South Africa Dermatologicals Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Medicated Shampoos, Topical Antifungals, Vaginal Antifungals, Hair Loss Treatments, Nappy (Diaper) Rash Treatments, Antiparasitics/Lice (Head and Body) Treatments, Antipruritics, Cold Sore Treatments, Haemorrhoid Treatments, Paediatric Dermatologicals, Topical Allergy Remedies/Antihistamines, Topical Germicidals/Antiseptics), By Dispensing Status (Prescription-based Drugs, Over-the-counter Drugs), By Route of Administration (Topical Administration, Oral Administration, Parenteral Administration), By Drug Type (Branded, Generics), By Skin Condition (Acne, Dermatitis, Psoriasis, Skin Cancer, Rosacea, Alopecia, Fungal Infections, Others), By End User (Hospitals, Cosmetic Centers, Dermatology Clinics, Homecare, Others), By Sales Channel (Retail Offline, Retail Online), By Region (Gauteng, Western Cape, Eastern Cape, North West, Others)

- Healthcare

- Jan 2026

- VI0842

- 115

-

South Africa Dermatologicals Market Statistics and Insights, 2026

- Market Size Statistics

- Dermatologicals in South Africa is estimated at USD 140 million in 2025.

- The market size is expected to grow to USD 170 million by 2032.

- Market to register a cagr of around 2.81% during 2026-32.

- Category Shares

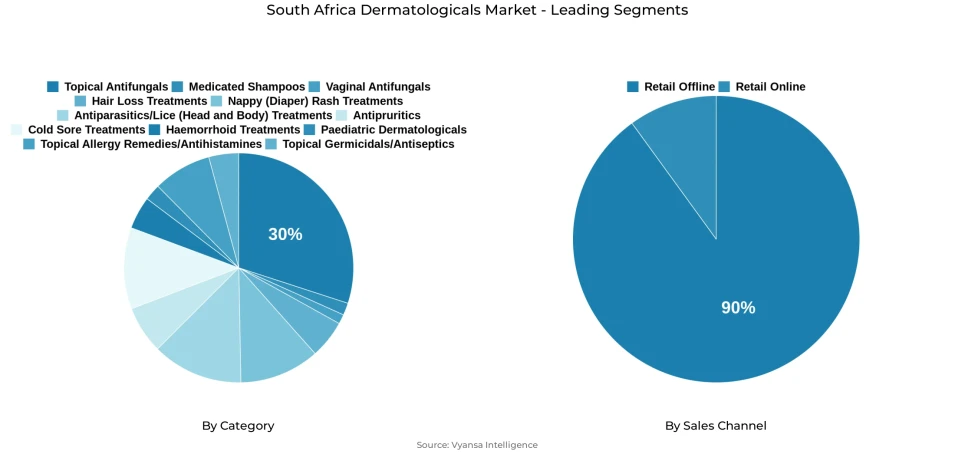

- Topical antifungals grabbed market share of 30%.

- Competition

- More than 20 companies are actively engaged in producing dermatologicals in South Africa.

- Top 5 companies acquired around 25% of the market share.

- GSK Consumer Healthcare; Technikon Laboratories (Pty) Ltd; Nativa (Pty) Ltd; Sanofi-Aventis South Africa (Pty) Ltd; Bayer (Pty) Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 90% of the market.

South Africa Dermatologicals Market Outlook

The South Africa dermatologicals market is set to expand from USD 140 million in 2025 to around USD 170 million in 2032 at a compound annual growth rate (CAGR) of 2.81%. The key driver for this market development is its stable demand for necessity products such as nappy rash products, topical antifungals, germididals, and antiparasitics. These products are still being significantly consumed. The nappy rash products will continue to show stable sales, with parents perceiving these products to be a necessity item for prevention rather than a medicinal item.

The relatively high incidence of skin-related diseases in South Africa also supports this segment. The warm climate, close-living patterns, as well as fungal infections caused because of moisture, propel a significant demand for topical antifungals, which currently account for a sales share of about 30% in this segment. The use of topical germicides/anti-septics also continues to be relevant, mainly because of minor cuts, burns, or rashes.

The major share in distribution is held by retail off-line distribution channels, accounting for around 90% of overall sales because pharmacies offer trusted expert advice. Many people prefer to take advice from pharmacists rather than dermatologists because of inaccessibility and high cost. This tendency helps reinforce the sales of dermatologicals through the pharmacy off-line distribution channel.

Digital influence is on the rise, though the offline world will continue to play an important role, owing to the need for guidance, product understanding, and affordability. Notwithstanding, stable demand across essential skincare treatments, as well as shifting consumption behavior, will offer moderate growth to this market over the forcast period.

South Africa Dermatologicals Market Growth DriverHigh Prevalence of Skin Conditions Boosts Demand

A large number of skin problems are also experienced in South Africa, making the region an important factor in boosting the demand for dermatological preparations. As per a report from the World Health Organization, fungal skin infections are one of the commonest types of skin diseases found in Sub-Saharan Africa because of high humidity and poor accessibility to early treatments .

end users, on the other hand, treat themselves for common infections in their homes in view of the constraints on expenses, thus making over-the-counter dermatologicals a primary necessity in the house. The requirement to manage athlete's foot, ringworm, as well as scalp infections ensures regular use of antidandruff preparations, of which the category has the highest share in the market at 30%.

South Africa Dermatologicals Market ChallengeThe Need for Access to Dermatologists is Low.

The availability of specialized care for dermatology is still a problem. The World Bank statistics show a meager 0.8 physicians per 1,000 for South Africa in 2022. Even fewer are specialized dermatologists whose costs make consultations unaffordable for most families; thus, most end users rarely consult healthcare services unless a situation becomes serious.

As a result, the dependence of South African end users on the guidance of pharmacists or personal choice results in treatment delays and the use of inappropriate items. Skin problems like eczema and fungal diseases can be exacerbated with the wrong formulations. Thus, the use of dermatology items with medical merit faces the constraint on the growth of the value of these items because they are substituted with beauty items.

South Africa Dermatologicals Market TrendIncreasing Trend in the Pharmacy-Dermed market

A notable emerging trend in the market is the increasing convergence between dermatological products and dermocosmetics. Nowadays, the Rising demand among retail pharmacies to feature dermatology-related brands is being observed due to the widespread popularity among end users. As reported by WHO, over 60% of the population in developing countries tend to self-treat skin disorders due to constraints on affordability and the need for viable non-healthcare alternatives. This is similar to the increasing acceptance among South Africans towards the usage of dermocosmetics.

end users often scour the shelves in pharmacies in search of dermatologist-recommended products, choosing more skin-friendly brands over medical-formulated products. Such products are less frightening in appearance, thus safe enough to be tested even by image-conscious end users. This behavior further enhances the power of pharmacies in the marketplace, further dictating the preference of end users towards skin-friendly products.

South Africa Dermatologicals Market OpportunityDeveloping A Culture of Preventative Skin Care

Preventive skin care represents a significant growth opportunity for the market, as end users in South Africa are increasingly prioritising proactive measures to address skin concerns. The WHO Africa Health Observatory points out increased health consciousness and adoption of self-care for African markets due to increased health education and dissemination of health information. This results in end users becoming conscious about purchasing skin care products to avoid complications with their skin.

Products ranging from germicidals, antifungals, and nappy rash creams will benefit most from this behavioral trend. Households purchase multiple units of products during promotional times. As awareness about health related to the scalp, irritation protection, and hygiene practices rises, brands requiring preventive solutions may see expanded occasions of use. This is because people will require protection rather than treatment.

South Africa Dermatologicals Market Segmentation Analysis

By Category

- Medicated Shampoos

- Topical Antifungals

- Vaginal Antifungals

- Hair Loss Treatments

- Nappy (Diaper) Rash Treatments

- Antiparasitics/Lice (Head and Body) Treatments

- Antipruritics

- Cold Sore Treatments

- Haemorrhoid Treatments

- Paediatric Dermatologicals

- Topical Allergy Remedies/Antihistamines

- Topical Germicidals/Antiseptics

The segment with highest market share under Category is topical Antifungals accounting for a share of nearly 30% market revenue. The leading market share of Topical Antifungals is primarily driven by the prominence of fungal infections such as athlete's foot, ringworm, and scalp irritation, which gets fueled by the warm climate and physically active lifestyle of people in South Africa.

Antifungal creams/sprays serve as a basic health sought-after item. Ease of access to these products through pharmacies adds to the positioning of the category. Many end users buy topical antifungals over the counter without consulting medical practitioners. This ensures a consistent stream of demand for the category, making the topical antifungals the most sought-after category during the forecasting period.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under sales channe is retail offline segment is the most prominent as far as sales channels are concerned and accounts for around 90% of overall sales. Pharmacies are currently the most trusted distribution chain for dermatological solutions because most people seek advice from a pharmacist because of a lack of availability of dermatologists in their vicinity.

Also, supermarkets are contributing significantly with easy accessibility for bulk purchases on a monthly basis, especially for key products such as nappy rash creams and antiseptics. Although there is a remarkable increase in retail online, offline sales are major because of end user preference for personal advice, instant availability, and verification of authenticity.

List of Companies Covered in South Africa Dermatologicals Market

The companies listed below are highly influential in the South Africa dermatologicals market, with a significant market share and a strong impact on industry developments.

- GSK Consumer Healthcare

- Technikon Laboratories (Pty) Ltd

- Nativa (Pty) Ltd

- Sanofi-Aventis South Africa (Pty) Ltd

- Bayer (Pty) Ltd

- Reckitt Benckiser South Africa (Pty) Ltd

- Johnson & Johnson (Pty) Ltd

- Aspen Pharmacare (Pty) Ltd

- Adcock Ingram Holdings Ltd

- Mundipharma (Pty) Ltd

Competitive Landscape

The dermatologicals market in South Africa in 2024 shows rising value sales across key categories, with strong performance from topical germicidals and antiseptics such as Zam-Buk and Dettol, topical allergy remedies like Phenergan, topical antifungals such as Lamisil, and antiparasitics/lice treatments including Para and Controlice, while nappy (diaper) rash treatments remain an essential purchase for parents who frequently stock up as a preventive measure. Private label plays an increasingly competitive role as price-sensitive consumers facing rising living costs seek more affordable alternatives to leading brands. Pharmacies retain dominance in distribution due to consumers’ reliance on pharmacists’ product recommendations, reinforcing brand familiarity and trust, while supermarkets provide convenience but remain secondary in influence within dermatological purchasing decisions.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. South Africa Dermatologicals Market Policies, Regulations, and Standards

4. South Africa Dermatologicals Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. South Africa Dermatologicals Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Medicated Shampoos- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Topical Antifungals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Vaginal Antifungals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Hair Loss Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Nappy (Diaper) Rash Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Antiparasitics/Lice (Head and Body) Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Antipruritics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Cold Sore Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.9. Haemorrhoid Treatments- Market Insights and Forecast 2022-2032, USD Million

5.2.1.10. Paediatric Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.11. Topical Allergy Remedies/Antihistamines- Market Insights and Forecast 2022-2032, USD Million

5.2.1.12. Topical Germicidals/Antiseptics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Dispensing Status

5.2.2.1. Prescription-based Drugs- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Over-the-counter Drugs- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Route of Administration

5.2.3.1. Topical Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Oral Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Parenteral Administration- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Drug Type

5.2.4.1. Branded- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Generics- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Skin Condition

5.2.5.1. Acne- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Dermatitis- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Psoriasis- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Skin Cancer- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Rosacea- Market Insights and Forecast 2022-2032, USD Million

5.2.5.6. Alopecia- Market Insights and Forecast 2022-2032, USD Million

5.2.5.7. Fungal Infections- Market Insights and Forecast 2022-2032, USD Million

5.2.5.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Hospitals- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Cosmetic Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Dermatology Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.6.4. Homecare- Market Insights and Forecast 2022-2032, USD Million

5.2.6.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Region

5.2.8.1. Gauteng

5.2.8.2. Western Cape

5.2.8.3. Eastern Cape

5.2.8.4. North West

5.2.8.5. Others

5.2.9.By Competitors

5.2.9.1. Competition Characteristics

5.2.9.2. Market Share & Analysis

6. South Africa Medicated Shampoos Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. South Africa Topical Antifungals Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. South Africa Vaginal Antifungals Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. South Africa Hair Loss Treatments Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Drug Type- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. South Africa Nappy (Diaper) Rash Treatments Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. South Africa Antiparasitics/Lice (Head and Body) Treatments Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. South Africa Antipruritics Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. South Africa Cold Sore Treatments Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. South Africa Haemorrhoid Treatments Market Statistics, 2022-2032

14.1. Market Size & Growth Outlook

14.1.1. By Revenues in USD Million

14.2. Market Segmentation & Growth Outlook

14.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

14.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

14.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

14.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

14.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

14.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

15. South Africa Paediatric Dermatologicals Market Statistics, 2022-2032

15.1. Market Size & Growth Outlook

15.1.1. By Revenues in USD Million

15.2. Market Segmentation & Growth Outlook

15.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

15.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

15.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

15.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

15.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

15.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

16. South Africa Topical Allergy Remedies/Antihistamines Market Statistics, 2022-2032

16.1. Market Size & Growth Outlook

16.1.1. By Revenues in USD Million

16.2. Market Segmentation & Growth Outlook

16.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

16.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

16.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

16.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

16.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

16.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

17. South Africa Topical Germicidals/Antiseptics Market Statistics, 2022-2032

17.1. Market Size & Growth Outlook

17.1.1. By Revenues in USD Million

17.2. Market Segmentation & Growth Outlook

17.2.1. By Dispensing Status- Market Insights and Forecast 2022-2032, USD Million

17.2.2. By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

17.2.3. By Drug Type- Market Insights and Forecast 2022-2032, USD Million

17.2.4. By Skin Condition- Market Insights and Forecast 2022-2032, USD Million

17.2.5. By End User- Market Insights and Forecast 2022-2032, USD Million

17.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

18. Competitive Outlook

18.1. Company Profiles

18.1.1. Sanofi-Aventis South Africa (Pty) Ltd

18.1.1.1. Business Description

18.1.1.2. Product Portfolio

18.1.1.3. Collaborations & Alliances

18.1.1.4. Recent Developments

18.1.1.5. Financial Details

18.1.1.6. Others

18.1.2. Bayer (Pty) Ltd

18.1.2.1. Business Description

18.1.2.2. Product Portfolio

18.1.2.3. Collaborations & Alliances

18.1.2.4. Recent Developments

18.1.2.5. Financial Details

18.1.2.6. Others

18.1.3. Reckitt Benckiser South Africa (Pty) Ltd

18.1.3.1. Business Description

18.1.3.2. Product Portfolio

18.1.3.3. Collaborations & Alliances

18.1.3.4. Recent Developments

18.1.3.5. Financial Details

18.1.3.6. Others

18.1.4. Johnson & Johnson (Pty) Ltd

18.1.4.1. Business Description

18.1.4.2. Product Portfolio

18.1.4.3. Collaborations & Alliances

18.1.4.4. Recent Developments

18.1.4.5. Financial Details

18.1.4.6. Others

18.1.5. Aspen Pharmacare (Pty) Ltd

18.1.5.1. Business Description

18.1.5.2. Product Portfolio

18.1.5.3. Collaborations & Alliances

18.1.5.4. Recent Developments

18.1.5.5. Financial Details

18.1.5.6. Others

18.1.6. GSK Consumer Healthcare

18.1.6.1. Business Description

18.1.6.2. Product Portfolio

18.1.6.3. Collaborations & Alliances

18.1.6.4. Recent Developments

18.1.6.5. Financial Details

18.1.6.6. Others

18.1.7. Technikon Laboratories (Pty) Ltd

18.1.7.1. Business Description

18.1.7.2. Product Portfolio

18.1.7.3. Collaborations & Alliances

18.1.7.4. Recent Developments

18.1.7.5. Financial Details

18.1.7.6. Others

18.1.8. Nativa (Pty) Ltd

18.1.8.1. Business Description

18.1.8.2. Product Portfolio

18.1.8.3. Collaborations & Alliances

18.1.8.4. Recent Developments

18.1.8.5. Financial Details

18.1.8.6. Others

18.1.9. Adcock Ingram Holdings Ltd

18.1.9.1. Business Description

18.1.9.2. Product Portfolio

18.1.9.3. Collaborations & Alliances

18.1.9.4. Recent Developments

18.1.9.5. Financial Details

18.1.9.6. Others

18.1.10. Mundipharma (Pty) Ltd

18.1.10.1.Business Description

18.1.10.2.Product Portfolio

18.1.10.3.Collaborations & Alliances

18.1.10.4.Recent Developments

18.1.10.5.Financial Details

18.1.10.6.Others

19. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Dispensing Status |

|

| By Route of Administration |

|

| By Drug Type |

|

| By Skin Condition |

|

| By End User |

|

| By Sales Channel |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.