Spain Consumer Lending Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Outstanding Balance, Gross Lending), By Loan Type (Personal Loans, Unsecured Personal Loans, Secured Personal Loans, Auto Loans, Mortgages / Home Loans, Credit Card Loans, Student Loans), By Interest Rate Type (Fixed Interest Rate Loans, Floating / Variable Interest Rate Loans), By Payment Method (Direct Deposit (Salary Transfers, Government Benefits, Tax Refunds), Debit Card, Credit Card, Mobile Wallet / UPI, Cheque), By Borrower Type (Individual Borrowers, Joint Borrowers), By Distribution Channel (Bank Branches, Online / Digital Lending Platforms, Non-Banking Financial Institutions (NBFCs)), By Collateral Type (Secured Loans (Vehicle Collateral, Property Collateral), Unsecured Loans), By Age Group (Youth (up to 24 years), Young Adults (25-34 years), Adults (35-54 years), Pre-Retirement (55-64 years), Seniors (65+ years))

- ICT

- Jan 2026

- VI0855

- 115

-

Spain Consumer Lending Market Statistics and Insights, 2026

- Market Size Statistics

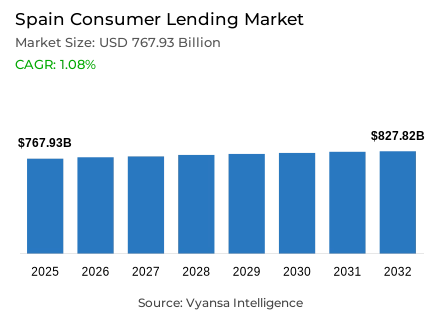

- Consumer lending in Spain outstanding balance is estimated at USD 767.93 billion and gross lending is estimated at USD 217.3 billion in 2025.

- An outstanding balance market size is expected to grow to USD 827.82 billion and gross lending USD 234.36 billion by 2032.

- Market to register an outstanding balance cagr of around 1.08% and gross lending cagr of around 1.09% during 2026-32.

- Loan Type Shares

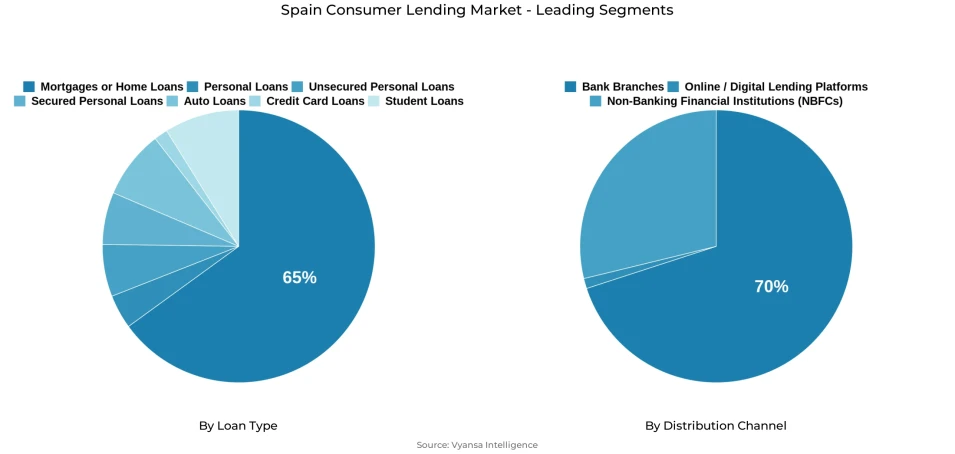

- Mortgages / home loans grabbed market share of 65%.

- Competition

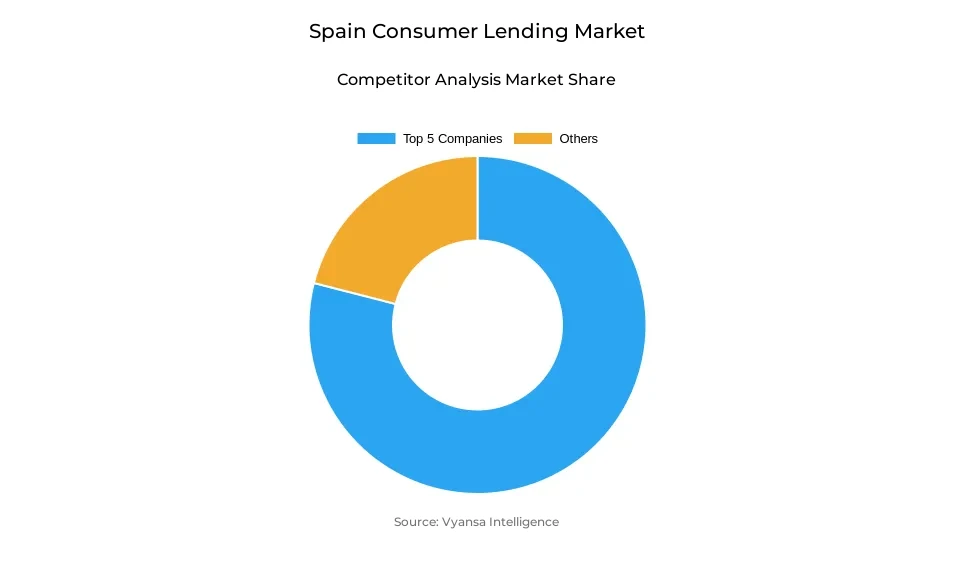

- Consumer lending in Spain is currently being catered to by more than 10 companies.

- Top 5 companies acquired the maximum share of the market.

- WiZink Bank SAU; ING; Bankinter; Banco Santander SA; BBVA etc., are few of the top companies.

- Distribution Channel

- Bank branches grabbed 70% of the market.

Spain Consumer Lending Market Outlook

The Spain consumer Lending Market is expected to record steady growth throughout 2026–2032, with easing inflation, economic resilience, and increasing consumption supportive of lending activity. The outstanding balance is anticipated to be USD 767.93 billion in 2025 and reach USD 827.82 billion by 2032 at a CAGR of 1.08%. Gross lending is expected to increase from USD 217.3 billion to USD 234.36 billion at a CAGR of 1.09%. Lower inflation and firming confidence will spur borrowing, while the persistent cost-of-living squeeze will keep demand high for short-term credit solutions.

Mortgages/home loans will continue to dominate, with 65% market share, although growth will remain modest due to high property prices and tightening mortgage rules. Outstanding balances will grow further as consumer go on making early repayments to reduce exposure to higher Euribor-linked rates. Meanwhile, card lending and BNPL services will expand further, especially among younger adults who prefer flexible repayment options. In contrast, BNPL growth may be somewhat dampened by the new EU CCD2 regulations coming into effect in 2026, which introduce more rigid creditworthiness checks and greater transparency.

Bank branches capture 70% of distribution and will remain at the center of consumer lending, although the way loans are accessed will increasingly be reshaped by digital channels and fintech partnerships. BNPL players, such as Klarna and Plazos X, are positioned to further cement their presence, buoyed by strong demand for apparel, electronics, and travel purchases. The Bank of Spain is growing increasingly concerned over consumer indebtedness and might consider new policy interventions, including the possibility of taxes on certain credit card types.

Going forward, the market will be characterized by a balancing act between opportunity and caution. It is expected that an expanding tourism market, foreign investment inflows, and a strong tech ecosystem will continue to spur economic growth and, by extension, help in lending demand. However, tight regulation regarding credit cards and BNPL, in addition to slow-moving segments like education and durables lending, may temper overall expansion.

Spain Consumer Lending Market Growth DriverLower Inflation Supporting Consumer Confidence and Lending

Drawing on data from Eurostat, Spain recorded a decline in its annual inflation rate to 3.1% in October 2024, remaining above the Eurozone average of approximately 2.0%. This should have eased price pressure and fortified consumer confidence for better budget management across households, despite the prevalent cost-of-living concerns. At approximately 3.1%, Spain's GDP growth outpaced the broader Eurozone's in 2024, at about 0.8%, supported by tourism, resilience in the labor market, and foreign investment flows, according to the Bank of Spain. Such sound macro conditions underpinned credit demand, particularly card-linked spending and travel-related consumption.

An improved economic environment restored consumer optimism and credit appetite, paving the way for increased demand for lending products. As household finances gradually normalize along with price moderation, financial institutions responded to growing credit needs of households, underpinning growth in consumer lending volumes.

Spain Consumer Lending Market ChallengeMortgage Pressure from Euribor Volatility

Persistently elevated interest benchmarks, with the 12-month Euribor averaging around 3.57% in 2024—albeit below the 4.16% peak recorded in 2023—continued to place significant pressure on variable-rate mortgage holders.The persistent volatility meant that monthly repayments were very high for those borrowers, while dampening appetite for new mortgage contracts. Spanish mortgage lending contracted further as households, boosted by savings, became keener on paying off their debt amidst unclear paths of rates.

Additional challenges for mortgage borrowers came from the lagged adjustment of Euribor changes into repayments, which complicated their financial planning. These factors, along with the general cost-of-living crisis, particularly affected longer-term credit demand and reinforced the constrained environment for mortgage lending in 2024.

Spain Consumer Lending Market TrendStrong Expansion of BNPL Adoption

BNPL services rapidly expanded in Spain during 2023–2024, especially amongst younger demographics seeking alternatives to traditional credit cards. Eurostat's Retail online data show that approximately 33% of Spanish online shoppers used installment payment options during this time. BNPL continues to gain traction because consumer enjoy knowing their repayment schedule and often face lower interest exposure than they would through credit card purchases.

Regulatory evolution is well in progress, while the European Union's consumer Credit Directive 2 is expected to be implemented before 2026, aiming to add transparency and consumer protection for BNPL products. The Bank of Spain monitors this rapidly developing market segment, with leading players like Klarna and Plazos X, underlining BNPL's position as one of the most dynamic areas of growth within Spain's consumer credit environment.

Spain Consumer Lending Market OpportunityGrowth Potential Through Digital and Card-Based Lending

Driven by recovering tourism and continuously increasing retail sales, the increase of 2.4% in household consumption within Spain, in 2024, created a very good path to expansion within the credit market. Lending by card still comprises the fastest-growing segment in terms of lending, thanks to the great consumer preference for flexible means of payment.

Meanwhile, digital banking adoption is high among younger, urban populaces-another market indicator that correlates with the wide utilization of mobile payments for daily expenditures. Financial institutions are trying to keep up with this development by expanding product ranges and digital underwriting capabilities. Even with upcoming government considerations on the taxation of credit cards, demand for transparent, flexible credit and BNPL options is expected to fuel continued market growth. When someone is unsure or lacks faith in their own ability and 'seeks help through others' to compete with the strongest opponent, the presence of an unbalancing element could result in short-term failure.

Spain Consumer Lending Market Segmentation Analysis

By Loan Type

- Personal Loans

- Unsecured Personal Loans

- Secured Personal Loans

- Auto Loans

- Mortgages / Home Loans

- Credit Card Loans

- Student Loans

The segment with highest market share under by Loan Type is Mortgages / Home Loans dominated the share, with around 65% under the category of Loan Type. Dominance is expected to continue through forcatst period, supported by the stable economic outlook of Spain, easing inflation, and a consumer focus on long-term financial planning. New mortgage contracts are slowing because of higher Euribor-linked interest rates, but demand remains resilient, households continue to give importance to owning a house, and early repayment strategies are considered to avoid exposure to future rate fluctuations. Improvement in consumer sentiment and gradual recovery in the housing market are the other factors contributing to the growth of this segment.

However, while card lending and BNPL are set to grow, home loans will continue to be in the leading position over the forecast period. Growing interest in hybrid and electric vehicles will also divert some of the demand to auto loans; however, these will remain supplementary to home financing. On the whole, the Mortgage / Home Loan segment will remain the backbone of Spain’s lending structure due to favorable economic conditions and a strong household commitment to property investment.

By Distribution Channel

- Bank Branches

- Online / Digital Lending Platforms

- Non-Banking Financial Institutions (NBFCs)

The segment with highest market share under distribution channel is Bank Branches with around 70% of the market share. Legacy banks are the traditional and dominant channel where most lending decisions take place, such as mortgages and long-term personal loans. Also, Spanish consumer still prefer to deal with physical branches for personalized counseling, credit rating checks, and safe operations of high-value borrowings, which will further strengthen the dominance of brick-and-mortar channels.

Looking forcats period, bank branches continue to be in the center, even as digital platforms and fintechs rise in adoption, especially toward small-ticket lending and BNPL services. Moreover, regulatory changes, such as CCD2, foster greater transparency and enhance consumer protection, with incentives for borrowers to become more involved with formal banking channels. The reasons, therefore, that branches will keep the leading position include trust in them, regulatory oversight of their work, and their strong presence in the financial system of Spain.

List of Companies Covered in Spain Consumer Lending Market

The companies associated with the Spain consumer lending market are outlined below.

- WiZink Bank SAU

- ING

- Bankinter

- Banco Santander SA

- BBVA

- CaixaBank SA

- Banco Sabadell SA

- Banco Cetelem

- Santander Consumer Finance

- Klarna

Competitive Landscape

Consumer lending in Spain in 2024 is supported by easing inflation and a still-high cost-of-living environment, which is encouraging consumers to rely on loans for expense management while improving economic conditions strengthen confidence. The economy is performing better than the Eurozone average, driven by tourism, immigration, foreign investment, public spending, and a growing technology start-up ecosystem linked to university-led research fields such as AI, robotics, cybersecurity, and renewable energy. Spanish banks remain cautious, applying stricter controls on new consumer credit following concerns from the Bank of Spain, while card lending posts the strongest gross lending growth due to higher spending and travel. Meanwhile, mortgage balances continue to decline as households prioritise early repayments to mitigate exposure to Euribor-linked variable mortgage rate increases.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Spain Consumer Lending Market Policies, Regulations, and Standards

4. Spain Consumer Lending Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Spain Consumer Lending Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Outstanding Balance- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Gross Lending- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Loan Type

5.2.2.1. Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Unsecured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Secured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Auto Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Mortgages / Home Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Credit Card Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Student Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Interest Rate Type

5.2.3.1. Fixed Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Floating / Variable Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Payment Method

5.2.4.1. Direct Deposit- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.1. Salary Transfers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2. Government Benefits- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.3. Tax Refunds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Debit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Credit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Mobile Wallet / UPI- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Cheque- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Borrower Type

5.2.5.1. Individual Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Joint Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Distribution Channel

5.2.6.1. Bank Branches- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Online / Digital Lending Platforms- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Non-Banking Financial Institutions (NBFCs)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Collateral Type

5.2.7.1. Secured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Vehicle Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Property Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Unsecured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Age Group

5.2.8.1. Youth (up to 24 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Young Adults (25-34 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.3. Adults (35-54 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.4. Pre-Retirement (55-64 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.5. Seniors (65+ years)- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Competitors

5.2.9.1. Competition Characteristics

5.2.9.2. Market Share & Analysis

6. Spain Outstanding Balance Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7. Spain Gross Lending Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Banco Santander SA

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.BBVA

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.CaixaBank SA

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Banco Sabadell SA

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Banco Cetelem

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.WiZink Bank SAU

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.ING

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Bankinter

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Santander Consumer Finance

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Klarna

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Loan Type |

|

| By Interest Rate Type |

|

| By Payment Method |

|

| By Borrower Type |

|

| By Distribution Channel |

|

| By Collateral Type |

|

| By Age Group |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.