Brazil Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By End User (Industrial Water & Wastewater, Municipal Water & Wastewater)

- Energy & Power

- Oct 2025

- VI0474

- 120

-

Brazil Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

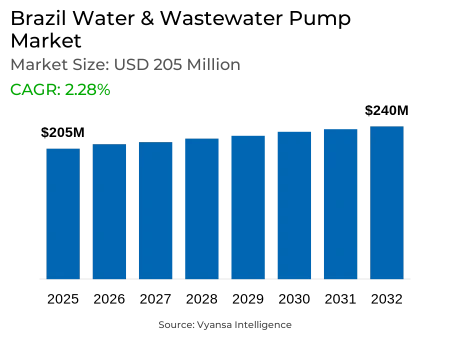

- Water & Wastewater Pump in Brazil is estimated at $ 205 Million.

- The market size is expected to grow to $ 240 Million by 2032.

- Market to register a CAGR of around 2.28% during 2026-32.

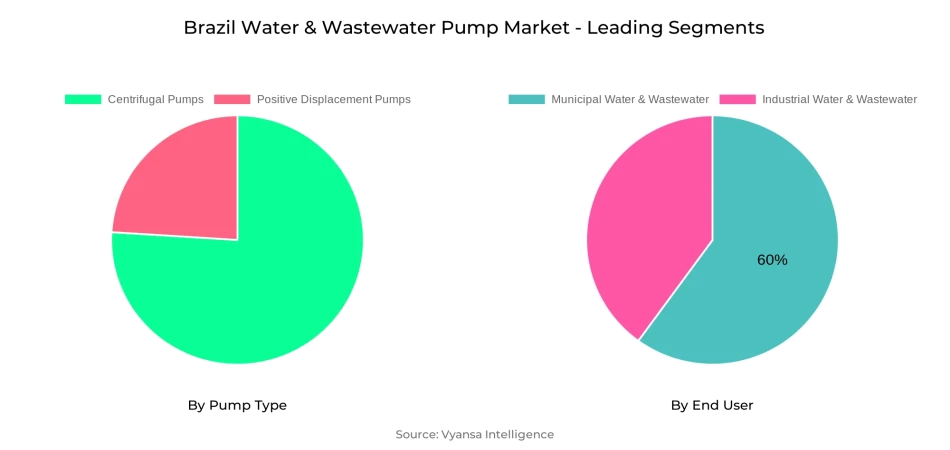

- Pump Type Segment

- Centrifugal Pumps continues to dominate the market.

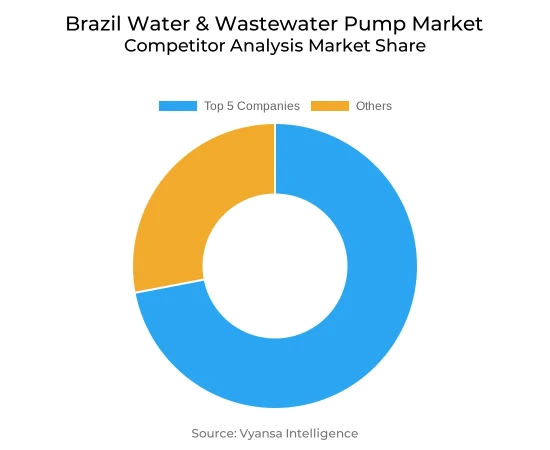

- Competition

- More than 10 companies are actively engaged in producing Water & Wastewater Pump in Brazil.

- Top 5 companies acquired the maximum share of the market.

- ITT, IDEX, Dover, Flowserve, Sulzer AG etc., are few of the top companies.

- End User

- Municipal Water & Wastewater grabbed 60% of the market.

Brazil Water & Wastewater Pump Market Outlook

Brazil Water & Wastewater Pump Market is experiencing high demand due to significant infrastructure deficiencies and government initiatives. Approximately 35 million Brazilians do not have access to treated water, and over 80 million do not have sewer connections. Regulatory goals call for 99% water supply and 90% sewage treatment by the year 2033, supported by over BRL 500 billion in earmarked expenditure. This is generating a long-term demand for pumping equipment, especially through mega-projects like the São Francisco River Integration, which comprises nine pumping stations and has a direct benefit to more than 12 million individuals.

Although it possesses 12% of the world's freshwater, the water supply systems in Brazil are highly inefficient with almost 40% of the water being lost to leakage and pilferage. Semi-arid areas such as the Northeast, where there are 28 million inhabitants but with access to only 3% of Brazil's water, depend heavily on pumping infrastructure for supply. Industrial use, particularly from mining, further increases the demand for high-capacity pumps to ensure replacement and upgrade cycles continue to be high throughout the country.

Adoption of technology is revolutionizing the industry, with utilities adopting IoT-enabled smart water management. SABESP deployed 100,000 smart meters for real-time monitoring, and firms such as Iguá Saneamento monitor thousands of sensors to streamline pump operations. Such efforts, combined with AI-enabled solutions from the National Water Agency, are improving efficiency and speeding the transition to smart pumping solutions.

The market was worth $205 million in 2025 and is expected to be worth $240 million by 2032. In pump categories, centrifugal pumps lead the pack because of their efficiency and reliability in municipal and industrial applications. On the supply side, Municipal Water & Wastewater is 60% of the market, the reflection of Brazil's desperate drive for access to water by everybody. Industrial end-users are growing steadily too, which is underpinning a diversified and long-term growth pattern for pump suppliers.

Brazil Water & Wastewater Pump Market Growth Driver

Expanding Infrastructure Development Drives Demand

Brazil has substantial water infrastructure shortcomings that drive pump market demand. 35 million Brazilians have no access to treated water, while more than 80 million Brazilians have no sewer hook-up. The country's aggressive regulatory landscape calls for achieving 99% water supply and 90% sewage treatment by 2033 at a cost of more than BRL 500 billion. Brazil's Water Regulatory Agency data show that only 51.2% of wastewater collected gets treated, leaving huge infrastructure gaps.

Government investments are driving infrastructure growth through projects such as the "New PAC" announced in 2023, featuring large water projects like the São Francisco River Integration Project for over 12 million inhabitants in 390 northeastern municipalities. The behemoth project encompasses 600 km of canals, 9 pumping stations, and 27 reservoirs, directly boosting demand for water and wastewater pumps in municipal and industrial usage.

Brazil Water & Wastewater Pump Market Challenge

Aging Infrastructure Creates Operational Hurdles

Brazil's deteriorating water distribution systems pose severe operating challenges to the pump market. Water utilities suffer around 40% water loss due to leakage, theft, and metering errors in old pipeline networks, necessitating higher pumping demands to offset system inefficiencies. Major urban cities suffer from cyclical supply interruption, with São Paulo suffering acute water stress even as Brazil boasts 12% of global freshwater supplies.

The semi-dry Northeast region, with a population of 28 million, is dependent upon pumping systems to reach available water resources that are only 3% within the region's share of Brazil's water availability. Industrial processes exacerbate these issues, as mining processes use 1.9 to 3.0 cubic meters of water per ton of ore treated, producing chronic demand for high-volume industrial pumps. These infrastructure constraints require ongoing pump system replacement and upgrades to ensure reliability of service.

Brazil Water & Wastewater Pump Market Trend

Smart Technology Integration Transforms Operations

Brazil water utilities are quickly embracing IoT-based smart water management systems to better manage pumps and minimize losses. SABESP, the largest sanitation company in Latin America, implemented 100,000 smart water meters via Sigfox technology successfully, making remote monitoring possible automatically several times a day. This goes a long way towards facilitating real-time pump control and predictive maintenance, greatly enhancing operational effectiveness.

Sophisticated automation systems are the new norm, and companies such as Iguá Saneamento have implemented IoT platforms to watch over thousands of sensors to detect leaks and optimize pumps in 121 municipalities that serve more than 7 million individuals. Brazil's National Water Agency is innovating AI-based Water Resilience Tracker technology to integrate water management into climate action, signaling growing incorporation of smart pump control systems. These advances in technology are fueling the need for intelligent, connected pumping technologies that can cater to changing water management needs.

Brazil Water & Wastewater Pump Market Opportunity

Infrastructure Modernization Creates Market Expansion

Brazil's modernization of its water sector represents tremendous opportunities for pump companies and suppliers. The government's universal sanitation policy calls for bringing an extra 35 million people under treated water systems and 104 million under sewage networks by 2033, representing unprecedented potential for market growth. Private sector involvement is on the rise through concessions and public-private partnerships, with the Ministry of Economy estimating more than R$ 700 billion in required investments.

Multiphase pump sales are being driven by mega-sized infrastructure projects such as the São Francisco River diversion, which incorporates six huge pumps with flowrates of 45,000 cubic meters per hour and 5,500 kW electric motors. Brazil's industrial water use statistics report that 77.6% of overall water use is in agriculture, followed by manufacturing at 11.3%, demonstrating varied market opportunities by industry. The synergy of regulatory demand, investment, and technology development sets up Brazil's pump sector for long-term expansion through infrastructure upgrading initiative

Brazil Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

The most demanded segment under the category of pump type is Centrifugal Pumps. Centrifugal pumps remain in top demand because of their high efficiency and reliability in water treatment and wastewater uses. Centrifugal pumps are best suited for the use in Brazil's extensive municipal water distribution networks and industrial processes, providing high flow rates and pressure requirements necessary for large pipeline networks.

Centrifugal pump technology is common in Brazil's infrastructure needs, whereby utilities require low-maintenance, durable solutions for constant operation. Their ability to work on a wide range of applications from municipal water treatment to industrial processing, with established maintenance skills and availability of parts, supports their market leadership position in the growing Brazil water and wastewater pump market.

By End User

- Industrial Water & Wastewater

- Municipal Water & Wastewater

The most market-share holding segment under the End User category is Municipal Water & Wastewater. Municipal Water & Wastewater took 60% of the market, mirroring Brazil's enormous public infrastructure demands and government requirements for universal access to water by 2033. This is a result of active projects such as the São Francisco River Integration to serve 12 million individuals and large urban water distribution networks that need incessant pump system renewal.

But the most rapidly expanding end user segment is Industrial Water & Wastewater, at 2.91% CAGR. This growth is supported by Brazil's growing industrial base, especially mining activities necessitating intensive water treatment and manufacturing plants using closed-loop water systems. The interplay between environmental regulations and water scarcity is forcing industries to invest in high-end pumping solutions for treatment and recycling purposes.

Top Companies in Brazil Water & Wastewater Pump Market

The top companies operating in the market include ITT, IDEX, Dover, Flowserve, Sulzer AG, KSB, Xylem, Grundfos, Ebara, SPX Flow, etc., are the top players operating in the Brazil Water & Wastewater Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Brazil Water & Wastewater Pump Market Policies, Regulations, and Standards

4. Brazil Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Brazil Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End User

5.2.3.1. Industrial Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Municipal Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Brazil Centrifugal Water & Wastewater Pump Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Brazil Positive Displacement Water & Wastewater Pump Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Flowserve Corporation

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Ebara Corporation

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.WILO SE

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Sulzer Limited

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Grundfos Holding A/S

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Xylem Inc.

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.KSB SE & Co. KGaA

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Kirloskar Brothers Limited (KBL)

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Franklin Electric

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Pentair PLC

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.