India Menstrual Care Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Pantyliners, Tampons (Applicator Tampons, Digital Tampons), Towels (Standard Towels (Standard Towels with Wings, Standard Towels Without Wings), Slim/Thin/Ultra-Thin Towels (Slim/Thin/Ultra-Thin Towels with Wings, Slim/Thin/Ultra-Thin Towels Without Wings)), Intimate Wipes, Menstrual Cups, Period Underwear), Nature (Disposable, Reusable), Age Group (Up to 18 Years, 19-30 Years, 31-40 Years, 40 Years and Above), Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

India Menstrual Care Market Statistics and Insights, 2026

- Market Size Statistics

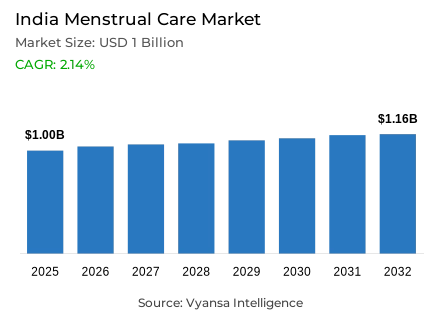

- Menstrual care in India is estimated at USD 1 billion in 2025.

- The market size is expected to grow to USD 1.16 billion by 2032.

- Market to register a cagr of around 2.14% during 2026-32.

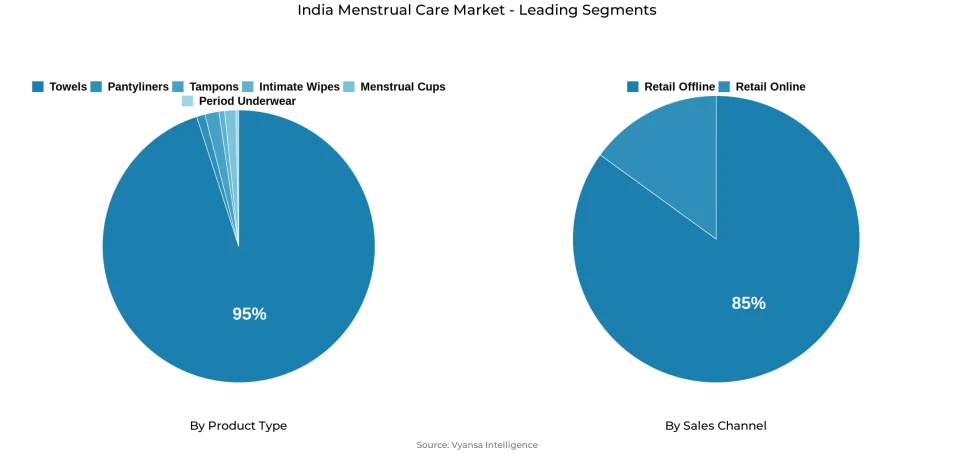

- Product Type Shares

- Towels grabbed market share of 95%.

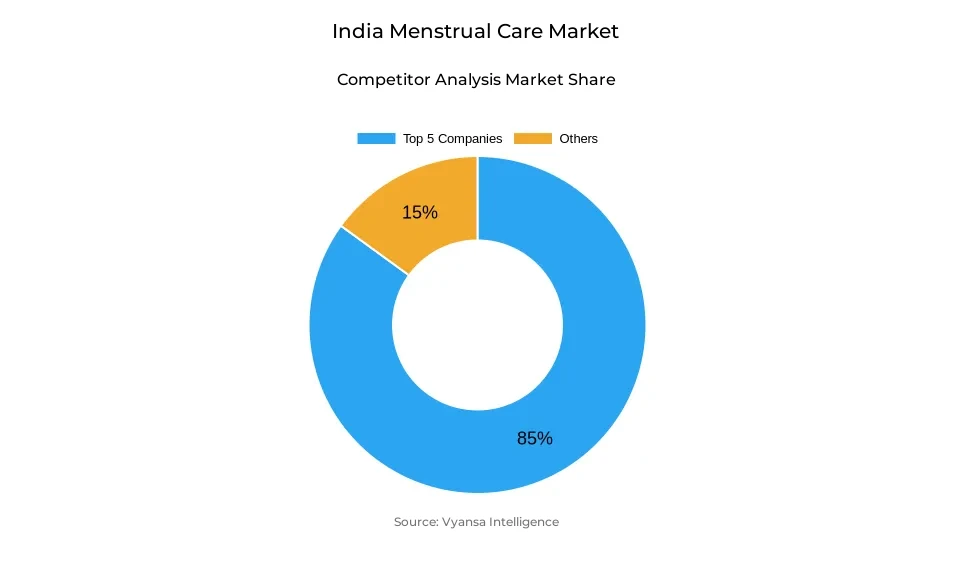

- Competition

- More than 5 companies are actively engaged in producing menstrual care in India.

- Top 5 companies acquired around 85% of the market share.

- Emami Ltd; Kimberly-Clark Lever Ltd; Gufic Biosciences Ltd; Procter & Gamble Hygiene & Health Care Ltd; Johnson & Johnson (India) Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

India Menstrual Care Market Outlook

The India Menstrual Care Market was valued around $1 billion in 2025 and is projected to reach around $1.16 billion by 2032, growing with a CAGR of approximately 2.14% from 2026-2032. The India Menstrual Care Market will continue to be driven by towels, as they occupy almost 95% of the product share due to rising campaigns, increased affluence, and government support in achieving menstrual hygiene. Nonetheless, there is still a problem of period poverty in rural regions, and affordability and availability still remain a hindrance in adopting the product. The problem has continued to drive the government and NGOs to work towards making their products more accessible in terms of affordability by providing them free of charge.

Factors that are expected to impact market development include sustainability and affordability. Environmentally conscious end user are gradually shifting towards biodegradable products like menstrual cups and period underwear, but established market players Whisper and Stayfree are coming up with eco-friendly disposable products made from bamboo and organic cotton. However, an overall lead is expected to continue in conventional disposable towels due to availability. Diversification of products and innovations with more sustainable materials would form a pivotal strategy adopted by established and newer market players.

In regards to market and route to market, the retail offline specialties and hypermarkets segment contributed about 85% of the market in 2025, though mainly due to the reasons of ease of accessibility, trust, and product comparison. However, the rapid rise in the retail Retail online market is mainly due to the rise in the level of digitalization and privacy as well as the emergence of quick-commerce platforms. Many end user in the urban areas have taken to online shopping to get their menstrual products.

Looking ahead, the future for the market lies in hybrid shopping, where offline and online shopping together would capture the dominant market share. Offline shopping would continue to be an essential part of making immediate purchases, with Retail online shopping focusing on discreet packaging, subscription shopping, and educating their end user. Raising awareness and increasing sustainability, the Indian menstrual health market looks forward to inclusive growth until 2032.

India Menstrual Care Market Growth DriverGovernment Initiatives and Rising Female Workforce Participation

Government-led hygiene programs and increasing female workforce participation are key factors driving India’s menstrual care market. The Ministry of Health and Family Welfare, under the National Health Mission, continues to improve accessibility through large-scale sanitary pad distribution, particularly in rural areas. These efforts have enhanced awareness and normalized menstrual hygiene conversations, helping bridge long-standing social and economic gaps.

Rising urbanisation and growing female participation in the workforce are also contributing to higher product adoption. According to the World Bank, India’s expanding working population increasingly prefers convenient and hygienic menstrual solutions suitable for modern lifestyles. With rising incomes and better awareness, more women are shifting towards branded and eco-friendly products, strengthening the market’s long-term growth foundation.

India Menstrual Care Market ChallengePeriod Poverty and Inequitable Distribution of Sanitation Facilities

Despite the numerous developments, period poverty remains a significant hindrance to the accessibility of MH in India. According to UNICEF India, many young girls in rural and disadvantaged areas continue to turn to non-hygenic substitutes due to financial constraints. In this case, the young girls find it difficult to maintain their MH due to inadequate, low-quality hygiene supplies.

The National Family Health Survey-5 also points towards the inequalities that exist in the aspects of education and infrastructure. The deeply rooted taboo associated with menstruation does not allow free discussion, especially in the more conservative areas of the country. Despite the initiatives of the government towards increasing the distribution of free sanitary products, the fact remains that the reach and effectiveness are hindered by logistics as well as taboo.

Unlock Market Intelligence

Explore the market potential with our data-driven report

India Menstrual Care Market TrendIncreasing Demand for Eco-Friendly & Reusable Menstrual Aids

Sustainability is becoming a hallmark pattern in the menstural care market in India, with end user steadily shifting towards using eco-friendly alternatives. According to the Ministry of Environment, Forest, and Climate Change, sanitary waste is a threat to the environment. As a result, eco-friendly alternatives made from plants and organic materials are being developed. Biodegradable towels, cups, and underwear are becoming popular.

The Sustainable Development Goals Index of the NITI Aayog points towards the increasing harmony of MHH practices and sustainable goals of the nation. It is observed that younger women in urban settings are leading this movement due to both environmental and comfort-driven innovations. The progress achieved in terms of bamboo fiber and organic cotton material properties has changed the expectations and behavior of responsible consumption.

India Menstrual Care Market OpportunityTechnology Integration and Data-Driven Product Custom

Technology integration offers great opportunities in the development of menstrual care in India. According to the Ministry of Electronics and Information Technology, the large number of internet users in the country contributes to the engagement of people in digital health. Technology, in the form of apps and Artificial Intelligence, is changing the way menstruation education is offered by providing recommendations and health services.

UN Women emphasizes the power that digital technology has in overcoming stigma and making the messages more Youth-friendly. Organizations that have the power of data analytics, subscription services, and M-gateway engagement have the opportunity to increase user loyalty and ease of access. With growing digital literacy in the Rural and Semi-Urban areas, technology-driven innovation is waiting in the wings to provide Women with the control that comes with their Menstrual Health.

Unlock Market Intelligence

Explore the market potential with our data-driven report

India Menstrual Care Market Segmentation Analysis

By Product Type

- Pantyliners

- Tampons

- Towels

- Intimate Wipes

- Menstrual Cups

- Period Underwear

The segment with highest market share under category is Towels, which accounted for around 95% of the market share. Towels continue to be the leading menstrual care component in use in India, rural as well as urban areas, owing to their affordability and familiarity among women in the region. Government initiatives like the National Health Mission’s Menstrual Hygiene Scheme in rural areas to provide low-cost sanitary pads to adolescent girls in rural areas have certainly augmented the penetration in rural areas, making towels the most trusted component in the menstrual care market in the region. Further, Whisper and Stayfree are also expanding their foothold in the business by launching more towels with better comfort, absorption capacity, and leakguards in them.

Although menstrual cups and period underwear are slowly gaining popularity in the cities, the ease of usage, economic viability, and social acceptance of disposal towels will keep them in the leading position in the forecast period as well.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under sales channel is Retail Offline with approximately 85% of share. Retail offline, particularly in pharmacies, health and beauty specialists, and hypermarkets, is still an enthusiastically chosen marketplace for women to make purchases related to menstrual care because of its accessibility, greater perceived reliability, and easy comparisons of merchandise. It is a fact that a lot of women still buy from offline retail outlets, particularly in remote areas where the internet is not easily accessible, and money transactions happen offline.

However, simultaneously, the prominent visibility of major brands and the periodic discount offers in stores also add to the success of offline sales. Though the Retail online sites are rapidly expanding with discreet delivery services, stores are already leading as they offer immediate access to products, as well as an authenticity guarantee. Therefore, retailing offline will continue to be dominant

List of Companies Covered in India Menstrual Care Market

The companies listed below are highly influential in the India menstrual care market, with a significant market share and a strong impact on industry developments.

- Emami Ltd

- Kimberly-Clark Lever Ltd

- Gufic Biosciences Ltd

- Procter & Gamble Hygiene & Health Care Ltd

- Johnson & Johnson (India) Ltd

- Soothe Healthcare Pvt Ltd

- Unicharm India Pvt Ltd

- Kimberly-Clark India Pvt Ltd

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. India Menstrual Care Market Policies, Regulations, and Standards

4. India Menstrual Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. India Menstrual Care Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Pantyliners- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Applicator Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Digital Tampons- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Standard Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.1. Standard Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1.2. Standard Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Slim/Thin/Ultra-Thin Towels- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.1. Slim/Thin/Ultra-Thin Towels with Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2.2. Slim/Thin/Ultra-Thin Towels Without Wings- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Intimate Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Menstrual Cups- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Period Underwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Nature

5.2.2.1. Disposable- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Reusable- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Age Group

5.2.3.1. Up to 18 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. 19-30 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. 31-40 Years- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. 40 Years and Above- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. India Pantyliners Menstrual Care Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. India Tampons Menstrual Care Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. India Towels Menstrual Care Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. India Intimate Wipes Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Age Group- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. India Menstrual Cups Menstrual Care Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. India Period Underwear Menstrual Care Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Nature- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Age Group- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Procter & Gamble Hygiene & Health Care Ltd

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Johnson & Johnson (India) Ltd

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Soothe Healthcare Pvt Ltd

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Unicharm India Pvt Ltd

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Kimberly-Clark India Pvt Ltd

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Emami Ltd

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Kimberly-Clark Lever Ltd

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Gufic Biosciences Ltd

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Nature |

|

| By Age Group |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.