Hungary Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), Price Category (Mass, Premium), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Feb 2026

- VI0971

- 115

-

Hungary Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

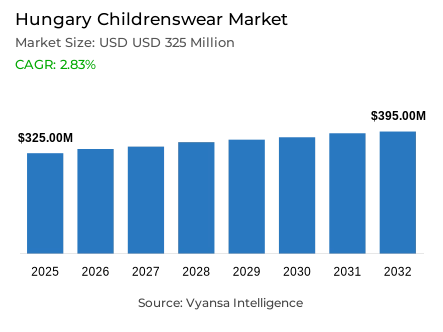

- Childrenswear in Hungary is estimated at USD 325 million in 2025.

- The market size is expected to grow to USD 395 million by 2032.

- Market to register a cagr of around 2.83% during 2026-32.

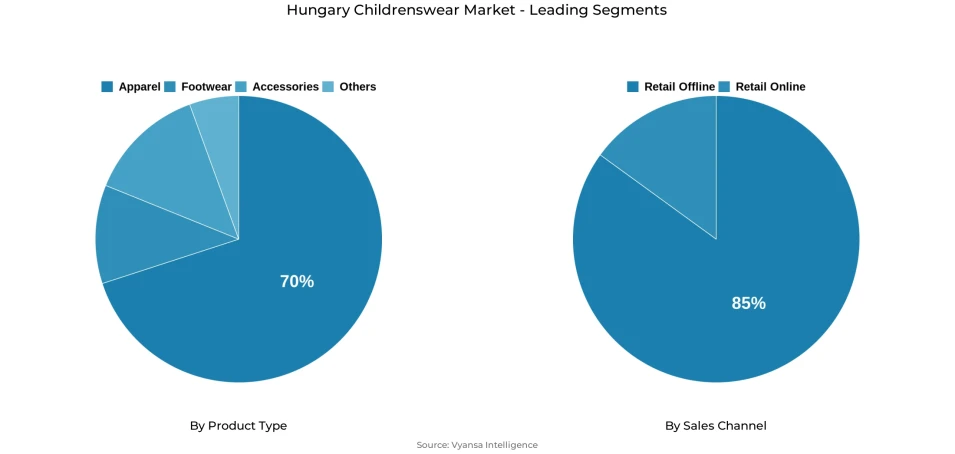

- Product Type Shares

- Apparel grabbed market share of 70%.

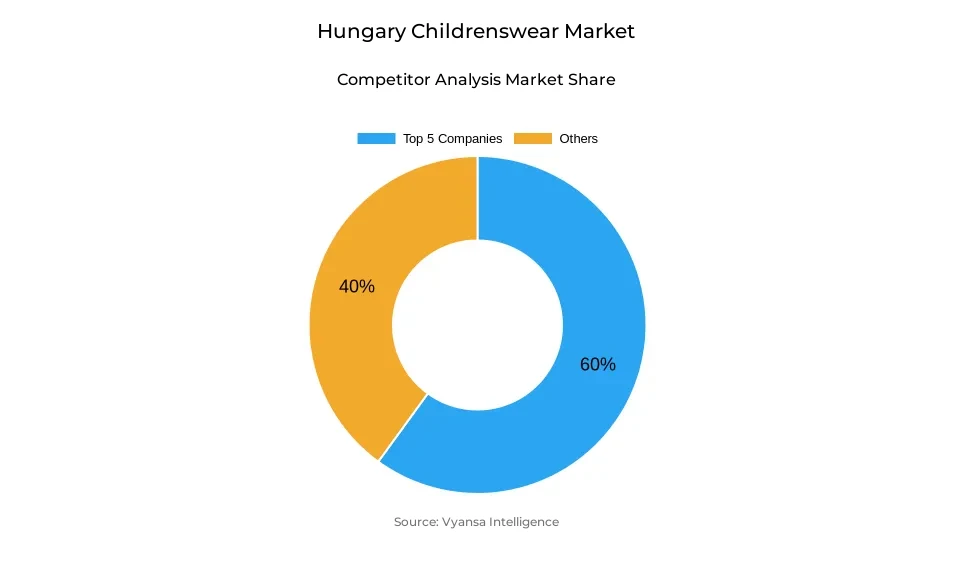

- Competition

- More than 20 companies are actively engaged in producing childrenswear in Hungary.

- Top 5 companies acquired around 60% of the market share.

- C&A Mode Kereskedelmi Kft; Brendon Gyermekáruházak Kft; ITX Magyarország Kft; Pepkor Hungary Kft; H&M Hennes & Mauritz Kft etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Hungary Childrenswear Market Outlook

The Hungary children wear market is estimated to be USD 325 million in 2025 and is expected to grow to USD 395 million in 2032 with a compound annual growth rate of approximately 2.83% between 2026 and 2032. The category has remained strong in terms of value and volume due to the high value that parents and families accord to children clothing. Childrenwear is a priority spending even in the face of inflation and economic uncertainty, and relatives often help in buying. The largest portion of the market is apparel, which is approximately 70% of total sales, highlighting the steady demand in the categories of everyday wear and occasion-based clothing.

The competitive environment is still dominated by affordable fashion providers. The most popular brand is Pepco, which is supported by strong promotions and widespread availability, then there is H&F and F&F, and Decathlon. Although low-end brands like Shein and Lidl have become popular, high-end brands like Zara Kids and Burberry are still popular when it comes to special events. The introduction of Primark in Hungary in 2024 has also added to the competition, offering affordable but fashionable collections that appeal to local families.

The retail offline remains the main channel of sale, with about 85% of the market share, as families prefer shopping in-store to get the right fit and feel the fabric. However, online stores like Temu, About You, Shein, and Zalando are gaining prominence due to their competitive prices and convenience. Influencer marketing and social media are influencing buying patterns, especially among parents and older children, where sneakermania and trendy intellectual property-themed clothing (such as Paw Patrol, Barbie, Minecraft) are driving demand on products that are a must-have.

In the future, the growth will be guided by omnichannel strategies and portfolio diversification. Retailers will strengthen physical and online touchpoints to appeal to a wider audience. Second-hand clothes are likely to be a major subtrend, supported by apps like Facebook Marketplace and other resale groups. This combination of low prices, fashionable demand, and changing retailing patterns will support the gradual growth of the Hungary children clothes market

Hungary Childrenswear Market Growth DriverParental Prioritization and Multigenerational Spending Support Growth

A strong cultural emphasis on children’s well-being and appearance continues to play a central role in shaping family spending priorities. Parents still focus on children clothing despite the inflationary pressures because they view it as a non-discretionary cost. Multigenerational financial support strengthens this feeling, and often grandparents and extended families contribute to buying clothes to children. This behavioural stability maintains consistent value and volume increases despite the wider economic uncertainty.

Household spending on children products grew by 6.8% in 2024 according to the Central Statistical Office (KSH) of Hungary, which shows resilience in this area. Also, a survey shows that the final consumption expenditure of households on clothing in Hungary increased by 5.1% annually, even with moderate inflation. These statistics demonstrate the long-term significance of children wear in the household budget, which makes it a fundamental part of the national apparel market.

Hungary Childrenswear Market ChallengeMarket Polarization and Pressure on Local Retailers

Growing market polarisation between low-priced mass brands and high-end international labels is intensifying competitive pressure, limiting the space for mid-range players to maintain distinct positioning. With the growth of global fast-fashion retailers, small local child-specialty stores find it difficult to compete, leading to the decrease in market diversity. This merger limits the innovation of domestic brands and increases competition in prices. According to the Hungary Retail Association data, more than 20% of independent childrenswear retailers went out of business between 2022 and 2024, in large part due to cost pressures and the prevalence of multinational players.

Moreover, inflation remains a limiting factor on end user buying power – Hungary has an average inflation rate of 17.6% in 2023, one of the highest in the EU. Such circumstances make it hard to maintain profitability and inventory stability among local retailers. The ensuing market imbalance underscores structural issues that may hamper the long-term competitiveness of the sector.

Hungary Childrenswear Market TrendSocial Media Influence and Sneakermania Shaping Fashion Choices

A prominent trend shaping the market is the rising influence of social media and youth-driven fashion movements, with sneaker culture playing a central role in guiding style preferences. Online communities and influencers are becoming more popular among parents and older children to discover what they must have to wear, thus creating aspirational consumption behaviors. The same is applied to the fashion of children, with limited-edition sneakers, hoodies, and streetwear-style designs being popular. A 2024 survey by Statista found that 62% of Hungary parents use social media trends to buy children clothes, highlighting the importance of digital influence as a factor in purchase decisions.

Furthermore, online fashion sales in Hungary increased by 14% in 2024, with families becoming more active on retail online platforms due to affordability and trend-driven collections. This intersection of online activity and street culture shows that global fashion trends are increasingly shaping the wardrobe of children.

Hungary Childrenswear Market OpportunityRising Demand for Themed and Sustainable Apparel Lines

Market evolution will create attractive growth avenues for thematic, sustainable, and inclusive childrenswear product lines. The social and media will drive the need to wear clothes that are related to the trending entertainment properties like Minecraft, Paw Patrol, and Barbie, thus opening up opportunities to license and launch co-branded products. Additionally, the sustainability focus that is prevalent in the world will appeal to Hungary families that are becoming more aware of fashion that is environmentally friendly.

The Sustainability Survey indicates that 58% of Hungary end users are willing to wear clothes made of organic or recycled materials, which is an indication of willingness to use greener options. Also, McKinsey states that the demand of sustainable apparel in Central Europe is expected to increase by 10% each year until 2030 due to the influence of young, environmentally conscious parents. These trends point to the untapped potential of brands and designers who can integrate sustainability, creativity, and emotional resonance in childrenswear collections.

Hungary Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Footwear

- Accessories

- Others

The product type with the greatest market share in the Hungary Childrenswear market is Apparel, accounting for about 70% of this market. The segment continues to receive support from parents and families who are driven to purchase clothes for children at any cost due to inflation. Clothing is an absolute necessity, with product lines ranging from casual wear to school wear to fashion-oriented wear influenced by social trends. The ever-growing trend of “sneakermania” contributes to this segment due to limited editions of hoodies and track suits.

Also, there are affordable and high-end clothing brands gaining acceptance with their quality and fashionable designs at affordable prices. Leading brands such as Pepco, H&M, and F&F are increasing their offerings in childrenswear, and international brands like Primark are improving accessibility with affordable and fashionable options, thus maintaining apparel's lead in Hungary's childrenswear market.

By Sales Channel

- Retail Offline

- Retail Online

Retail Offline Sales Channel continues to lead in Hungary as Hungary parents believe in buying offline as they get to check the quality of the product in person and its comfort along with its size. Shopping centers, supermarkets, and discount stores like Pepco, Lidl, and Decathlon continue to be prime offline malls for retailing of childrenswear along with other household goods.

Retail Offline is also strengthened by the ongoing focus on promotions and off-line events from key players. Even as online shopping sites such as Shein and Temu are gaining prominence, many parents are appreciating the tangible and immediate availability of off-line shopping. The increased adoption of omnichannel retail practices such as pick-up and returns is also closing the convenience and reliability gaps between online and off-line Retail Offline and ensuring off-line Retail Offline remains the bedrock of childrenswear in Hungary.

List of Companies Covered in Hungary Childrenswear Market

The companies listed below are highly influential in the Hungary childrenswear market, with a significant market share and a strong impact on industry developments.

- C&A Mode Kereskedelmi Kft

- Brendon Gyermekáruházak Kft

- ITX Magyarország Kft

- Pepkor Hungary Kft

- H&M Hennes & Mauritz Kft

- Tesco-Globál Áruházak Zrt

- Tízpróba Magyarország Kft

- KiK Textil és Non-Food Kft

- Shein Group

- LPP Hungary Kft

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Hungary Childrenswear Market Policies, Regulations, and Standards

4. Hungary Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Hungary Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Hungary Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Hungary Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Hungary Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Pepkor Hungary Kft

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.H&M Hennes & Mauritz Kft

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Tesco-Globál Áruházak Zrt

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Tízpróba Magyarország Kft

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.KiK Textil és Non-Food Kft

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.C&A Mode Kereskedelmi Kft

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Brendon Gyermekáruházak Kft

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.ITX Magyarország Kft

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Shein Group

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. LPP Hungary Kft

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.