US Dermatologicals Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Medicated Shampoos, Topical Antifungals, Vaginal Antifungals, Hair Loss Treatments, Nappy (Diaper) Rash Treatments, Antiparasitics/Lice (Head and Body) Treatments, Antipruritics, Cold Sore Treatments, Haemorrhoid Treatments, Paediatric Dermatologicals, Topical Allergy Remedies/Antihistamines, Topical Germicidals/Antiseptics), By Dispensing Status (Prescription-based Drugs, Over-the-counter Drugs), By Route of Administration (Topical Administration, Oral Administration, Parenteral Administration), By Drug Type (Branded, Generics), By Skin Condition (Acne, Dermatitis, Psoriasis, Skin Cancer, Rosacea, Alopecia, Fungal Infections, Others), By End User (Hospitals, Cosmetic Centers, Dermatology Clinics, Homecare, Others), By Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

US Dermatologicals Market Statistics and Insights, 2026

- Market Size Statistics

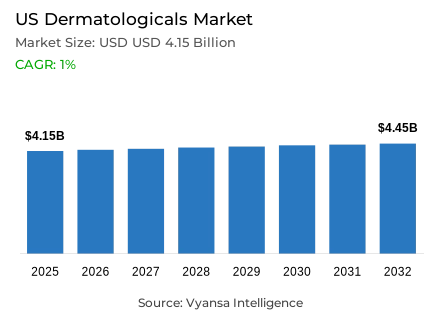

- Dermatologicals in US is estimated at USD 4.15 billion in 2025.

- The market size is expected to grow to USD 4.45 billion by 2032.

- Market to register a cagr of around 1% during 2026-32.

- Category Shares

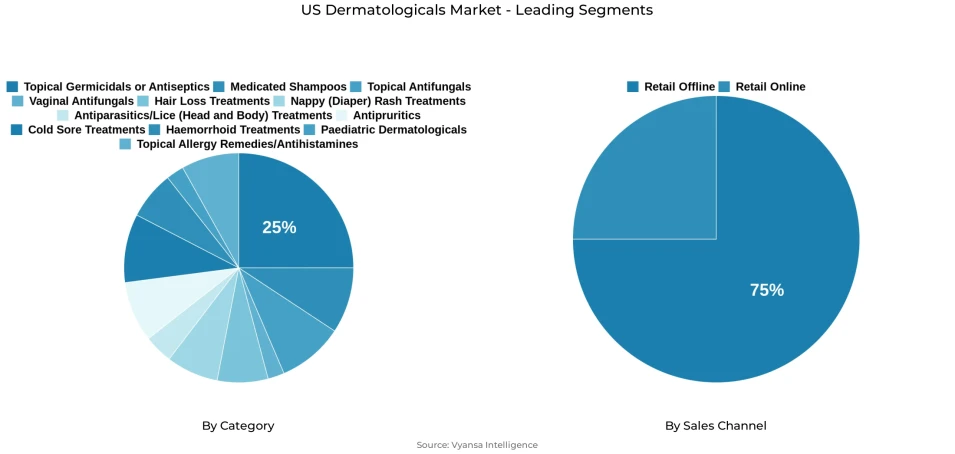

- Topical germicidals/antiseptics grabbed market share of 25%.

- Competition

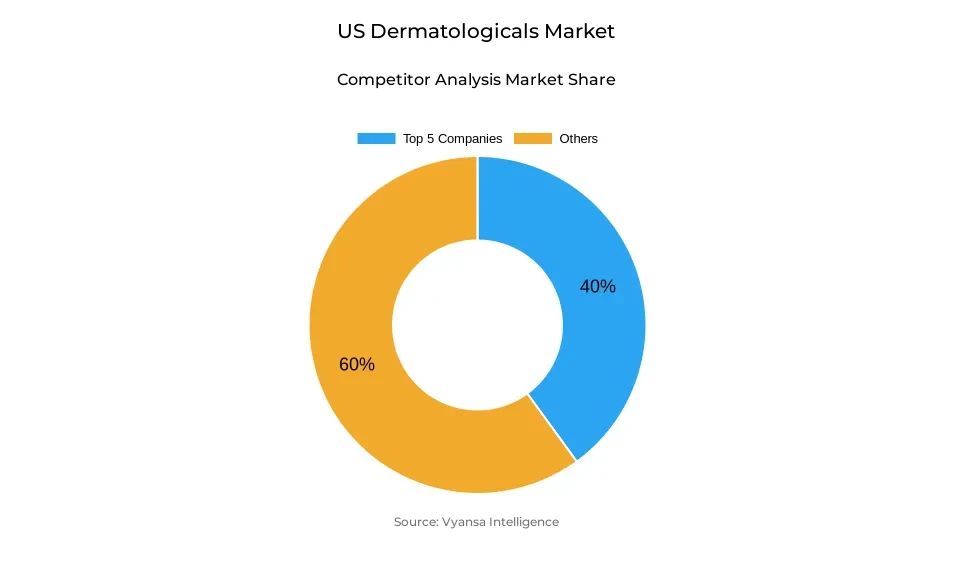

- More than 20 companies are actively engaged in producing dermatologicals in US.

- Top 5 companies acquired around 40% of the market share.

- Chattem Inc; Prestige Brands Inc; Bayer Corp; McNeil Consumer & Specialty Pharmaceuticals; Haleon US Inc etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

US Dermatologicals Market Outlook

The US dermatologicals market is projected to grow consistently over the time frame 2026-2032 in favor of the increased attention to the skin, hair, and scalp health as a component of wellness programming. It is expected to have an estimated market around USD 4.15 billion in 2025 and projected that the market will hit about USD 4.45 billion in 2032 with a compound annual growth rate of about 1%. Macroeconomic uncertainty and cautious end user spending are disadvantages to the dermatologicals which have a smaller price inflation than discretionary categories due to their essential nature.

Hair and scalp health is also a major point of demand with the end users beginning to appreciate early intervention as a way of preventing age related disorders like thinning of the hair. This emphasis has contributed to the sales of the hair loss care and medicated shampoos especially when such products are becoming more like the normal beauty and personal care products. There is also a high acceptance of branded dermatologicals in the market, but the decreased costs of private-label products enable the value-seeking behaviour of the end users to be met appropriately.

Topical Germicidals and Antiseptics are also divided into categories where each category of products holds about 25% of the market value as the company continues to depend on first-aid, wound-care, and infection-prevention products.

Retail Offline channels are distributed almost by 75% with anchoring of the pharmacies and mass retailers. Nonetheless, online distribution channels are being more significant in the hair and scalp related products where the discretion and convenience are the most important to the end user.

US Dermatologicals Market Growth DriverIncrease in Attention to Hair, Scalp and Prevention of Skin Health

An increasing emphasis by end users on preventive health is a major cause of demand in dermatology in the US. As reported by the Centers of Disease Control, the use of antiseptics, antifungals and scalp treatments is becoming a trended demand among over-the-counter products in the population, according to the Centers of Disease Control and Prevention, skin conditions and infections are among the most common health conditions that are treated at home settings rather than in hospitals.

Meanwhile, the National Institutes of Health emphasizes that the thinning of the hair in most adults occurs with a significant proportion, which speaks in favor of self-care and over-the-counter treatment early in life before the need to resort to a clinical method. This is in line with the greater trend of wellness in that hair and scalp health are now considered part of healthy ageing and wellbeing.

US Dermatologicals Market ChallengePrescription Expansion and Alternative Formats Stress OTC Demand.

The over the counter dermatologicals market faces increasing pressure from the expanding availability of prescription treatments, supported by improved access to healthcare services. The U.S. Department of Health and Human Services reports that the use of telehealth has been structurally increased in comparison to the situation before the pandemic, and that telehealth has made dermatologists and prescription pick-up speedier among the end users.

Moreover, the Centers for Medicare and Medicaid Services attest that the broadened Medicare Part D offers with the Inflation Reduction Act have broadened accessibility of prescription medications, specifically among the older adults. This will lessen the use of OTC solutions to some dermatological conditions, putting competitive pressure on the OTC segment.

Unlock Market Intelligence

Explore the market potential with our data-driven report

US Dermatologicals Market TrendShift in Direction toward Convenient and Beauty-Near Product Formats

The US dermatologicals market is increasingly shaped by a shift away from traditional topical ointments toward more convenient and user-friendly product formats.According to the U.S. Food and Drug Administration, there is a growing preference to end users in user-friendly dosage forms of wipes, patches and sprays especially on sensitive conditions where one might want to apply it without people noticing.

Meanwhile, dermatologicals, as moisturisers, washes and ingestible supplements to the beauty and personal care segments take on more science-supported claims. This convergence alters the end user expectations, with items that best fit within the everyday life and at the same time provide therapeutic value and clinical effectiveness.

US Dermatologicals Market OpportunityPregnancy-Safe and Life-Stage-Specific Products Exploit Opportunity.

A great potential is the dermatological solutions of life stages, especially the ones that are safe during pregnancy. The Cleveland Clinic claims that up to 30-40% of pregnant women develop haemorrhoids, which leaves them with a permanent desire to have non-medicated and pregnancy-safe forms of dermatological intervention.

Simultaneously, the Centers of Disease Control and Prevention emphasize the increased interest of the population in maternal health education on digital platforms, which positively influences the fact that previously stigmatised conditions are now openly discussed. This change aids product extensions to search female life phases, post partum services, and intimate needs of the entire forecast period.

Unlock Market Intelligence

Explore the market potential with our data-driven report

US Dermatologicals Market Segmentation Analysis

By Category

- Medicated Shampoos

- Topical Antifungals

- Vaginal Antifungals

- Hair Loss Treatments

- Nappy (Diaper) Rash Treatments

- Antiparasitics/Lice (Head and Body) Treatments

- Antipruritics

- Cold Sore Treatments

- Haemorrhoid Treatments

- Paediatric Dermatologicals

- Topical Allergy Remedies/Antihistamines

- Topical Germicidals/Antiseptics

The segment with highest market share under category is Topical Germicidals and Antiseptics, accounting for approximately 25% of the US dermatologicals market. These products play a critical role in wound care, infection prevention, and everyday first-aid applications, ensuring consistent demand across households.

Their widespread acceptance, broad usability, and inclusion in emergency and hygiene routines support repeat purchasing patterns and long-term relevance within the dermatologicals category.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under sales channel is Retail Offline, capturing approximately 75% of total market sales. Pharmacies, mass merchandisers, and drugstores dominate distribution due to end user trust, immediate product availability, and the ability to purchase dermatologicals alongside other health essentials.

While retail online sales are rising, especially for hair loss treatments where discretion is valued, offline retail remains central to market stability during the forecast period due to established purchasing habits and preference for in-person consultation.

List of Companies Covered in US Dermatologicals Market

The companies listed below are highly influential in the US dermatologicals market, with a significant market share and a strong impact on industry developments.

- Chattem Inc

- Prestige Brands Inc

- Bayer Corp

- McNeil Consumer & Specialty Pharmaceuticals

- Haleon US Inc

- Walgreen Co

- Walmart Inc

- CVS Health Corp

- Combe Inc

- Beiersdorf Inc

Competitive Landscape

The US Dermatologicals Market in 2025 is marked by intense competition between established brands, private labels, and fast-growing direct-to-consumer players. Leading brands such as Rogaine continue to defend their positions through innovation in hair and scalp health, while companies like Nutrafol and Hims gain traction by offering botanical formulations, supplements, and telehealth-enabled prescription solutions. Retailers are strengthening private label portfolios, with chains such as CVS leveraging simplified packaging and competitive pricing to appeal to value-conscious end users. Meanwhile, beauty-led players including L’Oréal are entering diagnostics through AI-powered skin analysis tools, raising competitive pressure. The growing role of e-commerce and telehealth is further reshaping market dynamics.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. US Dermatologicals Market Policies, Regulations, and Standards

4. US Dermatologicals Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. US Dermatologicals Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Medicated Shampoos- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Topical Antifungals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Vaginal Antifungals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Hair Loss Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Nappy (Diaper) Rash Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Antiparasitics/Lice (Head and Body) Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Antipruritics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Cold Sore Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.9. Haemorrhoid Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.10. Paediatric Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.11. Topical Allergy Remedies/Antihistamines- Market Insights and Forecast 2022-2032, USD Million

5.2.1.12. Topical Germicidals/Antiseptics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Dispensing Status

5.2.2.1. Prescription-based Drugs- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Over-the-counter Drugs- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Route of Administration

5.2.3.1. Topical Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Oral Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Parenteral Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Drug Type

5.2.4.1. Branded- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Generics- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Skin Condition

5.2.5.1. Acne- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Dermatitis- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Psoriasis- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Skin Cancer- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Rosacea- Market Insights and Forecast 2022-2032, USD Million

5.2.5.6. Alopecia- Market Insights and Forecast 2022-2032, USD Million

5.2.5.7. Fungal Infections- Market Insights and Forecast 2022-2032, USD Million

5.2.5.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Hospitals- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Cosmetic Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Dermatology Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.6.4. Homecare- Market Insights and Forecast 2022-2032, USD Million

5.2.6.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. US Medicated Shampoos Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. US Topical Antifungals Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. US Vaginal Antifungals Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. US Hair Loss Treatments Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. US Nappy (Diaper) Rash Treatments Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. US Antiparasitics/Lice (Head and Body) Treatments Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. US Antipruritics Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. US Cold Sore Treatments Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. US Haemorrhoid Treatments Market Statistics, 2022-2032

14.1. Market Size & Growth Outlook

14.1.1. By Revenues in USD Million

14.2. Market Segmentation & Growth Outlook

14.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

14.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

14.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

14.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

14.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

14.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

15. US Paediatric Dermatologicals Market Statistics, 2022-2032

15.1. Market Size & Growth Outlook

15.1.1. By Revenues in USD Million

15.2. Market Segmentation & Growth Outlook

15.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

15.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

15.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

15.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

15.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

15.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

16. US Topical Allergy Remedies/Antihistamines Market Statistics, 2022-2032

16.1. Market Size & Growth Outlook

16.1.1. By Revenues in USD Million

16.2. Market Segmentation & Growth Outlook

16.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

16.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

16.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

16.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

16.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

16.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

17. US Topical Germicidals/Antiseptics Market Statistics, 2022-2032

17.1. Market Size & Growth Outlook

17.1.1. By Revenues in USD Million

17.2. Market Segmentation & Growth Outlook

17.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

17.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

17.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

17.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

17.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

17.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

18. Competitive Outlook

18.1. Company Profiles

18.1.1. McNeil Consumer & Specialty Pharmaceuticals

18.1.1.1. Business Description

18.1.1.2. Product Portfolio

18.1.1.3. Collaborations & Alliances

18.1.1.4. Recent Developments

18.1.1.5. Financial Details

18.1.1.6. Others

18.1.2. Haleon US Inc

18.1.2.1. Business Description

18.1.2.2. Product Portfolio

18.1.2.3. Collaborations & Alliances

18.1.2.4. Recent Developments

18.1.2.5. Financial Details

18.1.2.6. Others

18.1.3. Walgreen Co

18.1.3.1. Business Description

18.1.3.2. Product Portfolio

18.1.3.3. Collaborations & Alliances

18.1.3.4. Recent Developments

18.1.3.5. Financial Details

18.1.3.6. Others

18.1.4. Walmart Inc

18.1.4.1. Business Description

18.1.4.2. Product Portfolio

18.1.4.3. Collaborations & Alliances

18.1.4.4. Recent Developments

18.1.4.5. Financial Details

18.1.4.6. Others

18.1.5. CVS Health Corp

18.1.5.1. Business Description

18.1.5.2. Product Portfolio

18.1.5.3. Collaborations & Alliances

18.1.5.4. Recent Developments

18.1.5.5. Financial Details

18.1.5.6. Others

18.1.6. Chattem Inc

18.1.6.1. Business Description

18.1.6.2. Product Portfolio

18.1.6.3. Collaborations & Alliances

18.1.6.4. Recent Developments

18.1.6.5. Financial Details

18.1.6.6. Others

18.1.7. Prestige Brands Inc

18.1.7.1. Business Description

18.1.7.2. Product Portfolio

18.1.7.3. Collaborations & Alliances

18.1.7.4. Recent Developments

18.1.7.5. Financial Details

18.1.7.6. Others

18.1.8. Bayer Corp

18.1.8.1. Business Description

18.1.8.2. Product Portfolio

18.1.8.3. Collaborations & Alliances

18.1.8.4. Recent Developments

18.1.8.5. Financial Details

18.1.8.6. Others

18.1.9. Combe Inc

18.1.9.1. Business Description

18.1.9.2. Product Portfolio

18.1.9.3. Collaborations & Alliances

18.1.9.4. Recent Developments

18.1.9.5. Financial Details

18.1.9.6. Others

18.1.10. Beiersdorf Inc

18.1.10.1.Business Description

18.1.10.2.Product Portfolio

18.1.10.3.Collaborations & Alliances

18.1.10.4.Recent Developments

18.1.10.5.Financial Details

18.1.10.6.Others

19. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Dispensing Status |

|

| By Route of Administration |

|

| By Drug Type |

|

| By Skin Condition |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.