Singapore Herbal/Traditional Products Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Topical Analgesics, Sleep Aids, Cough, Cold & Allergy Remedies, Digestive Remedies, Dermatologicals, Paediatric Dietary Supplements, Dietary Supplements, Tonics), By Form (Capsules/Tablets, Powder, Syrups, Oils & Ointments, Others), By Health Benefit (General Wellness, Cardiovascular Health, Cognitive & Mental Health, Digestive & Gut Health, Immunity Support, Respiratory Health, Bone & Joint Health, Others), By Source (Leaves, Roots, Barks, Flowers, Seeds, Others), By Ingredient Type (Single-Herb Products, Multi-Herb Products), By Function (Preventive Care, Curative/Relief Care), By End User (Adults, Geriatric Population, Children), By Prescription Type (Over-the-Counter (OTC), Prescription Herbal Medicines), By Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

Singapore Herbal/Traditional Products Market Statistics and Insights, 2026

- Market Size Statistics

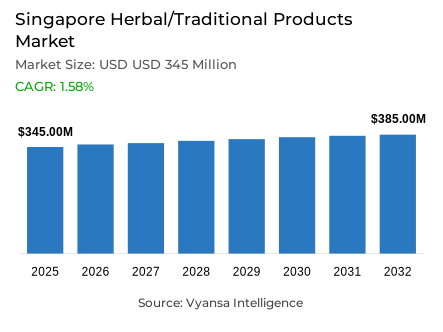

- Herbal/traditional products in Singapore is estimated at USD 345 million in 2025.

- The market size is expected to grow to USD 385 million by 2032.

- Market to register a cagr of around 1.58% during 2026-32.

- Category Shares

- Dietary supplements grabbed market share of 55%.

- Competition

- More than 20 companies are actively engaged in producing herbal/traditional products in Singapore.

- Top 5 companies acquired around 20% of the market share.

- Haw Par Healthcare Ltd; Nin Jiom Medicine Mfy (S) Pte Ltd; Korea Ginseng Corp; Ricola Asia Pacific Pte Ltd; Lofthouse of Fleetwood Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Singapore Herbal/Traditional Products Market Outlook

The Singapore herbal/traditional products market will experience consistent growth over the forcastperiod, which will be supported by strong cultural confidence in traditional remedies and a growing inclination of end users towards natural health remedies. The market value of 2025 is estimated to be USD 345 million, with a wide product range that encompasses herbal topical analgesics, traditional tonics, cough and cold products, and dietary supplements. Many Singaporean end users, especially older adults and those who are already conversant with Traditional Chinese Medicine (TCM), still show a dependency on herbal remedies to maintain their daily wellness and treat minor illnesses, which is indicative of the strong legacy of traditional healthcare practices in the national setting.

Dietary supplements represent about 55% of the total market share across product categories, with the growth of multifunctional wellness products combining herbal ingredients with vitamins and minerals. These are targeted at end users who want preventive health benefits and holistic well-being, and blended products containing ginseng, ashwagandha, and botanical extracts are becoming more popular than single-ingredient products because they are perceived to be more convenient and offer a wider range of health benefits.

The retail distribution is still largely defined by offline modalities, and offline retail generates about 70% of market revenue. Pharmacies, health food stores, traditional remedy stores, and specialist wellness retailers are crucial in product availability and professional advice. End users who require personalised consultation on pain relief and long-term health management are especially appreciative of these trusted physical channels. Simultaneously, the electronic commerce platforms are slowly expanding the market, particularly in niche, premium, and imported herbal products.

The market is expected to grow to USD 385 million by 2032, which is a compound annual growth rate of about 1.58% in the 2026–2032 forecast period. Demographic changes, such as an ageing population structure, with almost a quarter of the population aged 65 years and older, and a long-term interest in preventive health solutions, will support growth trajectories. Conventional topical analgesics, immune-support preparations, and multifunctional dietary supplements will continue to be fundamental demand drivers within end-user segments.

Singapore Herbal/Traditional Products Market Growth DriverGrowing Ageing Population and Preventive Health Focus

The market shows a strong growth due to the ageing population structure in Singapore that is increasingly demanding safe, familiar, and culturally trusted methods of dealing with minor health conditions. By 2025, 20.7% of the population will be aged 65 years and older, a demographic group with a higher likelihood of musculoskeletal pain and chronic tension, which will justify the demand of traditional topical analgesics and herbal wellness products. It is estimated that Singapore will become a super-aged society in 2026, which supports the significance of preventive health measures and chronic disease management as the key pillars of market growth in the long term.

This population shift is supported by an increasing focus on holistic well-being practices and preventive health behaviours. The availability of 2,253 licensed TCM physicians and 260 acupuncturists, which are controlled by the Traditional Chinese Medicine Practitioners Board, indicates the strong institutional base of the integration of traditional medicine into the larger healthcare ecosystem. Studies on the behavioural trends in healthcare reveal that many adult end users are integrating TCM with traditional medical services, which are backed by formal regulatory controls and well-organized professional training systems.

Singapore Herbal/Traditional Products Market ChallengeRegulatory and Safety Concerns Impacting Trust

The market is facing significant issues associated with end-user concerns regarding product safety, transparency, and regulatory compliance frameworks. The Health Sciences Authority (HSA) imposes strict safety requirements on traditional medicinal materials, such as maximum allowable concentration levels of heavy metals and bans on the use of undeclared medicinal components, including steroids. These regulatory measures include extensive testing procedures of contaminants, adulterants, and microbiological hazards to protect the health outcomes of the population.

Even with these regulatory measures, there have been isolated cases of products with undeclared pharmaceutical substances, which have increased the level of caution among end-user groups. In April 2023, HSA found herbal products sold as pain and cough relief falsely labeled as natural formulations but containing strong medicinal ingredients, which had severe adverse health effects. These instances, which are usually associated with informal cross-border or online distribution channels, underscore deficiencies in end-user trust. Also, differences in product labelling norms and perceived uncertainty in efficacy claims may create scepticism among evidence-based end users, which poses obstacles to wider market adoption and penetration.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Singapore Herbal/Traditional Products Market TrendGrowing Consumer Interest in Holistic Wellness

The market shows a strong trend that is marked by a growing interest in holistic wellness and integrated health practices. The strong institutional and professional framework of Singapore, such as 2,253 licensed TCM physicians and 260 acupuncturists in practice, supports the continued confidence in traditional medicine modalities and supports its contribution to end-user wellness behaviours. The cultural applicability of herbal remedies and TCM still resonates with end users who want to use complementary methods of self-care in addition to standard medical treatment regimens.

This tendency is also supported by the increased involvement in fitness and well-being programmes and lifestyle-oriented health programs. The younger and middle-aged adult populations are moving towards the use of herbal dietary supplements aimed at energy boosting, immunity, and stress reduction, and multifunctional formulations are well suited to daily habits and the lifestyle requirements. These trends are indicative of a wider shift to integrated health management systems, in which natural and traditional products operate in parallel with contemporary healthcare delivery systems.

Singapore Herbal/Traditional Products Market OpportunityRetail online Expansion and Product Innovation

There is significant business potential in capitalizing on electronic commerce infrastructure and product innovation to reinforce market penetration, especially in younger, digitally active end-user markets. Online channels allow increased access to niche, premium, and specialised herbal formulations that might show poor offline retail presence. Increased access to product information, user review systems, and ingredient transparency offered by digital platforms also contribute to informed buying behavior and alleviate trust issues.

Another growth opportunity is product innovation, particularly in the form of multifunctional dietary supplements, which are a combination of herbal extracts and vitamins and minerals. These combined formulations are attractive to end users who want convenience, efficiency and holistic health benefits in one product format. With the wellness ecosystem in Singapore still developing with strong regulatory oversight frameworks, cross-category formulations and digital engagement strategies are likely to drive demand outside of the conventional use cases and application scenarios.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Singapore Herbal/Traditional Products Market Segmentation Analysis

By Category

- Topical Analgesics

- Sleep Aids

- Cough, Cold & Allergy Remedies

- Digestive Remedies

- Dermatologicals

- Paediatric Dietary Supplements

- Dietary Supplements

- Tonics

Dietary supplements constitute the dominant category segment, accounting for approximately 55% of the Singapore herbal/traditional products market. These products perform central roles in preventive health strategies, supporting immune function, energy levels, and overall wellbeing objectives. Numerous supplement formulations combine herbal extracts such as ginseng and ashwagandha with essential vitamins and minerals, creating multifunctional preparations that appeal to wellness-oriented end users and individuals with demanding lifestyle requirements.

Singapore's multicultural population composition particularly end users with Chinese cultural heritage—demonstrates substantial familiarity with botanical ingredients, reinforcing acceptance of supplements that integrate traditional knowledge frameworks with modern nutritional science principles. As preventive health consciousness continues to gain prominence across demographic segments, dietary supplements remain a core source of market value generation and long-term end user engagement.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline represents the dominant sales channel segment, commanding approximately 70% of total market revenue. Pharmacies, health food stores, specialist TCM retail establishments, and wellness boutiques remain the primary procurement points, supported by strong end user trust relationships, visible on-shelf presence, and access to professional guidance services. These channels demonstrate particular influence for categories including topical analgesics and cough remedies, where brand familiarity and in-person consultation play key roles in purchasing decision processes.

Although electronic commerce continues to expand as a complementary distribution channel, offline retail infrastructure remains the cornerstone of market distribution, reflecting end user preference for in-store product evaluation, quality reassurance, and personalised advisory support. Consequently, retail offline is expected to retain its leadership position throughout the forecast period.

List of Companies Covered in Singapore Herbal/Traditional Products Market

The companies listed below are highly influential in the Singapore herbal/traditional products market, with a significant market share and a strong impact on industry developments.

- Haw Par Healthcare Ltd

- Nin Jiom Medicine Mfy (S) Pte Ltd

- Korea Ginseng Corp

- Ricola Asia Pacific Pte Ltd

- Lofthouse of Fleetwood Ltd

- Eu Yan Sang (S) Pte Ltd

- ONI Global Pte Ltd

- Kordel's Ltd

- Li Chung Shing Tong (Holdings) Ltd

- Nu Skin Enterprises Singapore Pte Ltd

Competitive Landscape

The competitive landscape for Singapore herbal and traditional products remains strongly anchored by long-established specialist retailers that benefit from deep consumer trust and cultural familiarity. Eu Yan Sang stands out as one of the most recognised names in TCM, supported by a long heritage, more than 40 domestic outlets, international presence, supermarket placements for its essence of chicken and waist tonic ranges, and continued investment in research and development to integrate traditional practices with modern science. Hockhua Tonic also plays a major role with over 60 stores and a portfolio spanning herbal tonics, traditional remedies, health supplements, herbal teas, essential oils and health foods. Together, these players act as key gateways for consumers seeking accessible, time-honoured wellness solutions.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Singapore Herbal/Traditional Products Market Policies, Regulations, and Standards

4. Singapore Herbal/Traditional Products Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Singapore Herbal/Traditional Products Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Topical Analgesics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sleep Aids- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Cough, Cold & Allergy Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Digestive Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Paediatric Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Tonics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Form

5.2.2.1. Capsules/Tablets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Syrups- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Oils & Ointments- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Health Benefit

5.2.3.1. General Wellness- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cardiovascular Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cognitive & Mental Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Digestive & Gut Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Immunity Support- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Respiratory Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Bone & Joint Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Source

5.2.4.1. Leaves- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Roots- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Barks- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Flowers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Seeds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Ingredient Type

5.2.5.1. Single-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Multi-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Function

5.2.6.1. Preventive Care- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Curative/Relief Care- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By End User

5.2.7.1. Adults- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Geriatric Population- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. Children- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Prescription Type

5.2.8.1. Over-the-Counter (OTC)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Prescription Herbal Medicines- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Sales Channel

5.2.9.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.10. By Competitors

5.2.10.1. Competition Characteristics

5.2.10.2. Market Share & Analysis

6. Singapore Topical Analgesics Herbal/Traditional Products Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

6.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Singapore Sleep Aids Herbal/Traditional Products Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

7.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Singapore Cough, Cold & Allergy Remedies Herbal/Traditional Products Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

8.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Singapore Digestive Remedies Herbal/Traditional Products Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

9.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Singapore Dermatologicals Herbal/Traditional Products Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

10.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Singapore Paediatric Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

11.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Singapore Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

12.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Singapore Tonics Herbal/Traditional Products Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

13.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. Competitive Outlook

14.1. Company Profiles

14.1.1. Ricola Asia Pacific Pte Ltd

14.1.1.1. Business Description

14.1.1.2. Product Portfolio

14.1.1.3. Collaborations & Alliances

14.1.1.4. Recent Developments

14.1.1.5. Financial Details

14.1.1.6. Others

14.1.2. Lofthouse of Fleetwood Ltd

14.1.2.1. Business Description

14.1.2.2. Product Portfolio

14.1.2.3. Collaborations & Alliances

14.1.2.4. Recent Developments

14.1.2.5. Financial Details

14.1.2.6. Others

14.1.3. Eu Yan Sang (S) Pte Ltd

14.1.3.1. Business Description

14.1.3.2. Product Portfolio

14.1.3.3. Collaborations & Alliances

14.1.3.4. Recent Developments

14.1.3.5. Financial Details

14.1.3.6. Others

14.1.4. ONI Global Pte Ltd

14.1.4.1. Business Description

14.1.4.2. Product Portfolio

14.1.4.3. Collaborations & Alliances

14.1.4.4. Recent Developments

14.1.4.5. Financial Details

14.1.4.6. Others

14.1.5. Kordel's Ltd

14.1.5.1. Business Description

14.1.5.2. Product Portfolio

14.1.5.3. Collaborations & Alliances

14.1.5.4. Recent Developments

14.1.5.5. Financial Details

14.1.5.6. Others

14.1.6. Haw Par Healthcare Ltd

14.1.6.1. Business Description

14.1.6.2. Product Portfolio

14.1.6.3. Collaborations & Alliances

14.1.6.4. Recent Developments

14.1.6.5. Financial Details

14.1.6.6. Others

14.1.7. Nin Jiom Medicine Mfy (S) Pte Ltd

14.1.7.1. Business Description

14.1.7.2. Product Portfolio

14.1.7.3. Collaborations & Alliances

14.1.7.4. Recent Developments

14.1.7.5. Financial Details

14.1.7.6. Others

14.1.8. Korea Ginseng Corp

14.1.8.1. Business Description

14.1.8.2. Product Portfolio

14.1.8.3. Collaborations & Alliances

14.1.8.4. Recent Developments

14.1.8.5. Financial Details

14.1.8.6. Others

14.1.9. Li Chung Shing Tong (Holdings) Ltd

14.1.9.1. Business Description

14.1.9.2. Product Portfolio

14.1.9.3. Collaborations & Alliances

14.1.9.4. Recent Developments

14.1.9.5. Financial Details

14.1.9.6. Others

14.1.10. Nu Skin Enterprises Singapore Pte Ltd

14.1.10.1.Business Description

14.1.10.2.Product Portfolio

14.1.10.3.Collaborations & Alliances

14.1.10.4.Recent Developments

14.1.10.5.Financial Details

14.1.10.6.Others

15. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Form |

|

| By Health Benefit |

|

| By Source |

|

| By Ingredient Type |

|

| By Function |

|

| By End User |

|

| By Prescription Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.