Mexico Herbal/Traditional Products Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Topical Analgesics, Sleep Aids, Cough, Cold & Allergy Remedies, Digestive Remedies, Dermatologicals, Paediatric Dietary Supplements, Dietary Supplements, Tonics), By Form (Capsules/Tablets, Powder, Syrups, Oils & Ointments, Others), By Health Benefit (General Wellness, Cardiovascular Health, Cognitive & Mental Health, Digestive & Gut Health, Immunity Support, Respiratory Health, Bone & Joint Health, Others), By Source (Leaves, Roots, Barks, Flowers, Seeds, Others), By Ingredient Type (Single-Herb Products, Multi-Herb Products), By Function (Preventive Care, Curative/Relief Care), By End User (Adults, Geriatric Population, Children), By Prescription Type (Over-the-Counter (OTC), Prescription Herbal Medicines), By Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

Mexico Herbal/Traditional Products Market Statistics and Insights, 2026

- Market Size Statistics

- Herbal/traditional products in Mexico is estimated at USD 1.26 billion in 2025.

- The market size is expected to grow to USD 1.47 billion by 2032.

- Market to register a cagr of around 2.23% during 2026-32.

- Category Shares

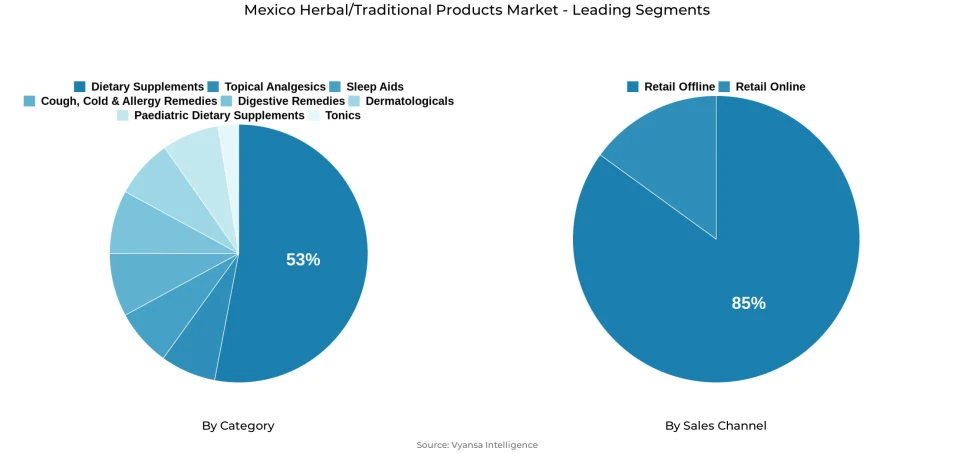

- Dietary supplements grabbed market share of 53%.

- Competition

- More than 20 companies are actively engaged in producing herbal/traditional products in Mexico.

- Top 5 companies acquired around 40% of the market share.

- Compañía Internacional de Comercio SAPI de CV; Sanofi-Aventis de México SA de CV; Distribuidora de Alimentos Naturales y Nutricionales SA de CV; Mondelez México S de RL de CV; Herbalife Internacional de México SA de CV etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Mexico Herbal/Traditional Products Market Outlook

The Mexico herbal and traditional products market is expected to maintain steady growth over the 2026–2032 timeframe, with the high cultural acceptance of medicinal plant-based therapies and a growing end user interest in natural wellness products. In 2025, the market is projected to reach USD 1.26 billion, and the growth will be supported by herbal sleep-aid formulations, adaptogen-based supplements, and plant-based calming products categories. The end users are becoming more convinced that herbal remedy options are safe, available, and consistent with traditional health practices and cultural heritage models.

Dietary supplements occupy about 53% of the market share by category classification, indicating a high level of usage of chamomile, passionflower, valerian, mint, and functional mushroom ingredients in the form of capsules, tea, and powdered formulations. The products enjoy multipurpose wellbeing positioning in stress relief, sleep support, and lifestyle balance applications, which support long-term value demand in urban and semi-urban household segments.

Retail offline has an estimated market share of 85% in the distribution channel classification, which is supported by the leading position of chain pharmacy operators such as Farmacias Similares and Farmacias Guadalajara. Pharmacy formats operate as full-line wellness retail stores, selling herbal tea products, extract formulations, and supplement lines with the support of loyalty program structures, promotion, and high levels of end-user confidence in pharmacist advice and consultation services.

Over te forcastperiod, the market is expected to increase at a compound annual growth rate of about 2.23% to USD 1.47 billion by 2032. The growth of the market is supported by the need in natural stress-relief products, herbal sleep and digestive remedy formulations, and sustainability-oriented brand positioning strategies. The long-term prospects of herbal and traditional products in Mexico are still improving due to the growing accessibility of retail and the growing cultural compatibility with plant-based therapeutic methods.

Mexico Herbal/Traditional Products Market Growth DriverGrowing Demand for Herbal Sleep and Stress-Relief Remedies

The key market growth factors is the increasing end-user demand of herbal sleep-support and relaxation remedy formulations. The prevalence of sleep difficulty among the population has been heightened by rapid urban lifestyle patterns, heightened screen exposure, and work-related stress factors. Sleep problems are common in Mexican adults, with the 2016 Mexican National Survey ENSANUT MC indicating that 37% of Mexican adults have sleep-related problems, with insomnia being the most frequent category of complaints. Previous population-based research in Mexico City reported a prevalence of insomnia of 39.7%, which validates the continuity of sleep disorder conditions among demographic groups.

Herbal remedy preparations such as chamomile, linden, and passionflower preparations are gaining popularity among end users due to their calming effect profiles and low side-effect risk profiles. These products are broadly incorporated into tea formats, capsule formulations, and liquid extract preparations, which strengthen their acceptance as daily wellness solution substitutes and underpin ongoing category growth in urban and traditional retail channel networks.

Mexico Herbal/Traditional Products Market ChallengeRegulatory Oversight and Product Quality Assurance

The significant issues facing the category is associated with product quality control standards, formulation safety protocols, and regulatory compliance requirements in a growing herbal product environment. With the growing availability of products in pharmacy networks and informal distribution channel operations, it is becoming more important to ensure that there are uniform standards of labeling accuracy, ingredient verification, and substantiation of therapeutic claims that are approved. The Federal Commission of Protection against Sanitary Risks (COFEPRIS) of Mexico is the main regulatory body that authorizes, registers, controls, inspects, monitors, and enforces the categories of herbal and natural products. COFEPRIS mandates detailed dossier filing to prove safety, efficacy, and quality compliance prior to market approval, and post-marketing surveillance by adverse effect reporting systems, Good Manufacturing Practice (GMP) compliance audit procedures, and periodic inspection schemes.

The powers of COFEPRIS enforcement authority are the suspension of the license of non-compliant manufacturing activities, the recall of products in case of unauthorized variants of formulations, and the issuance of warnings or fines in case of misleading claims. These strengthened regulatory oversight measures are recorded in 2022–2024 guidance communications. Although enhanced supervision enhances long-term end-user trust and product safety levels, it also raises operational expenses of smaller producer organizations and restricts the marketability of informally distributed herbal products that do not comply with registration and documentation requirements.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Mexico Herbal/Traditional Products Market TrendRising Adoption of Herbal Products for Emotional Wellbeing and Lifestyle Balance

The major trends that are transforming the market is the increased use of herbal and traditional product formulations to support emotional wellbeing, anxiety relief applications, and stress management purposes. Natural botanical ingredients are becoming more and more associated with holistic self-care practice models by end users, with ingredients such as chamomile, peppermint, valerian, and passionflower being used in tea preparations, supplement formulations, and daily beverage routines. Medical sources verify an increasing regional use of herbal and traditional products in emotional wellbeing in Mexico and Latin America, with Mesoamerican ethnobotanical studies reporting 92 plant species used in traditional medicine in mood and anxiety support applications, and modern end-user preference shifting to non-pharmacological wellness approach options.

This change in behavior broadens consumption patterns beyond illness-related consumption occasions, promoting regular wellness-based purchasing behavior among a wide range of age demographic groups and urban end-user segments. The more herbal calming and relaxation product categories are incorporated into daily habit routines, the stronger the demand is on both established ingredient platforms chamomile, linden and new wellness-positioned formulation innovations adaptogen blends, mood-support combinations.

Mexico Herbal/Traditional Products Market OpportunityExpansion Opportunities in Digestive and Natural Pain-Relief Products

A significant opportunity arises due to the growing end-user interest in natural digestive remedy solutions and safer pain-relief therapeutic options. Mexican cultural systems have been highly embedded in traditional Mexican herbal practices of digestive and stress management. Chamomile manzanilla is verified as one of the most widespread natural remedies in anxiety, mild depression, and digestive comfort applications, with traditional use in Mesoamerica documented and German Commission E approval of digestive tract spasm and inflammation management on the basis of clinical evidence substantiation.

Ginger has been widely reported to treat digestive disorders, inflammatory disorders, and nausea symptoms, and traditional Mexican use has been verified in the treatment of gastrointestinal disorders and relief of digestive discomfort. Mentha piperita peppermint hierba continues to be used in traditional Mexican medicine as a digestive ailment, cold symptoms, and stress-related condition management, with medicinal effects backed by phenolic acid, flavonoid, and lignan compounds that provide botanical efficacy mechanisms. Concurrently, growing end-user awareness of safety considerations in long-term synthetic analgesic use supports interest in plant-based topical and supportive formulation alternatives. This opens scope for responsibly regulated herbal digestive wellness and natural pain-relief product line development that aligns with end-user safety expectations and honors traditional health value systems. Medicinal herbalism plays a fundamental role in Mexican healthcare delivery, with medicinal plants serving as primary alternatives for treating illness among significant population segments.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Mexico Herbal/Traditional Products Market Segmentation Analysis

By Category

- Topical Analgesics

- Sleep Aids

- Cough, Cold & Allergy Remedies

- Digestive Remedies

- Dermatologicals

- Paediatric Dietary Supplements

- Dietary Supplements

- Tonics

Dietary supplements represent the dominant segment by category classification, accounting for approximately 53% of market share. This dominance is sustained by strong cultural familiarity with herbal tea preparations, capsule formulations, and extract products utilized for stress relief, digestive balance, and sleep support applications. Products featuring chamomile, passionflower, mint, and functional botanical ingredients benefit from everyday consumption habit patterns and perceived natural safety profile advantages.

Additionally, dietary supplement formats allow flexible presentation options including powder formulations, capsule delivery systems, and infusion blend preparations, enhancing accessibility across pharmacy retail operations and household usage contexts. Their multipurpose wellbeing positioning strategy and wide acceptance across age demographic groups reinforce the leading role of dietary supplements within Mexico's herbal and traditional products landscape.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline channels constitute the dominant segment by sales channel classification, representing approximately 85% of total market sales. Chain pharmacy networks remain the core purchasing hub for herbal and traditional product categories attributable to strong brand trust associations, pharmacist guidance availability, and extensive nationwide distribution coverage. These retail outlet formats support product discovery through promotional activity campaigns, loyalty scheme programs, and expanded herbal product range presentations alongside conventional health product offerings.

Physical store environments additionally reinforce habitual purchasing behavior patterns for tea products, extract formulations, and calming supplement categories, particularly among urban and family-oriented end-user segments. While retail online channels continue demonstrating expansion, retail offline pharmacy network operations retain clear market leadership attributable to accessibility advantages, reliability perceptions, and established end-user confidence levels.

List of Companies Covered in Mexico Herbal/Traditional Products Market

The companies listed below are highly influential in the Mexico herbal/traditional products market, with a significant market share and a strong impact on industry developments.

- Compañía Internacional de Comercio SAPI de CV

- Sanofi-Aventis de México SA de CV

- Distribuidora de Alimentos Naturales y Nutricionales SA de CV

- Mondelez México S de RL de CV

- Herbalife Internacional de México SA de CV

- Procter & Gamble de México SA de CV

- Genomma Lab Internacional SAB de CV

- Grupo Omnilife SA de CV

- GlaxoSmithKline México SA de CV

- Nature's Sunshine Products de México SA de CV

Competitive Landscape

In Mexico herbal/traditional products market, competition is led by Mondelez México, which consolidates its position through the continued strength of its Halls brand, gaining further value share as a trusted, widely distributed herbal cough and cold remedy. Genomma Lab emerges as the fastest-growing player, driven primarily by the strong performance of Passiflorine, a calming herbal formulation combining passionflower, valerian and lemon balm that has achieved broad consumer acceptance for sleep and stress relief. The company’s long-standing market presence, nationwide pharmacy penetration and expanding online availability have reinforced brand credibility and accessibility. Alongside these leaders, the market remains influenced by pharmacy chains such as Farmacias Similares, Guadalajara and Benavides, whose diversified herbal assortments and promotional strategies further shape competitive dynamics.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Mexico Herbal/Traditional Products Market Policies, Regulations, and Standards

4. Mexico Herbal/Traditional Products Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Mexico Herbal/Traditional Products Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Topical Analgesics- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Sleep Aids- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Cough, Cold & Allergy Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Digestive Remedies- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Dermatologicals- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Paediatric Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Dietary Supplements- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Tonics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Form

5.2.2.1. Capsules/Tablets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Syrups- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Oils & Ointments- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Health Benefit

5.2.3.1. General Wellness- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Cardiovascular Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Cognitive & Mental Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Digestive & Gut Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Immunity Support- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Respiratory Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.7. Bone & Joint Health- Market Insights and Forecast 2022-2032, USD Million

5.2.3.8. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Source

5.2.4.1. Leaves- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Roots- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Barks- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Flowers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Seeds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Ingredient Type

5.2.5.1. Single-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Multi-Herb Products- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Function

5.2.6.1. Preventive Care- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Curative/Relief Care- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By End User

5.2.7.1. Adults- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Geriatric Population- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. Children- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Prescription Type

5.2.8.1. Over-the-Counter (OTC)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Prescription Herbal Medicines- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Sales Channel

5.2.9.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.9.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.10. By Competitors

5.2.10.1. Competition Characteristics

5.2.10.2. Market Share & Analysis

6. Mexico Topical Analgesics Herbal/Traditional Products Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

6.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Mexico Sleep Aids Herbal/Traditional Products Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

7.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Mexico Cough, Cold & Allergy Remedies Herbal/Traditional Products Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

8.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Mexico Digestive Remedies Herbal/Traditional Products Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Source- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Function- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

9.2.8.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Mexico Dermatologicals Herbal/Traditional Products Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

10.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Mexico Paediatric Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

11.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Mexico Dietary Supplements Herbal/Traditional Products Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

12.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Mexico Tonics Herbal/Traditional Products Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Form- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Health Benefit - Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Source- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Ingredient Type- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By Function- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.7. By Prescription Type- Market Insights and Forecast 2022-2032, USD Million

13.2.8. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

14. Competitive Outlook

14.1. Company Profiles

14.1.1. Herbalife Internacional de México SA de CV

14.1.1.1. Business Description

14.1.1.2. Product Portfolio

14.1.1.3. Collaborations & Alliances

14.1.1.4. Recent Developments

14.1.1.5. Financial Details

14.1.1.6. Others

14.1.2. Mondelez México S de RL de CV

14.1.2.1. Business Description

14.1.2.2. Product Portfolio

14.1.2.3. Collaborations & Alliances

14.1.2.4. Recent Developments

14.1.2.5. Financial Details

14.1.2.6. Others

14.1.3. Procter & Gamble de México SA de CV

14.1.3.1. Business Description

14.1.3.2. Product Portfolio

14.1.3.3. Collaborations & Alliances

14.1.3.4. Recent Developments

14.1.3.5. Financial Details

14.1.3.6. Others

14.1.4. Genomma Lab Internacional SAB de CV

14.1.4.1. Business Description

14.1.4.2. Product Portfolio

14.1.4.3. Collaborations & Alliances

14.1.4.4. Recent Developments

14.1.4.5. Financial Details

14.1.4.6. Others

14.1.5. Omnilife SA de CV

14.1.5.1. Business Description

14.1.5.2. Product Portfolio

14.1.5.3. Collaborations & Alliances

14.1.5.4. Recent Developments

14.1.5.5. Financial Details

14.1.5.6. Others

14.1.6. Compañía Internacional de Comercio SAPI de CV

14.1.6.1. Business Description

14.1.6.2. Product Portfolio

14.1.6.3. Collaborations & Alliances

14.1.6.4. Recent Developments

14.1.6.5. Financial Details

14.1.6.6. Others

14.1.7. Sanofi-Aventis de México SA de CV

14.1.7.1. Business Description

14.1.7.2. Product Portfolio

14.1.7.3. Collaborations & Alliances

14.1.7.4. Recent Developments

14.1.7.5. Financial Details

14.1.7.6. Others

14.1.8. Distribuidora de Alimentos Naturales y Nutricionales SA de CV

14.1.8.1. Business Description

14.1.8.2. Product Portfolio

14.1.8.3. Collaborations & Alliances

14.1.8.4. Recent Developments

14.1.8.5. Financial Details

14.1.8.6. Others

14.1.9. GlaxoSmithKline México SA de CV

14.1.9.1. Business Description

14.1.9.2. Product Portfolio

14.1.9.3. Collaborations & Alliances

14.1.9.4. Recent Developments

14.1.9.5. Financial Details

14.1.9.6. Others

14.1.10. Nature's Sunshine Products de México SA de CV

14.1.10.1.Business Description

14.1.10.2.Product Portfolio

14.1.10.3.Collaborations & Alliances

14.1.10.4.Recent Developments

14.1.10.5.Financial Details

14.1.10.6.Others

15. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Form |

|

| By Health Benefit |

|

| By Source |

|

| By Ingredient Type |

|

| By Function |

|

| By End User |

|

| By Prescription Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.