Belgium Dermatologicals Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Medicated Shampoos, Topical Antifungals, Vaginal Antifungals, Hair Loss Treatments, Nappy (Diaper) Rash Treatments, Antiparasitics/Lice (Head and Body) Treatments, Antipruritics, Cold Sore Treatments, Haemorrhoid Treatments, Paediatric Dermatologicals, Topical Allergy Remedies/Antihistamines, Topical Germicidals/Antiseptics), By Dispensing Status (Prescription-based Drugs, Over-the-counter Drugs), By Route of Administration (Topical Administration, Oral Administration, Parenteral Administration), By Drug Type (Branded, Generics), By Skin Condition (Acne, Dermatitis, Psoriasis, Skin Cancer, Rosacea, Alopecia, Fungal Infections, Others), By End User (Hospitals, Cosmetic Centers, Dermatology Clinics, Homecare, Others), By Sales Channel (Retail Offline, Retail Online)

- Healthcare

- Feb 2026

- VI0941

- 110

-

Belgium Dermatologicals Market Statistics and Insights, 2026

- Market Size Statistics

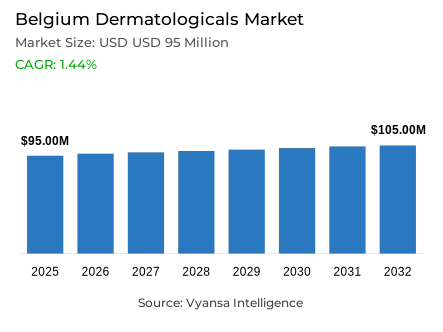

- Dermatologicals in Belgium is estimated at USD 95 million in 2025.

- The market size is expected to grow to USD 105 million by 2032.

- Market to register a cagr of around 1.44% during 2026-32.

- Category Shares

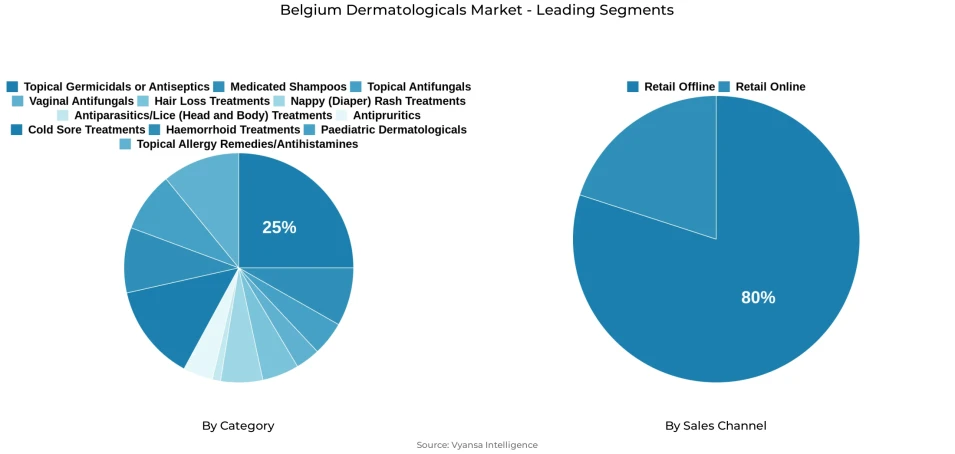

- Topical germicidals/antiseptics grabbed market share of 25%.

- Competition

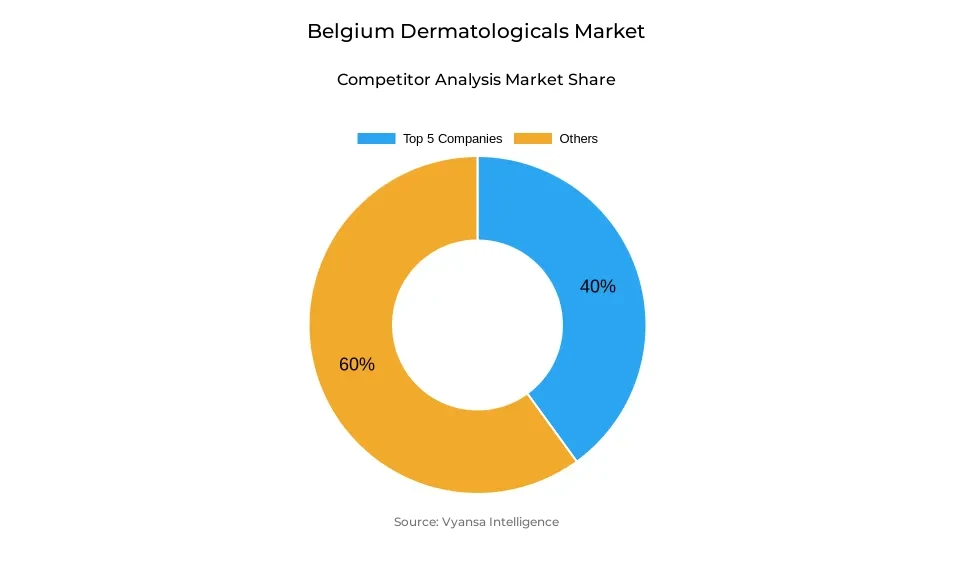

- More than 20 companies are actively engaged in producing dermatologicals in Belgium.

- Top 5 companies acquired around 40% of the market share.

- Omega Pharma Belgium NV; Bayer NV SA; Expanscience SA, Laboratoires; Kenvue Belgium NV; Cooper Consumer Health Belgium BV etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

Belgium Dermatologicals Market Outlook

Belgium dermatologicals market is expected to show a moderate growth with a growth rate of 1.44%, growing between USD 95 million in 2025 to USD 105 million in 2032. The market is expected to grow at a limited pace because of the maturity of the category and decreased end user focus on dermatological products in the current economic uncertainty. Although most product segments have been characterized by stagnant demand, some segments such as vaginal antifungals and topical allergy treatments are poised to perform well, supported by the changing social attitudes and the ongoing rise in the prevalence of allergic skin conditions. The core market segments, especially topical germicidals/antiseptics, with a market share of 25% are likely to remain stable, but with competition by beauty products that have assumed quasi-dermatological positioning strategies.

Kenvue Belgium NV continues to dominate the competitive environment, which is backed by the good performance of Daktarin in the antifungals segment. Cooper end user Health continues to hold its market share with the Iso-Betadine brand portfolio, and natural and plant-based brands are gaining more and more market share. The market players such as Puressentiel and Tilman SA (Calmiderm) are enjoying a booming growth as end user are showing increased interest in natural and cleaner formulation criteria. The dynamics of demographic transition, including the decrease in fertility rates and the decrease in the transmission of lice due to the change in the behavioural patterns of children, are putting downward pressure on the niche categories, including nappy rash and lice-treatment products.

Retail offline channels are expected to retain a market share of 80% due to the trust and professionalism provided in the pharmacy retail setting. Pharmacies will continue to be the place where advice-based buying decisions are made, but market share is undergoing a slow decline as supermarkets and health-and-personal-care stores increase their range of dermatological products. Supermarkets, especially Colruyt, are expanding the mainstream product lines, such as Fenigel and Bepanthen, and natural-oriented retail stores are enjoying the growing end user interest in wellness-based product solutions.

Over the forecast period, the category growth will be modest due to innovation in natural formulations, environmentally friendly brand positioning, and multifunctional product development. The growing end user focus on ingredient transparency and sustainable buying decisions will compel manufacturers to focus on cleaner, plant-based dermatological solutions. Nevertheless, the threat of substitute products posed by the beauty and personal-care market, especially those with dermatological credibility, will continue to be a strategic issue, requiring specific innovation efforts and channel-diversification strategies to remain relevant in the Belgian mature dermatologicals market.

Belgium Dermatologicals Market Growth DriverRising allergy prevalence and chronic skin-disease burden sustain targeted dermatological demand

The growing number of allergic and inflammatory skin diseases substantially contributes to the demand of dermatological products in Belgium. The population sensitivity levels and increased demands of topical relief products are indicated by the fact that over 30% of the Belgian population report having at least one allergic condition. At the same time, the trends of demographic ageing increase the load of chronic skin diseases, such as xerosis, dermatitis, and fungal infections. The elderly aged 65 years and above now constitute over 20% of the total population in Belgium, a demographic group that exhibits high vulnerability to frequent skin irritation and impaired epidermal-barrier activity.

These demographic and epidemiological variables reinforce focused demand of clinical over-the-counter products such as topical allergy treatments, antifungals, and sensitive-skin formulations. With the prevalence of atopic reactions and dermatological complications steadily rising, end users are increasingly demanding effective, fast-acting, and self-managed therapeutic options, which in turn maintains selective growth momentum despite the broader category stagnation dynamics.

Belgium Dermatologicals Market ChallengeMarket maturity and demographic decline weaken growth in paediatric-driven dermatological segments

The decreasing fertility rate and changing trends in childhood behaviour in Belgium still limit growth patterns in paediatric-based dermatological categories. In 2023, the fertility rate in Belgium dropped to 1.55 births per woman, placing the country in the lowest fertility rates in Europe and directly decreasing the long-term demand of nappy-rash and paediatric care products. Also, surveillance data show that the incidence of head-lice in school settings is lower than it was before 2018, which is partly due to a decrease in close-contact play behaviors among children.

The overlap of these demographic and behavioural trends suppresses consumption in some of the most dependable paediatric markets, such as antiparasitics/lice treatments and nappy-rash solutions. Since dermatologicals already exist in a mature, slow-growth market environment, these structural pressures further restrict the potential of innovation, slow the category turnover velocity, and constrain growth opportunities of manufacturers that traditionally depended on traditional paediatric-based volume generation.

Belgium Dermatologicals Market TrendNatural dermatologicals and low-irritant formulations accelerate as consumers seek ‘cleaner’ therapeutic care

End users in Belgium are showing growing interest in natural, botanical, and low-irritation dermatological products due to growing ingredient-related apprehension and the issue of synthetic allergen exposure. Fragrances and preservatives have been cited as one of the leading causes of contact dermatitis in the European Union, which supports the need to develop dermatological products with minimal or naturally based ingredient formulations. Also, eczema and dermatitis are still one of the most common chronic skin conditions in Belgium, which makes natural formulations with calming effects very appealing to the segments of the population with sensitive skin.

With the growing ingredient literacy of end users, there is a growing preference towards multifunctional formulations, which are symptomatic and barrier-support. The trend is driving the growth of demand in plant-based analgesics, essential-oil blends, and botanical active ingredients, which manufacturers are responding to by reformulating legacy brand portfolios and launching cleaner-label innovations in line with emerging wellness value systems.

Belgium Dermatologicals Market OpportunityWomen’s health and allergic-skin segments offer focused avenues for growth in a mature market

The dermatologicals category in Belgium is mature, there are subsegments that have significant growth potential. The increase in the prevalence of allergic reactions is one of such strategic areas, as about one out of three Belgians has allergic symptoms, thus continuing to generate long-term demand of topical allergy treatments and soothing formulation products.

Moreover, the health of women is a structurally sound market segment. Vulvovaginal candidiasis is present in up to 75% of women at least once in their lives, which supports the ongoing popularity of vaginal antifungal products. These are clinically motivated therapeutic requirements that provide stable and robust growth opportunities in a market that is otherwise limited. Manufacturers investing capital in specific innovation projects, such as microbiome-friendly antifungals, sensitive-skin relief products, and formulations that meet intimate health needs, can successfully tap into high-value segments of an otherwise stagnant overall market.

Belgium Dermatologicals Market Segmentation Analysis

By Category

- Medicated Shampoos

- Topical Antifungals

- Vaginal Antifungals

- Hair Loss Treatments

- Nappy (Diaper) Rash Treatments

- Antiparasitics/Lice (Head and Body) Treatments

- Antipruritics

- Cold Sore Treatments

- Haemorrhoid Treatments

- Paediatric Dermatologicals

- Topical Allergy Remedies/Antihistamines

- Topical Germicidals/Antiseptics

Topical Germicidals/Antiseptics represent the dominant category within Belgium dermatologicals market, commanding around 25% market share. This category maintains market leadership as Belgian end users continue to rely upon antiseptic solutions for everyday wound care, infection prevention, and hygiene protection requirements. Products positioned for rapid symptomatic relief remain in sustained demand, particularly as allergic skin reactions and minor irritations persist across all demographic age groups. The emergence of plant-based and natural antiseptic formulation options is additionally attracting end user interest, further reinforcing the segment's strong market standing.

Throughout the forecast period, this category is projected to retain market dominance as manufacturers expand natural and multifunctional formulation offerings that appeal to health-conscious end user segments. Belgium's increasing preference for gentle, clean-label ingredient compositions aligns strategically with antiseptic products that integrate safety assurance with therapeutic effectiveness. With both established brand portfolios and emerging natural entrants pursuing innovation strategies, this category is well-positioned to retain the highest market share throughout the forecast horizon.

By Sales Channel

- Retail Offline

- Retail Online

Retail Offline channels represent the dominant sales channel within Belgium dermatologicals market, accounting around 80% of total market value. Pharmacies continue to function as the primary touchpoint for dermatological product purchases in Belgium, attributed to their trusted advisory capabilities, specialised product assortments, and guidance provision regarding correct product application protocols. This substantial end user reliance ensures that Retail offline maintains commanding market leadership despite increasing competitive pressure from supermarket channels and natural-focused health retail establishments.

Throughout the forecast period, Retail Offline channels will sustain their position as the core Sales Channel as Belgian end users continue to value pharmacist recommendations for therapeutic conditions including allergies, fungal infections, rashes, and skin irritation. Supermarkets will continue gaining visibility for everyday dermatological product categories however, pharmacies are projected to capture the majority market share attributable to their professional credibility and clinical positioning advantages. As natural formulations and wellness-driven purchasing choices increase in prominence, Retail offline establishments will continue to offer category depth, reliability, and accessibility advantages, thereby securing their leading channel position throughout the forecast period

List of Companies Covered in Belgium Dermatologicals Market

The companies listed below are highly influential in the Belgium dermatologicals market, with a significant market share and a strong impact on industry developments.

- Omega Pharma Belgium NV

- Bayer NV SA

- Expanscience SA, Laboratoires

- Kenvue Belgium NV

- Cooper Consumer Health Belgium BV

- Qualiphar NV

- EG NV/SA

- Will Pharma NV SA

- Haleon Belgium SA

- Urgo NV SA

Competitive Landscape

Belgium dermatologicals market remains highly fragmented, with leadership concentrated among large global players while natural and plant-based brands steadily gain traction. Kenvue Belgium NV retained the top position, driven by the continued strength of Daktarin in antifungals. Cooper Consumer Health follows closely with its well-established Iso-Betadine franchise in antiseptic care. However, several specialised players are encountering demographic pressures: EG NV/SA saw stagnation in its lice-focused Silikom range amid declining fertility rates and reduced lice transmission, while Expanscience Laboratoires’ Mustela faced similar challenges in nappy rash treatments.Momentum is increasingly shifting toward natural-positioned brands. Laboratoire Puressentiel posted the fastest growth, particularly in natural lice treatments, while Tilman SA’s Calmiderm gained relevance in topical analgesics as consumers gravitate toward gentle, plant-based options. Broader supermarket distribution strengthened the presence of Fenigel (Haleon) and Bepanthen (Bayer), widening accessibility beyond pharmacies. As consumer preferences move toward clean, sustainable formulations, natural brands continue to erode share from traditional players, reshaping Belgium’s competitive landscape despite overall market stagnation.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Belgium Dermatologicals Market Policies, Regulations, and Standards

4. Belgium Dermatologicals Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Belgium Dermatologicals Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Medicated Shampoos- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Topical Antifungals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Vaginal Antifungals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Hair Loss Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Nappy (Diaper) Rash Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Antiparasitics/Lice (Head and Body) Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Antipruritics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Cold Sore Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.9. Haemorrhoid Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.10. Paediatric Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.11. Topical Allergy Remedies/Antihistamines- Market Insights and Forecast 2022-2032, USD Million

5.2.1.12. Topical Germicidals/Antiseptics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Dispensing Status

5.2.2.1. Prescription-based Drugs- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Over-the-counter Drugs- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Route of Administration

5.2.3.1. Topical Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Oral Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Parenteral Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Drug Type

5.2.4.1. Branded- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Generics- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Skin Condition

5.2.5.1. Acne- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Dermatitis- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Psoriasis- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Skin Cancer- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Rosacea- Market Insights and Forecast 2022-2032, USD Million

5.2.5.6. Alopecia- Market Insights and Forecast 2022-2032, USD Million

5.2.5.7. Fungal Infections- Market Insights and Forecast 2022-2032, USD Million

5.2.5.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Hospitals- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Cosmetic Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Dermatology Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.6.4. Homecare- Market Insights and Forecast 2022-2032, USD Million

5.2.6.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Belgium Medicated Shampoos Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Belgium Topical Antifungals Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Belgium Vaginal Antifungals Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Belgium Hair Loss Treatments Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Belgium Nappy (Diaper) Rash Treatments Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Belgium Antiparasitics/Lice (Head and Body) Treatments Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Belgium Antipruritics Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Belgium Cold Sore Treatments Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. Belgium Haemorrhoid Treatments Market Statistics, 2022-2032

14.1. Market Size & Growth Outlook

14.1.1. By Revenues in USD Million

14.2. Market Segmentation & Growth Outlook

14.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

14.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

14.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

14.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

14.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

14.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

15. Belgium Paediatric Dermatologicals Market Statistics, 2022-2032

15.1. Market Size & Growth Outlook

15.1.1. By Revenues in USD Million

15.2. Market Segmentation & Growth Outlook

15.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

15.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

15.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

15.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

15.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

15.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

16. Belgium Topical Allergy Remedies/Antihistamines Market Statistics, 2022-2032

16.1. Market Size & Growth Outlook

16.1.1. By Revenues in USD Million

16.2. Market Segmentation & Growth Outlook

16.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

16.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

16.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

16.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

16.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

16.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

17. Belgium Topical Germicidals/Antiseptics Market Statistics, 2022-2032

17.1. Market Size & Growth Outlook

17.1.1. By Revenues in USD Million

17.2. Market Segmentation & Growth Outlook

17.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

17.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

17.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

17.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

17.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

17.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

18. Competitive Outlook

18.1. Company Profiles

18.1.1. Kenvue Belgium NV

18.1.1.1. Business Description

18.1.1.2. Product Portfolio

18.1.1.3. Collaborations & Alliances

18.1.1.4. Recent Developments

18.1.1.5. Financial Details

18.1.1.6. Others

18.1.2. Cooper Consumer Health Belgium BV

18.1.2.1. Business Description

18.1.2.2. Product Portfolio

18.1.2.3. Collaborations & Alliances

18.1.2.4. Recent Developments

18.1.2.5. Financial Details

18.1.2.6. Others

18.1.3. Qualiphar NV

18.1.3.1. Business Description

18.1.3.2. Product Portfolio

18.1.3.3. Collaborations & Alliances

18.1.3.4. Recent Developments

18.1.3.5. Financial Details

18.1.3.6. Others

18.1.4. EG NV/SA

18.1.4.1. Business Description

18.1.4.2. Product Portfolio

18.1.4.3. Collaborations & Alliances

18.1.4.4. Recent Developments

18.1.4.5. Financial Details

18.1.4.6. Others

18.1.5. Will Pharma NV SA

18.1.5.1. Business Description

18.1.5.2. Product Portfolio

18.1.5.3. Collaborations & Alliances

18.1.5.4. Recent Developments

18.1.5.5. Financial Details

18.1.5.6. Others

18.1.6. Omega Pharma Belgium NV

18.1.6.1. Business Description

18.1.6.2. Product Portfolio

18.1.6.3. Collaborations & Alliances

18.1.6.4. Recent Developments

18.1.6.5. Financial Details

18.1.6.6. Others

18.1.7. Bayer NV SA

18.1.7.1. Business Description

18.1.7.2. Product Portfolio

18.1.7.3. Collaborations & Alliances

18.1.7.4. Recent Developments

18.1.7.5. Financial Details

18.1.7.6. Others

18.1.8. Expanscience SA Laboratoires

18.1.8.1. Business Description

18.1.8.2. Product Portfolio

18.1.8.3. Collaborations & Alliances

18.1.8.4. Recent Developments

18.1.8.5. Financial Details

18.1.8.6. Others

18.1.9. Haleon Belgium SA

18.1.9.1. Business Description

18.1.9.2. Product Portfolio

18.1.9.3. Collaborations & Alliances

18.1.9.4. Recent Developments

18.1.9.5. Financial Details

18.1.9.6. Others

18.1.10. Urgo NV SA

18.1.10.1.Business Description

18.1.10.2.Product Portfolio

18.1.10.3.Collaborations & Alliances

18.1.10.4.Recent Developments

18.1.10.5.Financial Details

18.1.10.6.Others

19. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Dispensing Status |

|

| By Route of Administration |

|

| By Drug Type |

|

| By Skin Condition |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.