Asia Pacific Municipal Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By Country (China, Japan, India, South Korea, Australia, Indonesia, Rest of Asia Pacific)

- Energy & Power

- Jan 2026

- VI0734

- 165

-

Asia Pacific Municipal Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

- Asia Pacific municipal water & wastewater pump market is estimated at USD 4 billion in 2025.

- The market size is expected to grow to USD 5.22 billion by 2032.

- Market to register a cagr of around 3.88% during 2026-32.

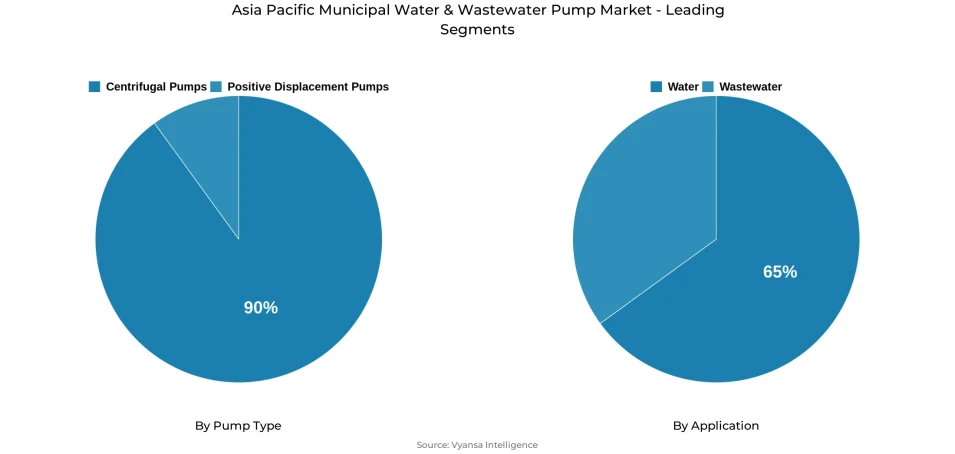

- Pump Type Shares

- Centrifugal pumps grabbed market share of 90%.

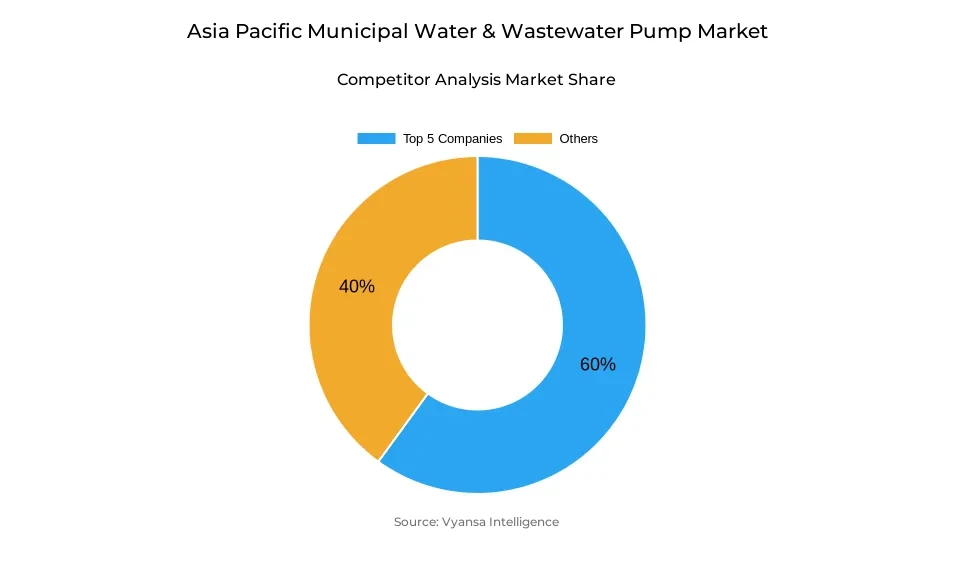

- Competition

- More than 10 companies are actively engaged in producing municipal water & wastewater pump in Asia Pacific.

- Top 5 companies acquired around 60% of the market share.

- Pentair PLC; Kirloskar Brothers Limited (KBL); Shanghai Kaiquan Pump Group; Xylem Inc.; Grundfos Holding A/S etc., are few of the top companies.

- Application

- Water grabbed 65% of the market.

- Country

- China leads with a 40% share of the Asia Pacific market.

Asia Pacific Municipal Water & Wastewater Pump Market Outlook

Asia pacific municipal water & wastewater pump market was approximately USD 4 billion in 2025 and is projected to grow up to USD 5.22 billion in 2032, showing a CAGR of 3.88% during the periods of 2026-32. This steady growth further marks the continued focus on the development of municipal water and wastewater infrastructure across Asia pacific because of the constant growth of urbanization and pressure on the present infrastructure. Asia pacific holds nearly 54% of the urban population of the world, and hence there is constant pressure on the infrastructure to enhance the pumping capacity for supplying water to the ever-growing urban population.

These governmental-led infrastructure developmental programs are directly driving the demand within the pumps. Strategic developments in the pipework, treatment facilities, and pumping facilities across China, India, and Southeast Asia have been enhancing market fundamentals. These globally aligned governmental developmental programs have been aimed at enhancing access to drinking Water, advancement of sewerage networks, and enhancing facilities within the treatment sector, thereby mandating extensive pumps.

From a technological viewpoint, centrifugal pumps currently lead the market, contributing 90% to the total, owing to their adaptability to high flow and continuous operation in the municipal water treatment sector. Their adoption in raw water entry, distribution of treated water, and management of WwTW further establishes their prime position in the expansion and replacement schemes in the municipal water treatment segment. Water supply continues to lead the market by application, contributing about 65% to the total share due to the high priority accorded to the development and stabilizing of the water supply sector.

By geography, China currently leads the Asia Pacific market for municipal water & waste water pumps, followed by India, Southeast Asia, and Japan. The Asia Pacific market, led by Asia-based companies, is expected to offer robust opportunities and is likely to grow at the highest rate among other regions. The Asia Pacific market is also expected to remain the leading market during the forecast period.

Asia Pacific Municipal Water & Wastewater Pump Market Growth DriverUrban Infrastructure Expansion Accelerating Municipal Pump Deployment

Asia Pacific’s fast-rising rate of urbanization is stressing its water and sewage infrastructure, leading to an immediate need for pumps in water distribution and sewage treatment applications. Asia currently has approximately 54% of the world’s total population living in urban areas with just over 2.2 billion people; this number of city dwellers is set to sharply rise in number by the end of this century’s middle years. This has put pressure on existing distribution infrastructure and sewage treatment works, prompting massive subsequent investment in new pipes, water treatment plants, and pump stations to provide constant availability to consumers. Water requirements in Asia Pacific are set to increase significantly in the middle of this century.

Government-supported infrastructure development is turning into long-term procurement at the petrol stations. Record investments of approximately USD 187.8 billion by China in the field of water conservancy infrastructure projects during the year 2024 show the huge demand for network development and upgradation. In the Indian context, Jal Jeevan Mission has supplied tap water connections to 15.44 crores (154.4 million) rural households, and it is at 79.74% as of February 1st, 2025. Supplying treated water for the geographically scattered rural setups, different elevations, and rural pipes of long-distance networks demands continuous pumping for its abstraction, transmission, and pressurizing. Alongside, the Namami Gange sewerage projects are bringing long-term demands for municipal pumping requirements.

Asia Pacific Municipal Water & Wastewater Pump Market ChallengeAging Assets and Water Quality Pressures Straining Utility Operations

Municipal utilities in the Asia Pacific region are facing growing pressures attributable to old infrastructure, thereby presenting a constant demand for replacements and upgrades of pumping equipment. For example, in more developed markets such as Japan, over one-fifth of the total water pipes have outlived their intended 40-year lifespan. This age-related damage to pipes, as well as pumping stations, continues to demand constant replacements and new equipment, particularly high-performance pumping equipment that can perform well when exposed to stress.

The increase in the levels of degradation of water quality and the amount of untreated sewage adds to the operational burden. Although China has managed to increase the quality of surface water to above 90% in Grade I to III classification by 2024, continued advancements in the associated infrastructure of treatment and pumps are required to be sustained. The level of sewage treatment in India continues to be substantially lower than the amount of sewage production, which is expected to increase with the approval of thousands of MLD of sewage treatment capacity by the government under national initiatives, thereby requiring continued demand for extensive pumps.

Asia Pacific Municipal Water & Wastewater Pump Market TrendDigital Water Management and Smart Infrastructure Adoption

The digitalization of the water management systems in urban areas is transforming the planning and pump demands in the Asia-Pacific region. Countries are shifting towards integrating intelligent frameworks for managing water to enhance efficiency and minimize losses. China has been moving forward with intelligent water management by formulating country-level policies to promote the use of digitally efficient pumping technologies with monitoring capabilities to raise demands for intelligent pump technologies with advanced technical features.

Factors such as sustainability and reuse mandates are fueling modernization. Reuse goals as part of various national rivers and sanitation campaigns in India are pressuring utility companies toward modernization in terms of capable multiple reuse cycles. On similar lines, modernization trends are noticed in Southeast Asia, with emphasis on Water Conservation at various government levels amid Water Demand in Cities. Shrewd utility sector modernization in Asia Pacific is increasingly including pumps with sensors, VSD pumps, and remote-access technology in Asia Pacific municipal water and wastewater pumps.

Asia Pacific Municipal Water & Wastewater Pump Market OpportunityExpanding Investment Pipelines Creating Long-Term Growth Headroom

Investments to the extent required to fill the gap in the water infrastructure of the Asia Pacific region provide robust expansion prospects. Multilateral agencies have identified annual expenditure of several hundred billion dollars to provide for regional needs related to the use of water, sanitation, and hygiene; however, the present expenditure by the public sector addresses less than half of the identified demands. This gap has brought innovative approaches for funding and public-private initiatives, and this impacts the continuous procurement of municipal pumping equipment.

Although significant strides have been made, an estimated massive number of users in the South/Southeast Asian region are yet to enjoy basic service provision for drinking water. Notably, filling the gap, as well as the replacement and extension of sewerage capacity to meet the increasing demand within the rapidly expanding metropolitan centers, translates to the long-term demand for pumps. National schemes, including the multi-thousand MLD sewerage capacity program in India, are indicative of the sheer demand to come.

Asia Pacific Municipal Water & Wastewater Pump Market Country Analysis

By Country

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

China leads regional demand, accounting for roughly 40% of the Asia pacific municipal water & wastewater pump market. This leadership is underpinned by the country’s massive urban population, extensive water networks, and sustained government investment in modernization. Record spending on water conservancy projects during 2024 reflects continued emphasis on upgrading supply, drainage, and treatment infrastructure. Improvements in national water quality indicators further signal the scale of treatment capacity additions and operational upgrades underway.

The remaining 60% of demand is distributed across other major regional markets. India stands out due to large-scale sanitation and water supply programs driving extensive pump deployment. Southeast Asian countries such as Vietnam and Indonesia are emerging as high-growth markets, supported by multilateral funding and national infrastructure targets. Developed economies including Japan and South Korea contribute steady replacement demand driven by aging systems. Collectively, these countries sustain broad-based growth across municipal pumping applications.

Asia Pacific Municipal Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- End Suction

- Split Case

- Vertical

- Turbine

- Axial Pump

- Mixed Flow Pump

- Submersible Pump

- Positive Displacement Pumps

- Progressing Cavity

- Diaphragm

- Gear Pump

- Others

Centrifugal pumps form the backbone of municipal water and wastewater operations across Asia Pacific, accounting for around 90% of total market share. Their dominance reflects suitability for high-volume, continuous-duty applications such as raw water intake, treated water distribution, sewage conveyance, and core wastewater treatment processes. Municipal systems serving millions of end users require pumps that deliver consistent flow, operational reliability, and energy efficiency across large geographic networks, attributes that centrifugal technology provides at scale.

The remaining share is held by positive displacement and specialty pumps used in niche applications including sludge handling, dosing, and specific treatment stages. While these pumps play an important supporting role, large-scale infrastructure expansion and network replacement programs predominantly rely on centrifugal solutions. Ongoing modernization initiatives across China, India, Vietnam, and Southeast Asia are expected to continue favoring centrifugal pumps, reinforcing their leadership position within the Asia pacific municipal water & wastewater pump market.

By Application

- Water

- Wastewater

Wastewater and sewage treatment applications account for the remaining 35% and are growing rapidly as urbanization accelerates. Rising sewage generation and low treatment penetration in several countries are prompting aggressive capacity additions. Large-scale sewerage projects sanctioned under national programs highlight the scale of upcoming installations. As treatment coverage expands and environmental regulations tighten, demand for pumps across collection, transfer, and treatment stages is expected to strengthen steadily across the region.

Various Market Players in Asia Pacific Municipal Water & Wastewater Pump Market

The companies mentioned below are highly active in the Asia Pacific municipal water & wastewater pump market, occupying a considerable portion of the market and shaping industry progress.

- Pentair PLC

- Kirloskar Brothers Limited (KBL)

- Shanghai Kaiquan Pump Group

- Xylem Inc.

- Grundfos Holding A/S

- Flowserve Corporation

- KSB SE & Co. KGaA

- Ebara Corporation

- Sulzer Ltd.

- Liancheng Group

- Wilo SE

Market News & Updates

- Xylem Inc., 2025:

Xylem launched the Flygt 2450, described as the only high‑head fully submersible pump for mining dewatering, at the AGG1 Aggregates Academy & Expo in March 2025, combining a Hard‑Iron hydraulic end with Dura‑Spin diffuser technology to drastically reduce wear and extend service intervals to around 6,000 hours, while the redesigned Flygt 2401 submersible pump offers two hydraulic configurations optimized for either high‑head lifting or high‑volume flow, together strengthening Xylem’s position in demanding water and wastewater applications including mining and municipal infrastructure by lowering total cost of ownership and simplifying water management.

- Flowserve Corporation, 2025:

Flowserve’s Q1 2025 update reaffirmed full‑year 2025 guidance for 3-5% organic sales growth and adjusted EPS of 3.10–3.30, supported by about 5% revenue growth, higher bookings and margin expansion, with management highlighting benefits from the MOGAS acquisition integration and regional supply chain and manufacturing footprints (including Asia‑Pacific) that enhance service to municipal and industrial water and wastewater projects while mitigating tariffs through localization and pricing.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Asia Pacific Municipal Water & Wastewater Pump Market Policies, Regulations, and Standards

4. Asia Pacific Municipal Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Asia Pacific Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Million Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Country

5.2.3.1. China

5.2.3.2. Japan

5.2.3.3. India

5.2.3.4. South Korea

5.2.3.5. Australia

5.2.3.6. Indonesia

5.2.3.7. Rest of Asia Pacific

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. China Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Million Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

7. Japan Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Million Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

8. India Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Units Sold in Million Units

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

9. South Korea Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Units Sold in Million Units

9.2. Market Segmentation & Growth Outlook

9.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application - Market Insights and Forecast 2022-2032, USD Million

10. Australia Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.1.2. By Units Sold in Million Units

10.2. Market Segmentation & Growth Outlook

10.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

11. Indonesia Municipal Water & Wastewater Pump Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.1.2. By Units Sold in Million Units

11.2. Market Segmentation & Growth Outlook

11.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Application - Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Xylem Inc.

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Grundfos Holding A/S

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Flowserve Corporation

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. KSB SE & Co. KGaA

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Ebara Corporation

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Pentair PLC

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Kirloskar Brothers Limited (KBL)

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Shanghai Kaiquan Pump Group

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Sulzer Ltd.

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Liancheng Group

12.1.10.1.Business Description

12.1.10.2.Product Portfolio

12.1.10.3.Collaborations & Alliances

12.1.10.4.Recent Developments

12.1.10.5.Financial Details

12.1.10.6.Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.