Germany Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), Price Category (Mass, Premium), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Feb 2026

- VI0968

- 125

-

Germany Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

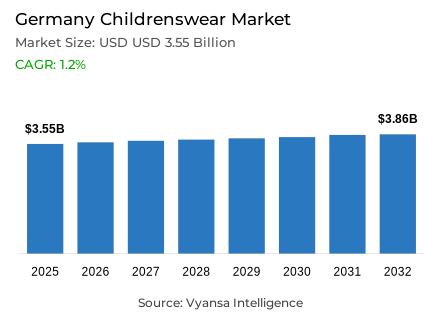

- Childrenswear in Germany is estimated at USD 3.55 billion in 2025.

- The market size is expected to grow to USD 3.86 billion by 2032.

- Market to register a cagr of around 1.2% during 2026-32.

- Product Type Shares

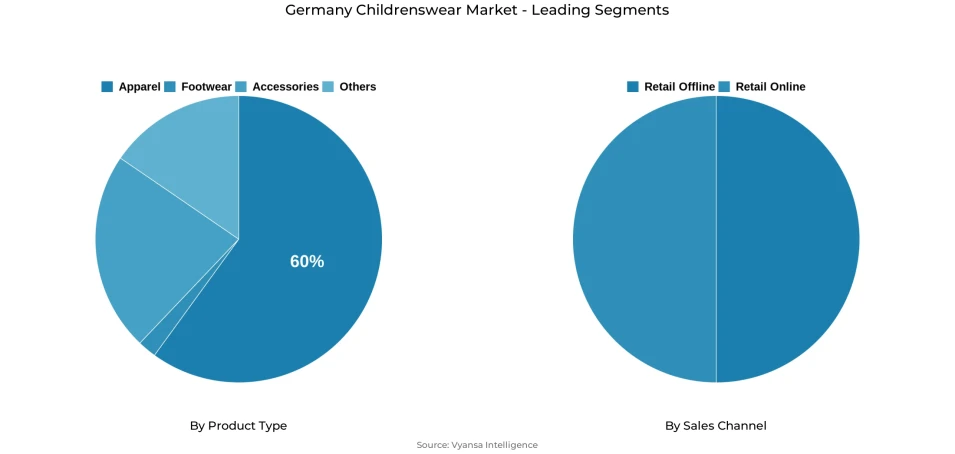

- Apparel grabbed market share of 60%.

- Competition

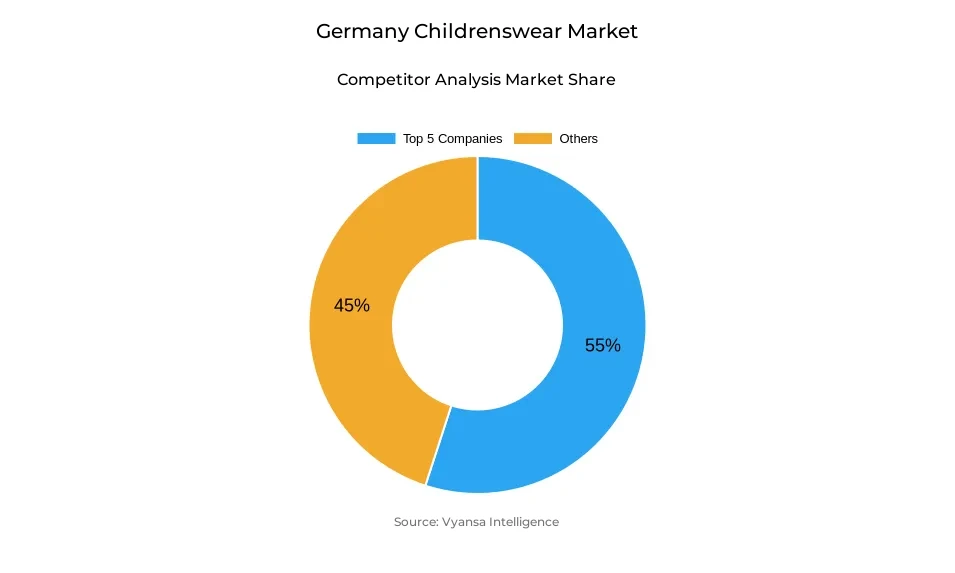

- Childrenswear in Germany is currently being catered to by more than 20 companies.

- Top 5 companies acquired around 55% of the market share.

- Lidl Dienstleistung GmbH & Co KG; KiK Textilien & Non-Food GmbH; Otto GmbH & Co KG; Ernsting's Family GmbH & Co KG; C&A Mode GmbH & Co KG etc., are few of the top companies.

Germany Childrenswear Market Outlook

The Germany childrenwear market is expected to reach USD 3.55 billion in 2025 and then reach USD 3.86 billion in 2032, growing at a compound annual growth rate of approximately 1.2% from 2026 through 2032. Notwithstanding the fact that the demand for baby and toddler wear is still decreasing due to the declining birth rate in Germany, this type of wear is still the predominant type and accounts for approximately 60% of overall sales. The market is also characterized by superiority in terms of quality and sustainability. Parents in Germany are supportive of environmentally and socially responsible children’s wear and opt for products made from organic and recycled sources and are fair-trade compliant.

Family of Ernsting continues to dominate the market with their widely spread retail chains and budget-friendly as well as family-oriented product designs. Together, the five top-most companies account for nearly 55% market share in overall market share, signifying fairly a saturated market structure. Grocery retailing chains such as LIDL and Aldi are increasingly being accepted by their in-house brands offered by them at quite cheap rates and gradually improving quality. Fast-fashion and ultra-fashion brands are being seen to emerge as major alternatives for such families which have been constrained by budgetary implications owing to economic uncertainties.

The marketing and sales environment is still led by retail offline, where parents prefer offline stores, where they can physically assess the quality and fit of fabrics. Still, the omnichannel trends are developing at a very high speed, where they are bringing together the advantages of online and offline channels. Online stores are enjoying a good boost, which is caused by the impact created by social networks, online promotions, and online technologies such as augmented reality virtual try-on tools.

In the coming years, sustainability and the circular economy are set to be the key focus in market development. The parents are shifting to used and resale sites, while brands are introducing the buy-back initiative and sustainable product lines to cater to conscious end users. It is believed that the private labels will continue to grow in the market, and the focus will be on the cost-effective yet sustainable designs, which would be innovative and functional to ensure sustainable market growth.

Germany Childrenswear Market Growth DriverStrong Parental Preference for Sustainable and Durable Clothing

The Germany childrenswear market is also motivated by the increasing focus of sustainability, durability and ethical sourcing by parents. With the growing environmental awareness, parents are demanding clothes that are manufactured using organic and eco-certified products that ensure safety, durability and minimum environmental effects. The German Environment Agency reports that 67% of Germans consider environmental protection to be a factor in their daily consumption decisions, which highlights a high national orientation towards sustainability. According to Statista (2024), more than 60% of end users in Germany are willing to use sustainable textiles, especially in children clothing where comfort and safety are the most important factors.

At the same time, sustainability certifications like GOTS and Fairtrade are emerging as decisive purchase influencers. German parents are ready to spend a little more on the clothes that assure them of ethical manufacturing and extended product life. Such increased environmental and social consciousness influences end user behavior and prompts manufacturers to shift to more transparent and circular production models to address the growing demands.

Germany Childrenswear Market ChallengeDeclining Birth Rates and Weakened Consumer Spending Power

The major challange faced by the market is the fact that birth rates are still decreasing, and end user confidence is low, not to mention the economic uncertainty that is still present. Germany has a fertility rate of 1.36 children per woman in 2024, which is one of the lowest in Europe, according to Destatis (Federal Statistical Office of Germany), which means a declining end user base. At the same time, the German Economic Institute (IW Koel) states that the real household disposable income decreased by 1.8% in 2024, which restricts the purchasing power of parents. Such financial and structural limitations force families to cut down on non-essential clothes and focus on affordability.

The twin effects of demographic and cost-of-living stresses represent a long-term threat to the segment. The decline in family formation and tight frugality in spending results in slower sales cycles, and rising production and energy costs limit profit margins of manufacturers. The outcome is a difficult market environment in which growth can only be maintained through innovative pricing and a move towards value-based, long-lasting clothing.

Germany Childrenswear Market TrendDigitalization and Social Media Influence on Parental Purchasing

The growing integration of digital retail platforms and influencer engagement into parents’ purchasing behaviour is reshaping how childrenswear is discovered and bought. German parents are becoming more and more online shoppers who are comparing prices, finding discounts and reading product reviews, combining digital convenience with quality-conscious decision-making. Bitkom Research (2024) states that approximately 78% of German parents buy children clothing online at least once a month, which indicates the ongoing increase of omnichannel behaviour. According to the Germany Social Trends Report 2024 by Hootsuite, 65% of parents use social media recommendations when buying children products.

This intersection of retail online and social validation defines the way parents interact with brands and assess sustainability claims. Trust-based storytelling has become a significant source of engagement due to the influence of parenting figures in influencer marketing. In the meantime, virtual fitting tools powered by AI and AR-enhanced browsing experiences enhance purchase satisfaction. These online changes mark a radical change in the way contemporary parents think about convenience, value and quality assurance.

Germany Childrenswear Market OpportunityRising Potential in Circular Economy and Eco-Certified Fashion

Future growth will be supported by the expansion of circular economy practices and the increasing adoption of eco-certified apparel across the market. Parents will also embrace repair, resale and recycling programmes that will prolong the life of clothes and minimize wastage. According to the European Environment Agency (EEA), the textile reuse and recycling rate in Germany will increase to 47% in 2024, compared to 39% in 2021, which means that the country is moving towards the adoption of circular consumption practices at an accelerated pace. Also, the 2024 survey conducted by Greenpeace Germany reveals that 72% of parents will purchase second-hand or recycled childrenswear in case of quality and hygiene assurance.

This change in behaviour will mark a structural change to business models that are sustainability-oriented. Brands will be in line with the wider circular economy agenda in Germany by launching repairable fabrics, buy-back programs, and open recycling systems. Ethical manufacturing, combined with traceable supply chains, will not only appeal to eco-friendly parents but will also put the market in a position to grow sustainably in the long-term.

Germany Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Footwear

- Accessories

- Others

The segment with the highest share under the product type category in the Germany Childrenswear Market is Apparel, which accounts for around 60% of the market. This dominance is largely driven by the essential nature of clothing items such as everyday wear, school uniforms, and seasonal apparel. German parents continue to prioritise quality, durability, and comfort when purchasing childrenswear, opting for premium materials that ensure long-term use. Despite declining birth rates, the steady replacement demand for apparel sustains the segment’s strong performance.

Moreover, the shift towards sustainable and ethically produced apparel has further supported this category’s growth. Many parents are choosing brands that use organic cotton, recycled fabrics, and eco-friendly dyes to ensure both safety and environmental responsibility. With increasing interest in craftsmanship and transparency, smaller sustainable labels and private brands are steadily gaining traction alongside leading players like H&M and C&A, reinforcing apparel’s lead in the market.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel category in the Germany Childrenswear Market is Retail Offline, which continues to dominate the market. Physical stores remain the preferred shopping destination for most German parents, as they value the ability to assess fabric quality, durability, and fit before making a purchase. Major players such as Ernsting’s Family and H&M maintain strong nationwide store networks that ensure accessibility and convenience, driving consistent sales through trusted in-person experiences.

However, the growing adoption of omnichannel strategies has further strengthened retail offlineers’ position. Many are integrating digital tools such as online catalogues, AI recommendations, and in-store pickup options to enhance convenience. These hybrid models combine the tactile benefits of physical shopping with the ease of retail online, ensuring a balanced approach that appeals to modern, value-conscious parents. As a result, retail offline remains the leading and most resilient sales channel in Germany’s childrenswear market.

List of Companies Covered in Germany Childrenswear Market

The companies listed below are highly influential in the Germany childrenswear market, with a significant market share and a strong impact on industry developments.

- Lidl Dienstleistung GmbH & Co KG

- KiK Textilien & Non-Food GmbH

- Otto GmbH & Co KG

- Ernsting's Family GmbH & Co KG

- C&A Mode GmbH & Co KG

- H&M Hennes & Mauritz BV & Co KG

- NKD Vertriebs GmbH

- Takko Holding GmbH

- Aldi Einkauf GmbH & Co oHG

- Groupe Okaïdi

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Germany Childrenswear Market Policies, Regulations, and Standards

4. Germany Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Germany Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Germany Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Germany Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Germany Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Ernsting's Family GmbH & Co KG

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.C&A Mode GmbH & Co KG

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.H&M Hennes & Mauritz BV & Co KG

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.NKD Vertriebs GmbH

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Takko Holding GmbH

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Lidl Dienstleistung GmbH & Co KG

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.KiK Textilien & Non-Food GmbH

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Otto GmbH & Co KG

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Aldi Einkauf GmbH & Co oHG

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Okaïdi, Groupe

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.