South Africa Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By End User (Industrial Water & Wastewater, Municipal Water & Wastewater)

- Energy & Power

- Oct 2025

- VI0488

- 130

-

South Africa Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

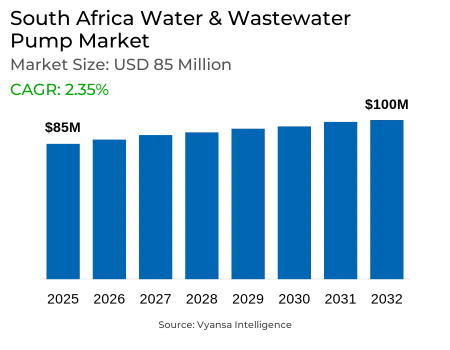

- Water & Wastewater Pump in South Africa is estimated at $ 85 Million.

- The market size is expected to grow to $ 100 Million by 2032.

- Market to register a CAGR of around 2.35% during 2026-32.

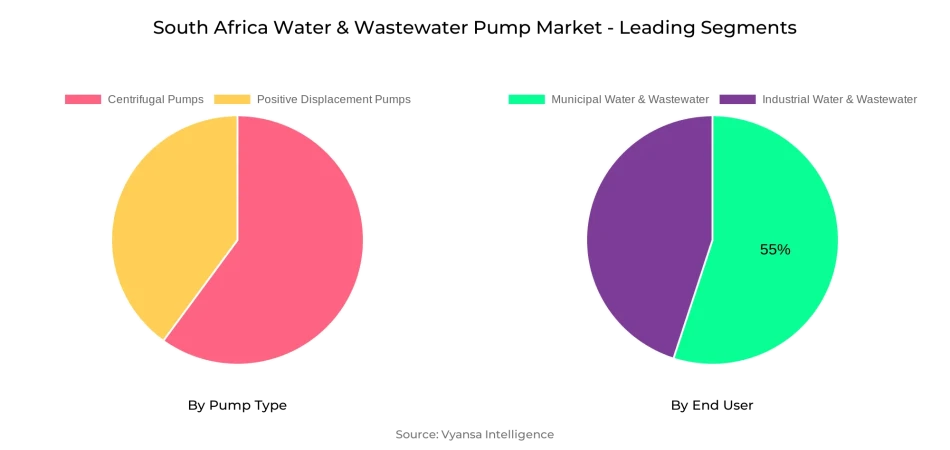

- Pump Type Segment

- Centrifugal Pumps continues to dominate the market.

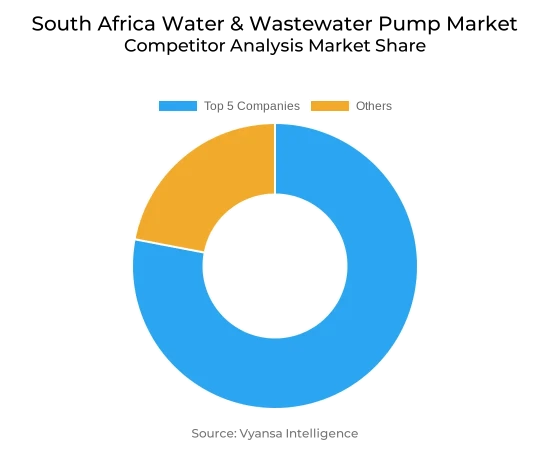

- Competition

- More than 10 companies are actively engaged in producing Water & Wastewater Pump in South Africa.

- Top 5 companies acquired the maximum share of the market.

- ITT, IDEX, Dover, Flowserve, Sulzer AG etc., are few of the top companies.

- End User

- Municipal Water & Wastewater grabbed 55% of the market.

South Africa Water & Wastewater Pump Market Outlook

South Africa Water & Wastewater Pump Market is experiencing steady growth with support from urgent investment in replacing old water networks and treatment plants. The market size is estimated at $85 million in 2025 and is set to grow to $100 million in 2032, driven by the government's focus on responding to increasing demand in water-stressed areas. More than 460 million residents reside in water-scarce areas, compelling municipalities to implement advanced pumping systems to provide reliable supply.

Government financing is a key driver of this momentum. In 2023, the Department of Water and Sanitation spent more than R3.2 billion on new pumping stations and rehabilitation work. These have high-efficiency pumps as a priority, minimizing energy consumption and maintenance expenses, and promoting healthy competition between suppliers and contractors. In addition to public money, private sector involvement through concession arrangements and international development loans also speeds up modern pump installations nationwide.

Operational issues are still a major concern owing to frequent power outages in South Africa. Rolling blackouts interfere with pumping operations, causing reservoir overflows, service disruptions, and heavy diesel generator dependency. Utilities are, therefore, turning to solar-powered and hybrid pumping systems, which blend grid and photovoltaic power. These solutions assist in maintaining continuity when there are blackouts, minimize fuel expenditure, and aid water access for disadvantaged communities, as well as fit with renewable energy targets.

From a segmentation point of view, Municipal Water & Wastewater leads with 55% share, fueled by major infrastructure projects and rigorous regulatory requirements. Industrial Water & Wastewater is becoming the fastest-growing segment, aided by plant expansions in manufacturing and more stringent effluent regulations. Centrifugal pumps lead by share among pump types because of their capacity to process high flow volumes economically, further entrenching their role in municipal and industrial sectors.

South Africa Water & Wastewater Pump Market Growth Driver

Government Investments in Water Network Upgrades Driving Pump Demand

Governments are giving top priority to modernizing aging water pipelines and treatment facilities to address increasing demand. More than 460 million people in South Africa reside in water-stressed regions, compelling immediate investment in efficient pumping technologies. Municipalities experience frequent failure of aging pumping stations, causing service loss and the risk of contamination. These demands hasten retrofitting activity and deployment of advanced pump technology for guaranteed supply.

Stakeholders are accessing significant public investment to address these requirements. In 2023, the Department of Water and Sanitation invested more than R3.2 billion in new pumping stations and rehabilitation work, including high-efficiency variants to minimize energy consumption and maintenance expenses. This investment boom generates a compelling draw for contractors and suppliers, encouraging a competitive marketplace for resilient, innovative pump equipment.

South Africa Water & Wastewater Pump Market Challenge

Power Outages and Load-Shedding Hindering Pump Operations

South African water utilities struggle with regular power outages, with rolling blackouts halting pump operation and treatment processes. The interruptions cause reservoir overflows, service disconnections, and heavier use of expensive diesel generators. Maintaining stable power for pumps is a key challenge as demand continues to increase.

Maintenance crews struggle to quickly restore service when electrical and mechanical failures overlap under load-shedding conditions. The combined pressure of aging equipment and unstable power supply erodes operational resilience, underscoring the need for backup options and intelligent monitoring to pre-empt failure

South Africa Water & Wastewater Pump Market Trend

Rising Adoption of Solar and Hybrid Pumping Solutions

The market is strong in the direction of solar-powered pump installations in distant and off-grid regions. Solar pumping systems increasingly serve irrigation schemes and small town water supplies, allowing standalone operation during blackout hours. This trend lowers fuel bills and carbon emissions while improving access to water in low-access communities.

Further, utilities increasingly test hybrid configurations, where they mix grid-supplied and solar-powered pumps. These setups maximize energy utilization, taking power from the grid off-peak and from the sun peak sunlight. Hybrid models are becoming more popular as climate uncertainty increases and renewable requirements get stricter.

South Africa Water & Wastewater Pump Market Opportunity

Public–Private Partnerships and International Funding Creating Growth Opportunities

Cooperation between state authorities and private companies is creating new opportunities for risk sharing and project funding. Private operators design, construct, and service pumping plants under concession deals, with performance guarantees. This arrangement brings in expertise and capital, speeding rollout of advanced pump facilities.

International development agencies are also contributing grants and low-interest loans to finance large-scale improvements. By combining public money with private capital, South Africa can accelerate critical water and wastewater upgrades, generating long-term value for investors and communities alike.

South Africa Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

The most dominant segment under Pump Type in terms of market share is Centrifugal Pumps. These are preferred for their high flow rates and low-viscosity fluid handling capability, which makes them the go-to for municipal water supply, wastewater treatment, and industrial dewatering purposes. The ease of maintenance, coupled with their low-profile design, further entrenches their dominance.

Manufacturers are increasingly providing variable-speed drives and hardened impeller materials to maximize energy efficiency and wear resistance. This trend boosts performance in demanding applications, including mining effluent pumping and desalination brine handling, maintaining the centrifugal segment's dominant position.

By End User

- Industrial Water & Wastewater

- Municipal Water & Wastewater

The most significant market share within End User is Municipal Water & Wastewater, which captured 55% of the market in recent studies. This is due to big-city urban infrastructure projects and government-mandated potable water delivery and sewerage management requirements. Municipal investment schemes keep financing new pumping stations and network extensions.

The fastest-growing End User market is Industrial Water & Wastewater, at 3.27% CAGR. It is fueled by manufacturing growth and tighter effluent discharge requirements. Companies are moving to energy-efficient pump systems and adding smart controls to reduce downtime and meet environmental regulations.

Top Companies in South Africa Water & Wastewater Pump Market

The top companies operating in the market include ITT, IDEX, Dover, Flowserve, Sulzer AG, KSB, Xylem, Grundfos, Ebara, SPX Flow, etc., are the top players operating in the South Africa Water & Wastewater Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. South Africa Water & Wastewater Pump Market Policies, Regulations, and Standards

4. South Africa Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. South Africa Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End User

5.2.3.1. Industrial Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Municipal Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. South Africa Centrifugal Water & Wastewater Pump Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. South Africa Positive Displacement Water & Wastewater Pump Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Flowserve Corporation

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Ebara Corporation

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.WILO SE

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Sulzer Limited

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Grundfos Holding A/S

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Xylem Inc.

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.KSB SE & Co. KGaA

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Kirloskar Brothers Limited (KBL)

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Franklin Electric

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Pentair PLC

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.