Saudi Arabia Consumer Lending Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Outstanding Balance, Gross Lending), By Loan Type (Personal Loans, Unsecured Personal Loans, Secured Personal Loans, Auto Loans, Mortgages / Home Loans, Credit Card Loans, Student Loans), By Interest Rate Type (Fixed Interest Rate Loans, Floating / Variable Interest Rate Loans), By Payment Method (Direct Deposit (Salary Transfers, Government Benefits, Tax Refunds), Debit Card, Credit Card, Mobile Wallet / UPI, Cheque), By Borrower Type (Individual Borrowers, Joint Borrowers), By Distribution Channel (Bank Branches, Online / Digital Lending Platforms, Non-Banking Financial Institutions (NBFCs)), By Collateral Type (Secured Loans (Vehicle Collateral, Property Collateral), Unsecured Loans), By Age Group (Youth (up to 24 years), Young Adults (25-34 years), Adults (35-54 years), Pre-Retirement (55-64 years), Seniors (65+ years))

- ICT

- Jan 2026

- VI0833

- 120

-

Saudi Arabia Consumer Lending Market Statistics and Insights, 2026

- Market Size Statistics

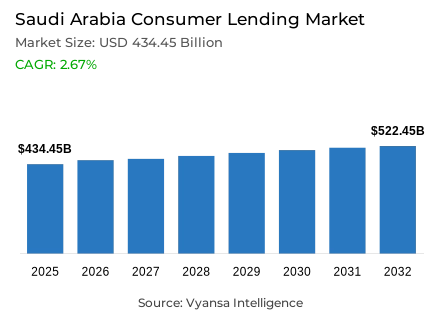

- Consumer lending in Saudi Arabia outstanding balance is estimated at USD 434.45 billion and gross lending is estimated at USD 252.49 billion in 2025.

- An outstanding balance market size is expected to grow to USD 522.45 billion and gross lending USD 301.74 billion by 2032.

- Market to register an outstanding balance cagr of around 2.67% and gross lending cagr of around 2.58% during 2026-32.

- Loan Type Shares

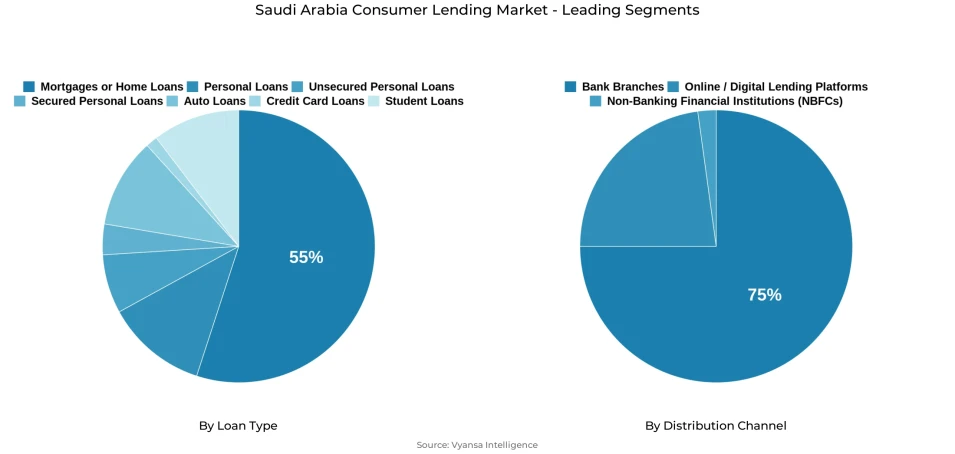

- Mortgages / home loans grabbed market share of 55%.

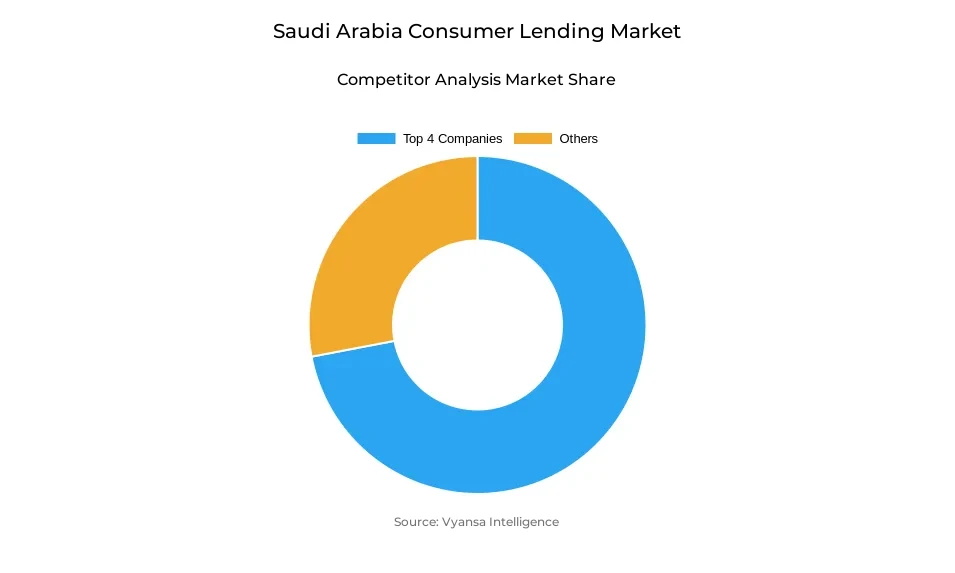

- Competition

- Consumer lending in Saudi Arabia is currently being catered to by more than 5 companies.

- Top 4 companies acquired the maximum share of the market.

- Jeel Pay; Fintech Saudi; Dyna.Ai; Fortis etc., are few of the top companies.

- Distribution Channel

- Bank branches grabbed 75% of the market.

Saudi Arabia Consumer Lending Market Outlook

The Saudi Arabia consumer Lending Market is expected to expand steadily during 2026–32, driven by strong banking stability, ongoing real estate development, and broader economic transformation under Vision 2030. Indeed, the outstanding balance of this market was valued at approximately USD 434.45 billion in 2025, which is poised to touch USD 522.45 billion by 2032, while growing at a CAGR of about 2.67%. Meanwhile, gross lending is projected to surge from USD 252.49 billion to USD 301.74 billion between 2025 and 2032, reflecting a CAGR of around 2.58%. Growth will continue to be steered by housing demand, evolving consumer finance behaviour, and disciplined lending conditions.

Mortgages/Home Loans, at approximately 55% of the loan mix, will continue to be one of the key growth drivers, underpinned by housing development, population expansion, expatriate demand, and continued progress in large real estate and urban projects. Banks are expected to continue their prudent underwriting practices and strong risk controls-supportive of portfolio quality while allowing for incremental market expansion.

consumer lending will continue to take shape in the forecast period due to digitalization. The proliferation of fintech, AI solutions, and proptech platforms will make the process of lending faster, more transparent, and easier to access. At the same time, regulatory oversight combined with structured lending standards will help maintain stability in the financial system as lending activities grow.

From a distribution perspective, Bank Branches are expected to retain a dominant share of about 75%, supported by consumer trust, advisory-led lending, and the continued role of banks in mortgage and secured lending. During a period when Saudi Arabia is pushing major development initiatives and attracting new residents and investors, consumer lending is set to maintain a steady, resilience-driven growth.

Saudi Arabia Consumer Lending Market Growth DriverExpansion of Real Estate Lending Supported by Strong Economic Conditions

Real estate lending in Saudi Arabia reached record highs in 2024, confirming robust growth driven by favorable macroeconomic factors and Vision 2030 initiatives. According to data from the Saudi Central Bank, the real estate loan portfolio reached approximately SAR 846.5 billion, about $225.7 billion, by Q3 2024, up more than 13% year-over-year. About 78% of this portfolio consisted of retail housing loans, reflecting strong demand from households for mortgage finance. The unemployment rate stood at 3.5% in early 2024 for the total population, according to GASTAT, which implies good borrowers' debt-servicing capacity, considering that the unemployment rates for Saudi nationals are slightly higher.

Other ongoing mega-projects include NEOM, the Red Sea Development, and expansion in Riyadh and Jeddah these continue to fuel the real estate markets, with lending pipelines expanding correspondingly. Population growth, according to data from GASTAT, places the population of Riyadh above 7.6 million by 2024, underpinning long-term housing demand. Stability in property prices and increased apartment demand in early 2024 further support residential mortgage growth, making real estate lending the main driver of the credit market expansion.

Saudi Arabia Consumer Lending Market ChallengeHigh Interest Rates Restricting Borrowing Capacity

Rising environmental awareness is increasingly creating new growth opportunities for brands operating within the menstrual care market in Hong Kong. While rates have been cut, financing costs remain high compared to long-term averages and are restraining mortgage growth, particularly in retail segments. Interestingly, residential apartment lending posted a year-on-year 9% growth against the slight contraction of 1% in house financing, reflecting selective responses of demand to the rate environment.

Price pressures, such as the increasing cost of construction inputs and staples, continue to squeeze household budgets. Furthermore, real estate fraud has been especially problematic in tourist areas, further increasing buyer and lender caution. These issues, on top of more stringent collateral rules and loan-to-value limits, reduce borrowing capacity for most, especially first-time buyers and middle-class households.

Saudi Arabia Consumer Lending Market TrendRapid Growth of Fintech and AI-Driven Financial Services

Saudi Arabia's young demographic profile, with 70% of the population below the age of 30, coupled with almost complete smartphone penetration at ~92% - 96%, accelerates the digital transformation of financial services. The attainment of the objectives under Vision 2030 still constitutes a driver for fintech development, with its discourse on AI-driven credit risk assessment and the shift to full-cycle digital onboarding changing lending and payment landscapes.

Such collaborations between banks and FinTechs have delivered mature point-of-sale solutions, CRM platforms, and digital payments to the market, catering to rising SME and consumer demand for flexible, technology-enabled solutions. SAMA's recent reports indicate that digital payments formed 79% of retail transactions in 2024, up from 70% in 2023, illustrating rapid digital adoption that accelerates financial inclusion.

Saudi Arabia Consumer Lending Market OpportunityIncreasing Demand for Homeownership under Vision 2030

Demographic and policy trends underscore rising homeownership demand in Saudi Arabia. Riyadh's population exceeded 7.6 million in 2024, while the national population stands near 35.3 million. Expatriate buyers aged 35-55 years increasingly prefer apartment ownership, raising mid-income housing demand. Longer-term Vision 2030 projects and residency schemes, such as the Premium Residency Scheme, incentivize property acquisition.

Banks answer that with competitive mortgage products and a pursuit of alternative funding, adding to the government-supported housing affordability scheme and further extending digital mortgage platforms. These collectively cement market prospects and place housing finance as a cornerstone opportunity for lending growth amidst stabilizing rates and changing buyer demographics.

Saudi Arabia Consumer Lending Market Segmentation Analysis

By Loan Type

- Personal Loans

- Unsecured Personal Loans

- Secured Personal Loans

- Auto Loans

- Mortgages / Home Loans

- Credit Card Loans

- Student Loans

By Loan Type, the mortality of the segment is headed by Mortgages / Home Loans, which attained a share of 55%. This leadership demonstrates Saudi Arabia's strong movement toward home ownership, fostered by Vision 2030, the expansion of residential projects, and increased demand from both nationals and expatriates. Real estate lending has already reached SAR 800.5 billion in early 2024, and mortgages remain the anchor to household borrowing, especially with rising demand for apartments due to greater affordability and changes in lifestyle preference.

Over forcast period, mortgages will remain the leading segment as large-scale real estate projects and government-backed initiatives create more accessible financing. Saudi banks are likely to diversify their funding structures to meet increasing loan demand, especially with growing expatriate ownership through the Premium Residency Program. Even with increased interest rates and strict loan-to-value regulations, the long-term stability in the housing market and ongoing expansion of the urban developments will keep mortgages the largest loan type.

By Distribution Channel

- Bank Branches

- Online / Digital Lending Platforms

- Non-Banking Financial Institutions (NBFCs)

By Distribution Channel category, the Bank Branches segment dominates with a 75% share. consumer preference for in-person consultations during the application process for major loans such as mortgages, personal financing, and real estate-backed credit accounts for this strong position. Branches are core to the lending process for regulatory requirements, assurance of identity, and an embedded culture of financial stability and stringent credit criteria, especially in Saudi Arabia. Bank branches will continue to lead the way in distribution through 2026–32, considering the fact that Sharia-compliant financing, mortgage approvals, and corporate credit assessments normally require direct interaction and scrutiny in minute detail.

Though Fintech adoption is accelerating, with the support of AI solutions, PropTech platforms, and new BNPL regulations, digital channels supplement rather than supplant branches. As banks begin to integrate digital tools into their platforms—smoothening applications and enhancing transparency—physical branches will remain the backbone of lending operations against a rapidly modernizing backdrop of changes in the financial landscape.

List of Companies Covered in Saudi Arabia Consumer Lending Market

The companies associated with the Saudi Arabia consumer lending market are outlined below.

- Jeel Pay

- Fintech Saudi

- Dyna.Ai

- Fortis

Competitive Landscape

Consumer lending in Saudi Arabia in 2024 shows strong recovery in current value terms, supported by rising oil prices, higher interest rates, and growth in the non-oil economy, which together create a favourable banking environment despite regional tensions. Real estate lending remains the key growth driver, with SAMA reporting portfolios reaching SAR800.5 billion in Q1 2024, while corporate lending expands rapidly due to large-scale Vision 2030 projects such as NEOM. Lending dynamics reflect price trends and housing preferences, with stronger financing demand for commercial property and increasing borrowing for apartments over villas. Despite tighter loan-to-value limits and stricter credit assessments, banks maintain resilience, demonstrated by declining NPL ratios and strong capitalisation under Basel IV standards, reinforcing financial stability and investor confidence.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Saudi Arabia Consumer Lending Market Policies, Regulations, and Standards

4. Saudi Arabia Consumer Lending Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Saudi Arabia Consumer Lending Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Outstanding Balance- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Gross Lending- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Loan Type

5.2.2.1. Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Unsecured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Secured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Auto Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Mortgages / Home Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Credit Card Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Student Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Interest Rate Type

5.2.3.1. Fixed Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Floating / Variable Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Payment Method

5.2.4.1. Direct Deposit- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.1. Salary Transfers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2. Government Benefits- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.3. Tax Refunds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Debit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Credit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Mobile Wallet / UPI- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Cheque- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Borrower Type

5.2.5.1. Individual Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Joint Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Distribution Channel

5.2.6.1. Bank Branches- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Online / Digital Lending Platforms- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Non-Banking Financial Institutions (NBFCs)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Collateral Type

5.2.7.1. Secured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Vehicle Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Property Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Unsecured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Age Group

5.2.8.1. Youth (up to 24 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Young Adults (25-34 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.3. Adults (35-54 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.4. Pre-Retirement (55-64 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.5. Seniors (65+ years)- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Competitors

5.2.9.1. Competition Characteristics

5.2.9.2. Market Share & Analysis

6. Saudi Arabia Outstanding Balance Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7. Saudi Arabia Gross Lending Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Saudi National Bank (SNB)

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Al Rajhi Bank

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Riyad Bank

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Arab National Bank (ANB)

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Bank Albilad

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Banque Saudi Fransi

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.SABB

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Alinma Bank

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Saudi Investment Bank

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Bank Al Jazira

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Loan Type |

|

| By Interest Rate Type |

|

| By Payment Method |

|

| By Borrower Type |

|

| By Distribution Channel |

|

| By Collateral Type |

|

| By Age Group |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.