Thailand Herbal/Traditional Products Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Topical Analgesics, Sleep Aids, Cough, Cold & Allergy Remedies, Digestive Remedies, Dermatologicals, Paediatric Dietary Supplements, Dietary Supplements, Tonics), By Form (Capsules/Tablets, Powder, Syrups, Oils & Ointments, Others), By Health Benefit (General Wellness, Cardiovascular Health, Cognitive & Mental Health, Digestive & Gut Health, Immunity Support, Respiratory Health, Bone & Joint Health, Others), By Source (Leaves, Roots, Barks, Flowers, Seeds, Others), By Ingredient Type (Single-Herb Products, Multi-Herb Products), By Function (Preventive Care, Curative/Relief Care), By End User (Adults, Geriatric Population, Children), By Prescription Type (Over-the-Counter (OTC), Prescription Herbal Medicines), By Sales Channel (Retail Offline, Retail Online)

- Healthcare

- Feb 2026

- VI0869

- 125

-

Thailand Herbal/Traditional Products Market Statistics and Insights, 2026

- Market Size Statistics

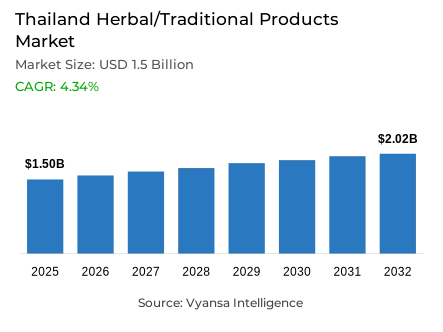

- Herbal/traditional products in Thailand is estimated at USD 1.5 billion in 2025.

- The market size is expected to grow to USD 2.02 billion by 2032.

- Market to register a cagr of around 4.34% during 2026-32.

- Category Shares

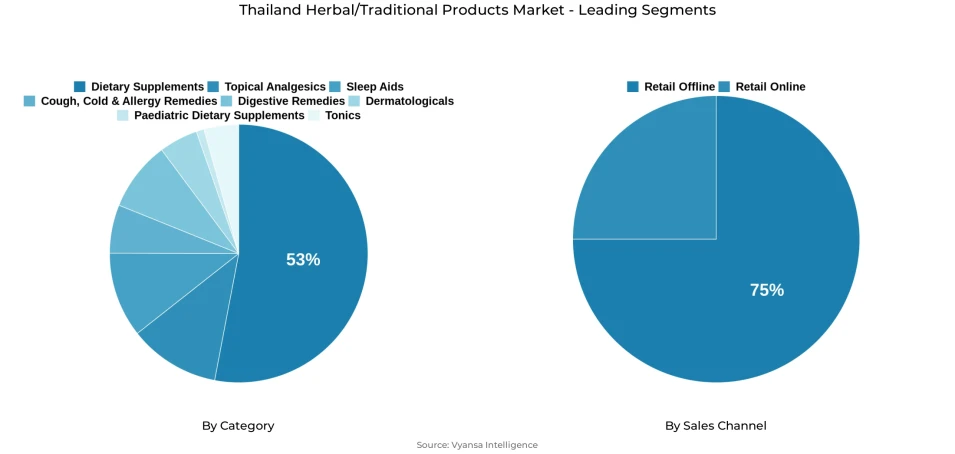

- Dietary supplements grabbed market share of 53%.

- Competition

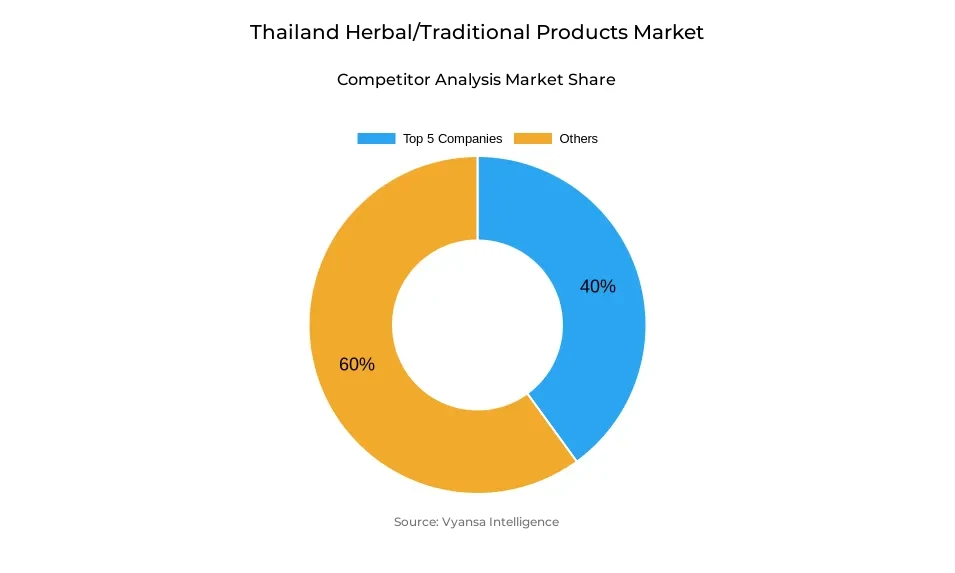

- More than 20 companies are actively engaged in producing herbal/traditional products in Thailand.

- Top 5 companies acquired around 40% of the market share.

- Lofthouse of Fleetwood Ltd; Bertram Chemical (1982) Co Ltd; Haw Par Tiger Balm (Thailand) Ltd; Brand's Suntory (Thailand) Co Ltd; Mondelez International (Thailand) Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Thailand Herbal/Traditional Products Market Outlook

The market for herbal/traditional products in Thailand is poised to grow consistently during the period from 2026 to 2032 as people are increasingly resorting to natural and plant-based formulations for their well-being. In 2025, the market for herbal and traditional products in Thailand is approximately USD 1.5 billion, and it is set to rise to USD 2.02 billion by 2032, as it currently experiences a CAGR of approximately 4.34% during the impending forecasting years. This has been primarily driven by the vast cultural acceptance of herbal and traditional products, especially tonics like bird’s nest and chicken essence.

Consumer demand for natural alternatives leads to a steady growth trend in a variety of categories, such as cough, cold, and allergy formulas, as well as digestive and supplement categories. As far as segmentation in this category goes, Dietary Supplements hold a market share of about 53%, which goes on to define its longstanding position in traditional health practice. While traditional tonics continue to be regarded as a necessary consumption, marketers have been encouraging their mass use through deals, value multi-packs, and other lifestyle associations.

Furthermore, the market environment is also influenced by the growing Thai involvement in the export market for herbal products. The efforts being made by the government in promoting local herb cultivation, standardizing herbal products, and providing access to foreign markets are anticipated to promote the capabilities of the industry. Moreover, innovation in the development of products such as inhalant decongestants and custom packaging designs is also broadening acceptance among young generations.

Moreover, Retail Offline maintains a prominent market position under the sales channel with a share of approximately 75% due to major end user trust and faith in pharmacies, health stores, and specialist retail outlets. Although online distribution is increasing steadily, traditional retail will always play a major role due to its health-related nature and end user perception regarding health and wellness products. The cultural relevance, government support, and increased adoption of natural health and wellness practices are anticipated to maintain positive market development throughout 2032.

Thailand Herbal/Traditional Products Market Growth DriverDemographic Ageing Strengthening Demand for Herbal Wellness Solutions

Thailand's demographic transition to an aging society remains a fundamental growth foundation for the Thailand herbal/traditional products market. According to national population statistics, more than 20% of the residents are aged 60 years or older, which is a structural shift that supports sustained demand for preventive and restorative wellness products. Older end users normally take long-term health maintenance, immunity enhancement, and recovery support as top priorities, while positioning herbal and traditional formulations as preferred daily supplements within this demographic cohort.

Traditional tonics include bird's nest drinks and essence-based products, which have strong cultural connotations among older end users for vitality, resilience, and holistic balance. Demand is further reinforced by a preference for natural formulations with minimal synthetic additives, as ageing end users increasingly seek gentle, plant-based solutions in line with traditional health beliefs. This demographic dynamic underpins consistent consumption patterns across core herbal categories and provides long-term volume stability.

Thailand Herbal/Traditional Products Market ChallengeDietary Shifts Toward Functional Nutrition Limiting Supplement Spend

Evolving dietary preferences are a significant restraint to the Thailand herbal/traditional products market, with awareness related to functional nutrition and proper diets continuing to surge. There is a growing subset of end customers focusing on fresh produce, fortified foods, and nutrient-rich daily meals as central health strategies; these can often offset the need for herbal supplements as a means of managing regular wellness. This could potentially shift discretionary spending away from traditional herbal products.

This pressure is exacerbated by the cost sensitivity that makes some end consumers view dietary enhancements as a more affordable strategy compared with taking supplements regularly. From a bigger health perspective, functional foods have their clear positive contributions, but the rising popularity works to dampen the frequency of repeat purchases for herbal tonics and supplements. This constitutes a structural volume growth constraint, particularly if the rate of adoption for functional nutrition surpasses the pace of innovation-led differentiation within the herbal product category.

Thailand Herbal/Traditional Products Market TrendGrowing Adoption of Digital Commerce for Health Products

The growing adoption of digital and e-commerce channels to buy health and wellness products is on the rise in Thailand. According to both Thai and international data, the country's retail e-commerce market is growing rapidly, and beauty and personal care are among the top categories purchased online.

This widens access, especially to a younger, digitally native consumer who seeks convenience and online discovery of products. Online platforms integrated with social commerce and mobile shopping experiences help herbal/traditional brands reach larger audiences than traditional retail footprints.

Thailand Herbal/Traditional Products Market OpportunityInternational Market Expansion Supporting Long-Term Revenue Potential

Export-oriented growth represents a meaningful future pathway for the Thailand herbal/traditional products market. The government-driven initiatives on herb cultivation, quality certification, and value-added processing enhance the global competitiveness of Thai herbal products. The mechanisms of support that enable producers to meet international regulatory standards create concrete opportunities for cross-border market entry and brand recognition.

The growing global interest in natural, plant-based wellness solutions creates great demand potential for Thai-origin botanicals, such as turmeric and ginger, as well as herbs indigenous to the country. Export expansion does not only increase diversified revenues but also enhances the international profile of Thailand brands through provenance storytelling and traditional cultivation narratives. Strategic partnerships with overseas distributors and wellness brands can further strengthen market penetration, positioning Thailand herbal products as premium, heritage-driven offerings in global health and wellness markets.

Thailand Herbal/Traditional Products Market Segmentation Analysis

By Category

- Topical Analgesics

- Sleep Aids

- Cough, Cold & Allergy Remedies

- Digestive Remedies

- Dermatologicals

- Paediatric Dietary Supplements

- Dietary Supplements

- Tonics

Dietary supplements are the largest category in Thailand's herbal/traditional products market, with a share of around 53% of the total market. This is indicative of the continued cultural acceptance of the tonic-based formulation, especially that of bird's nest and essence drinks, which are highly perceived for their efficacies pertaining to immunity support, recovery, and enhancement of vitality.

These are deeply ingrained products in everyday wellness routines, especially among older end users who provide a stable consumption base. The sustained category leadership has been maintained through continuous refinement of the products, better aesthetics of packaging, and correct positioning towards younger, health-conscious end users. In so doing, manufacturers of tonics and supplements bridge traditional credibility with modern branding, while at the same time reinforcing trust and extending relevance across age brackets to ensure the segment remains the main revenue contributor in the overall market structure.

By Sales Channel

- Retail Offline

- Retail Online

Retail Offline remains the dominant sales channel in the Thailand herbal/traditional products market, representing approximately 75% of total market share. Pharmacies, health stores, and traditional retail outlets continue to play a central role in product discovery, education, and trust-building, which are critical factors for health-related purchases. End users often value face-to-face guidance and reassurance when selecting herbal and traditional products.

Established shopping habits and the experiential nature of evaluating wellness products further reinforce offline channel strength. Physical stores allow end users to assess product authenticity, compare formulations, and receive personalised recommendations, supporting higher confidence in purchase decisions. Although online channels are expanding, offline retail retains structural dominance due to credibility, convenience for older end users, and its integration within long-standing healthcare and wellness purchasing behaviours across Thailand.

List of Companies Covered in Thailand Herbal/Traditional Products Market

The companies listed below are highly influential in the Thailand herbal/traditional products market, with a significant market share and a strong impact on industry developments.

- Lofthouse of Fleetwood Ltd

- Bertram Chemical (1982) Co Ltd

- Haw Par Tiger Balm (Thailand) Ltd

- Brand's Suntory (Thailand) Co Ltd

- Mondelez International (Thailand) Co Ltd

- Scotch Industrial Thailand Co Ltd

- Amway (Thailand) Ltd

- Goldmint Products Co Ltd

- Golden Cup Pharmaceutical Co Ltd

- A Menarini (Thailand) Co Ltd

Competitive Landscape

Thailand’s Herbal/Traditional Products Market in 2025 is shaped by the strong dominance of Brand’s Suntory (Thailand) Co Ltd, which leads the category through its well-established bird’s nest and chicken essence tonics, widely trusted for recovery, vitality, and wellness, especially among older consumers. The company continues to strengthen its position by expanding its target base to younger demographics and encouraging more frequent consumption through bundle packs and value promotions. Meanwhile, local producers are gaining momentum, supported by government initiatives promoting herbal product exports and investment in small manufacturers. Competition is also intensifying in inhalant decongestants, where brands leverage celebrity endorsements, social-media visibility, and creative packaging to attract younger buyers and differentiate offerings within the expanding herbal wellness space.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Thailand Herbal/Traditional Products Market Policies, Regulations, and Standards

4. Thailand Herbal/Traditional Products Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Thailand Herbal/Traditional Products Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Topical Analgesics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sleep Aids- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Cough, Cold & Allergy Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Digestive Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Paediatric Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Tonics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Form

5.2.2.1. Capsules/Tablets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Syrups- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Oils & Ointments- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Health Benefit

5.2.3.1. General Wellness- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cardiovascular Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cognitive & Mental Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Digestive & Gut Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Immunity Support- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Respiratory Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Bone & Joint Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Source

5.2.4.1. Leaves- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Roots- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Barks- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Flowers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Seeds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Ingredient Type

5.2.5.1. Single-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Multi-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Function

5.2.6.1. Preventive Care- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Curative/Relief Care- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By End User

5.2.7.1. Adults- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Geriatric Population- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. Children- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Prescription Type

5.2.8.1. Over-the-Counter (OTC)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Prescription Herbal Medicines- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Sales Channel

5.2.9.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.10. By Competitors

5.2.10.1. Competition Characteristics

5.2.10.2. Market Share & Analysis

6. Thailand Topical Analgesics Herbal/Traditional Products Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

6.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Thailand Sleep Aids Herbal/Traditional Products Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

7.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Thailand Cough, Cold & Allergy Remedies Herbal/Traditional Products Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

8.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Thailand Digestive Remedies Herbal/Traditional Products Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

9.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Thailand Dermatologicals Herbal/Traditional Products Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

10.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Thailand Paediatric Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

11.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Thailand Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

12.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Thailand Tonics Herbal/Traditional Products Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

13.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. Competitive Outlook

14.1. Company Profiles

14.1.1. Brand’s Suntory (Thailand) Co Ltd

14.1.1.1. Business Description

14.1.1.2. Product Portfolio

14.1.1.3. Collaborations & Alliances

14.1.1.4. Recent Developments

14.1.1.5. Financial Details

14.1.1.6. Others

14.1.2. Mondelez International (Thailand) Co Ltd

14.1.2.1. Business Description

14.1.2.2. Product Portfolio

14.1.2.3. Collaborations & Alliances

14.1.2.4. Recent Developments

14.1.2.5. Financial Details

14.1.2.6. Others

14.1.3. Scotch Industrial Thailand Co Ltd

14.1.3.1. Business Description

14.1.3.2. Product Portfolio

14.1.3.3. Collaborations & Alliances

14.1.3.4. Recent Developments

14.1.3.5. Financial Details

14.1.3.6. Others

14.1.4. Amway (Thailand) Ltd

14.1.4.1. Business Description

14.1.4.2. Product Portfolio

14.1.4.3. Collaborations & Alliances

14.1.4.4. Recent Developments

14.1.4.5. Financial Details

14.1.4.6. Others

14.1.5. Goldmint Products Co Ltd

14.1.5.1. Business Description

14.1.5.2. Product Portfolio

14.1.5.3. Collaborations & Alliances

14.1.5.4. Recent Developments

14.1.5.5. Financial Details

14.1.5.6. Others

14.1.6. Lofthouse of Fleetwood Ltd

14.1.6.1. Business Description

14.1.6.2. Product Portfolio

14.1.6.3. Collaborations & Alliances

14.1.6.4. Recent Developments

14.1.6.5. Financial Details

14.1.6.6. Others

14.1.7. Bertram Chemical (1982) Co Ltd

14.1.7.1. Business Description

14.1.7.2. Product Portfolio

14.1.7.3. Collaborations & Alliances

14.1.7.4. Recent Developments

14.1.7.5. Financial Details

14.1.7.6. Others

14.1.8. Haw Par Tiger Balm (Thailand) Ltd

14.1.8.1. Business Description

14.1.8.2. Product Portfolio

14.1.8.3. Collaborations & Alliances

14.1.8.4. Recent Developments

14.1.8.5. Financial Details

14.1.8.6. Others

14.1.9. Golden Cup Pharmaceutical Co Ltd

14.1.9.1. Business Description

14.1.9.2. Product Portfolio

14.1.9.3. Collaborations & Alliances

14.1.9.4. Recent Developments

14.1.9.5. Financial Details

14.1.9.6. Others

14.1.10. A Menarini (Thailand) Co Ltd

14.1.10.1.Business Description

14.1.10.2.Product Portfolio

14.1.10.3.Collaborations & Alliances

14.1.10.4.Recent Developments

14.1.10.5.Financial Details

14.1.10.6.Others

15. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Form |

|

| By Health Benefit |

|

| By Source |

|

| By Ingredient Type |

|

| By Function |

|

| By End User |

|

| By Prescription Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.