Mexico Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), By Application (Water, Wastewater), By End User (Industrial Water & Wastewater, Municipal Water & Wastewater)

- Energy & Power

- Oct 2025

- VI0484

- 120

-

Mexico Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

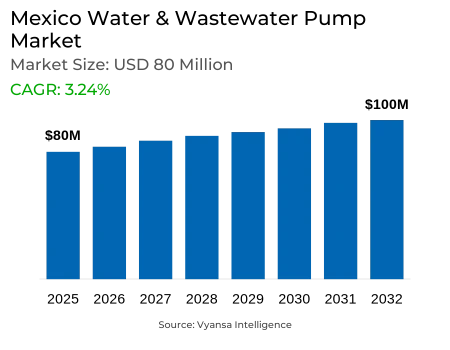

- Water & Wastewater Pump in Mexico is estimated at $ 80 Million.

- The market size is expected to grow to $ 100 Million by 2032.

- Market to register a CAGR of around 3.24% during 2026-32.

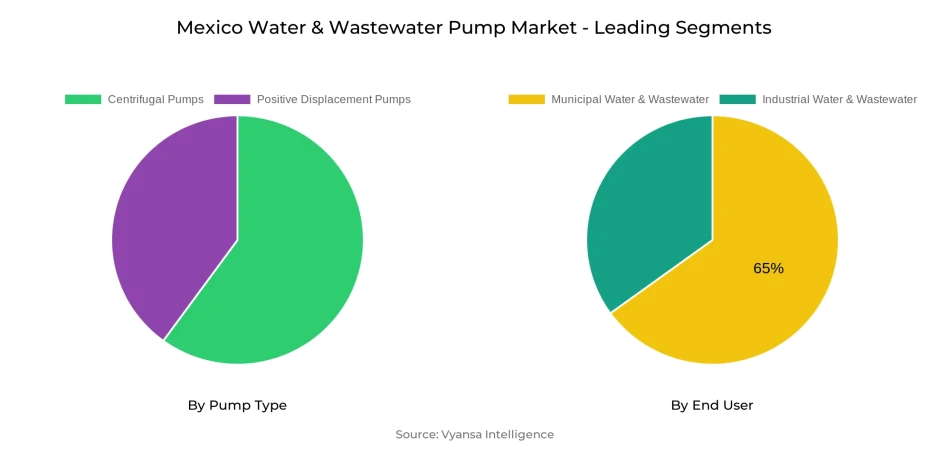

- Pump Type Segment

- Centrifugal Pumps continues to dominate the market.

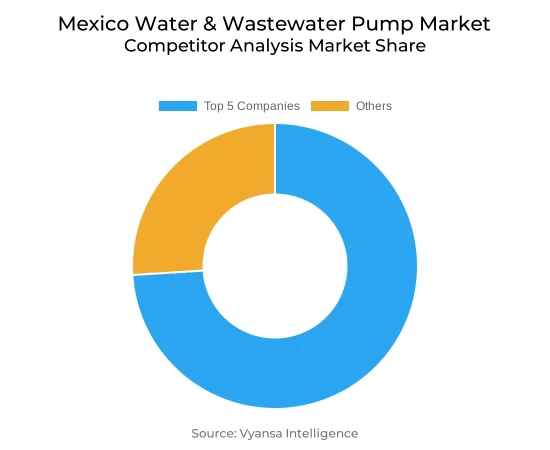

- Competition

- More than 10 companies are actively engaged in producing Water & Wastewater Pump in Mexico.

- Top 5 companies acquired the maximum share of the market.

- ITT, IDEX, Dover, Flowserve, Sulzer AG etc., are few of the top companies.

- End User

- Municipal Water & Wastewater grabbed 65% of the market.

Mexico Water & Wastewater Pump Market Outlook

The Mexico Water & Wastewater Pump Market is anticipated to grow steadily, the market being valued at $80 million in 2025 and expected to grow up to $100 million by 2032. The growth is an indication of the government's firm focus on enhancing water infrastructure with considerable budgetary allocations, such as MX$20 billion in 2025 and envisioned recurring annual investments of MX$90 billion in strategic projects. Increased demand is further fueled by the reality that 72 million Mexicans remain without access to safe water, and 47 million have insufficient sanitation facilities. These issues emphasize the pressing need for secure pumping systems in both municipal and industrial use.

Municipal water and wastewater operations are the market leaders, representing 65% of overall demand. The nation has almost 3,000 wastewater treatment plants with an aggregate capacity of 194,442 liters per second, generating consistent demands for pump replacement and upgrade. Large plants like the Atotonilco plant, which serves more than 12 million people, show the scale of municipal pumping requirements. Industrial water and wastewater is becoming the fastest-growing market, aided by tighter discharge regulations and increasing water usage in all manufacturing industries.

Centrifugal pumps remain with the largest market share because of their ability to process high flow rates for water transmission and treatment processes. Single-stage centrifugal pumps are producing the most revenue, with multistage types reporting faster growth with the assistance of digital technologies like variable frequency drives and intelligent monitoring systems. These technologies assist in enhancing energy efficiency and operational reliability that supports national agendas aimed at minimizing leakage, increasing sustainability, and updating infrastructure.

Future demand will be driven by municipal wastewater modernization projects, industrial water treatment investments, and upgrades of agricultural irrigation. Moreover, smart water management solution adoption and private sector investments in efficiency-driven technologies will drive the advanced pump demand further. As Mexico deepens its water infrastructure to address expanding urban, industrial, and agricultural demands, pump market growth is expected to be steady through 2032.

Mexico Water & Wastewater Pump Market Growth Driver

Driving Forces in Infrastructure Investment and Compliance

Mexico has severe water infrastructure needs that require aggressive pump system deployment. In 2025, the government appropriated MX$20 billion toward water infrastructure projects, but CONAGUA budget submissions indicate MX$90 billion of annual investment is required for total 47 priority water projects. Today, 72 million Mexicans (57% population) do not have access to safe water, with 47 million without safe sanitation facilities. The nation has 2,928 wastewater treatment facilities with a total capacity of 194,442 liters per second but only processes 4,529 million cubic meters of urban wastewater per year. Industrial applications use 5% of all water consumed, and municipal water systems serve 65% of the market.

Strict discharge standards according to Mexican Official Standards impose industrial compliance, necessitating sophisticated pump systems for the treatment of wastewater. The National Water Plan 2024-2030 prioritizes infrastructure upgrade in 17 strategic projects that serve 36 million residents. Mexico City's Atotonilco plant treats wastewater for 12.6 million residents, illustrating the extent of municipal pump needs in the country.

Mexico Water & Wastewater Pump Market Challenge

Critical Water Loss and Energy Efficiency Challenges

Mexico faces huge water distribution inefficiencies that limit pump market performance. Water loss due to leakage accounts for 40% of the total supply, posing operational problems for pump systems across the country. Cutzamala System reservoirs have 53.3% capacity utilization as of March 2025, reflecting strain on the current pumping infrastructure. Water pumping energy use accounts for 5.4% of the national utility supply, reflecting efficiency issues in pump operations.

Industrial water usage grew 30% during the last decade, adding more pressure on pumping equipment. Mexico is 26th among all countries in terms of water stress and is realizing only 69.9% of the advancement towards Sustainable Development Goal. Climate change affects worsen operational requirements, and 71% of its territory suffers from long-term droughts. Such conditions force pumps to run under more challenging conditions while upholding reliability and efficiency levels during long periods of dry weather.

Mexico Water & Wastewater Pump Market Trend

Smart Technology Integration and Digitalization

Mexico adopts digital water management technologies that revolutionize the operations of pumping systems. One million units of smart meter deployment take place within 10 years, covering real-time monitoring and automatic pump control systems. Amazon invested $2.45 million in Mexico City water automation initiatives, where SCADA systems are installed for telemetry and real-time control. The automation of Santa Lucía branch reduces 300 liters per second through intelligent pump management, showcasing efficiency benefits from digital integration.

Industrial digitalization promotes membrane technology uptake, with this sector recording fastest expansion in water treatment applications. Advanced monitoring technology integrating IoT and artificial intelligence maximizes pump efficiency for municipal networks. Mexican plants increasingly use variable frequency drives and intelligent monitoring systems in centrifugal pumps, part of a global sustainability trend. Digital infrastructure facilitates predictive maintenance and energy efficiency, maximizing pump life while lowering operation costs across water and wastewater treatment plants.

Mexico Water & Wastewater Pump Market Opportunity

Expanding Industrial and Municipal Market Opportunities

Mexico offers tremendous growth opportunities in water infrastructure development needing sophisticated pumping solutions. Industrial water treatment market accounted for $726.1 million in 2024 and is expected to grow at 4.8% CAGR during 2033. Municipal wastewater upgrading schemes target 1,400 municipalities with $500 million budget, offering tremendous pump replacement possibilities. Manufacturing firms intend to invest $500 million in industrial wastewater treatment gear during 2023-2025.

Seawater desalination plans pick up pace in water-short coastal areas, calling for high-pressure pump systems. The Rosarito desalination plant is one of several examples of infrastructure spending fueling pump demand. Farm modernization on 225,000 hectares vows 51% productivity gains through improved irrigation systems, increasing the agricultural pump market. Private investments of MX$16.4 billion for industrial water efficiency improvement create opportunities for energy-efficient pumps across Mexico's growing industrial base.

Mexico Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

The segment has the highest market share under the Pump Type is Centrifugal Pumps, which continues to dominate the market. Centrifugal pumps maintain their leading position due to superior efficiency in high-volume water transfer applications essential for municipal and industrial operations. These pumps excel in handling large flow rates at varying pressures, making them ideal for Mexico's diverse water management requirements from irrigation systems to wastewater treatment facilities.

Single-stage centrifugal pumps represent the largest revenue-generating segment, while multistage configurations show fastest growth rates. The centrifugal pump demonstrates strong demand across water supply, wastewater treatment, oil and gas, and manufacturing sectors. Advanced features including variable frequency drives and smart monitoring systems enhance operational efficiency, supporting the dominant market position of centrifugal technology in Mexico's expanding water infrastructure landscape.

By End User

- Industrial Water & Wastewater

- Municipal Water & Wastewater

The largest market share in the End User is Municipal Water & Wastewater, which captured 65% of the market. Municipal usage predominates because of massive government infrastructure investments towards water access by 127 million citizens. The end user segment with the largest growth is Industrial Water & Wastewater with a CAGR of 3.65%, fueled by manufacturing growth and regulatory mandates.

Municipal leadership correlates to Mexico's 2,928 operating wastewater treatment facilities demanding continuous pump replacement and upgrading. CONAGUA's strategic initiatives assist 36 million residents by optimizing municipal water infrastructures. Industrial expansion results from higher manufacturing water usage and stricter discharge standards, and manufacturers invest $500 million in treatment gear. Industrial segment growth matches Mexico's economic development agenda with sustainable demand for niche pumping applications in traditional and developing industrial sectors over the forecast period.

Top Companies in Mexico Water & Wastewater Pump Market

The top companies operating in the market include ITT, IDEX, Dover, Flowserve, Sulzer AG, KSB, Xylem, Grundfos, Ebara, SPX Flow, etc., are the top players operating in the Mexico Water & Wastewater Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Mexico Water & Wastewater Pump Market Policies, Regulations, and Standards

4. Mexico Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Mexico Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End User

5.2.3.1. Industrial Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Municipal Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Mexico Centrifugal Water & Wastewater Pump Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Mexico Positive Displacement Water & Wastewater Pump Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Flowserve Corporation

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Ebara Corporation

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.WILO SE

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Sulzer Limited

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Grundfos Holding A/S

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Xylem Inc.

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.KSB SE & Co. KGaA

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Kirloskar Brothers Limited (KBL)

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Franklin Electric

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Pentair PLC

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.