Poland Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By End User (Industrial Water & Wastewater, Municipal Water & Wastewater)

- Energy & Power

- Oct 2025

- VI0486

- 115

-

Poland Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

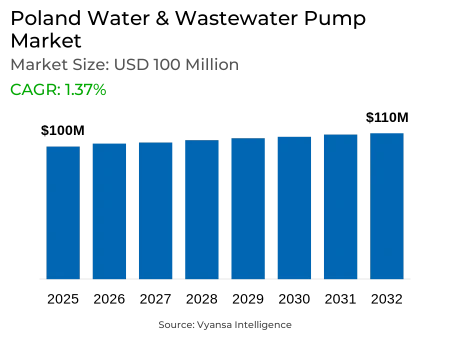

- Water & Wastewater Pump in Poland is estimated at $ 100 Million.

- The market size is expected to grow to $ 110 Million by 2032.

- Market to register a CAGR of around 1.37% during 2026-32.

- Pump Type Segment

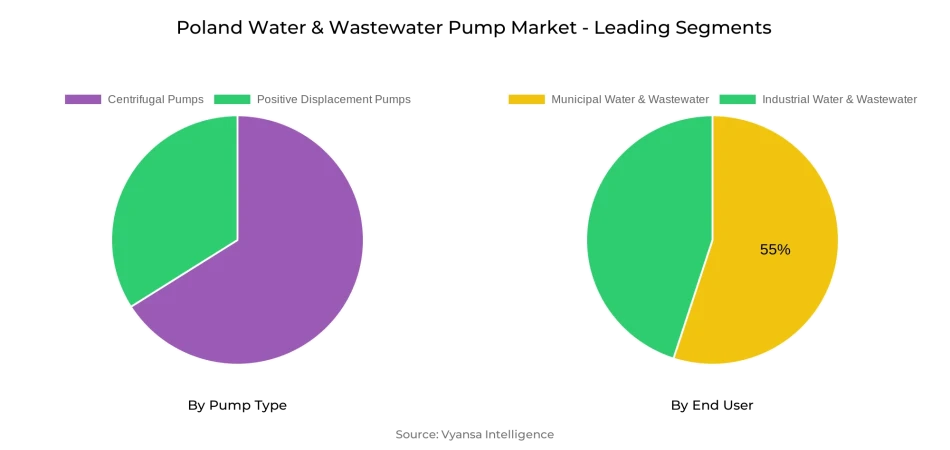

- Centrifugal Pumps continues to dominate the market.

- Competition

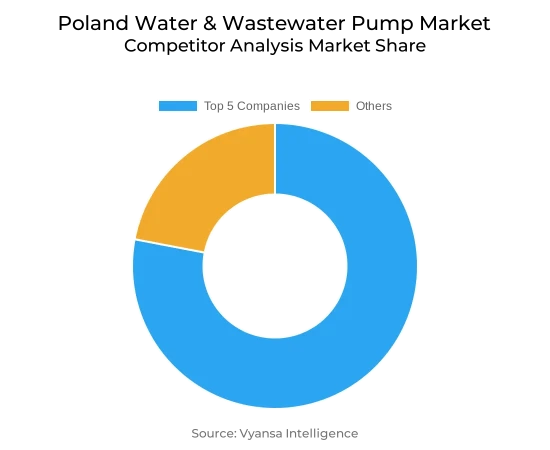

- More than 10 companies are actively engaged in producing Water & Wastewater Pump in Poland.

- Top 5 companies acquired the maximum share of the market.

- ITT, IDEX, Dover, Flowserve, Sulzer AG etc., are few of the top companies.

- End User

- Municipal Water & Wastewater grabbed 55% of the market.

Poland Water & Wastewater Pump Market Outlook

Poland Water & Wastewater Pump Market size is estimated to be USD 100 million in 2025 and is expected to grow to USD 110 million by 2032. This steady growth is an indicator of stable infrastructure development and ongoing investment in municipal and industrial water infrastructure. 4.3 thousand kilometers expansion of sewage networks and 112,000 new household connections in 2024 are indicative of increasing demand for pump installations to aid in water supply as well as wastewater management.

Government and European Union investment continue to be powerful market drivers. Poland has spent more than 1.2 billion PLN via NFOŚiGW on the construction and upgrading of water infrastructure, while almost 30 billion PLN under FEnIKS and EU programs provides long-term growth. Investment is centered on treatment plants, distribution networks, and pumping stations, resulting in steady demand for robust pump technology across the country.

Centrifugal pumps have the widest market share by type because of their affordability, flexibility, and applicability to bulk water transport and municipal piping systems. Positive displacement pumps find specialized applications in industrial processes but circumvent Poland's municipal water supply and sewage treatment by virtue of lower maintenance and established performance. Centrifugal pumps are anticipated to maintain the lead position for 2026–32.

On the demand side, municipal water and wastewater is still the largest end-user market share, at 55%. Large urban infrastructure, water supply systems, and sewage treatment plants continue to put municipalities at the forefront of pump demand. Industrial uses are the leading growth segment, aided by manufacturing expansion and environmental regulation needs. Combined, these factors ensure that public and industrial segments maintain market opportunities for pump suppliers through 2032.

Poland Water & Wastewater Pump Market Growth Driver

Rising Infrastructure Investment Demands Driving Market Growth

Poland experiences high water infrastructure needs that fuel pump demand throughout the nation. The sewage system grew by 4.3 thousand kilometers in 2024, a 2.4% expansion, while sewage connections to residential buildings increased by 112,000 units or 2.8%. All this growth necessitates massive pump installations in order to provide adequate water pressure and wastewater transport capacity. The government invested more than 1.2 billion PLN by the NFOŚiGW program for the construction and upgrade of water facilities to counter flood and drought effects. Water infrastructure of municipalities accounts for 79% of all water consumption in Poland, while industrial uses demand substantial additional volumes. The investments in these infrastructures yield persistent demand for positive displacement pumps and centrifugal pumps in municipal and industrial uses.

The water construction industry hit revenues of 19.3 billion PLN in 2023, with water and sewage products yielding more than 6.7 billion PLN. Investment projects under the FEnIKS program and European Union schemes offer close to 30 billion PLN for investments in water and sewage until 2027. This enormous funding pipeline guarantees ongoing infrastructure growth necessitating large-scale pump installations throughout treatment plants, distribution systems, and pumping stations.

Poland Water & Wastewater Pump Market Challenge

Aging Infrastructure and Maintenance Burdens Hindering Market Growth

Poland's water system has major maintenance challenges that limit system efficiency and present operational issues. Poland's water supply systems span more than 341,000 kilometers as of 2023, with the majority of the systems needing complete upgrades and replacement. In-depth monitoring systems continue to be limited, missing technical conditions documentation and network upkeep requirements that increase operational inefficiencies. Water losses against volumes of water supplied by utilities continue because of worsening technical conditions of aging infrastructure and inadequate repair. Excessive municipal debt limits local governments' investment capital, forcing them to forego investment in aging pump stations and ancillary infrastructure.

Increasing construction and material costs further exacerbate maintenance issues, while lengthy administrative approval procedures hold back key infrastructure projects. Lack of coherent policy guidelines for sector development introduces uncertainty into long-term maintenance planning. Extremely fragmented water and sewerage companies are unable to coordinate maintenance across interlinked networks, resulting in inefficient resource allocation and delayed work across the network infrastructure.

Poland Water & Wastewater Pump Market Trend

Smart Water Technology Integration

Poland advances digital transformation initiatives that modernize water management systems and create new technological opportunities. Smart meter deployment reaches 35% of electricity consumers by 2024, with mandatory 80% coverage required by 2028 and complete rollout by 2031. Remote water meter reading systems cover over 6,000 meters in Bytom using LoRaWAN technology, enabling comprehensive monitoring and failure detection capabilities.

Sophisticated digital technologies lower water network losses by 30% and reduce sewer system overflows through predictive analytics and real-time monitoring. IoT cloud computing, artificial intelligence applications, and digital twin technologies deliver new risk analysis, automation, and environmental protection capabilities across water management systems. These advanced technologies open doors to intelligent pump systems that are integrated with larger smart infrastructure networks, maximizing energy usage and operational efficiency in municipal and industrial sectors.

Poland Water & Wastewater Pump Market Opportunity

European Union Compliance Requirements to Drive Market Growth

Poland enjoys significant European Union funding sources supporting water infrastructure development and regulatory compliance projects. The EU devotes about 5 billion euros entirely to Poland's recovery efforts following flooding, with eased co-financing terms speeding up the implementation of projects. European Investment Bank cooperation facilitates financing of 200 million euros for SMEs, of which at least 40 million euros is used for action on climate change such as upgrading water management. EU cohesion funds play a crucial role in modernizing infrastructure, while the Solidarity Fund finances reconstruction of water infrastructure after natural disasters. Implementation of the Water Framework Directive provides organized methods for the management of water quality and ecological protection levels.

Poland is involved in cross-border water management projects under the Interreg NEXT Programme Poland-Ukraine 2021-2027, carrying out sustainable water management measures in eastern regions. Such collaborative projects involve construction and upgrading of water supply infrastructure, wastewater treatment plants, and sewerage in various locations. European financing mechanisms demand advanced technologies for treatment and energy-neutral operation, and this creates a need for efficient pump systems with high environmental standards while facilitating sustainable water management practices.

Poland Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

The highest market share under the Pump Type is Centrifugal Pumps, which still leads the market in all applications in Poland's water and wastewater. Centrifugal pumps retain the top position as they are capable of coping with large volume water transfer, municipal distribution systems, and wastewater treatment processes. These pumps perform best in applications involving steady flow rate and moderate pressure requirements common to municipal water supply grids and industrial cooling loops. Their proven performance track record along with decreased maintenance needs render them popular options for continuous use applications across Polish water infrastructure.

Positive displacement pumps serve specialized applications requiring precise flow control and higher pressure capabilities, particularly in chemical dosing systems and specialized industrial processes. However, centrifugal technology's cost-effectiveness and operational simplicity ensure its continued market leadership. Municipal water utilities favor centrifugal pumps for their reliability in large-scale distribution networks, while industrial facilities utilize them for cooling water circulation and general water transfer applications across manufacturing processes.

By End User

- Industrial Water & Wastewater

- Municipal Water & Wastewater

The most dominant market share under the End User is Municipal Water & Wastewater, which captured 55% of the market share. Municipal uses are predominant owing to widespread public water supply infrastructure, sewage treatment plants, and urban infrastructure needs in Poland's cities and towns. The municipal water utilities have intricate distribution networks catering to residential, commercial, and institutional users, necessitating large pump installations for water treatment, distribution, and wastewater collection activities. The industry's high market share is a result of continuous infrastructure growth, with sewerage networks increasing by 4.3 thousand kilometers and residential connections by 112,000 units in 2024.

Industrial Water & Wastewater is the growth segment with the highest CAGR of 2.73% led by increasing manufacturing operations and strict environmental regulation compliance needs. Industrial plants need specialized pump solutions for process water, cooling applications, and wastewater treatment processes. This growth segment is boosted by enhanced investment in industrial water management technologies and environmental protection initiatives enforced by European Union directives across Polish manufacturing industries.

Top Companies in Poland Water & Wastewater Pump Market

The top companies operating in the market include ITT, IDEX, Dover, Flowserve, Sulzer AG, KSB, Xylem, Grundfos, Ebara, SPX Flow, etc., are the top players operating in the Poland Water & Wastewater Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Poland Water & Wastewater Pump Market Policies, Regulations, and Standards

4. Poland Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Poland Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End User

5.2.3.1. Industrial Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Municipal Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Poland Centrifugal Water & Wastewater Pump Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Poland Positive Displacement Water & Wastewater Pump Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Flowserve Corporation

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Ebara Corporation

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.WILO SE

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Sulzer Limited

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Grundfos Holding A/S

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Xylem Inc.

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.KSB SE & Co. KGaA

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Kirloskar Brothers Limited (KBL)

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Franklin Electric

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Pentair PLC

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.