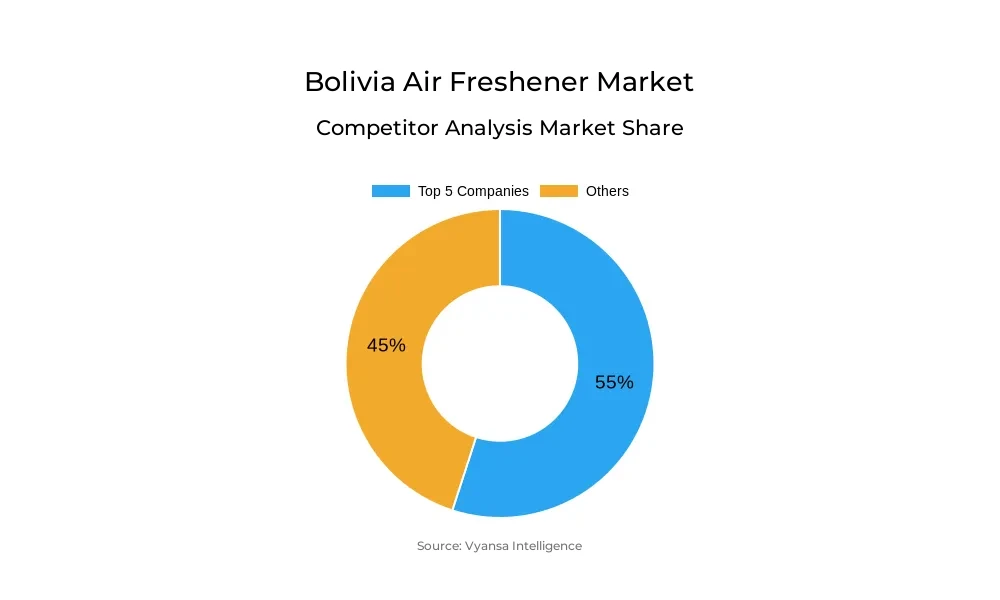

- More than 10 companies are actively engaged in producing Air Freshener in Bolivia.

- Top 5 companies acquired around 55% of the market share.

- Clin SRL, Astrix SA, Thais Ltda, Alicorp SAA, Minoil Bolivia Ltda etc., are few of the top companies.

- Sales Channel

- Retail Offline continues to dominate the market.

Bolivia Air Freshener Market Outlook

Bolivia Air Freshener Market was estimated to be $8.5 million in 2025 and was expected to reach an approximate value of $10 million by 2032, driven by a shift toward locally produced and more affordable products. Steep price increases in imported air fresheners, caused by foreign exchange constraints and declining availability of US dollars, have encouraged end users to turn to domestic brands such as Industrias Luri’s Todo Brillo and Industrias Venado’s Bristar. These local products offer competitive pricing and formulas tailored to Bolivian preferences, including native fragrances like Tajibo en Flor and Achachairú, which strengthen cultural resonance and appeal among price-sensitive households.

Volume growth in 2024 continued to be under strain despite double-digit increases in value, as it mirrored the strains of affordability over a wide base of end users. Argentina's peso devaluation lessened the incentive for smuggling, and the narrowing of the price difference between local and imported products limited overall demand. Nonetheless, local brands have leveraged this structural shift to capture greater value share, particularly in the spray/aerosol category, which dominates the market with a 90% share due to its affordability, versatility, and instant fragrance delivery.

New local brands are also turning towards product differentiation and innovation, with natural, eco-friendly variants and disinfectant-enhanced sprays now popular. End consumers are attracted to those that provide a mix of hygiene, fragrance, and environmental safety, and new formats like long-lasting gels and affordable electric air fresheners are likely to increase choice among consumers. The value offered by domestic products, which is the combination of affordability, cultural familiarity, and functional benefit, places them for moderate growth during the forecast period.

Retail offline channels continue to dominate the Bolivia Air Freshener Market, providing end users with direct access to a wide selection of products. Grocery stores, drugstores, and general retail outlets remain preferred for their convenience, visibility, and ability to showcase both domestic and imported brands. Offline distribution supports strong brand recognition and trust, particularly for economy-focused local players, making it the primary channel driving market sales and ensuring continued growth across Bolivia.

Bolivia Air Freshener Market Growth Driver

Rising Demand Shaped by Economic Shifts Driving Market Growth

Significant changes in Bolivia’s economic landscape have created new opportunities for local air freshener brands. With steep price hikes affecting imported products, particularly due to the shortage of US dollars and declining foreign reserves, end users have begun shifting toward more affordable domestic alternatives. Local players such as Industrias Luri’s Todo Brillo and Industrias Venado’s Bristar have gained value share, offering competitive price points and formulas suited to Bolivian preferences.

Bristar’s introduction of spray/aerosol products with disinfectant properties, combined with scents rooted in local culture like Tajibo en Flor and Achachairú, has strengthened its appeal among price-sensitive end users. These developments indicate a growing willingness among Bolivians to embrace brands that balance affordability, functionality, and cultural resonance, reshaping demand within the market over the forecast period.

Bolivia Air Freshener Market Challenge

Inflationary Pressures Restraining Volume Growth

Even as double-digit value growth in current and constant terms was recorded during 2024, volume sales continued to feel the squeeze as high rates of price escalation made products less affordable for most households. Imported brands were especially hard hit, with foreign exchange limitations causing imports to be pricey and less available for consumption by end-users. This had a significant disconnect between increasing market value and contained volume growth.

In addition, while illicit trade has historically influenced the sector, smuggling from neighboring Argentina became less lucrative in 2024 following a sharp devaluation of the peso. This narrowed the price gap between locally produced goods and smuggled imports, reducing the scale of parallel trade but leaving overall demand constrained. These financial and structural barriers highlight how market growth potential remains limited by affordability challenges across a broad base of end users.

Bolivia Air Freshener Market Trend

Market Shifts Toward Local Innovation and Ecological Formats

Emerging brands in Bolivia are increasingly differentiating themselves through innovation in both product formulas and scent profiles. The use of native fragrances, such as Achachairú fruit and Tajibo flowers, has bolstered local identity and provided end users with products that resonate with their cultural preferences. Economy-focused positioning has further strengthened the value appeal of these brands, building loyalty among price-conscious households.

Additionally, the forecast period is expected to see a notable rise in natural and ecological variants. Growing awareness of the health risks associated with chemical-based products is driving end users toward safer, environmentally friendly solutions. New formats, including longer-lasting gels and innovative spray/aerosol offerings, are anticipated to broaden choice and stimulate demand, ensuring that product development aligns with evolving lifestyle and wellness expectations.

Bolivia Air Freshener Market Opportunity

Expanding Prospects for Competitive Local Players

The withdrawal of some international names, such as Unilever’s decision to halt imports of its Ola brand, has opened space for domestic companies to strengthen their position in the market. Local manufacturers, by focusing on affordability and practical features, are well-positioned to capture greater value share over the forecast period. This reconfiguration highlights a structural shift favoring Bolivian players in a segment historically dominated by imports.

Electric air fresheners, while less affordable overall, are also set to benefit from the entry of new economy-focused brands. Companies like Todo Brillo, Aromas, and Saphirus are expected to generate momentum by offering more accessible pricing than established international competitors. This shift ensures growth opportunities not only within the dominant spray/aerosol category but also in higher-value segments, paving the way for a more diversified competitive environment in Bolivia.

Bolivia Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

Spray/aerosol air fresheners dominate the Bolivia Air Freshener Market, holding an overwhelming 90% share within the product type segment. Their popularity stems from their affordability, wide availability, and versatility in instantly refreshing living spaces. End users prefer these products due to their ability to provide quick fragrance solutions at a low cost, making them the most practical choice in an inflationary economy.

The segment has also been aided through local innovation, with players such as Bristar providing disinfection characteristics in addition to fragrance, addressing both hygiene and ambiance requirements. The availability of locally derived fragrances further enhanced their applicability to Bolivian consumers. In contrast to others like electric formats, spray/aerosols continue to remain much more accessible, both distribution- and price-wise, to maintain their stronghold over the forecast period.

By Sales Channel

- Retail Online

- Retail Offline

Retail offline channel account for the highest share in the Bolivia Air Freshener Market, mainly due to offering end users access directly to a wide range of products. Grocery stores, drugstores, and general retail stores account for most of the sales, thereby realizing high convenience in availability of a product. This convenience particularly is significant in air fresheners, where sampling of fragrance is an essential marketing factor, along with visibility of packaging, impacting purchasing decisions.

Retail Offline has also supported the visibility and penetration of local brands, which rely heavily on in-store exposure to build recognition and trust. End users seeking affordable options often turn to these channels, where economy and domestic products are prominently displayed alongside premium imports. The established presence and reach of offline distribution ensures it remains the leading sales channel, making it the most influential point of access for air freshener purchases in Bolivia.

Top Companies in Bolivia Air Freshener Market

The top companies operating in the market include Clin SRL, Astrix SA, Thais Ltda, Alicorp SAA, Minoil Bolivia Ltda, Matto Imports - Exports Srl, Industrias Luri Srl, Unilever Andina Bolivia SA, DICOM Distribuidores del Oriente SRL, etc., are the top players operating in the Bolivia Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Bolivia Air Freshener Market Policies, Regulations, and Standards

4. Bolivia Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Bolivia Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Bolivia Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Bolivia Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Bolivia Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Bolivia Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Bolivia Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Bolivia Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Alicorp SAA

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Minoil Bolivia Ltda

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Matto Imports - Exports Srl

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Industrias Luri Srl

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Unilever Andina Bolivia SA

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Clin SRL

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Astrix SA

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Thais Ltda

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. DICOM Distribuidores del Oriente SRL

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.