Hong Kong Bottled Water Market Report: Trends, Growth and Forecast (2026-2032)

By Type of Water (Carbonated Bottled Water, Flavoured Bottled Water, Functional Bottled Water, Still Bottled Water (Purified Water, Mineral Water, Spring Water, Plain Water)), By Packaging Material (Plastic Bottles, Glass Bottles, Metal Cans, Others (Tetra Pack Cartons, Bioplastics, etc.)), By Price Point (Mass, Premium), By Sales Channel (On Trade, Off Trade (Retail Offline, Retail Online))

- FMCG

- Feb 2026

- VI0970

- 125

-

Hong Kong Bottled Water Market Statistics and Insights, 2026

- Market Size Statistics

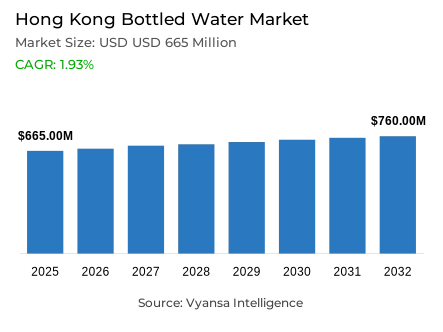

- Bottled water in Hong Kong is estimated at USD 665 million in 2025.

- The market size is expected to grow to USD 760 million by 2032.

- Market to register a cagr of around 1.93% during 2026-32.

- Type of Water Shares

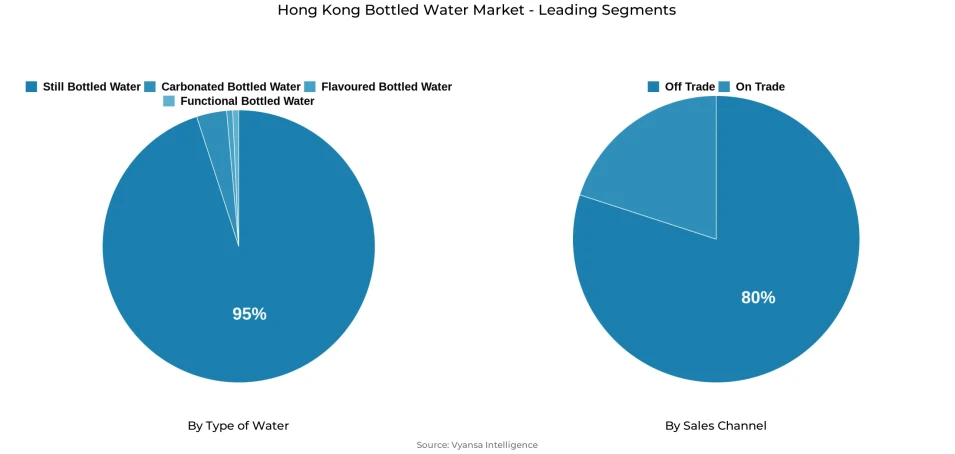

- Still bottled water grabbed market share of 95%.

- Competition

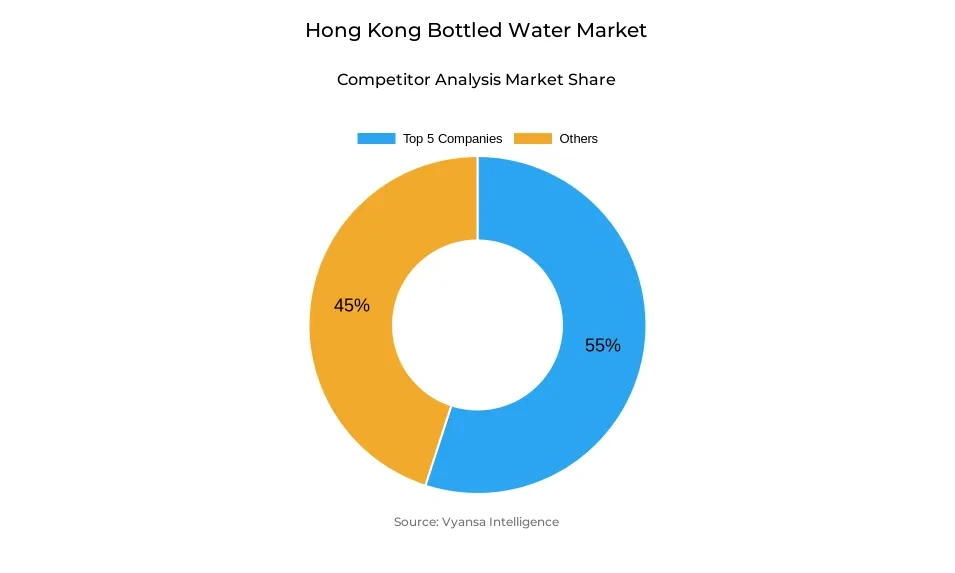

- Bottled water in Hong Kong is currently being catered to by more than 15 companies.

- Top 5 companies acquired around 55% of the market share.

- Danone Imported Waters (Greater China); DFI Retail Group; Nestlé SA; AS Watson Group; Swire Coca-Cola Hong Kong Ltd etc., are few of the top companies.

- Sales Channel

- Off trade grabbed 80% of the market.

Hong Kong Bottled Water Market Outlook

The Hong Kong bottled water market is estimated to be USD 665 million in 2025 and is expected to grow to almost USD 760 million in 2032, indicating a moderate CAGR of about 1.93% between the years 2026 and 2032. However, the bottled water segment is the most dominant, with an estimated 95% market share, thus highlighting its status as the most preferred option when it comes to daily hydration. In terms of distribution, off-trade outlets contribute about 80% of the total sales, and this fact indicates the significance of supermarkets and convenience stores in influencing the habitual buying patterns. These size and share dynamics, when combined, suggest a mature but stable market structure.

The hydration behaviour in Hong Kong is subject to a strong influence of the public confidence in the safety of drinking water. The strict control of physical, chemical, bacteriological, and radiological parameters by the Water Supplies Department guarantees that the treated tap water is always of the required standard of local drinking-water. End users are not faced with any obstacles to accessing safe piped water, and thus the overall hydration demand is stabilised. As a result, bottled water is not a substitute to municipal water but a complement to it, as it is convenient and mobile and meets high standards of purity and safety.

Market conditions are becoming more and more environmentally conscious. Plastic waste constitutes a large percentage of landfill waste, and plastic beverage containers continue to be the subject of policy analysis. The future Producer Responsibility Scheme of plastic beverage containers is an indication of increased expectations in terms of collection and recycling. Although this presents compliance and coordination issues to the bottled-water producers, it also promotes the progressive enhancement of the packaging design and waste-recovery activities throughout the industry.

Additionally, the market perspective is being influenced by policy momentum in favour of circular-economy practices, which prefer low-growth over high-volume growth. By changing their packaging strategies to meet regulatory and environmental requirements, brands can increase their credibility and remain relevant. With a robust retail base, dense population, and stable hydration requirements, the Hong Kong bottled water market is projected to expand steadily up to 2032, with convenience-based consumption and sustainability alignment shaping its development.

Hong Kong Bottled Water Market Growth DriverRising Confidence in Water Safety Strengthening Hydration Demand

The perception of the safety of drinking water by the population has a significant impact on hydration behaviour and demand in the Hong Kong bottled water market. The Hong Kong Water Supplies Department has stringent monitoring to make sure that all the treated drinking water meets the Hong Kong Drinking Water Standards in terms of physical, chemical, bacteriological and radiological parameters. Such extensive monitoring builds end-user trust in both municipal and packaged water sources, which form the basis of routine hydration decisions and influences expectations of purity and safety. The availability of piped drinking water, which is nearly universal, i.e. about 100% of urban dwellers are linked to safe, treated water, further stabilises the hydration landscape and minimises access-related obstacles.

Although bottled water is still popular in terms of convenience and on-the-go consumption, high confidence in the quality of municipal water promotes a moderate attitude towards hydration among final consumers. This trust maintains the demand of bottled water and also promotes the interest in the high quality and functional hydration products that meet the high safety standards, thus supporting the relevance of the category in the everyday consumption events in the dense urban setting of Hong Kong.

Hong Kong Bottled Water Market ChallengeEnvironmental Pressures from Plastic Waste and Disposal

Plastic waste management is a structural limitation of the Hong Kong bottled water market, which is directly connected to the volumes of single-use packaging. In 2024, plastic materials constituted about 18% of the municipal solid waste discarded in landfills, which underscores the continuing environmental stress despite the slow decline in total waste production. Plastic beverage containers represent about 5 % of the municipal waste plastics, which is why the policy focuses on the contribution of the bottled beverage industry to landfill addiction and recovery failures.

In response to these issues, the Hong Kong Government is developing a Producer Responsibility Scheme (PRS) of plastic beverage containers to enhance the effectiveness of collection and recycling. Although this is an indicator of regulatory dedication to waste minimization, the complexity of implementation, infrastructure preparedness, and inter-stakeholder coordination are critical issues. The compatibility of environmental goals with the convenience of end-users and cost-effectiveness remains a limitation to swift sustainability shifts.

Hong Kong Bottled Water Market TrendRegulatory Emphasis on Sustainable Packaging Innovation

Sustainability is a growing regulatory concern that is influencing packaging policies in the Hong Kong bottled water market. The future Producer Responsibility Scheme on plastic beverage containers will likely compel producers and importers to contribute to end-of-life management, which will strengthen the principles of recycling, reuse, and the circular economy. This regulatory trend forces bottled water brands to re-evaluate material selection, packaging design, and recovery compatibility to stay in compliance and competitive.

Meanwhile, municipal waste indicators show slow but steady growth in recovery rates and a decrease in the volume of plastic disposal, which indicates gradual improvement in environmental management. These trends are in line with the increasing sustainability demands of policymakers and final consumers, which affect product development and corporate environmental responsibility. Sustainability in packaging is thus becoming more of a strategic differentiator than a compliance issue in the competitive bottled water environment.

Hong Kong Bottled Water Market OpportunityAdvancing Circular Packaging as a Strategic Market Opportunity

The policy momentum in the direction of the adoption of the circular economy provides the bottled water producers with the meaningful opportunities to enhance the positioning by the means of the packaging innovation. With Hong Kong developing legislative frameworks to manage plastic beverage containers, brands can invest in fully recyclable or reusable packaging formats that can be used with formal recovery systems. Early adoption is not only conducive to regulatory alignment but also brand credibility and environmental differentiation.

In addition to compliance, partnership with waste collection agencies, recycling technology suppliers, and end-user engagement programs can open the door to operational efficiencies and long-term sustainability benefits. The increasing environmental consciousness of the population strengthens the need of environmentally friendly packaging of goods, and the use of circular packaging becomes a competitive edge. Firms that incorporate circularity in product design and supply chains are in a good position to realize value in a market environment that is becoming more sustainability-oriented.

Hong Kong Bottled Water Market Segmentation Analysis

By Type of Water

- Carbonated Bottled Water

- Flavoured Bottled Water

- Functional Bottled Water

- Still Bottled Water

- Purified Water

- Mineral Water

- Spring Water

- Plain Water

Still Bottled Water holds the dominant position within the Type of Water category in the Hong Kong bottled water market, accounting for approximately 95% of the market share. Its leadership reflects end users’ preference for simplicity, neutral taste, and suitability for routine hydration across diverse daily occasions. The segment’s accessibility, price stability, and alignment with Hong Kong’s hot and humid climate firmly anchor its role as the primary hydration solution.

Within this leading segment, purified, spring, and natural mineral water coexist, catering to varying preferences and perceived quality expectations. Natural mineral water is gaining attention for its mineral composition and perceived health benefits, appealing to niche end-user groups. Despite gradual diversification, still bottled water remains the structural foundation of market volumes and retail presence.

By Sales Channel

- On Trade

- Off Trade

- Retail Offline

- Retail Online

Off-Trade sales channel represent the largest share of bottled water sales in Hong Kong, accounting for approximately 80% of the market. Supermarkets, convenience stores, and other retail outlets dominate purchasing behaviour due to their extensive reach, high footfall, and ability to support both planned and impulse purchases. These channels offer end users convenient access to a wide range of brands, pack sizes, and price tiers within a single shopping trip.

Supermarkets anchor off-trade dominance by providing broad assortments spanning value-oriented still water to premium offerings. Their widespread urban and suburban presence ensures consistent product visibility and availability, reinforcing habitual purchasing patterns. As the primary distribution backbone, off-trade channels continue to shape competitive positioning and volume stability across the Hong Kong bottled water market.

List of Companies Covered in Hong Kong Bottled Water Market

The companies listed below are highly influential in the Hong Kong bottled water market, with a significant market share and a strong impact on industry developments.

- Danone Imported Waters (Greater China)

- DFI Retail Group

- Nestlé SA

- AS Watson Group

- Swire Coca-Cola Hong Kong Ltd

- Danone Groupe

- Vitasoy International Holdings Ltd

- Fiji Water LLC

- Acqua Minerale San Benedetto SpA

- Wildalpen Wasserverwertungs GmbH

Competitive Landscape

Hong Kong’s bottled water market is led by Swire Coca-Cola’s Bonaqua, positioned as a premium mineralised purified water brand emphasising purity, health, and sustainability. Bonaqua strengthened leadership through innovation, launching the world’s first label-less bottled water using lighter recycled PET, reinforcing its eco-friendly image. Its wide range of pack sizes supports both bulk and retail demand, supported by strong presence in convenience stores and supermarkets. Danone is a key challenger through its Evian and Volvic brands, which are gaining share via premium positioning, natural spring sourcing, and diversified formats including glass, cans, and sports-cap bottles. Danone’s focus on quality, health, and sustainability, supported by strategic distribution and innovation, intensifies competition at the premium end of Hong Kong’s bottled water market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Hong Kong Bottled Water Market Policies, Regulations, and Standards

4. Hong Kong Bottled Water Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Hong Kong Bottled Water Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Volume (Million Litres)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type of Water

5.2.1.1. Carbonated Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Flavoured Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Functional Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Still Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Purified Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Mineral Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Spring Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Plain Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Packaging Material

5.2.2.1. Plastic Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Glass Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Metal Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others (Tetra Pack Cartons, Bioplastics, etc.)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Point

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. On Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Off Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Hong Kong Carbonated Bottled Water Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Volume (Million Litres)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Hong Kong Flavoured Bottled Water Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Volume (Million Litres)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Hong Kong Functional Bottled Water Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Volume (Million Litres)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Hong Kong Still Bottled Water Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Volume (Million Litres)

9.2. Market Segmentation & Growth Outlook

9.2.1.By Type of Water- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Price Point- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. AS Watson Group

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Swire Coca-Cola Hong Kong Ltd

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Danone Groupe

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Vitasoy International Holdings Ltd

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Fiji Water LLC

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Danone Imported Waters (Greater China)

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. DFI Retail Group

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Nestlé SA

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Acqua Minerale San Benedetto SpA

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Wildalpen Wasserverwertungs GmbH

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type of Water |

|

| By Packaging Material |

|

| By Price Point |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.