Norway Herbal/Traditional Products Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Topical Analgesics, Sleep Aids, Cough, Cold & Allergy Remedies, Digestive Remedies, Dermatologicals, Paediatric Dietary Supplements, Dietary Supplements, Tonics), By Form (Capsules/Tablets, Powder, Syrups, Oils & Ointments, Others), By Health Benefit (General Wellness, Cardiovascular Health, Cognitive & Mental Health, Digestive & Gut Health, Immunity Support, Respiratory Health, Bone & Joint Health, Others), By Source (Leaves, Roots, Barks, Flowers, Seeds, Others), By Ingredient Type (Single-Herb Products, Multi-Herb Products), By Function (Preventive Care, Curative/Relief Care), By End User (Adults, Geriatric Population, Children), By Prescription Type (Over-the-Counter (OTC), Prescription Herbal Medicines), By Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

Norway Herbal/Traditional Products Market Statistics and Insights, 2026

- Market Size Statistics

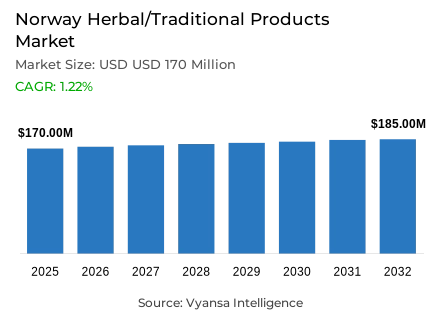

- Herbal/traditional products in Norway is estimated at USD 170 million in 2025.

- The market size is expected to grow to USD 185 million by 2032.

- Market to register a cagr of around 1.22% during 2026-32.

- Category Shares

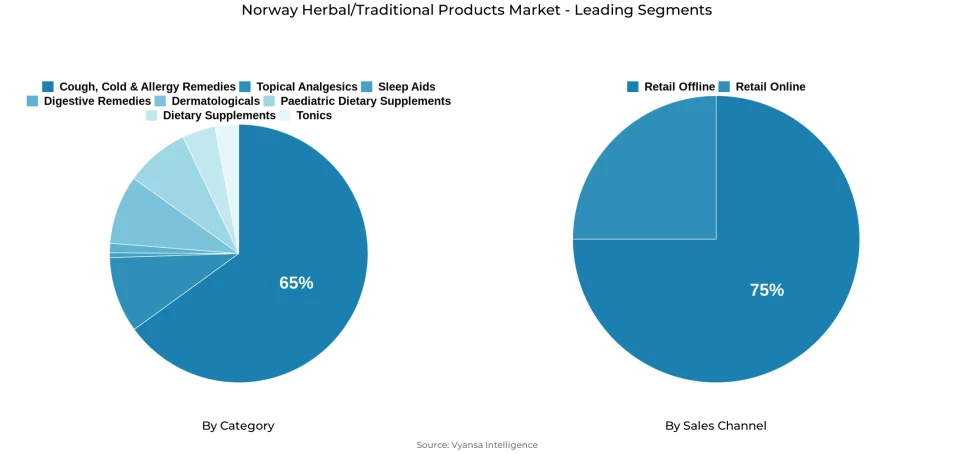

- Cough, cold & allergy remedies grabbed market share of 65%.

- Competition

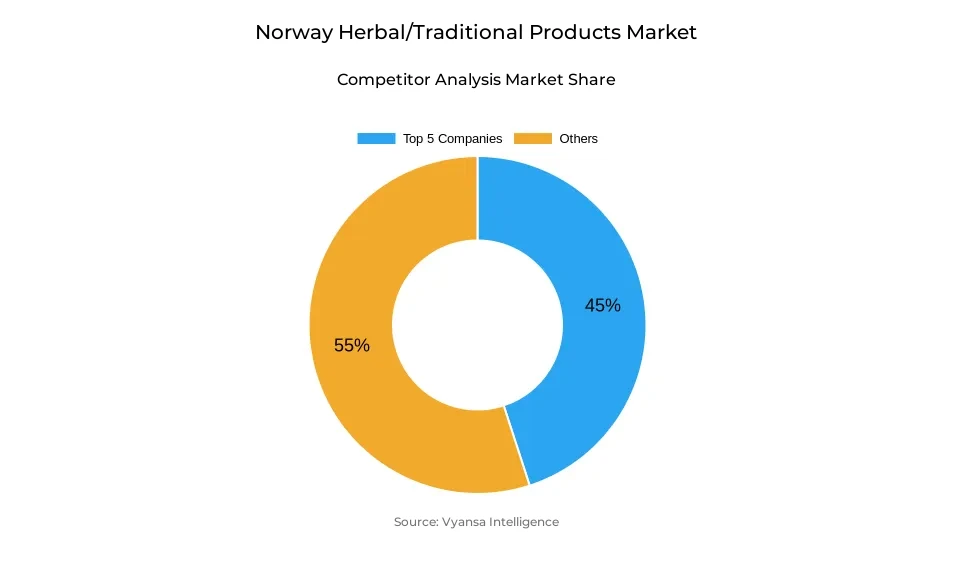

- More than 20 companies are actively engaged in producing herbal/traditional products in Norway.

- Top 5 companies acquired around 45% of the market share.

- Sana Pharma Medical AS; Perrigo Norge AS; Sunkost AS; Conaxess Trade Norway AS; Cloetta Norge AS etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Norway Herbal/Traditional Products Market Outlook

The Norway Herbal/Traditional Products Market is projected to show moderate but consistent growth over the period due to the interest in preventive health and natural remedy solutions, but a level of end-user scepticism will constrain the potential of more expansive growth. The market is projected to reach USD 170 million in 2025, with the performance of the market being dominated by well-established segments such as medicated confectionery, herbal sleep-aid formulations, and niche digestive remedy offerings. Although this category is consistent with the wellness-oriented lifestyle orientation in Norway, the trust in the traditional over-the-counter (OTC) and prescription medicine substitutes still affects the purchasing behaviour patterns.

Cough, cold and allergy remedies by category classification represent about 65% of total market share, which is a significant contribution of medicated confectionery products that are commonly used to treat the throat and in daily soothing uses. These products enjoy the advantage of habitual consumption and accessibility of the grocery distribution network, thus facilitating consistent demand despite the small scale of other subcategories in the herbal products spectrum.

In terms of sales channel, retail offline has about 75% of the market sales which is mainly through pharmacy networks, grocery retail outlets and health-food store formats. Pharmacy operators focus on products that are seen to possess better safety credentials and professional endorsement attributes, and health-store formats serve niche end users who are interested in natural and alternative product alternatives. At the same time, retail online is increasing the availability of specialist and imported herbal product lines, especially in the case of informed and digitally savvy end-user groups.

The market is expected to expand to USD 185 million by 2032, with a compound annual growth rate (CAGR) of about 1.22% in the period 2026-2032. The growth is stable but cautious, influenced by low credibility perceptions of some categories of herbal formats, slow growth in digital-channel penetration, and the persistence of medicated confectionery and relaxation-focused herbal products among end-user groups that are loyal.

Norway Herbal/Traditional Products Market Growth DriverHigh Trust in Conventional Healthcare Systems Limits Herbal Adoption

The primary motivators of behavioural results in the category is that Norway has a high level of trust in formal healthcare guidance systems, which shapes the way end users consider herbal and traditional remedy options. Pharmacy operators and public health authorities focus on the principles of evidence-based medicine, and end users often use the recommendations of pharmacists prior to choosing the options of wellness products. Norwegian healthcare is organized on the basis of institutional trust and professional consultation models, and the patient law clearly states that there should be a relationship of trust between patients and healthcare service. Studies affirm that, the Norwegians trust their fellow citizens and welfare institutions more than other Europeans, thus supporting the adoption of alternative solutions with caution without professional endorsement validation.

In this operating environment, herbal products that fit the preventive wellbeing goals and mild symptom-relief uses are accepted, especially when they are framed as complementary and not substitute remedy solutions. Pharmacists are important in terms of providing advice on the use of medications, possible side effects, and drug interactions, which makes them the gatekeepers of herbal product acceptance frameworks. Sleep support products, relaxation apps, and mild throat comfort products are the most appropriate products to be supported by this behavioural pattern because they can be placed in the context of self-care routines and still be consistent with the medically guided consumption habit frameworks.

Norway Herbal/Traditional Products Market ChallengePersistent Consumer Skepticism Toward Efficacy

The major challange facing the market is the continued scepticism about the clinical effectiveness of herbal and traditional product formulations in comparison to conventional OTC or prescription medicine options. The end users are more likely to focus on products that have medical validation frameworks, and this restricts the desire to experiment with niche herbal alternative products. The World Health Organization stresses that complementary and traditional medicines must have evidence-based frameworks to enhance end-user confidence, and WHO has confirmed that countries have found considerable gaps in the realisation of the potential of TCIM, and countries have asked the WHO to focus on evidence and data to inform policies, standards, and regulatory frameworks to ensure safe, cost-effective, and equitable use of TCIM.

European market research confirms that, in Europe, there are still some end user who remain skeptical about the effectiveness of herbal supplements compared to traditional medicine, and credibility gaps remain in the mature healthcare system settings like Norway. The WHO Traditional Medicine Strategy 2025-2034 defines the evidence base as a fundamental value, which promotes the incorporation of complementary and traditional medicine into the national health policy frameworks based on evidence. As a result, pharmacy operators selectively allocate shelf space, and grocery retail operators limit offerings to well-known categories of medicated confectionery formats. This credibility gap limits the potential of category depth, decreases the adoption of less familiar herbal remedy formulations, and keeps growth focused on a small range of trusted product types instead of the wider herbal product range.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Norway Herbal/Traditional Products Market TrendRising Use of Herbal Sleep and Relaxation Products

Norway is the growing use of herbal sleep and relaxation product formulations by end users who are interested in non-pharmaceutical solutions to mild sleep problems and stress-relief uses. WHO guidance focuses on self-care intervention models such as methods of coping with stress, substance use, anxiety, and other mental health issues, acknowledging the increasing end-user interest in low-risk, supportive solution options to lifestyle-related wellness issues. The World Health Organization specifically highlights that sleep health is central to all human functioning and that it is time to take action to promote a culture of sleep health at the local, regional, and global levels.

This is consistent with wellness-oriented end-user behaviour patterns in Norway, where Norwegian end users are known to have high purchasing power, digital maturity, and a preference to ethical brands and sustainable consumption. The penetration of retail online has been 89% in the health product categories, with mobile-first end users and digitally advanced platform infrastructures that have facilitated broader product discovery. Herbal tea formulations, drop preparations, and calming formulation products are embraced by end users as evening routine practices and not as alternative medical treatments. The trend is still niche but steady, with the increasing digital adoption of wellness products by health-conscious people who choose natural and preventive methods of managing their everyday wellbeing.

Norway Herbal/Traditional Products Market OpportunityDigital Channels Expanding Access to Niche Herbal Products

The opportunity for the market lies in the continued expansion of retail online channel operations, which enable wider discovery of niche herbal and traditional product line offerings that may not receive shelf presence in physical retail store environments. Norway demonstrates high digital adoption in health commerce categories, with retail online penetration reaching 89% in health product segments. The European e-pharmacy market was valued at USD 29.65 billion in 2023 and is expected to reach USD 79.43 billion by 2029, growing at a compound annual growth rate of 17.85%, with Nordic countries as strong performance contributors.

Retail online pharmacy platform operators and specialist health retail formats provide broader product assortment portfolios and advanced filtering tool capabilities, allowing end users to compare ingredient compositions, origin specifications, and product claim substantiation before purchasing. Digital channel infrastructures enable herbal brands to build credibility through transparent product information disclosure, scientific validation documentation, end user review content, and educational material distribution—an increasingly important strategy in evidence-oriented market environments where regulatory compliance and scientific backing are key trust driver mechanisms. This environment supports brands that emphasize transparent labeling practices, ingredient traceability documentation, and clear positioning within wellness routine frameworks, allowing emerging herbal brand portfolios to reach evidence-oriented end users gradually and strengthen credibility through comprehensive product information and educational content rather than relying solely on in-store exposure strategies.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Norway Herbal/Traditional Products Market Segmentation Analysis

By Category

- Topical Analgesics

- Sleep Aids

- Cough, Cold & Allergy Remedies

- Digestive Remedies

- Dermatologicals

- Paediatric Dietary Supplements

- Dietary Supplements

- Tonics

Cough, Cold & Allergy Remedies represent the dominant segment by category classification, accounting for approximately 65% of the Norway market. This dominance is driven primarily by medicated confectionery product formats that are widely utilized for throat soothing, mild irritation relief, and everyday comfort applications. Their familiarity characteristics, broad grocery retail availability, and perception as functional yet approachable product options support frequent and habitual consumption behavior patterns.

Additionally, these product formats benefit from crossover appeal between wellness and confectionery category positioning, making them suitable for both symptomatic use occasions and casual, preventive intake contexts. Compared with niche herbal format alternatives, they exhibit stronger brand recognition levels and repeat-purchase behavior patterns, reinforcing their leading role within the overall herbal and traditional products landscape in Norway.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline channels constitute the dominant segment by sales channel structure, representing approximately 75% of total market sales. Pharmacy networks, grocery store operations, and health-food retail formats remain the core purchasing locations, supported by end user trust in professionally curated product assortment selections and pharmacist guidance availability. Physical store environments additionally perform an important role in ensuring product reassurance perceptions, particularly in a category where credibility significantly influences buying decision processes.

Concurrently, retail offline channels benefit from strong visibility for established medicated confectionery and herbal sleep product categories, which end users typically discover through in-store browsing activities and promotional display presentations. While retail online continues to expand its market presence, brick-and-mortar retail operations remain the dominant route to purchase attributable to Norway's preference for verified and carefully managed health-related product retail environments.

List of Companies Covered in Norway Herbal/Traditional Products Market

The companies listed below are highly influential in the Norway herbal/traditional products market, with a significant market share and a strong impact on industry developments.

- Sana Pharma Medical AS

- Perrigo Norge AS

- Sunkost AS

- Conaxess Trade Norway AS

- Cloetta Norge AS

- Brynild Gruppen AS

- Orkla Health AS

- Midsona Norge AS

- Life Scandinavia AS

- Solaray/AU Naturell (UK) Inc Norway

Competitive Landscape

Norway Herbal/traditional products market remains highly fragmented in 2025, with leadership concentrated among a few established players while smaller niche brands gain ground. Conaxess Trade Norway AS maintains the leading position through well-known medicated confectionery brands such as Fisherman’s Friend, Ricola, Vekk i Morgen and AC3 Comfort Gel, although its value share is set to decline as competition intensifies. Cloetta Norge AS, ranked second with its Läkerol brand, is also projected to lose share. Growth momentum increasingly shifts toward the Others segment, reflecting rising consumer interest in specialist and alternative offerings available via health-focused retailers and retail e-commerce. Within cough, cold and allergy remedies, long-standing medicated confectionery brands continue to dominate due to strong familiarity and habitual usage, while sleep aids remain largely herbal by default, with health stores and pharmacies playing a key role in distributing both local and imported relaxation-focused brands.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Norway Herbal/Traditional Products Market Policies, Regulations, and Standards

4. Norway Herbal/Traditional Products Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Norway Herbal/Traditional Products Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Topical Analgesics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sleep Aids- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Cough, Cold & Allergy Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Digestive Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Paediatric Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Tonics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Form

5.2.2.1. Capsules/Tablets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Syrups- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Oils & Ointments- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Health Benefit

5.2.3.1. General Wellness- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cardiovascular Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cognitive & Mental Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Digestive & Gut Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Immunity Support- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Respiratory Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Bone & Joint Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Source

5.2.4.1. Leaves- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Roots- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Barks- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Flowers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Seeds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Ingredient Type

5.2.5.1. Single-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Multi-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Function

5.2.6.1. Preventive Care- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Curative/Relief Care- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By End User

5.2.7.1. Adults- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Geriatric Population- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. Children- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Prescription Type

5.2.8.1. Over-the-Counter (OTC)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Prescription Herbal Medicines- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Sales Channel

5.2.9.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.10. By Competitors

5.2.10.1. Competition Characteristics

5.2.10.2. Market Share & Analysis

6. Norway Topical Analgesics Herbal/Traditional Products Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

6.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Norway Sleep Aids Herbal/Traditional Products Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

7.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Norway Cough, Cold & Allergy Remedies Herbal/Traditional Products Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

8.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Norway Digestive Remedies Herbal/Traditional Products Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

9.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Norway Dermatologicals Herbal/Traditional Products Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

10.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Norway Paediatric Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

11.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Norway Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

12.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Norway Tonics Herbal/Traditional Products Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

13.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. Competitive Outlook

14.1. Company Profiles

14.1.1. Conaxess Trade Norway AS

14.1.1.1. Business Description

14.1.1.2. Product Portfolio

14.1.1.3. Collaborations & Alliances

14.1.1.4. Recent Developments

14.1.1.5. Financial Details

14.1.1.6. Others

14.1.2. Cloetta Norge AS

14.1.2.1. Business Description

14.1.2.2. Product Portfolio

14.1.2.3. Collaborations & Alliances

14.1.2.4. Recent Developments

14.1.2.5. Financial Details

14.1.2.6. Others

14.1.3. Brynild Gruppen AS

14.1.3.1. Business Description

14.1.3.2. Product Portfolio

14.1.3.3. Collaborations & Alliances

14.1.3.4. Recent Developments

14.1.3.5. Financial Details

14.1.3.6. Others

14.1.4. Orkla Health AS

14.1.4.1. Business Description

14.1.4.2. Product Portfolio

14.1.4.3. Collaborations & Alliances

14.1.4.4. Recent Developments

14.1.4.5. Financial Details

14.1.4.6. Others

14.1.5. Midsona Norge AS

14.1.5.1. Business Description

14.1.5.2. Product Portfolio

14.1.5.3. Collaborations & Alliances

14.1.5.4. Recent Developments

14.1.5.5. Financial Details

14.1.5.6. Others

14.1.6. Sana Pharma Medical AS

14.1.6.1. Business Description

14.1.6.2. Product Portfolio

14.1.6.3. Collaborations & Alliances

14.1.6.4. Recent Developments

14.1.6.5. Financial Details

14.1.6.6. Others

14.1.7. Viatris AS

14.1.7.1. Business Description

14.1.7.2. Product Portfolio

14.1.7.3. Collaborations & Alliances

14.1.7.4. Recent Developments

14.1.7.5. Financial Details

14.1.7.6. Others

14.1.8. Perrigo Norge AS

14.1.8.1. Business Description

14.1.8.2. Product Portfolio

14.1.8.3. Collaborations & Alliances

14.1.8.4. Recent Developments

14.1.8.5. Financial Details

14.1.8.6. Others

14.1.9. Sunkost AS

14.1.9.1. Business Description

14.1.9.2. Product Portfolio

14.1.9.3. Collaborations & Alliances

14.1.9.4. Recent Developments

14.1.9.5. Financial Details

14.1.9.6. Others

14.1.10. Life Scandinavia AS

14.1.10.1.Business Description

14.1.10.2.Product Portfolio

14.1.10.3.Collaborations & Alliances

14.1.10.4.Recent Developments

14.1.10.5.Financial Details

14.1.10.6.Others

15. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Form |

|

| By Health Benefit |

|

| By Source |

|

| By Ingredient Type |

|

| By Function |

|

| By End User |

|

| By Prescription Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.