UK Dermatologicals Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Medicated Shampoos, Topical Antifungals, Vaginal Antifungals, Hair Loss Treatments, Nappy (Diaper) Rash Treatments, Antiparasitics/Lice (Head and Body) Treatments, Antipruritics, Cold Sore Treatments, Haemorrhoid Treatments, Paediatric Dermatologicals, Topical Allergy Remedies/Antihistamines, Topical Germicidals/Antiseptics), By Dispensing Status (Prescription-based Drugs, Over-the-counter Drugs), By Route of Administration (Topical Administration, Oral Administration, Parenteral Administration), By Drug Type (Branded, Generics), By Skin Condition (Acne, Dermatitis, Psoriasis, Skin Cancer, Rosacea, Alopecia, Fungal Infections, Others), By End User (Hospitals, Cosmetic Centers, Dermatology Clinics, Homecare, Others), By Sales Channel (Retail Offline, Retail Online)

- Healthcare

- Feb 2026

- VI0939

- 125

-

UK Dermatologicals Market Statistics and Insights, 2026

- Market Size Statistics

- Dermatologicals in UK is estimated at USD 635 million in 2025.

- The market size is expected to grow to USD 700 million by 2032.

- Market to register a cagr of around 1.4% during 2026-32.

- Category Shares

- Topical antifungals grabbed market share of 15%.

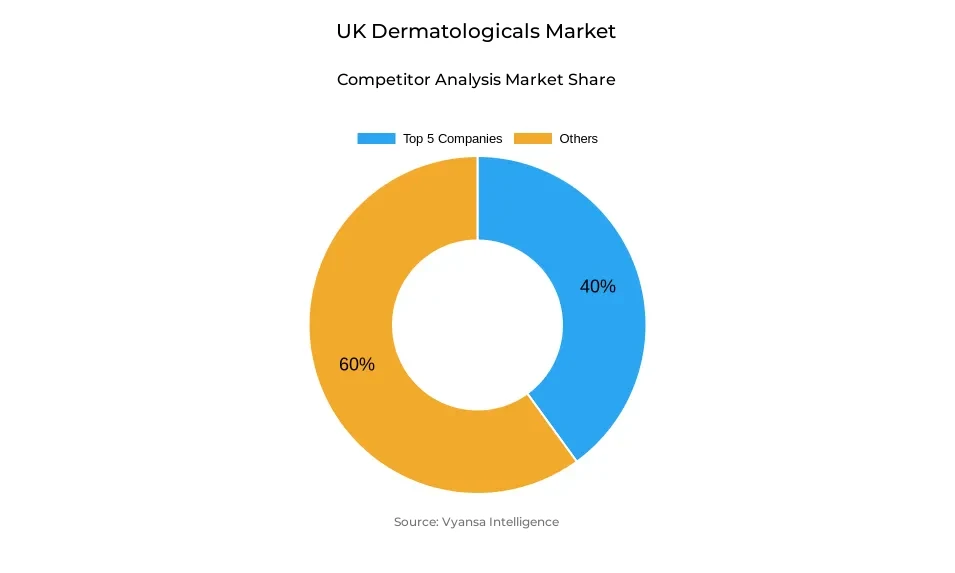

- Competition

- More than 20 companies are actively engaged in producing dermatologicals in UK.

- Top 5 companies acquired around 40% of the market share.

- McNeil Healthcare (UK) Ltd; Johnson & Johnson Ltd; GSK Consumer Healthcare; Bayer Plc; Reckitt Benckiser Group Plc (RB) etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

UK Dermatologicals Market Outlook

The UK dermatologicals market will show stable growth in the years 2026-2032 due to the increase in awareness of the importance of skin health, the rise of self-treatment activities, and the increased dependence on solution at home. The market is projected to be USD 635 million in 2025, with growth rate of 1.4% per annum, and is set to grow to about USD 700 million by 2032. The rise in the market howsoever is a sign of the preference of the end user to use the readily available over-the-counter remedies over clinical interventions especially in the wake of affordability concerns and prolonged delay in access to clinical services.

Treatments in hair loss are one of the most dynamic categories, which can be explained by the increasing levels of openness regarding the desire to deal with the problem of hair thinning at an early age and the affordability of the over-the-counter products in comparison to the clinical treatments. Demand is being supported by greater marketing, social media interaction and expanded accessibility both in the retail and the retail online platforms.

Simultaneously, end users are still inclined to rely on well-known brands in the more sensitive groups of antifungal and cold sore treatments, where discretion and reliability are very important buying criteria.

Categorically, Topical Antifungals will contribute about 15% market value to the total market, which is backed by the high occurrence of common skin fungal diseases and self-medication. Retail Offline channels dominate the market share of almost 70% with the pharmacies at the top of the chain as the end user has confidence in professional advice. Nonetheless, retail online channels are increasingly becoming more popular and will have an increasing role within the forecast period.

UK Dermatologicals Market Growth DriverIncreasing Self-Care and Awareness of Frequent Skin Conditions.

Raising awareness of skin minor conditions is also one of the major forces behind dermatological demand in the UK. NHS England states that such skin conditions as fungal infections, dermatitis, and cold sores are the most widespread causes of self-treatment, and millions of GP visits annually are associated with a dermatology issue in the population.

Simultaneously, the Office for National Statistics also points out an ongoing increase in self-care behaviours since the pandemic, and more adults are now taking care of minor illnesses by themselves to minimize the number of visits to healthcare. This transition is the direct champion to over-the-counter sales of dermatological products, especially in antifungals, antipruritics and intimate care items in the various end user groups.

UK Dermatologicals Market ChallengeCost-Sharing Barriers Globalize Specialist Care.

Economic forces are also an issue that faced dermatologicals in UK that influence patterns of purchasing behaviour. Inflation and cost-of-living pressures have also driven the continued focus on discretionary spending by the UK Office of National statistics, who have pushed end users towards cheaper over-the-counter medicine instead of the more expensive private dermatology.

Also, the high NHS waiting time to see a dermatologist does not motivate specialists consultations. The statistics provided by NHS England indicate that the dermatology sphere is one of the most outpatient services with long waiting lists, which supports the necessity of pharmacy-based and home-based solutions. These two issues of affordability and accessibility remain to influence the end user treatment decisions across the market.

UK Dermatologicals Market TrendAI-Powered Skin Analysis and Digital Health.

The UK dermatologicals sector is witnessing a notable shift toward the adoption of digital health technologies, most prominently the use of AI-powered skin and scalp assessment tools.. There is a growing number of retail online services that provide virtual consultations and customisations to help with early intervention in consumer categories like hair loss treatment, cold sore treatment.

The UK government is a leading proponent of digital health. NHS Digital reports that digital health tools are being promoted to enhance preventive care, decrease pressure on the system, and enable end users to self-manage minor conditions. Such technologies can increase the confidence of the end users, increase product matching and enhance the interaction without having to supplant over-the-counter dermatological demand.

UK Dermatologicals Market OpportunityPreventive and At-Home Skin Solutions: Make Opportunity.

A significant opportunity in the market lies in the growing demand for preventive and maintenance-oriented skincare products, supported by heightened awareness of long-term skin health and proactive care practices. The UK is an ageing society and elderly people are more prone to chronic skin diseases. The Office of National Statistics reports that more than 19% of the people in the UK are 65 and older, which justifies the continued demand of dermatological products that deal with the problems of dryness, irritation, and fungal infections.

Also, according to the World Health Organization, minor skin ailments treated at the initial stages with over-the-counter agents minimize the advancement of disease and the health care cost, which is a source of enduring demand of dermatologicals. This preventive model of care will be able to generate long-term category growth over the next forecasting period.

UK Dermatologicals Market Segmentation Analysis

By Category

- Medicated Shampoos

- Topical Antifungals

- Vaginal Antifungals

- Hair Loss Treatments

- Nappy (Diaper) Rash Treatments

- Antiparasitics/Lice (Head and Body) Treatments

- Antipruritics

- Cold Sore Treatments

- Haemorrhoid Treatments

- Paediatric Dermatologicals

- Topical Allergy Remedies/Antihistamines

- Topical Germicidals/Antiseptics

The segment with highest market share undercategory is Topical Antifungals, accounting for approximately 15% of the UK dermatologicals market. Demand is supported by the high prevalence of common fungal infections such as athlete's foot and candidiasis, along with strong end user familiarity with over-the-counter treatments.

End users value discretion, rapid relief, and trusted brands, which sustains repeat purchasing patterns. Continued self-medication practices and pharmacy-led guidance reinforce this segment's leadership position within the dermatologicals category.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under sales chnnel is Retail Offline channels, capturing approximately 70% of total market sales. Pharmacies dominate distribution due to end user trust, ease of access, and the ability to combine professional advice with over-the-counter purchasing.

While retail online represents the fastest-growing channel, regulatory standards, preference for pharmacist reassurance, and habit continuity ensure offline retail remains the primary distribution channel during the forecast period.

List of Companies Covered in UK Dermatologicals Market

The companies listed below are highly influential in the UK dermatologicals market, with a significant market share and a strong impact on industry developments.

- McNeil Healthcare (UK) Ltd

- Johnson & Johnson Ltd

- GSK Consumer Healthcare

- Bayer Plc

- Reckitt Benckiser Group Plc (RB)

- Thornton & Ross Ltd

- Haleon Plc

- Teva UK Ltd

- Karo Pharma UK Ltd

- Trimb Healthcare AB

Competitive Landscape

The UK Dermatologicals Market in 2025 remains competitive, led by Bayer Plc, which continues to strengthen its position through the strong performance of its Canesten brand, particularly in antifungal and women’s health solutions. The brand benefits from high consumer trust, broad availability, and continued investment in education and innovation. McNeil Healthcare is emerging as one of the most dynamic players, driven by rapid growth in its Regaine hair loss treatment range, supported by digital marketing and expanded online presence. Competition is intensifying as brands leverage e-commerce, targeted innovation, and affordability to capture demand for at-home dermatological solutions, particularly in hair loss, intimate care, and self-treatment categories.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UK Dermatologicals Market Policies, Regulations, and Standards

4. UK Dermatologicals Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UK Dermatologicals Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Medicated Shampoos- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Topical Antifungals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Vaginal Antifungals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Hair Loss Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Nappy (Diaper) Rash Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Antiparasitics/Lice (Head and Body) Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Antipruritics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Cold Sore Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.9. Haemorrhoid Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.10. Paediatric Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.11. Topical Allergy Remedies/Antihistamines- Market Insights and Forecast 2022-2032, USD Million

5.2.1.12. Topical Germicidals/Antiseptics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Dispensing Status

5.2.2.1. Prescription-based Drugs- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Over-the-counter Drugs- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Route of Administration

5.2.3.1. Topical Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Oral Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Parenteral Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Drug Type

5.2.4.1. Branded- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Generics- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Skin Condition

5.2.5.1. Acne- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Dermatitis- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Psoriasis- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Skin Cancer- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Rosacea- Market Insights and Forecast 2022-2032, USD Million

5.2.5.6. Alopecia- Market Insights and Forecast 2022-2032, USD Million

5.2.5.7. Fungal Infections- Market Insights and Forecast 2022-2032, USD Million

5.2.5.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Hospitals- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Cosmetic Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Dermatology Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.6.4. Homecare- Market Insights and Forecast 2022-2032, USD Million

5.2.6.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. UK Medicated Shampoos Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. UK Topical Antifungals Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. UK Vaginal Antifungals Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. UK Hair Loss Treatments Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. UK Nappy (Diaper) Rash Treatments Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. UK Antiparasitics/Lice (Head and Body) Treatments Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. UK Antipruritics Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. UK Cold Sore Treatments Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. UK Haemorrhoid Treatments Market Statistics, 2022-2032

14.1. Market Size & Growth Outlook

14.1.1. By Revenues in USD Million

14.2. Market Segmentation & Growth Outlook

14.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

14.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

14.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

14.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

14.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

14.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

15. UK Paediatric Dermatologicals Market Statistics, 2022-2032

15.1. Market Size & Growth Outlook

15.1.1. By Revenues in USD Million

15.2. Market Segmentation & Growth Outlook

15.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

15.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

15.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

15.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

15.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

15.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

16. UK Topical Allergy Remedies/Antihistamines Market Statistics, 2022-2032

16.1. Market Size & Growth Outlook

16.1.1. By Revenues in USD Million

16.2. Market Segmentation & Growth Outlook

16.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

16.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

16.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

16.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

16.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

16.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

17. UK Topical Germicidals/Antiseptics Market Statistics, 2022-2032

17.1. Market Size & Growth Outlook

17.1.1. By Revenues in USD Million

17.2. Market Segmentation & Growth Outlook

17.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

17.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

17.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

17.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

17.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

17.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

18. Competitive Outlook

18.1. Company Profiles

18.1.1. Bayer Plc

18.1.1.1. Business Description

18.1.1.2. Product Portfolio

18.1.1.3. Collaborations & Alliances

18.1.1.4. Recent Developments

18.1.1.5. Financial Details

18.1.1.6. Others

18.1.2. Reckitt Benckiser Group Plc (RB)

18.1.2.1. Business Description

18.1.2.2. Product Portfolio

18.1.2.3. Collaborations & Alliances

18.1.2.4. Recent Developments

18.1.2.5. Financial Details

18.1.2.6. Others

18.1.3. Thornton & Ross Ltd

18.1.3.1. Business Description

18.1.3.2. Product Portfolio

18.1.3.3. Collaborations & Alliances

18.1.3.4. Recent Developments

18.1.3.5. Financial Details

18.1.3.6. Others

18.1.4. Haleon Plc

18.1.4.1. Business Description

18.1.4.2. Product Portfolio

18.1.4.3. Collaborations & Alliances

18.1.4.4. Recent Developments

18.1.4.5. Financial Details

18.1.4.6. Others

18.1.5. Teva UK Ltd

18.1.5.1. Business Description

18.1.5.2. Product Portfolio

18.1.5.3. Collaborations & Alliances

18.1.5.4. Recent Developments

18.1.5.5. Financial Details

18.1.5.6. Others

18.1.6. Kenvue EMEA Services Ltd

18.1.6.1. Business Description

18.1.6.2. Product Portfolio

18.1.6.3. Collaborations & Alliances

18.1.6.4. Recent Developments

18.1.6.5. Financial Details

18.1.6.6. Others

18.1.7. McNeil Healthcare (UK) Ltd

18.1.7.1. Business Description

18.1.7.2. Product Portfolio

18.1.7.3. Collaborations & Alliances

18.1.7.4. Recent Developments

18.1.7.5. Financial Details

18.1.7.6. Others

18.1.8. Johnson & Johnson Ltd

18.1.8.1. Business Description

18.1.8.2. Product Portfolio

18.1.8.3. Collaborations & Alliances

18.1.8.4. Recent Developments

18.1.8.5. Financial Details

18.1.8.6. Others

18.1.9. GSK Consumer Healthcare

18.1.9.1. Business Description

18.1.9.2. Product Portfolio

18.1.9.3. Collaborations & Alliances

18.1.9.4. Recent Developments

18.1.9.5. Financial Details

18.1.9.6. Others

18.1.10. Karo Pharma UK Ltd

18.1.10.1.Business Description

18.1.10.2.Product Portfolio

18.1.10.3.Collaborations & Alliances

18.1.10.4.Recent Developments

18.1.10.5.Financial Details

18.1.10.6.Others

19. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Dispensing Status |

|

| By Route of Administration |

|

| By Drug Type |

|

| By Skin Condition |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.