UK Herbal/Traditional Products Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Topical Analgesics, Sleep Aids, Cough, Cold & Allergy Remedies, Digestive Remedies, Dermatologicals, Paediatric Dietary Supplements, Dietary Supplements, Tonics), By Form (Capsules/Tablets, Powder, Syrups, Oils & Ointments, Others), By Health Benefit (General Wellness, Cardiovascular Health, Cognitive & Mental Health, Digestive & Gut Health, Immunity Support, Respiratory Health, Bone & Joint Health, Others), By Source (Leaves, Roots, Barks, Flowers, Seeds, Others), By Ingredient Type (Single-Herb Products, Multi-Herb Products), By Function (Preventive Care, Curative/Relief Care), By End User (Adults, Geriatric Population, Children), By Prescription Type (Over-the-Counter (OTC), Prescription Herbal Medicines), By Sales Channel (Retail Offline, Retail Online)

- Healthcare

- Feb 2026

- VI0958

- 115

-

UK Herbal/Traditional Products Market Statistics and Insights, 2026

- Market Size Statistics

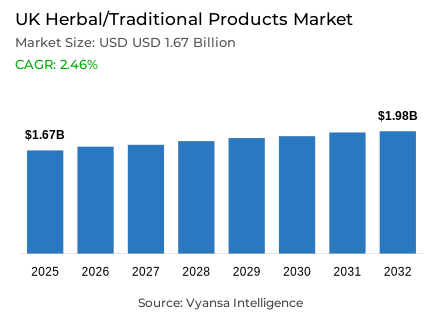

- Herbal/traditional products in UK is estimated at USD 1.67 billion in 2025.

- The market size is expected to grow to USD 1.98 billion by 2032.

- Market to register a cagr of around 2.46% during 2026-32.

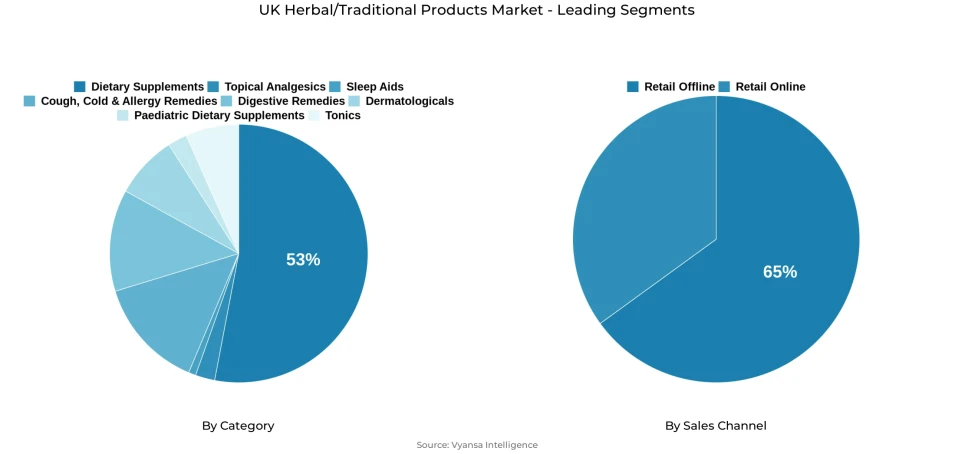

- Category Shares

- Dietary supplements grabbed market share of 53%.

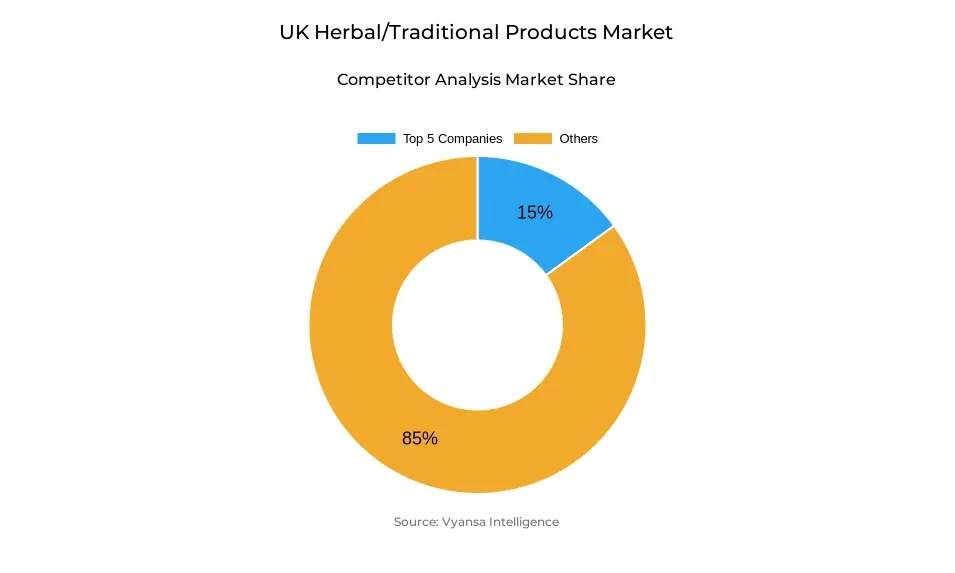

- Competition

- More than 20 companies are actively engaged in producing herbal/traditional products in UK.

- Top 5 companies acquired around 15% of the market share.

- Dragonfly Biosciences Ltd; New Leaf Products Ltd; Minerva Research Labs Ltd; Omega Pharma Ltd; Ernest Jackson Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 65% of the market.

UK Herbal/Traditional Products Market Outlook

The UK market of herbal and traditional products is projected to increase steadily throughout the period of 2026-2032 due to the presence of good underlying demand on natural and preventive health products. The market would have a value of USD 1.67 billion in 2025 with an estimated CAGR of 2.46 over the forecast period and a projected market value of USD 1.98 billion in 2032.

The main growth factor is the increased demand towards the herbal and plant-based dietary supplements, which were more than 50% of the total category sales in 2025. The wider acceptance of natural products has been in immunity boosters, stress, sleep, and overall wellbeing, representing greater appreciation of the holistic nature of health and the ageing population. Herbal and traditional topical analgesics also are becoming more popular as end users are seeking plant solutions, which are non-systemic analgesics to address discomfort on a daily basis.

Although online platforms are still growing at an alarming rate, the physical forms of retailing such as pharmacies and grocery stores are still quite useful as they are convenient and trusted by end users. In 2025, Retail Offline would make approximately 65% of the total market sales, which highlights the long-term value of being available in stores and receiving professional advice.

In general, the future should see steady involvement in natural health strategy, and innovation and increased distribution should help the sector achieve modest growth up to 2032.

UK Herbal/Traditional Products Market Growth DriverExpansion of Preventive Health and Supplement Usage

The preventive health behaviour and the use of supplements in the UK are strictly connected with the adoption of herbal and traditional products. National nutrition surveys show that approximately 23% of the adult population in the UK took a food supplement with vitamins and minerals in the last survey sample and the rate of use is higher among the older age groups.

It is an indication that a major proportion of the population is implementing the supplements into daily health care instead of treatment only. Preventative care is becoming more integrated into everyday living, which is why the popularity of plant-based and clean labels is on the rise, which in turn directly contributes to the demand of herbal and traditional products in the form of botanical capsules, immunity tonics and wellness blends.

UK Herbal/Traditional Products Market ChallengeSafety Concerns and Perception Around Supplement Use

The UK herbal and traditional products market encounters a significant limitation due to ongoing concerns among end users regarding the safety and effectiveness of these products. This is despite the fact that the use of supplements is a widespread practice and most end user consume such supplements without the advice of professionals, thus, posing a concern of misuse and possible interactions. A 2025 UK end user survey indicated that 76% of the respondents took supplements, but a comparatively low percentage of those who took supplements frequently read the label instructions or engaged a health care professional prior to taking it.

This self-managed usage trend is capable of diminishing confidence amongst the apprehensive customers, especially when there is more regulatory scrutiny on assertions and disclosure. Maintaining solid product safety, accurate labeling, and believable health communication thus continues to be a key requirement in terms of financial security of end user confidence over the long term.

UK Herbal/Traditional Products Market TrendBotanical and Herbal Ingredient Popularity

The UK herbal and traditional products market is increasingly shaped by rising interest in individual botanicals, particularly turmeric and other traditional plant extracts. Food nutrition statistics show that taking of supplements and fortified foods including plant-based foods is a part of everyday wellness behaviour in all age groups.

This tendency is supported by the increase in interest in botanicals related to overall health, including immunity and inflammation. Herbal supplements are becoming more perceived as daily wellness devices, as opposed to niche cures, as these ingredients continue to head to the mainstream market aiding in the growth of the segmented market.

UK Herbal/Traditional Products Market OpportunityRegulatory Support and Increased Consumer Trust

The UK herbal and traditional products market presents strong potential through improving regulatory clarity, which is strengthening end user confidence and encouraging wider product adoption. By giving more serious considerations to evidence-based claims and safe usage, authorities will enable manufacturers to be more inventive and more credible. Open regulatory systems aid in the development of trust, which leads to more sceptical end user groups adopting the same.

With the fact that use of the supplement has already been predetermined among certain segments of the population, a regulatory guarantee added to professional approval can open up a larger mainstream market. Cooperation between the manufacturers, healthcare specialists, and the authorities can also contribute to the increase of the quality of the products and the spread of their acceptance throughout the market.

UK Herbal/Traditional Products Market Segmentation Analysis

By Category

- Topical Analgesics

- Sleep Aids

- Cough, Cold & Allergy Remedies

- Digestive Remedies

- Dermatologicals

- Paediatric Dietary Supplements

- Dietary Supplements

- Tonics

Dietary Supplements represent the largest category segment, accounting for approximately 53% of total herbal and traditional product sales in the UK in 2025. This dominance reflects the shift toward daily preventive health routines, where botanical capsules, immune-support formulas, and wellness tonics are consumed regularly.

Dietary supplements are widely distributed through pharmacies, supermarkets, and online platforms and are commonly used for ongoing health maintenance rather than acute treatment. Their leading position highlights their role as the foundation of the herbal and traditional products sector, driven by repeat purchase behaviour and sustained wellness interest.

By Sales Channel

- Retail Offline

- Retail Online

Retail Offline holds the highest share within the sales-channel structure, capturing around 65% of total market sales in 2025. Physical retail formats including pharmacies, grocery retailers, and health stores remain central due to perceived authenticity, convenience, and access to professional advice.

Many end users prefer in-person consultation, particularly when selecting herbal remedies or dietary supplements for the first time or for therapeutic use. Although online channels continue to gain importance for convenience and range, the dominance of offline retail reflects established shopping habits and the value placed on expert guidance and immediacy.

List of Companies Covered in UK Herbal/Traditional Products Market

The companies listed below are highly influential in the UK herbal/traditional products market, with a significant market share and a strong impact on industry developments.

- Dragonfly Biosciences Ltd

- New Leaf Products Ltd

- Minerva Research Labs Ltd

- Omega Pharma Ltd

- Ernest Jackson Ltd

- Lane Health Products Ltd

- Procter & Gamble UK Ltd

- Jakemans Ltd

- Reckitt Benckiser Group Plc

- Love Hemp Ltd

Competitive Landscape

The UK herbal/traditional products market in 2025 is highly competitive, shaped by strong heritage brands, fast-growing supplement specialists, and rising digital-first players. Omega Pharma’s Halls brand leads the market, supported by strong trust in cough and immunity remedies and a wide portfolio including Halls Defense and Halls Naturals. Solgar has emerged as a dynamic competitor in herbal supplements, strengthening visibility through high-profile partnerships such as its 2025 collaboration with Dame Kelly Holmes. Competition is further intensified by widespread availability across supermarkets, pharmacies, and fast-growing e-commerce platforms, where brands use targeted digital marketing, influencer partnerships, and clean-label positioning to attract health-conscious consumers seeking natural, preventative wellness solutions.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. UK Herbal/Traditional Products Market Policies, Regulations, and Standards

4. UK Herbal/Traditional Products Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. UK Herbal/Traditional Products Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Topical Analgesics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sleep Aids- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Cough, Cold & Allergy Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Digestive Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Paediatric Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Tonics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Form

5.2.2.1. Capsules/Tablets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Syrups- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Oils & Ointments- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Health Benefit

5.2.3.1. General Wellness- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cardiovascular Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cognitive & Mental Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Digestive & Gut Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Immunity Support- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Respiratory Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Bone & Joint Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Source

5.2.4.1. Leaves- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Roots- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Barks- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Flowers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Seeds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Ingredient Type

5.2.5.1. Single-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Multi-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Function

5.2.6.1. Preventive Care- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Curative/Relief Care- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By End User

5.2.7.1. Adults- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Geriatric Population- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. Children- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Prescription Type

5.2.8.1. Over-the-Counter (OTC)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Prescription Herbal Medicines- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Sales Channel

5.2.9.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.10. By Competitors

5.2.10.1. Competition Characteristics

5.2.10.2. Market Share & Analysis

6. UK Topical Analgesics Herbal/Traditional Products Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

6.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. UK Sleep Aids Herbal/Traditional Products Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

7.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. UK Cough, Cold & Allergy Remedies Herbal/Traditional Products Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

8.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. UK Digestive Remedies Herbal/Traditional Products Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

9.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. UK Dermatologicals Herbal/Traditional Products Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

10.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. UK Paediatric Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

11.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. UK Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

12.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. UK Tonics Herbal/Traditional Products Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

13.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. Competitive Outlook

14.1. Company Profiles

14.1.1. Omega Pharma Ltd

14.1.1.1. Business Description

14.1.1.2. Product Portfolio

14.1.1.3. Collaborations & Alliances

14.1.1.4. Recent Developments

14.1.1.5. Financial Details

14.1.1.6. Others

14.1.2. Ernest Jackson Ltd

14.1.2.1. Business Description

14.1.2.2. Product Portfolio

14.1.2.3. Collaborations & Alliances

14.1.2.4. Recent Developments

14.1.2.5. Financial Details

14.1.2.6. Others

14.1.3. Lane Health Products Ltd GR

14.1.3.1. Business Description

14.1.3.2. Product Portfolio

14.1.3.3. Collaborations & Alliances

14.1.3.4. Recent Developments

14.1.3.5. Financial Details

14.1.3.6. Others

14.1.4. Procter & Gamble UK Ltd

14.1.4.1. Business Description

14.1.4.2. Product Portfolio

14.1.4.3. Collaborations & Alliances

14.1.4.4. Recent Developments

14.1.4.5. Financial Details

14.1.4.6. Others

14.1.5. Jakemans (Confectioners) Ltd

14.1.5.1. Business Description

14.1.5.2. Product Portfolio

14.1.5.3. Collaborations & Alliances

14.1.5.4. Recent Developments

14.1.5.5. Financial Details

14.1.5.6. Others

14.1.6. Dragonfly Biosciences Ltd

14.1.6.1. Business Description

14.1.6.2. Product Portfolio

14.1.6.3. Collaborations & Alliances

14.1.6.4. Recent Developments

14.1.6.5. Financial Details

14.1.6.6. Others

14.1.7. New Leaf Products Ltd

14.1.7.1. Business Description

14.1.7.2. Product Portfolio

14.1.7.3. Collaborations & Alliances

14.1.7.4. Recent Developments

14.1.7.5. Financial Details

14.1.7.6. Others

14.1.8. Minerva Research Labs Ltd

14.1.8.1. Business Description

14.1.8.2. Product Portfolio

14.1.8.3. Collaborations & Alliances

14.1.8.4. Recent Developments

14.1.8.5. Financial Details

14.1.8.6. Others

14.1.9. Reckitt Benckiser Group Plc (RB)

14.1.9.1. Business Description

14.1.9.2. Product Portfolio

14.1.9.3. Collaborations & Alliances

14.1.9.4. Recent Developments

14.1.9.5. Financial Details

14.1.9.6. Others

14.1.10. Love Hemp Ltd

14.1.10.1.Business Description

14.1.10.2.Product Portfolio

14.1.10.3.Collaborations & Alliances

14.1.10.4.Recent Developments

14.1.10.5.Financial Details

14.1.10.6.Others

15. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Form |

|

| By Health Benefit |

|

| By Source |

|

| By Ingredient Type |

|

| By Function |

|

| By End User |

|

| By Prescription Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.