Nigeria Herbal/Traditional Products Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Topical Analgesics, Sleep Aids, Cough, Cold & Allergy Remedies, Digestive Remedies, Dermatologicals, Paediatric Dietary Supplements, Dietary Supplements, Tonics), By Form (Capsules/Tablets, Powder, Syrups, Oils & Ointments, Others), By Health Benefit (General Wellness, Cardiovascular Health, Cognitive & Mental Health, Digestive & Gut Health, Immunity Support, Respiratory Health, Bone & Joint Health, Others), By Source (Leaves, Roots, Barks, Flowers, Seeds, Others), By Ingredient Type (Single-Herb Products, Multi-Herb Products), By Function (Preventive Care, Curative/Relief Care), By End User (Adults, Geriatric Population, Children), By Prescription Type (Over-the-Counter (OTC), Prescription Herbal Medicines), By Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

Nigeria Herbal/Traditional Products Market Statistics and Insights, 2026

- Market Size Statistics

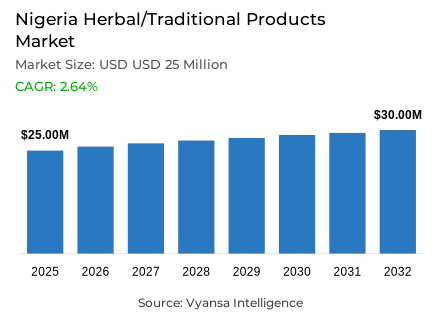

- Herbal/traditional products in Nigeria is estimated at USD 25 million in 2025.

- The market size is expected to grow to USD 30 million by 2032.

- Market to register a cagr of around 2.64% during 2026-32.

- Category Shares

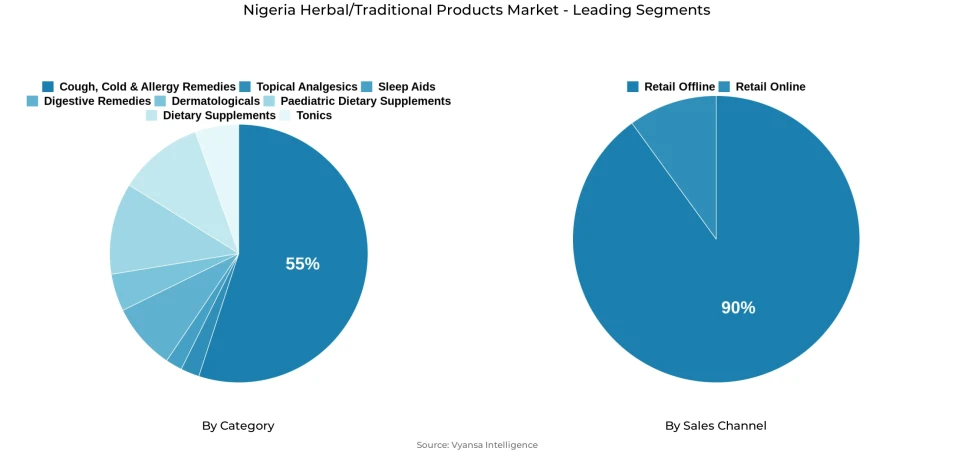

- Cough, cold & allergy remedies grabbed market share of 55%.

- Competition

- More than 20 companies are actively engaged in producing herbal/traditional products in Nigeria.

- Top 5 companies acquired around 40% of the market share.

- Mega We Care Nigeria Ltd; Forever Living Products Nigeria Ltd; Neimeth International Pharmaceuticals Plc; Procter & Gamble Nigeria Ltd; Fareast Mercantile Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 90% of the market.

Nigeria Herbal/Traditional Products Market Outlook

The Nigeria market of herbal and traditional products will continue to grow steadily in the years 2026–2032, supported by a strong cultural dependence on traditional medicines and a consistent end user demand of natural and low-cost health products. By 2025, the market is projected to reach USD 25 million, and the demand is supported by herbal topical analgesics, bitters, and tonic preparations that are commonly used to relieve stress, manage fever, and maintain overall health. These herbal products remain popular as low-cost alternatives to traditional pharmaceuticals even in the face of inflationary pressures.

Based on category classification, cough, cold, and allergy remedies have a market share of about 55% and this indicates the common use of herbal-medicated confectioneries, tonic formulations, and bitters to treat cold symptoms and respiratory discomfort. These products have the beneficial qualities of low cost, recognizability, and ubiquity in informal and traditional retail environments, which strengthens their daily applicability and assimilation into domestic routines.

In terms of distribution-channel classification, offline retail channels occupy about 90% of the market share, dominated by open-market transactions, pharmacy outlet networks, and neighbourhood store formats. Physical retail remains necessary due to the visibility of herbal analgesics, low-cost tonic products, and locally-made remedy formulations, and the confidence in word-of-mouth buying behavior. Informal trade also has a visible presence, particularly in the sale of bitters and unpackaged herbal mixtures via traditional market outlets.

The market is projected to increase at a compound annual growth rate of about 2.64% in 2026–2032 to USD 30 million in 2032. The improvement in end user buying power and macro-economic factors will strengthen the demand of natural remedy solutions that are perceived to have fewer side-effect profiles. The increased pharmacist education programmes, awareness campaigns through social media, and stricter product-regulation frameworks will probably enhance end user confidence in herbal and traditional health solutions across Nigeria.

Nigeria Herbal/Traditional Products Market Growth DriverStrong Cultural Reliance on Traditional Remedies

A key driver of the market is Nigeria's longstanding reliance on traditional and plant-based remedies for primary healthcare needs. Many households utilize herbal products as first-line solutions for fever, cold symptoms, digestive discomfort, and general wellness maintenance. The World Health Organization confirms that over 80% of people in many African countries rely on traditional medicine for basic health needs, reflecting its accessibility, affordability, and deep cultural acceptance across populations.

This widespread familiarity strengthens everyday usage of herbal topical analgesics, cough remedies, and tonics. As consumers seek low-cost options during periods of economic pressure, traditional remedies remain relevant, reinforcing consistent demand across both urban and rural populations. The WHO Africa Regional Office documents that "Herbal medicines using various parts of plants constitute about 80% of ATM [African Traditional Medicine] products," confirming the centrality of plant-based remedies within traditional healthcare systems.

Nigeria Herbal/Traditional Products Market ChallengePrevalence of Unregulated and Informal Herbal Products

The major challange facing the market is the increasing number of unregistered and informally marketed herbal products, especially in the tonic and bitters segments. These variants often do not have confirmed compositional records, safety validation measures, or adherence to accepted labeling standards. The National Agency for Food and Drug Administration and Control (NAFDAC) in Nigeria documents continuous seizure activities and enforcement against unregistered herbal preparations sold in informal distribution channels. In 2023, NAFDAC confiscated herbal aphrodisiac products worth about 15 million naira in the street, focusing on unregistered variants of preparations. In February–March 2025, NAFDAC conducted enforcement raids on three large Open Drug Market (ODM) operators and found that warehouse facilities, retail shop operations, and storage locations did not meet the minimum requirements of Good Storage and Distribution Practices and lacked evidence of registration documentation; therefore, the agency seized products that included unregistered, expired, prohibited, and substandard formulations.

The presence of cheap fake or unregulated products compromises end user confidence and creates competitive pressure on manufacturers who act in compliance. Poor end user knowledge on product authenticity verification also makes the effectiveness of regulatory enforcement more difficult, and NAFDAC has been publicly encouraging Nigerias to avoid using drug hawkers as part of its continuing public-safety messages. Such informal distribution-channel activities present quality-control risks to the larger herbal and traditional products environment and are directly in violation of the Herbal Medicines and Related Products Regulations of NAFDAC, which expressly forbids the production, importation, distribution, or sale of unregistered herbal medicine preparations.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Nigeria Herbal/Traditional Products Market TrendGrowing Use of Herbal Topical Analgesics and Tonics

Another trend in the market is the strong adoption of herbal topical analgesic formulations and multipurpose wellness tonics, which is explained by their low cost and the ability to be used in a variety of ways. These products are widely used in the treatment of pain, congestion, cold symptoms, and overall body discomfort, which is consistent with the traditional household health practice models. The medical literature and WHO Africa records affirm that traditional and plant-based remedy solutions remain significant in the health management of communities at the West African level, and herbal medicines comprise about 80% of the traditional medicine products offered.

The WHO Africa documentation focuses on the incorporation of traditional medicine into primary healthcare delivery systems in the region. In Nigeria, the increased exposure in market settings and pharmacy chains, coupled with cultural familiarity and affordability of prices, strengthens the recurrent buying of herbal balm preparations, liniment preparations, and bitters. This trend helps to maintain the demand even in times of low end user spending power, making these affordable and accessible product categories a necessity in household health management in a wide range of economic demographic groups.

Nigeria Herbal/Traditional Products Market OpportunityScope for Growth Through Formal Retail and Consumer Education

A opportunity lies in strengthening formal distribution channel operations and end user education programs to differentiate regulated herbal product offerings from informal market alternatives. Nigeria's Federal Government, through recent strategic initiatives announced by the Federal Ministry of Health September 2025, unveiled the "Strategic Plan of Action for the Implementation of the Traditional Medicine Policy" and "Code of Ethics and Practice for Traditional Medicine Practitioners." These initiatives include creation of a Department of Traditional, Complementary and Alternative Medicine TCAM at the Ministry of Health, development of a Nigeria Herbal Pharmacopoeia documenting 200+ medicinal plant species, directives for all 36 states and the Federal Capital Territory to establish TCAM departmental structures, and emphasis on evidence-based integration of traditional medicine into Nigeria's national health system framework.

Expanding end user education programming, clearer labeling protocols with mandatory NAFDAC Registration Number display as required by regulatory standard frameworks, and public communication regarding authentic registered herbal remedy verification can enhance trust levels and support higher-quality market participation. NAFDAC's regulatory framework mandates "NAFDAC Registration Number assigned and displayed clearly on outer and inner label," providing a verification mechanism for end users. As macroeconomic conditions improve and regulatory clarity strengthens, better-regulated brand portfolios offering credible, culturally aligned, and evidence-based formulation solutions are strategically positioned to capture rising demand for natural and low-side-effect health solutions from end users increasingly aware of product authenticity and safety standard requirements.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Nigeria Herbal/Traditional Products Market Segmentation Analysis

By Category

- Topical Analgesics

- Sleep Aids

- Cough, Cold & Allergy Remedies

- Digestive Remedies

- Dermatologicals

- Paediatric Dietary Supplements

- Dietary Supplements

- Tonics

Cough, Cold & Allergy Remedies represent the dominant segment by category classification, accounting for approximately 55% of market share. This leadership position is driven by frequent reliance on herbal medicated confectionery formulations, bitters, and tonic-style remedy products utilized to relieve cold symptoms, congestion conditions, and throat discomfort. Their affordability characteristics and everyday household presence support repeat purchase patterns across income groups and demographic segments.

Additionally, the cultural familiarity of liquid tonic and bitters formulations strengthens end user acceptance among those seeking natural, non-pharmaceutical remedy options. The combination of price accessibility, multipurpose usage applications, and strong traditional alignment reinforces the dominant role of this category within Nigeria's herbal and traditional products market.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline channels constitute the dominant segment by sales channel classification, representing approximately 90% of total market sales. Open market networks, neighborhood store operations, and pharmacy outlet formats remain the primary access points for herbal topical balm products, bitters, and tonic formulations, reflecting strong community-based purchasing behavior patterns and wide product availability across distribution network infrastructures.

Retail offline channels additionally enable visibility for low-priced and traditional household remedy offerings, particularly in geographic areas where informal trade operations remain influential in product distribution dynamics. While retail online access is gradually expanding, physical retail network operations continue dominating distribution attributable to accessibility advantages, familiarity associations, and trusted face-to-face purchasing pattern preferences among Nigeria end users.

List of Companies Covered in Nigeria Herbal/Traditional Products Market

The companies listed below are highly influential in the Nigeria herbal/traditional products market, with a significant market share and a strong impact on industry developments.

- Mega We Care Nigeria Ltd

- Forever Living Products Nigeria Ltd

- Neimeth International Pharmaceuticals Plc

- Procter & Gamble Nigeria Ltd

- Fareast Mercantile Co Ltd

- Global Industries Ltd

- Abllat Nigeria Ltd

- PZ Cussons Nigeria Plc

- Groupe Danone

- Mekophar Chemical Pharmaceutical JSC

Competitive Landscape

In Nigeria herbal/traditional products market, competition is shaped by a mix of established brands, affordable local offerings, and emerging unregulated players. Herbal/traditional topical analgesics remain a key competitive battleground, led by popular brands such as Aboniki and Tiger Balm, alongside the newly introduced Salonpas pain relief patch from Hisamitsu Pharmaceutical (distributed by DrugStoc Inc), which has strengthened category interest through its innovative herbal-based positioning. In tonics, affordable brands like Ruzu Healthy Herbal Bitters and Yoyo Bitters support stronger performance by appealing to price-sensitive consumers seeking wellness-oriented remedies. However, the landscape is increasingly pressured by unregistered and informally distributed tonic and bitters products, which compete on lower prices and erode share from regulated brands. Direct sellers continue to influence awareness and adoption, though economic constraints and currency depreciation have limited their recent momentum.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Nigeria Herbal/Traditional Products Market Policies, Regulations, and Standards

4. Nigeria Herbal/Traditional Products Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Nigeria Herbal/Traditional Products Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Topical Analgesics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sleep Aids- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Cough, Cold & Allergy Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Digestive Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Paediatric Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Tonics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Form

5.2.2.1. Capsules/Tablets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Syrups- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Oils & Ointments- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Health Benefit

5.2.3.1. General Wellness- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cardiovascular Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cognitive & Mental Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Digestive & Gut Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Immunity Support- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Respiratory Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Bone & Joint Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Source

5.2.4.1. Leaves- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Roots- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Barks- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Flowers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Seeds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Ingredient Type

5.2.5.1. Single-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Multi-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Function

5.2.6.1. Preventive Care- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Curative/Relief Care- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By End User

5.2.7.1. Adults- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Geriatric Population- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. Children- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Prescription Type

5.2.8.1. Over-the-Counter (OTC)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Prescription Herbal Medicines- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Sales Channel

5.2.9.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.10. By Competitors

5.2.10.1. Competition Characteristics

5.2.10.2. Market Share & Analysis

6. Nigeria Topical Analgesics Herbal/Traditional Products Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

6.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Nigeria Sleep Aids Herbal/Traditional Products Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

7.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Nigeria Cough, Cold & Allergy Remedies Herbal/Traditional Products Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

8.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Nigeria Digestive Remedies Herbal/Traditional Products Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

9.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Nigeria Dermatologicals Herbal/Traditional Products Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

10.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Nigeria Paediatric Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

11.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Nigeria Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

12.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Nigeria Tonics Herbal/Traditional Products Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

13.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. Competitive Outlook

14.1. Company Profiles

14.1.1. Procter & Gamble Nigeria Ltd

14.1.1.1. Business Description

14.1.1.2. Product Portfolio

14.1.1.3. Collaborations & Alliances

14.1.1.4. Recent Developments

14.1.1.5. Financial Details

14.1.1.6. Others

14.1.2. Fareast Mercantile Co Ltd

14.1.2.1. Business Description

14.1.2.2. Product Portfolio

14.1.2.3. Collaborations & Alliances

14.1.2.4. Recent Developments

14.1.2.5. Financial Details

14.1.2.6. Others

14.1.3. Global Industries Ltd

14.1.3.1. Business Description

14.1.3.2. Product Portfolio

14.1.3.3. Collaborations & Alliances

14.1.3.4. Recent Developments

14.1.3.5. Financial Details

14.1.3.6. Others

14.1.4. Abllat Nigeria Ltd

14.1.4.1. Business Description

14.1.4.2. Product Portfolio

14.1.4.3. Collaborations & Alliances

14.1.4.4. Recent Developments

14.1.4.5. Financial Details

14.1.4.6. Others

14.1.5. PZ Cussons Nigeria Plc

14.1.5.1. Business Description

14.1.5.2. Product Portfolio

14.1.5.3. Collaborations & Alliances

14.1.5.4. Recent Developments

14.1.5.5. Financial Details

14.1.5.6. Others

14.1.6. Mega We Care Nigeria Ltd

14.1.6.1. Business Description

14.1.6.2. Product Portfolio

14.1.6.3. Collaborations & Alliances

14.1.6.4. Recent Developments

14.1.6.5. Financial Details

14.1.6.6. Others

14.1.7. Forever Living Products Nigeria Ltd

14.1.7.1. Business Description

14.1.7.2. Product Portfolio

14.1.7.3. Collaborations & Alliances

14.1.7.4. Recent Developments

14.1.7.5. Financial Details

14.1.7.6. Others

14.1.8. Neimeth International Pharmaceuticals Plc

14.1.8.1. Business Description

14.1.8.2. Product Portfolio

14.1.8.3. Collaborations & Alliances

14.1.8.4. Recent Developments

14.1.8.5. Financial Details

14.1.8.6. Others

14.1.9. Danone Group

14.1.9.1. Business Description

14.1.9.2. Product Portfolio

14.1.9.3. Collaborations & Alliances

14.1.9.4. Recent Developments

14.1.9.5. Financial Details

14.1.9.6. Others

14.1.10. Mekophar Chemical Pharmaceutical JSC

14.1.10.1.Business Description

14.1.10.2.Product Portfolio

14.1.10.3.Collaborations & Alliances

14.1.10.4.Recent Developments

14.1.10.5.Financial Details

14.1.10.6.Others

15. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Form |

|

| By Health Benefit |

|

| By Source |

|

| By Ingredient Type |

|

| By Function |

|

| By End User |

|

| By Prescription Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.