Australia Bags and Luggage Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Bags (Cross Body Bags, Bags and Backpacks, Business Bags, Duffle Bags, Clutches, Others), Luggage (Soft Luggage, Hard Luggage, Wheeled Luggage, Non-Wheeled Luggage)), By Sales Channel (Retail Offline, Retail Online), By Material Type (Soft Case (Nylon, Polyester, Ballistic Nylon), Hard Case (Polycarbonate, ABS (Acrylonitrile Butadiene Styrene), Polypropylene)), By Price Category (Luxury, Mass/Economy, Premium), By Application (Travel, Business), By Region (Queensland, New South Wales, Victoria, South Australia, Others)

|

Major Players

|

Australia Bags and Luggage Market Statistics and Insights, 2026

- Market Size Statistics

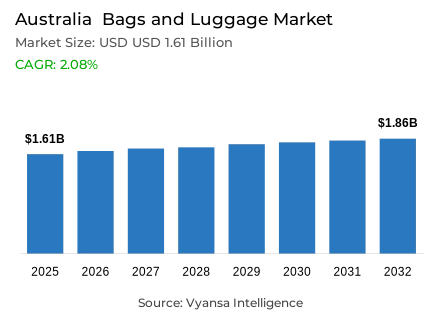

- Bags and luggage in Australia is estimated at USD 1.61 billion in 2025.

- The market size is expected to grow to USD 1.86 billion by 2032.

- Market to register a cagr of around 2.08% during 2026-32.

- Category Shares

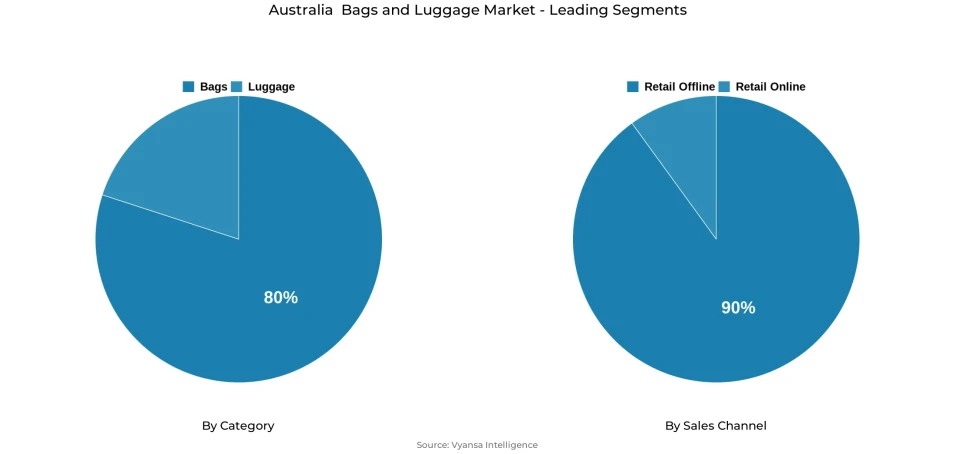

- Bags grabbed market share of 80%.

- Competition

- More than 20 companies are actively engaged in producing bags and luggage in Australia .

- Top 5 companies acquired around 35% of the market share.

- Gucci Australia Pty Ltd; Bottega Veneta Australia Pty Ltd; Capri Holdings Ltd; Louis Vuitton Australia Pty Ltd; Samsonite Australia Pty Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 90% of the market.

Australia Bags and Luggage Market Outlook

The Australia bags and luggage market is expected to register a steady growth rate over the forecast period of 20262032, driven by the continued recovery in inbound and outbound travel and the resurgence of end user interest in travelrelated expenditure. The bags and luggage market in Australia is estimated to be valued at $1.61 billion in 2025 and is expected to reach $1.86 billion by 2032, registering a CAGR of 2.08% over the period. The general demand in 2024 is still lower in volume terms than before the pandemic, but the recovery of the processes in tourism activity and the slow adjustment of travel behaviour will be the basis of the future growth.

Bags remain in control of the demand as they are based on the daily use trends and stronger replacement cycles than luggage. Luxury handbags will also be a growth driver as it will be enjoying the influx of international tourists, especially the highspending Asian tourists. At the same time, the demand in luggage is expected to be stable because the Australian people are still focused on longdistance travel and renew or update suitcases to continue a long trip. The bag segment makes up about 80 percent of the market since they have a broader range of uses than travel purposes.

The industry is marked by the presence of both international luxury brands and international luggage brands mixed with strong local competition. Besides well known luxury brands, hightechnology modern and domestic upscale brands are on the rise and attract end users interested in quality, longevity, and without overstatement design with lower affordability. The concepts of sustainability and circulareconomies are also becoming more prevalent in product development, where the use of recycled materials, takeback projects, and resale programs are becoming more dominant in brand development.

In terms of distribution, retail offline is still leading with an estimated 90 per cent of market share since end users still tend to appreciate instore shopping experiences, especially when the handbags and luggage are of higher price. Retail retail online is fairly advanced, but its development is expected to level, which confirms the relevance of physical retail with the use of the omnichannel approach. The outlook in general indicates a moderate but steady growth driven by the recovery in travel, premiumisation trends, and the changing expectations on sustainability.

Australia Bags and Luggage Market Growth Driver

International Travel Recovery Drives Luggage and Premium Bag Demand.

The key factor that contributes to the Australia bags and luggage market is the noticeable recovery in international travel activity since the pandemic, which arouses the demand in the travelrelated products market. According to the official statistics of Tourism Research Australia, the number of international visitors arrivals reached 8.0 million trips in the year ending September 2025 an upsurge of 7% of previous year and total expenditure in Australia was AUD 37.1 billion. The tourists of major markets, such as China, New Zealand, the United States, and the United Kingdom, are contributing to the increase in the luxury experience spending and the luxury goods prices, such as the highquality handbags and luggage.

The rebound of inbound and outbound travel has increased the need of high quality luggage, where end users replenish their travel equipment to modernise after years of being locked out. Durable hardcase luggage brands are of particular interest to longhaul travellers as longhaul travel increases and leisure tourism drives more spending. Therefore, the reinstatement of the traveling business does not only increase the volume of direct luggage sales but also the initial ones like premium handbags among the highend tourists.

Australia Bags and Luggage Market Challenge

Discretionary Spending is curtailed by CostofLiving Pressures.

The major challange that the Australian bags and luggage market is currently experiencing is the costofliving squeeze that is still present reducing discretionary spending in spite of the travel revival. According to the reports of the Australian Bureau of Statistics, the end user price index increased in a year 2023 by 3.8% and household expenditure has been influenced the most by housing, food and transport prices. Such pressures reduce the willingness of end users to redirect their funds from nonnecessity items like fashion bags or luggage upgrades.

Besides, imported bags and luggage face cost interactions related to currency fluctuation and freights. The Reserve Bank of Australia notes that the exchangerate fluctuations continue to affect the prices of imported end user goods hence increasing the sensitivity in prices in retail. Consequently, the volume demand is not high in the masspriced and middlepriced segments as far as affordability is the key factor in making a purchase decision.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Australia Bags and Luggage Market Trend

Digital and OmniChannel Shopping Acquires Structural Significance.

The key trends that have impacted the Australian bags and luggage market is the growing importance of online and omnichannel retailing, but physical stores are still important in highend and luxury purchases. The Australian Bureau of Statistics says that in 2024 online retail constituted 11.6% of the total retail turnover when it was less than 10% in the prepandemic era, an indication that it is structurally at a higher level of digital usage.

Customers are increasingly doing product research online, price comparison, and taking advantage of online offers before they buy bags and luggage. This behaviour forms the basis of the hybrid shopping journeys, where online exploration is supported with store consideration. Therefore, brands are investing in smooth digital interfaces, clickandcollects, and enhanced online product details to capture digitally savvy end users but stay physically retail trusted.

Australia Bags and Luggage Market Opportunity

Sustainability and Circular Economy Adoption Generates Differentiation.

A promising avenue for future growth in the Australia bags and luggage market lies in the expanding emphasis on sustainability and circular economy practices, underpinned by supportive policy initiatives and rising end user environmental awareness. According to the National Waste Policy of the Australian Government, every year Australia produces a production of over 200,000 tonnes of textile waste which is primarily placed in landfill. This has increased pressure on brands to use recyclable materials, repair, and takeback programmes.

Efforts by the industry, including Seamless, which is a governmentsupported program that has been in operation since 2024 are meant to prevent 120,000 tonne of clothing and textile waste by 2027. Even though they are mostly concentrated on clothes, the framework is becoming more relevant to accessories, such as bags and luggage. Adhering to the principles of circular design, responsible sourcing, and resale models, these brands are in a good position to appeal to end userism that is conscious of environmental issues and establish longlasting brand loyalty.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Australia Bags and Luggage Market Segmentation Analysis

By Category

- Bags

- Cross Body Bags

- Bags and Backpacks

- Business Bags

- Duffle Bags

- Clutches

- Others

- Luggage

- Soft Luggage

- Hard Luggage

- Wheeled Luggage

- Non-Wheeled Luggage

Bags constitute the segment with the highest share in the Australia bags and luggage market, accounting for approximately 80% of total market share. This dominance reflects the everyday relevance of bags, including handbags, backpacks, and travel bags, which are utilised across work, leisure, and daily activities. Unlike luggage, which is closely tied to travel frequency, bags benefit from more consistent demand and faster replacement cycles, supporting their leading market position.

Within the bags category, luxury handbags fulfill a key role in driving value growth, particularly as inbound tourism recovers and international visitors return to premium shopping destinations. Simultaneously, nonluxury and advanced contemporary bags remain important, catering to end users seeking durable, stylish products at more accessible price points. Throughout the forecast period, bags are expected to remain the backbone of the market, supported by their versatility, strong brand differentiation, and growing emphasis on sustainable and responsibly sourced materials.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline represents the segment with the highest share within the sales channel category, accounting for approximately 90% of the Australia bags and luggage market. Physical retail establishments continue to fulfill a crucial role, particularly for handbags and luggage, as end users prefer to assess size, material quality, craftsmanship, and functionality in person. This preference is especially relevant for luxury and premium products, where the instore experience and brand environment strongly influence purchasing decisions.

retail offline is additionally supported by the presence of flagship stores, shopping centres, and specialist luggage retailers, which offer curated product ranges and personalised service. While retail online remains an important complementary channel, its growth is expected to stabilise as end users return to stores for experiential shopping. Throughout the forecast period, retail offline is likely to maintain its dominant position, increasingly supported by omnichannel features such as online browsing, instore pickup, and digital enhancements within physical retail spaces.

List of Companies Covered in Australia Bags and Luggage Market

The companies listed below are highly influential in the Australia bags and luggage market, with a significant market share and a strong impact on industry developments.

- Gucci Australia Pty Ltd

- Bottega Veneta Australia Pty Ltd

- Capri Holdings Ltd

- Louis Vuitton Australia Pty Ltd

- Samsonite Australia Pty Ltd

- Strandbags Group Pty Ltd

- Saint Laurent Australia Pty Ltd

- Country Road Ltd

- Oroton Group Ltd

- Kathmandu Holdings Ltd

Competitive Landscape

Australia bags and luggage market features a diverse competitive mix of global luxury houses, international luggage specialists, and strong local players. Louis Vuitton Australia Pty Ltd retains market leadership, underpinned by its dominance in luxury handbags through brands such as Louis Vuitton, Dior, Céline, Fendi, and Marc Jacobs, supported by renewed inbound tourism. Other luxury groups, including Kering, maintain a solid presence, while brands such as Chanel, Prada, Hermès, and Burberry have regained momentum. In luggage, Samsonite Australia Pty Ltd and Strandbags Group Pty Ltd rank among the leading players, benefiting from brand breadth, affordability, and travel recovery. Local premium brands like Oroton and advanced contemporary labels are gaining traction by appealing to consumers seeking quality, sustainability, and understated luxury, intensifying competition across price tiers.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Australia Bags and Luggage Market Policies, Regulations, and Standards

4. Australia Bags and Luggage Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Australia Bags and Luggage Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Thousand Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Cross Body Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Bags and Backpacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Business Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Duffle Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.5. Clutches- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Soft Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Hard Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Non-Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Material Type

5.2.3.1. Soft Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.1. Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.2. Polyester- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.3. Ballistic Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Hard Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1. Polycarbonate- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2. ABS (Acrylonitrile Butadiene Styrene)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.3. Polypropylene- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Price Category

5.2.4.1. Luxury- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Mass/Economy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Application

5.2.5.1. Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Business- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Region

5.2.6.1. Queensland

5.2.6.2. New South Wales

5.2.6.3. Victoria

5.2.6.4. South Australia

5.2.6.5. Others

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Australia Bags Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Thousand Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Region- Market Insights and Forecast 2022-2032, USD Million

7. Australia Luggage Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Thousand Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Region- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Louis Vuitton Australia Pty Ltd

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Samsonite Australia Pty Ltd

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Strandbags Group Pty Ltd

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Saint Laurent Australia Pty Ltd

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Country Road Ltd

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Gucci Australia Pty Ltd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Bottega Veneta Australia Pty Ltd

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Capri Holdings Ltd

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Oroton Group Ltd

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Kathmandu Holdings Ltd

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Sales Channel |

|

| By Material Type |

|

| By Price Category |

|

| By Application |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.