Poland Herbal/Traditional Products Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Topical Analgesics, Sleep Aids, Cough, Cold & Allergy Remedies, Digestive Remedies, Dermatologicals, Paediatric Dietary Supplements, Dietary Supplements, Tonics), By Form (Capsules/Tablets, Powder, Syrups, Oils & Ointments, Others), By Health Benefit (General Wellness, Cardiovascular Health, Cognitive & Mental Health, Digestive & Gut Health, Immunity Support, Respiratory Health, Bone & Joint Health, Others), By Source (Leaves, Roots, Barks, Flowers, Seeds, Others), By Ingredient Type (Single-Herb Products, Multi-Herb Products), By Function (Preventive Care, Curative/Relief Care), By End User (Adults, Geriatric Population, Children), By Prescription Type (Over-the-Counter (OTC), Prescription Herbal Medicines), By Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

Poland Herbal/Traditional Products Market Statistics and Insights, 2026

- Market Size Statistics

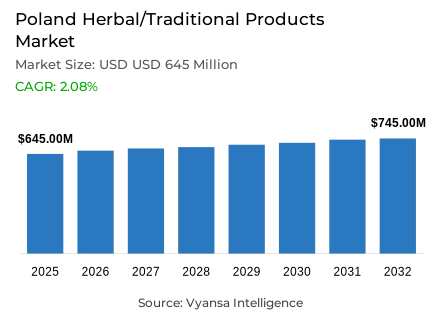

- Herbal/traditional products in Poland is estimated at USD 645 million in 2025.

- The market size is expected to grow to USD 745 million by 2032.

- Market to register a cagr of around 2.08% during 2026-32.

- Category Shares

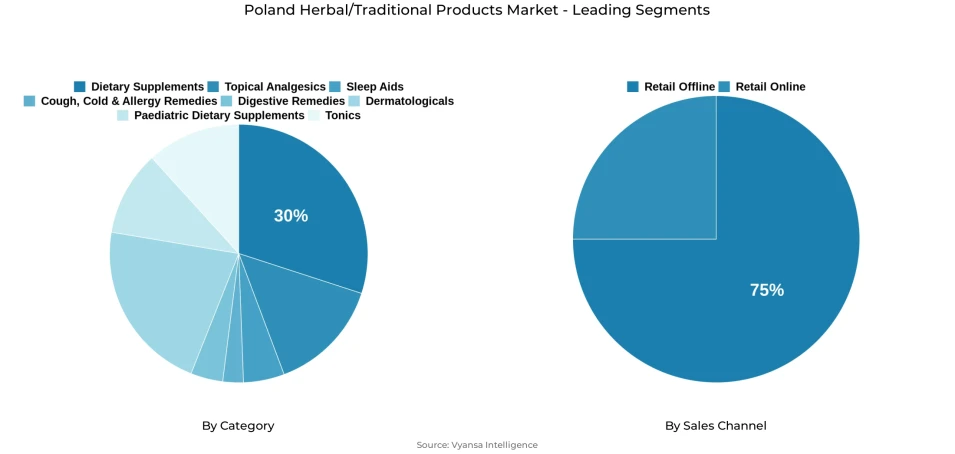

- Dietary supplements grabbed market share of 30%.

- Competition

- More than 20 companies are actively engaged in producing herbal/traditional products in Poland.

- Top 5 companies acquired around 25% of the market share.

- Sanofi-Aventis Sp zoo; Egis Gyógyszergyár Zrt; Zaklady Farmaceutyczne Polpharma SA; Aflofarm Farmacja Polska Sp zoo; PPF Hasco-Lek SA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Poland Herbal/Traditional Products Market Outlook

The Poland herbal/traditional products market will record a moderate growth over the forcast period, which will be supported by the increasing health awareness and the growing end-user preference towards natural wellness products. The 2025 market value is projected to be USD 645 million, which will be driven by the demand of dietary supplements, cough and cold products, digestive formulations, and sleep-support products. Polish end users show gradual prioritisation of preventive healthcare measures and often use herbal products that are viewed as safe and linked to a lower risk of adverse effects and often use them as first line self-care measures before switching to more traditional therapeutic methods.

In the product composition environment, dietary supplements constitute about 30% of total market share, which indicates strong commercial success of plant-based vitamin preparations, mineral supplements, and traditional herbal preparations aimed at maintaining overall health, immune system, and digestive balance. Senna leaf laxatives and multi-herb formulations of sleep aids remain products that appeal to end users who desire milder and more naturally derived effects than synthetic pharmaceutical substitutes.

sales channel is still largely defined by offline modalities, with retail offline accounting about 75% of total market revenue. Pharmacies, health stores, and grocery retail stores serve as key buying points, where pharmacist consultation can be offered, and where the familiarity with existing herbal remedy formulations can be exploited. Although electronic commerce and direct-to-end-user channels are increasing access to niche and innovative product formats, physical retail infrastructure remains the main procurement channel to most end users.

The market is expected to reach USD 745 million in 2032, which is a compound annual growth rate of about 2.08% in the forecast period. The long-term growth trends will be facilitated by the long-term end-user desire to use natural health management strategies, the gradual product innovation in the digestive and sleep-support segments, and the further growth of well-established herbal brands in both traditional and modern retailing.

Poland Herbal/Traditional Products Market Growth DriverGrowing Self-Care and Preventive Health Practices

The Poland herbal and traditional products market is characterized by a strong growth rate due to the prevalence of self-care practices and preventive health measures among the adult population. According to recent survey data, about 78% of Polish end users report using dietary supplements, and 48% show regular usage patterns, which shows a high level of involvement in plant-based wellness products as part of everyday health practices. Central components of these behavioural patterns are vitamins, minerals and botanical formulations, which play important roles in herbal and traditional product portfolios.

The increasing health literacy and the increasing preference of the end-user to treat minor health issues without necessarily resorting to prescription pharmaceutical treatment support this consumption behaviour. Herbal sleep supplements and digestive aids are becoming more and more considered as available, less risky therapeutic choices, especially in older adult populations and working groups who need to balance wellness goals with the demands of their busy lifestyles. With the ever-increasing popularity of preventive health strategies and self-management, herbal and natural products remain highly relevant in the context of supplementing the traditional healthcare delivery models.

Poland Herbal/Traditional Products Market ChallengeRegulatory Complexity and Consumer Skepticism

The market faces significant challange posed by the enduring end-user scepticism associated with ambivalent views on therapeutic effectiveness and regulatory classification systems. Despite the reported use of complementary and alternative medicine among the segments of the Polish population, the available research data show that herbal products are often viewed as less effective in terms of their therapeutic efficacy compared to conventional over-the-counter pharmaceutical preparations. In one study, 76% of the respondents were reported to use synthetic over-the-counter treatments to manage the symptoms of the common cold, as opposed to 30% of those who used herbal product alternatives.

This perception gap indicates that end-users prefer faster symptom management and are more confident in traditional treatment options, especially working people and student groups who value faster recovery periods. This is further complicated by regulatory limitations on product health claims, with many herbal products being marketed as dietary supplements, as opposed to licensed medicines, which may reduce perceived therapeutic efficacy among final end user. Improved communication plans on product advantages, clinical data, and proper positioning are still needed to improve end-user confidence and increase adoption among wider demographic groups.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Poland Herbal/Traditional Products Market TrendSteady Use of Herbal and Complementary Practices

Poland exhibits a significant trend that is typified by a continued use of complementary and traditional health practices, such as herbal medicine modalities. Medical literature documents that the use of complementary and alternative medicine (CAM) is not uniformly distributed among population groups, with herbal and dietary supplements being the most popular CAM modality, comprising 32.3% of CAM users. This trend shows that even with an established traditional healthcare system, a significant percentage of the population still incorporates herbal products into their daily wellness routines.

Herbal cough and cold preparations, digestive preparations, and mild sleep preparations have a specific prevalence in self-care behaviours, with cultural familiarity with home-prepared infusions and teas, and with established brands that combine traditional knowledge with modern formulation strategies. With the spread of health awareness among various demographic groups, this harmonious combination of traditional and modern therapeutic methods strengthens a stable and long-term trend of complementary product use.

Poland Herbal/Traditional Products Market OpportunityExpansion into Segment-Specific and Evidence-Backed Products

There is a significant business potential in the growth of segment-specific herbal products with improved scientific validation systems. As end-users grow more interested in specific wellness solutions, such categories as digestive health, sleep support, and immune function enhancement can be supported with a stronger clinical evidence base to enhance the credibility of the product. A survey of 743 healthcare professionals shows that 73.49% of them are aware of dietary supplements, and 84.52% of them consider product composition to be a decisive factor in their recommendation, which is a strong basis of evidence-based professional interaction.

This dynamic provides space through which brands can form collaborative relationships with pharmacists, dietitians, and research institutions to enhance safety and efficacy communication in product positioning strategies. Herbal products with clear composition information and valid research findings have a higher chance of acceptance by the end users who want to have both natural ingredient profiles and proven therapeutic effects. This strategic direction will help to further incorporate herbal products into daily health management routines, and the endorsement of healthcare professionals will serve as a driving force behind the development of trust and faster adoption.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Poland Herbal/Traditional Products Market Segmentation Analysis

By Category

- Topical Analgesics

- Sleep Aids

- Cough, Cold & Allergy Remedies

- Digestive Remedies

- Dermatologicals

- Paediatric Dietary Supplements

- Dietary Supplements

- Tonics

Dietary supplements constitute the dominant segment within the category structure, accounting for approximately 30% of the Poland herbal/traditional products market. These products perform central roles in daily health maintenance, encompassing vitamins, minerals, and plant-based nutrient blends utilised to support immune function, digestive health, bone health, and general wellbeing objectives. Their widespread adoption establishes dietary supplements as a consistent and influential contributor to overall category value generation.

End user familiarity significantly reinforces demand dynamics, with research evidence indicating that a substantial proportion of Polish adult populations integrate supplements into regular wellness routines. Product versatility across age demographics and health priorities—combined with straightforward regulatory positioning as wellness products—supports stable and sustained consumption patterns. As preventive health awareness continues to strengthen across population segments, dietary supplements remain the foundational pillar of the herbal and traditional products landscape.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline represents the dominant segment within the sales channel structure, commanding approximately 75% of total market revenue. Pharmacies, health food stores, and traditional retail outlets continue to function as primary procurement points for herbal and traditional products, benefitting from pharmacist consultation availability, established end user trust relationships, and strong on-shelf visibility that influences purchasing decisions.

Pharmacies perform particularly important roles in over-the-counter health management, frequently stocking herbal cough, digestive, and sleep products alongside conventional pharmaceutical medicines. Health food stores further support access to specialised and niche herbal offerings. Although electronic commerce adoption is demonstrating incremental growth, offline retail channels remain dominant, reflecting end user preferences for in-person professional consultation and physical product evaluation prior to purchase. Claude is AI and can make mistakes. Please double-check responses.

List of Companies Covered in Poland Herbal/Traditional Products Market

The companies listed below are highly influential in the Poland herbal/traditional products market, with a significant market share and a strong impact on industry developments.

- Sanofi-Aventis Sp zoo

- Egis Gyógyszergyár Zrt

- Zaklady Farmaceutyczne Polpharma SA

- Aflofarm Farmacja Polska Sp zoo

- PPF Hasco-Lek SA

- GSK Consumer Healthcare

- US Pharmacia Sp zoo

- Hempoland sp zoo

- Axellus Sp zoo

- Asa Sp zoo

Competitive Landscape

Poland Herbal/traditional products market are expected to post moderate current value growth, supported by rising health and wellness awareness and a growing preference for natural remedies perceived as safe and free from side effects. These products are generally used as a first line of defence, with consumers switching to OTC medicines if symptoms worsen. The largest categories are dietary supplements, cough and cold remedies, digestive remedies and sleep aids, with digestive remedies showing the strongest value and volume growth, driven by rising popularity of senna leaf laxatives such as Xenna and Regulax. Herbal sleep aids also continue to perform well, with combinations of Melissa officinalis and Valerianae radix under brands like NeoPersen and Valerin appealing due to their mild formulations and minimal side effects.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Poland Herbal/Traditional Products Market Policies, Regulations, and Standards

4. Poland Herbal/Traditional Products Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Poland Herbal/Traditional Products Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Topical Analgesics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sleep Aids- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Cough, Cold & Allergy Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Digestive Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Paediatric Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Tonics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Form

5.2.2.1. Capsules/Tablets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Syrups- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Oils & Ointments- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Health Benefit

5.2.3.1. General Wellness- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cardiovascular Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cognitive & Mental Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Digestive & Gut Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Immunity Support- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Respiratory Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Bone & Joint Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Source

5.2.4.1. Leaves- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Roots- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Barks- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Flowers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Seeds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Ingredient Type

5.2.5.1. Single-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Multi-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Function

5.2.6.1. Preventive Care- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Curative/Relief Care- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By End User

5.2.7.1. Adults- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Geriatric Population- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. Children- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Prescription Type

5.2.8.1. Over-the-Counter (OTC)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Prescription Herbal Medicines- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Sales Channel

5.2.9.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.10. By Competitors

5.2.10.1. Competition Characteristics

5.2.10.2. Market Share & Analysis

6. Poland Topical Analgesics Herbal/Traditional Products Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

6.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Poland Sleep Aids Herbal/Traditional Products Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

7.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Poland Cough, Cold & Allergy Remedies Herbal/Traditional Products Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

8.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Poland Digestive Remedies Herbal/Traditional Products Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

9.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Poland Dermatologicals Herbal/Traditional Products Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

10.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Poland Paediatric Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

11.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Poland Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

12.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Poland Tonics Herbal/Traditional Products Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

13.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. Competitive Outlook

14.1. Company Profiles

14.1.1. Aflofarm Farmacja Polska Sp zoo

14.1.1.1. Business Description

14.1.1.2. Product Portfolio

14.1.1.3. Collaborations & Alliances

14.1.1.4. Recent Developments

14.1.1.5. Financial Details

14.1.1.6. Others

14.1.2. PPF Hasco-Lek SA

14.1.2.1. Business Description

14.1.2.2. Product Portfolio

14.1.2.3. Collaborations & Alliances

14.1.2.4. Recent Developments

14.1.2.5. Financial Details

14.1.2.6. Others

14.1.3. GSK Consumer Healthcare

14.1.3.1. Business Description

14.1.3.2. Product Portfolio

14.1.3.3. Collaborations & Alliances

14.1.3.4. Recent Developments

14.1.3.5. Financial Details

14.1.3.6. Others

14.1.4. US Pharmacia Sp zoo

14.1.4.1. Business Description

14.1.4.2. Product Portfolio

14.1.4.3. Collaborations & Alliances

14.1.4.4. Recent Developments

14.1.4.5. Financial Details

14.1.4.6. Others

14.1.5. Sanofi-Aventis Sp zoo

14.1.5.1. Business Description

14.1.5.2. Product Portfolio

14.1.5.3. Collaborations & Alliances

14.1.5.4. Recent Developments

14.1.5.5. Financial Details

14.1.5.6. Others

14.1.6. Hempoland sp zoo

14.1.6.1. Business Description

14.1.6.2. Product Portfolio

14.1.6.3. Collaborations & Alliances

14.1.6.4. Recent Developments

14.1.6.5. Financial Details

14.1.6.6. Others

14.1.7. Egis Gyógyszergyár Zrt

14.1.7.1. Business Description

14.1.7.2. Product Portfolio

14.1.7.3. Collaborations & Alliances

14.1.7.4. Recent Developments

14.1.7.5. Financial Details

14.1.7.6. Others

14.1.8. Zaklady Farmaceutyczne Polpharma SA

14.1.8.1. Business Description

14.1.8.2. Product Portfolio

14.1.8.3. Collaborations & Alliances

14.1.8.4. Recent Developments

14.1.8.5. Financial Details

14.1.8.6. Others

14.1.9. Axellus Sp zoo

14.1.9.1. Business Description

14.1.9.2. Product Portfolio

14.1.9.3. Collaborations & Alliances

14.1.9.4. Recent Developments

14.1.9.5. Financial Details

14.1.9.6. Others

14.1.10. Asa Sp zoo

14.1.10.1.Business Description

14.1.10.2.Product Portfolio

14.1.10.3.Collaborations & Alliances

14.1.10.4.Recent Developments

14.1.10.5.Financial Details

14.1.10.6.Others

15. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Form |

|

| By Health Benefit |

|

| By Source |

|

| By Ingredient Type |

|

| By Function |

|

| By End User |

|

| By Prescription Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.