Global Animal Regenerative Therapies Market Report: Trends, Growth and Forecast (2026-2032)

By Therapy Type (Stem Cell Therapy (Adipose-derived stem cells, Bone marrow-derived stem cells, Umbilical cord-derived stem cells, Peripheral blood stem cells), Platelet-Rich Plasma (PRP) Therapy, Gene Therapy, Tissue Engineering), By Animal Type (Companion Animals (Dogs, Cats, Horses, Others), Livestock Animals (Cattle, Pigs, Sheep, Poultry, Others), Others), By Application (Orthopedic Conditions (Osteoarthritis, Tendon and ligament injuries, Fractures, Joint disorders), Wound Healing, Cardiovascular Conditions, Neurological Disorders, Dermatological Conditions, Ophthalmology, Dental Applications, Others), By End User (Veterinary Hospitals and Clinics, Veterinary Research Institutes, Academic and Research Organizations, Animal Rehabilitation Centers, Others), By Distribution Channel (Direct Sales, Veterinary Distributors, Online Platforms, Retail Veterinary Pharmacies), By Region (North America, South America, Europe, Middle East & Africa, Asia Pacific)

- Healthcare

- Jan 2026

- VI0846

- 220

-

Global Animal Regenerative Therapies Market Statistics and Insights, 2026

- Market Size Statistics

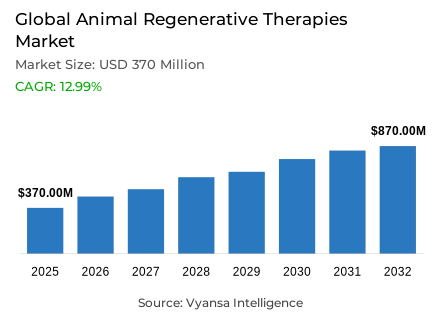

- Global animal regenerative therapies market is estimated at USD 370 million in 2025.

- The market size is expected to grow to USD 870 million by 2032.

- Market to register a CAGR of around 12.99% during 2026-32.

- Therapy Type Shares

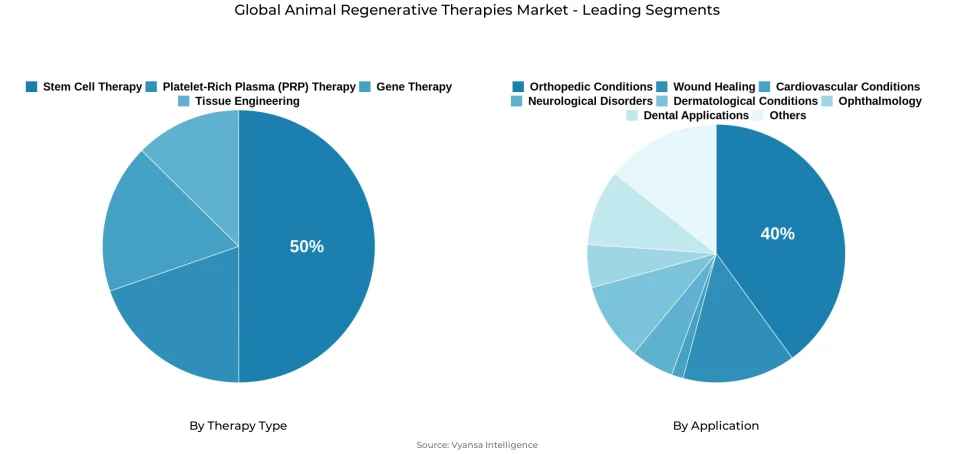

- Stem cell therapy grabbed market share of 50%.

- Competition

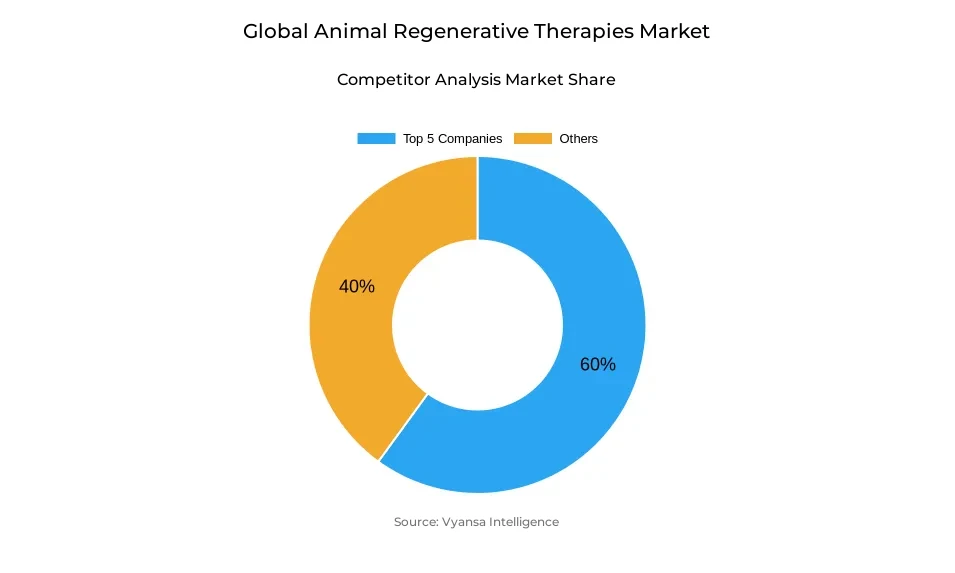

- Global animal regenerative therapies market is currently being catered to by more than 25 companies.

- Top 5 companies acquired around 60% of the market share.

- Integra Lifesciences; Enso Discoveries; Animal Cell Therapies Inc.; Zoetis; Boehringer Ingelheim International GmbH etc., are few of the top companies.

- Application

- Orthopedic conditions grabbed 40% of the market.

- Region

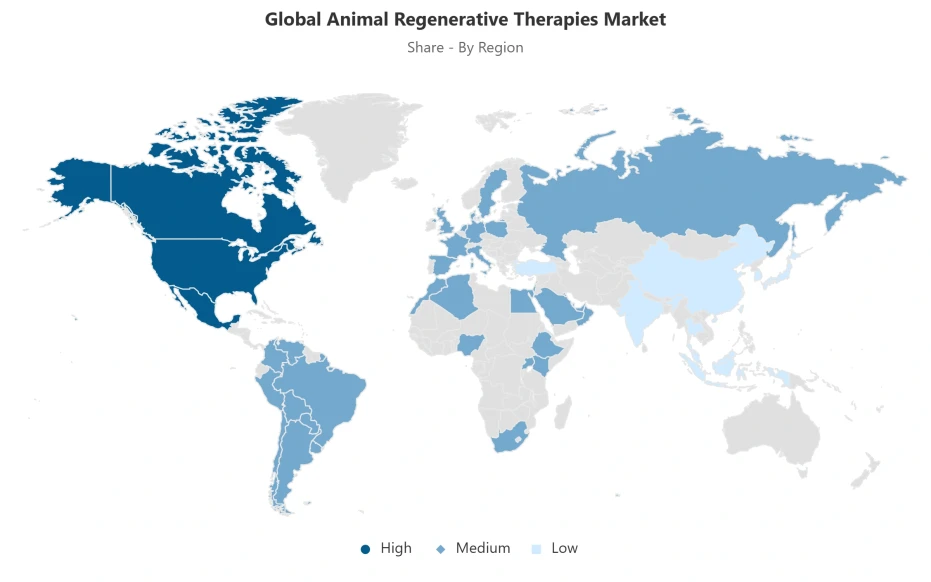

- North America leads with a 40% share of the global market.

Global Animal Regenerative Therapies Market Outlook

The global animal regenerative therapies market analysis, the market was measured at USD 370 million in 2025. However, the market is estimated to reach USD 870 million by the year 2032, with the market growing at a CAGR of nearly 12.99% during the estimated period of 2026-2032. Notably, the market witnesses significant support in terms of increased pet ownership in established markets, where pet owners are increasingly focusing on animal health. Additionally, in the US market alone, 94 million households had pet ownership in 2025. Furthermore, the expenditures associated with the US pet industry had reached USD 152 billion in 2024.

Despite immense interest, treatment costs and insurance availability remain significant barriers to adoption, to some extent, confining it to only rich pet owners. More than 96% of pet owners in North America still do not have access to insurance for advanced therapies. Lack of uniform treatment protocols in various geographical areas, though limited infrastructure in remote areas, hinders large-scale adoption. But reforms in policies at the FDA level boost confidence in this treatment method, authenticating it to be completely safe and successful.

Regenerative therapies are also reaching other diseases besides orthopedic disorders. currently dominates the use of regenerative therapies with a 40% share of the market due to the high prevalence of degenerative joint disorders and the rising interest in treatments that cure instead of covering up the symptoms. Other therapeutic uses with great promise include the treatment of intractable feline chronic gingivostomatitis.

Stem cells are leading in terms of type with 50% market share. They have strong clinical proof and focused investments. North America is a leading region in the overall market with a 40% share. Well-developed veterinary infrastructure and focused investments are major drivers in this region. With increasing numbers of regulatory approvals and clinical evidence, there will be a steady increase in the adoption of regenerative therapies until 2032.

Global Animal Regenerative Therapies Market Growth Driver

Expanding Pet Ownership and Rising Veterinary Expenditures Fuel Market Growth

Pet ownership in mature markets grows steadily, as 94 million American households kept at least one pet as of 2025, 68 million households owned a dog, and 49 million owned a cat. The total spending on pets in the U.S. pet industry reached $152 billion as of 2024, and $39.8 billion was directly assigned to spending and product sales within vet practices. The fact that a considerable number of stakeholders display such dedication to pet health suggests that there is ample room for even sophisticated technological advancements, considering their application in regeneration and healing.

Personal expenditures for pet care also reflect this. Pet owners annually spend between 1,600 and 3,000 dollars on their pets, including veterinary care. Cat owners also spend 310 dollars annually on food and 253 dollars per year regarding veterinary services. This, combined with the rising global pet population and the rising expenditure of the global middle class regarding pet healthcare, results in steady demand for innovative pet treatments. This provides a strong economic base for the uptake of high-end innovative regenerative therapies directed at chronic conditions, hence a steady rise in the global animal regenerative therapy market.

Global Animal Regenerative Therapies Market Challenge

High Costs and Limited Insurance Hinder Treatment Accessibility

An important factor is the high cost of regenerative treatments, wherein the manufacturing complexity associated with these therapies leads to costs of treatment going beyond the affordability of the general population of consumers. This is further accentuated by the limitations of insurance coverage in 2024 for only 3.69% of United States and 3.52% of Canadian pet owners having an active pet insurance policy; this results in fewer than 96% of North American pet owners having no financial assistance for experimental and cell-based regenerative treatments.

Regional differences add to these limitations, especially when focusing on areas that lack the development of veterinary services and the availability of regenerative medicine facilities. The lack of normalized treatment practices and the absence of associated insurance coverage practices deters both the practitioners and the end-users from opting for the advanced treatment. These limitations in the treatment delivery are hindering the accessibility of the market only to the affluent pet owners and are thus restricting the growth of the overall pet regenerative medicine market.

Global Animal Regenerative Therapies Market Trend

Regulatory Milestones Accelerate Market Adoption

The environment surrounding animal regenerative therapies has been aggressively moving ahead, with several drug approvals allowing for its ease of commercialization. Back in September 2025, Gallant reported that a “Technical Section Complete” letter has been obtained for Reasonable Expectation of Effectiveness by the Center for Veterinary Medicine from sonruvetcel, which is a uterine-derived allogeneic mesenchymal stromal cell therapeutic for refractory feline chronic gingivostomatitis. Around the same time, Target Animal Safety studies verified 365-day safety, providing an opportunity for conditional approval by early 2026.

There also appears to be clinical support for approval as Gallant’s pivotal study resulted in more than 75% of treated cats experiencing a meaningful improvement in quality of life by day 90 while nearly half presenting measurable lesion improvement without a single serious adverse event. The accumulation of both positive trial results as well as regulatory and FDA approval will go far in increasing practitioner confidence in the new technology. Consumers will also rapidly adopt regenerative medicine as regulatory approvals continue to add up.

Global Animal Regenerative Therapies Market Opportunity

Emerging Therapeutic Applications Address Unmet Medical Needs

Regenerative therapies also continue to move from orthopedic applications into other therapeutic areas with a substantially large demand for treatment. In refractive feline chronic gingivostomatitis (FCGS) alone, for instance, the disorder influences about 26% of pet cats worldwide with very little effectiveness using mainstream therapy approaches. The success demonstrated by Gallant in a clinical trial involving over 75% of treated feline patients realizing effective improvement beyond initial therapy failure indicates the capability of regenerative therapy to fill major treatment gaps in the pet health area.

Development pipelines are also increasingly addressing situations in which traditional treatments are largely symptomatic, rather than addressing pathophysiology. This further reflects the clinical flexibility of these technologies, indicating potential in various chronic diseases in companion animals, in addition to their original intention in an orthopedic capacity. The prevalence of diseases, lack of effectiveness for alternative treatments, and their clinical success make these opportunities highly attractive in a commercial and clinical sense. The centralization of investment capital in developing these regenerative therapies indicates that these developing areas are perceived as important market-expanding opportunities.

Global Animal Regenerative Therapies Market Regional Analysis

By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific

North America holds approximately 40% of the global animal regenerative therapies market, supported by its extensive network of specialty veterinary hospitals, advanced clinical research institutions, and well-established regulatory pathways for cell and tissue-based products. The region benefits from a large base of trained veterinary specialists who are equipped to administer regenerative procedures, allowing for faster adoption compared to regions where trained professionals and specialized facilities remain limited. Robust collaboration among biotech developers, academic institutions, and veterinary clinics further strengthens innovation pipelines and accelerates translation of regenerative science into clinical practice.

Regulatory clarity provided by agencies such as the FDA and USDA offers structured approval pathways that encourage investment and product development. North America also hosts a dense concentration of clinical trials that generate the evidence practitioners rely on for integrating new regenerative modalities into treatment protocols. While Asia Pacific and parts of Europe are gradually expanding capabilities, they continue to face infrastructural and regulatory delays. North America's combination of clinical expertise, regulatory maturity, and strong innovation networks ensures continued regional leadership as global adoption widens.

Global Animal Regenerative Therapies Market Segmentation Analysis

By Therapy Type

- Stem Cell Therapy

- Platelet-Rich Plasma (PRP) Therapy

- Gene Therapy

- Tissue Engineering

Stem cell therapy dominates the therapy type segment, capturing approximately 50% of market share. This leadership reflects robust clinical evidence supporting efficacy across diverse companion animal conditions, coupled with concentrated investment in research and development. Mesenchymal stem cells sourced from adipose tissue, bone marrow, and uterine tissue are widely applied in treating orthopedic disorders, soft tissue injuries, and emerging conditions such as feline chronic gingivostomatitis. The combination of scientific validation and targeted investment underpins stem cell therapy’s market preeminence.

Alternative modalities, including platelet-rich plasma (PRP) therapies and tissue engineering, represent smaller segments. PRP offers less invasive administration and shorter treatment timelines but exhibits limited efficacy for complex degenerative conditions. Tissue engineering continues progressing toward clinical use but has not achieved substantial penetration. Regulatory approvals, clinical trials, and investment concentration around stem cell therapies indicate that this modality will maintain dominant market share, driving the overall trajectory of the global animal regenerative therapies market.

By Application

- Orthopedic Conditions

- Wound Healing

- Cardiovascular Conditions

- Neurological Disorders

- Dermatological Conditions

- Ophthalmology

- Dental Applications

- Others

End users increasingly seek regenerative therapies for orthopedic conditions due to their potential to restore cartilage integrity, reduce inflammation through cellular mechanisms, and support tissue repair. Clinical trials provide evidence of functional improvement, reinforcing adoption by veterinary practitioners. These therapeutic advantages, combined with substantial disease burden and increasing awareness among pet owners, ensure orthopedic applications remain the primary driver of current market activity within the regenerative therapies sector.

Market Players in Global Animal Regenerative Therapies Market

These market players maintain a significant presence in the Global animal regenerative therapies market sector and contribute to its ongoing evolution.

- Integra Lifesciences

- Enso Discoveries

- Animal Cell Therapies Inc.

- Zoetis

- Boehringer Ingelheim International GmbH

- Dechra Pharmaceuticals PLC

- VetStem Inc.

- Ardent Animal Health

- Vetherapy

- Medrego

- Vetbiologics

- Celavet Inc.

- Magellan Stem Cells

- Equine Amnio Solutions

- Hilltop Bio/Hilltop Biosciences

Market News & Updates

- VetStem Inc., 2025:

VetStem Inc. announced additional funding in March 2025 to support the FDA’s conditional approval pathway for its allogeneic stem cell therapy StemStat™ Ortho, intended for canine osteoarthritis. If approved, StemStat™ Ortho would become the first FDA-approved off-the-shelf allogeneic stem cell therapy in veterinary medicine. This marks a major shift from autologous treatments toward scalable allogeneic solutions, positioning the therapy to address a market opportunity estimated at over USD 1 billion in regenerative treatments for companion animals.

- Zoetis, 2025:

Zoetis entered a consulting partnership with Infosys in June 2025 to expand AI-driven automation within its global IT and digital operations. The collaboration supports Zoetis’ strategy to integrate AI-enabled diagnostics, automated treatment monitoring, and digital workflow optimization across its veterinary therapeutics and regenerative medicine portfolio. This strengthened digital infrastructure is expected to enhance precision diagnostics, predictive analytics, and regenerative therapy delivery for both companion and livestock animals.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Global Animal Regenerative Therapies Market Policies, Regulations, and Standards

4. Global Animal Regenerative Therapies Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Global Animal Regenerative Therapies Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Therapy Type

5.2.1.1. Stem Cell Therapy- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Adipose-derived stem cells- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Bone marrow-derived stem cells- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Umbilical cord-derived stem cells- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Peripheral blood stem cells- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Platelet-Rich Plasma (PRP) Therapy- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Gene Therapy- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Tissue Engineering- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Animal Type

5.2.2.1. Companion Animals- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.1. Dogs- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.2. Cats- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.3. Horses- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Livestock Animals- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.1. Cattle- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.2. Pigs- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.3. Sheep- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.4. Poultry- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Application

5.2.3.1. Orthopedic Conditions- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.1. Osteoarthritis- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.2. Tendon and ligament injuries- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.3. Fractures- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.4. Joint disorders- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Wound Healing- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cardiovascular Conditions- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Neurological Disorders- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Dermatological Conditions- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Ophthalmology- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Dental Applications- Market Insights and Forecast 2022-2032, USD Million

5.2.3.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By End User

5.2.4.1. Veterinary Hospitals and Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Veterinary Research Institutes- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Academic and Research Organizations- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Animal Rehabilitation Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Distribution Channel

5.2.5.1. Direct Sales- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Veterinary Distributors- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Online Platforms- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Retail Veterinary Pharmacies- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Region

5.2.6.1. North America

5.2.6.2. South America

5.2.6.3. Europe

5.2.6.4. Middle East & Africa

5.2.6.5. Asia Pacific

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. North America Animal Regenerative Therapies Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Animal Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Country

6.2.6.1. US

6.2.6.2. Canada

6.2.6.3. Mexico

6.2.6.4. Rest of North America

6.3. US Animal Regenerative Therapies Market Statistics, 2022-2032F

6.3.1.Market Size & Growth Outlook

6.3.1.1. By Revenues in USD Million

6.3.2.Market Segmentation & Growth Outlook

6.3.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

6.3.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

6.4. Canada Animal Regenerative Therapies Market Statistics, 2022-2032F

6.4.1.Market Size & Growth Outlook

6.4.1.1. By Revenues in USD Million

6.4.2.Market Segmentation & Growth Outlook

6.4.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

6.4.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

6.5. Mexico Animal Regenerative Therapies Market Statistics, 2022-2032F

6.5.1.Market Size & Growth Outlook

6.5.1.1. By Revenues in USD Million

6.5.2.Market Segmentation & Growth Outlook

6.5.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

6.5.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

7. South America Animal Regenerative Therapies Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Animal Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Country

7.2.6.1. Brazil

7.2.6.2. Argentina

7.2.6.3. Rest of South America

7.3. Brazil Animal Regenerative Therapies Market Statistics, 2022-2032F

7.3.1.Market Size & Growth Outlook

7.3.1.1. By Revenues in USD Million

7.3.2.Market Segmentation & Growth Outlook

7.3.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

7.3.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

7.4. Argentina Animal Regenerative Therapies Market Statistics, 2022-2032F

7.4.1.Market Size & Growth Outlook

7.4.1.1. By Revenues in USD Million

7.4.2.Market Segmentation & Growth Outlook

7.4.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

7.4.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

8. Europe Animal Regenerative Therapies Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Animal Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Country

8.2.6.1. Germany

8.2.6.2. UK

8.2.6.3. France

8.2.6.4. Italy

8.2.6.5. Spain

8.2.6.6. Rest of Europe

8.3. Germany Animal Regenerative Therapies Market Statistics, 2022-2032F

8.3.1.Market Size & Growth Outlook

8.3.1.1. By Revenues in USD Million

8.3.2.Market Segmentation & Growth Outlook

8.3.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

8.3.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

8.4. UK Animal Regenerative Therapies Market Statistics, 2022-2032F

8.4.1.Market Size & Growth Outlook

8.4.1.1. By Revenues in USD Million

8.4.2.Market Segmentation & Growth Outlook

8.4.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

8.4.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

8.5. France Animal Regenerative Therapies Market Statistics, 2022-2032F

8.5.1.Market Size & Growth Outlook

8.5.1.1. By Revenues in USD Million

8.5.2.Market Segmentation & Growth Outlook

8.5.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

8.5.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

8.6. Italy Animal Regenerative Therapies Market Statistics, 2022-2032F

8.6.1.Market Size & Growth Outlook

8.6.1.1. By Revenues in USD Million

8.6.2.Market Segmentation & Growth Outlook

8.6.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

8.6.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

8.7. Spain Animal Regenerative Therapies Market Statistics, 2022-2032F

8.7.1.Market Size & Growth Outlook

8.7.1.1. By Revenues in USD Million

8.7.2.Market Segmentation & Growth Outlook

8.7.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

8.7.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

9. Middle East & Africa Animal Regenerative Therapies Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Animal Type- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Country

9.2.6.1. GCC

9.2.6.2. South Africa

9.2.6.3. Rest of Middle East & Africa

9.3. GCC Animal Regenerative Therapies Market Statistics, 2022-2032F

9.3.1.Market Size & Growth Outlook

9.3.1.1. By Revenues in USD Million

9.3.2.Market Segmentation & Growth Outlook

9.3.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

9.3.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

9.4. South Africa Animal Regenerative Therapies Market Statistics, 2022-2032F

9.4.1.Market Size & Growth Outlook

9.4.1.1. By Revenues in USD Million

9.4.2.Market Segmentation & Growth Outlook

9.4.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

9.4.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

10. Asia Pacific Animal Regenerative Therapies Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Country

10.2.6.1. China

10.2.6.2. Japan

10.2.6.3. India

10.2.6.4. Australia

10.2.6.5. South Korea

10.2.6.6. Rest of Asia Pacific

10.3. China Animal Regenerative Therapies Market Statistics, 2022-2032F

10.3.1. Market Size & Growth Outlook

10.3.1.1. By Revenues in USD Million

10.3.2. Market Segmentation & Growth Outlook

10.3.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

10.3.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

10.4. Japan Animal Regenerative Therapies Market Statistics, 2022-2032F

10.4.1. Market Size & Growth Outlook

10.4.1.1. By Revenues in USD Million

10.4.2. Market Segmentation & Growth Outlook

10.4.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

10.4.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

10.5. India Animal Regenerative Therapies Market Statistics, 2022-2032F

10.5.1. Market Size & Growth Outlook

10.5.1.1. By Revenues in USD Million

10.5.2. Market Segmentation & Growth Outlook

10.5.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

10.5.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

10.6. Australia Animal Regenerative Therapies Market Statistics, 2022-2032F

10.6.1. Market Size & Growth Outlook

10.6.1.1. By Revenues in USD Million

10.6.2. Market Segmentation & Growth Outlook

10.6.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

10.6.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

10.7. South Korea Animal Regenerative Therapies Market Statistics, 2022-2032F

10.7.1. Market Size & Growth Outlook

10.7.1.1. By Revenues in USD Million

10.7.2. Market Segmentation & Growth Outlook

10.7.2.1. By Therapy Type- Market Insights and Forecast 2022-2032, USD Million

10.7.2.2. By Animal Type- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. Zoetis

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Boehringer Ingelheim International GmbH

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Dechra Pharmaceuticals PLC

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. VetStem Inc.

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Ardent Animal Health

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Integra Lifesciences

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Enso Discoveries

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Animal Cell Therapies Inc.

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. Vetherapy

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Medrego

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

11.1.11. Vetbiologics

11.1.11.1.Business Description

11.1.11.2.Product Portfolio

11.1.11.3.Collaborations & Alliances

11.1.11.4.Recent Developments

11.1.11.5.Financial Details

11.1.11.6.Others

11.1.12. Celavet Inc.

11.1.12.1.Business Description

11.1.12.2.Product Portfolio

11.1.12.3.Collaborations & Alliances

11.1.12.4.Recent Developments

11.1.12.5.Financial Details

11.1.12.6.Others

11.1.13. Magellan Stem Cells

11.1.13.1.Business Description

11.1.13.2.Product Portfolio

11.1.13.3.Collaborations & Alliances

11.1.13.4.Recent Developments

11.1.13.5.Financial Details

11.1.13.6.Others

11.1.14. Equine Amnio Solutions

11.1.14.1.Business Description

11.1.14.2.Product Portfolio

11.1.14.3.Collaborations & Alliances

11.1.14.4.Recent Developments

11.1.14.5.Financial Details

11.1.14.6.Others

11.1.15. Hilltop Bio/Hilltop Biosciences

11.1.15.1.Business Description

11.1.15.2.Product Portfolio

11.1.15.3.Collaborations & Alliances

11.1.15.4.Recent Developments

11.1.15.5.Financial Details

11.1.15.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Therapy Type |

|

| By Animal Type |

|

| By Application |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.