Peru Herbal/Traditional Products Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Topical Analgesics, Sleep Aids, Cough, Cold & Allergy Remedies, Digestive Remedies, Dermatologicals, Paediatric Dietary Supplements, Dietary Supplements, Tonics), By Form (Capsules/Tablets, Powder, Syrups, Oils & Ointments, Others), By Health Benefit (General Wellness, Cardiovascular Health, Cognitive & Mental Health, Digestive & Gut Health, Immunity Support, Respiratory Health, Bone & Joint Health, Others), By Source (Leaves, Roots, Barks, Flowers, Seeds, Others), By Ingredient Type (Single-Herb Products, Multi-Herb Products), By Function (Preventive Care, Curative/Relief Care), By End User (Adults, Geriatric Population, Children), By Prescription Type (Over-the-Counter (OTC), Prescription Herbal Medicines), By Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

Peru Herbal/Traditional Products Market Statistics and Insights, 2026

- Market Size Statistics

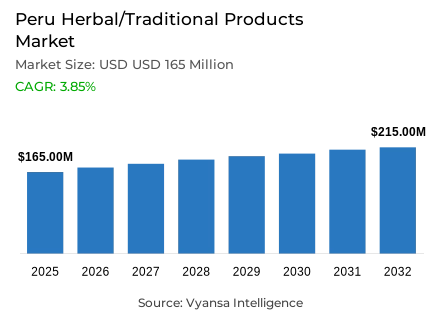

- Herbal/traditional products in Peru is estimated at USD 165 million in 2025.

- The market size is expected to grow to USD 215 million by 2032.

- Market to register a cagr of around 3.85% during 2026-32.

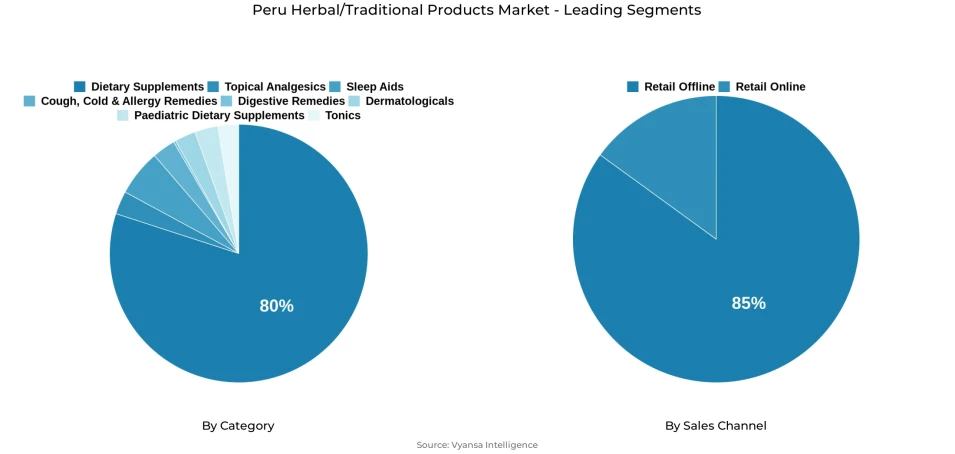

- Category Shares

- Dietary supplements grabbed market share of 80%.

- Competition

- More than 15 companies are actively engaged in producing herbal/traditional products in Peru.

- Top 5 companies acquired around 30% of the market share.

- Teva Perú SA; Laboratorio Farmaceúticos Markos SA; Medifarma SA; Herbalife Perú SRL; FuXion Biotech SAC etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Peru Herbal/Traditional Products Market Outlook

The Peru herbal-traditional products market is characterized by a long-term growth, which is supported by the affordability of the products, the deep-rooted cultural acceptance, and the growing health awareness among the various income groups. The market value of 2025 is estimated at USD 165 million, which is due to the continued use of traditional therapeutic formulations by lower-income households that are interested in finding economically viable alternatives to synthetic pharmaceutical products. Existing macroeconomic limitations still support the end-user preference of herbal remedies in the treatment of common health issues, especially when the perceived therapeutic effectiveness is similar to that of conventional medicines at significantly lower cost levels.

The category dynamics are still marked by the strong dominance of dietary supplements, which occupy about 80% aggregate market share. This leadership role is based on the widespread distribution of seeds, herbs, and powdered formulations based on native botanical species, such as maca, kiwicha, turmeric, purple corn, and yacon. These products are sold mainly in small-scale local retail stores and conventional points of sale, which usually sell loose or minimally packaged forms that facilitate price accessibility and conform to the established consumption patterns.

In terms of sales-channel, offline retail controls about 85% of the total market revenue, which is supported by neighbourhood stores, traditional markets, and pharmacies that serve as the main distribution channels of native herbal ingredients and over-the-counter preparations. At the same time, improved packaging and product standardisation are leading to greater penetration in supermarkets and hypermarkets, with brand positioning becoming more focused on nutritional value, geographical origin, and strategic placement of Peruvian superfoods.

The market is expected to grow to USD 215 million by 2032, which is a compound annual growth rate of about 3.85% over the 2026-2032 forecast period. The growth trends are facilitated by the increasing health awareness of younger demographic groups, the increasing use of herbal sleep and relaxation formulations, and the continued interest in native botanical ingredients. Nevertheless, the increasing rivalry of health-conscious food and beverage products with superfood ingredients directly integrated into everyday eating habits is expected to have a moderating effect on growth rate, especially in urban and more affluent end-user groups.

Peru Herbal/Traditional Products Market Growth DriverRising Reliance on Affordable Herbal Remedies

The Peru herbal-traditional products market is characterized by a strong growth rate due to the continued use of economically available remedies in an environment of limited household buying power. In 2023, the prevalence of monetary poverty was 29.0% of the national population, significantly restricting the ability of households to purchase branded pharmaceutical products of high quality and price, which further supports the popularity of low-cost plant-based therapeutic substitutes. These recipes are used as the main intervention strategies in respiratory illnesses, digestive disorders, and minor health issues, especially in traditional societies and in the lower-income urban groups where cultural familiarity and economic availability keep them in constant use.

Moreover, Peruvian families still bear significant direct healthcare spending. The statistics on health financing show that out-of-pocket spending is a significant part of the existing health expenditure, which highlights the paramount significance of cost-sensitive self-care behavior. In this economic model, herbal powders, infusions, and simple preparations continue to be relevant as viable, culturally integrated, and cost-effective alternatives to regular wellness maintenance and symptom management.

Peru Herbal/Traditional Products Market ChallengeCompetitive Pressure from Health-Positioned Foods and Beverages

The herbal and traditional supplements market is under intense competitive pressure due to the growing category of foods and beverages that are strategically placed around nutritional enhancement and mitigation of non-communicable diseases. Peru is facing an increasing burden of lifestyle-related health issues, with prevalence rates of obesity among adult women and adult men reported at 26.7% and 17.3%, respectively, driving increased interest in better dietary habits and functional nutrition approaches. Manufacturers of food and beverages are increasingly adding native superfoods and micronutrients to juice formulations, ready-to-drink tea products, and snack formats and positioning these products as integrated nutritional solutions, not as supplementary products.

As a result, the final end user, especially in urban and higher-income population groups, are becoming more inclined to achieve health goals by modifying their diets instead of using individual supplements. As diabetes is estimated to impact 8.7% of adult women and 7.9% of adult men, products that provide hydration, convenience, and perceived metabolic benefits are gaining increasing end-user interest. This trend adds to a more competitive wellness market where herbal and traditional dietary supplements need to create a distinct differentiation in therapeutic benefits, quality assurance standards, and value proposition to retain market positioning and commercial relevance.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Peru Herbal/Traditional Products Market TrendGrowing Use of Natural Sleep and Relaxation Products

The market shows significant expansion in the natural sleep and relaxation product segments, driven by the growing focus on the mental health aspects and the issues of sleep quality. According to academic studies carried out on the population of Peruvian universities, 47.1% of students report insomnia symptoms, and 52.7% demonstrate signs of anxiety, which indicates a significant prevalence of stress- and sleep-related disorders among younger demographic groups. These mental and physical stressors are creating more interest in mild, plant-based treatment methods that can be incorporated into everyday wellness practices without any pharmaceutical side effects or dependency issues.

In this changing environment, herbal preparations, such as valerian, chamomile, passionflower, and lemon balm, are becoming commercially popular as substitutes or adjunctive to traditional sleep preparations. Pills, infusions, and hot herbal preparations placed around the themes of sleep support and relaxation are proving to be more visible in the retail sales channels, such as specialised stock-keeping units that are tailored to evening consumption events. This trend is part of the slow diversification of the herbal products market beyond the traditional digestive and respiratory therapeutic indications, with mental-health-related uses forming new product niches in line with reported end-user needs.

Peru Herbal/Traditional Products Market OpportunityExpansion Potential in Niche Functional Botanicals

There is a large commercial potential in the growth and development of specialised functional botanical ingredients, which is backed by the highly diverse base of medicinal plant species and bioactive compounds in Peru. According to scientific records, the Peruvian people use about 5,000 native plant species, with about 1,400 of these species having recorded medicinal properties, which means that the potential of innovation in supplement formulations and functional product development is high. Ethnobotanical studies point to a wide range of traditional therapeutic uses including immunity boosting, digestive health, cognitive, and dermatological uses.

This botanical biodiversity strengthens emerging commercial interest in specialised ingredients including spirulina, moringa, resveratrol-rich botanical sources, and maca-based formulations, supporting the development of targeted product categories focused on antioxidant protection, gastrointestinal health, and cognitive performance enhancement. As manufacturers advance extraction methodologies, implement enhanced quality assurance protocols, and improve evidence-based product communication strategies, opportunities emerge to develop higher-value product platforms centred on specific health benefit claims. Regional research from Northern Peru documents over 510 medicinal plant species associated with respiratory, urinary, reproductive, hepatic, inflammatory, and rheumatic condition management, underscoring the depth of traditional ethnobotanical knowledge available to support contemporary product innovation and commercial differentiation.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Peru Herbal/Traditional Products Market Segmentation Analysis

By Category

- Topical Analgesics

- Sleep Aids

- Cough, Cold & Allergy Remedies

- Digestive Remedies

- Dermatologicals

- Paediatric Dietary Supplements

- Dietary Supplements

- Tonics

Dietary supplements constitute the dominant segment within the category structure, commanding approximately 80% of the Peru herbal/traditional products market. This leadership position reflects the substantial commercial role of native superfood ingredients and botanical compounds presented in powder, capsule, and blended formats targeting energy support, immune function, and digestive health applications. Products derived from maca, kiwicha, turmeric, purple corn, yacón, and other Andean or Amazonian botanical species are extensively distributed through small-scale local retail establishments and traditional sales outlets, where price-sensitive end users demonstrate preference for simple and familiar product formats.

Simultaneously, dietary supplements are achieving enhanced visibility within modern retail environments as manufacturers strengthen packaging quality, labelling clarity, and product standardisation protocols. Supermarkets and hypermarkets increasingly position these formulations within dedicated health-focused retail sections, framing them as functional components of evolving dietary patterns. As health awareness expands among younger, urban, and higher-income end user segments, dietary supplements continue to represent the primary source of revenue generation within Peru's herbal and traditional products market.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline represents the dominant segment within the sales channel structure, accounting for approximately 85% of total market revenue. Traditional neighbourhood retail establishments, local markets, and pharmacies remain the principal access points for herbal and traditional product procurement, reflecting Peru's substantial reliance on proximity-based retail infrastructure and established purchasing behaviours. These distribution outlets maintain particular importance for lower-income end users, who typically acquire small quantities of loose herbs, seeds, and powdered formulations linked to longstanding cultural therapeutic practices.

Modern retail formats—including supermarkets and hypermarkets—are demonstrating increasing commercial relevance as herbal dietary supplements progressively appear in packaged and clearly labelled presentations. Nevertheless, offline sales channels continue to dominate product discovery and purchasing behaviour, as end users place value on direct merchant interaction, established trust relationships with local retailers, and the ability to physically inspect product quality prior to purchase. While electronic commerce adoption is expanding from a modest baseline, retail offline is projected to remain the core distribution pillar throughout the forecast period.

List of Companies Covered in Peru Herbal/Traditional Products Market

The companies listed below are highly influential in the Peru herbal/traditional products market, with a significant market share and a strong impact on industry developments.

- Teva Perú SA

- Laboratorio Farmaceúticos Markos SA

- Medifarma SA

- Herbalife Perú SRL

- FuXion Biotech SAC

- Megalabs SA

- Omnilife Perú SAC

- Good Brands SAC

- Hersil SA Laboratorios Industriales Farmacéuticos

- Nuna Terra SAC

Competitive Landscape

Peru Herbal/traditional products maret remain shaped by affordability, strong cultural familiarity, and widening consumer acceptance across income groups, with demand supported by economic pressures that encourage consumers to choose lower-priced natural remedies over costlier pharmaceutical alternatives. Traditional ingredients such as eucalyptus, ginger, lemon, honey and Hedera Helix continue to drive growth in cough, cold and allergy remedies, while brands like Abrilar and Ciruelax strengthen their positioning through plant-based formulations in cough relief and digestive care. Companies such as Gloranta, Good Brands SAC and Megalabs benefit from products that blend recognised herbal components with established therapeutic perceptions, while emerging launches from players like Teva seek to capture share through innovation. Growing presence in supermarkets and improved packaging standards further enhance visibility and trust across consumer segments.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Peru Herbal/Traditional Products Market Policies, Regulations, and Standards

4. Peru Herbal/Traditional Products Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Peru Herbal/Traditional Products Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Topical Analgesics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sleep Aids- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Cough, Cold & Allergy Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Digestive Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Paediatric Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Tonics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Form

5.2.2.1. Capsules/Tablets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Syrups- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Oils & Ointments- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Health Benefit

5.2.3.1. General Wellness- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cardiovascular Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cognitive & Mental Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Digestive & Gut Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Immunity Support- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Respiratory Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Bone & Joint Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Source

5.2.4.1. Leaves- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Roots- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Barks- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Flowers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Seeds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Ingredient Type

5.2.5.1. Single-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Multi-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Function

5.2.6.1. Preventive Care- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Curative/Relief Care- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By End User

5.2.7.1. Adults- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Geriatric Population- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. Children- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Prescription Type

5.2.8.1. Over-the-Counter (OTC)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Prescription Herbal Medicines- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Sales Channel

5.2.9.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.10. By Competitors

5.2.10.1. Competition Characteristics

5.2.10.2. Market Share & Analysis

6. Peru Topical Analgesics Herbal/Traditional Products Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

6.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Peru Sleep Aids Herbal/Traditional Products Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

7.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Peru Cough, Cold & Allergy Remedies Herbal/Traditional Products Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

8.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Peru Digestive Remedies Herbal/Traditional Products Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

9.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Peru Dermatologicals Herbal/Traditional Products Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

10.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Peru Paediatric Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

11.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Peru Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

12.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Peru Tonics Herbal/Traditional Products Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

13.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. Competitive Outlook

14.1. Company Profiles

14.1.1. Herbalife Perú SRL

14.1.1.1. Business Description

14.1.1.2. Product Portfolio

14.1.1.3. Collaborations & Alliances

14.1.1.4. Recent Developments

14.1.1.5. Financial Details

14.1.1.6. Others

14.1.2. FuXion Biotech SAC

14.1.2.1. Business Description

14.1.2.2. Product Portfolio

14.1.2.3. Collaborations & Alliances

14.1.2.4. Recent Developments

14.1.2.5. Financial Details

14.1.2.6. Others

14.1.3. Megalabs SA

14.1.3.1. Business Description

14.1.3.2. Product Portfolio

14.1.3.3. Collaborations & Alliances

14.1.3.4. Recent Developments

14.1.3.5. Financial Details

14.1.3.6. Others

14.1.4. Omnilife Perú SAC

14.1.4.1. Business Description

14.1.4.2. Product Portfolio

14.1.4.3. Collaborations & Alliances

14.1.4.4. Recent Developments

14.1.4.5. Financial Details

14.1.4.6. Others

14.1.5. Good Brands SAC

14.1.5.1. Business Description

14.1.5.2. Product Portfolio

14.1.5.3. Collaborations & Alliances

14.1.5.4. Recent Developments

14.1.5.5. Financial Details

14.1.5.6. Others

14.1.6. Teva Perú SA

14.1.6.1. Business Description

14.1.6.2. Product Portfolio

14.1.6.3. Collaborations & Alliances

14.1.6.4. Recent Developments

14.1.6.5. Financial Details

14.1.6.6. Others

14.1.7. Laboratorio Farmacéuticos Markos SA

14.1.7.1. Business Description

14.1.7.2. Product Portfolio

14.1.7.3. Collaborations & Alliances

14.1.7.4. Recent Developments

14.1.7.5. Financial Details

14.1.7.6. Others

14.1.8. Medifarma SA

14.1.8.1. Business Description

14.1.8.2. Product Portfolio

14.1.8.3. Collaborations & Alliances

14.1.8.4. Recent Developments

14.1.8.5. Financial Details

14.1.8.6. Others

14.1.9. Hersil SA Laboratorios Industriales Farmacéuticos

14.1.9.1. Business Description

14.1.9.2. Product Portfolio

14.1.9.3. Collaborations & Alliances

14.1.9.4. Recent Developments

14.1.9.5. Financial Details

14.1.9.6. Others

14.1.10. Nuna Terra SAC

14.1.10.1.Business Description

14.1.10.2.Product Portfolio

14.1.10.3.Collaborations & Alliances

14.1.10.4.Recent Developments

14.1.10.5.Financial Details

14.1.10.6.Others

15. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Form |

|

| By Health Benefit |

|

| By Source |

|

| By Ingredient Type |

|

| By Function |

|

| By End User |

|

| By Prescription Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.