Colombia Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), By Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), By Price Category (Mass, Premium), By Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

Colombia Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

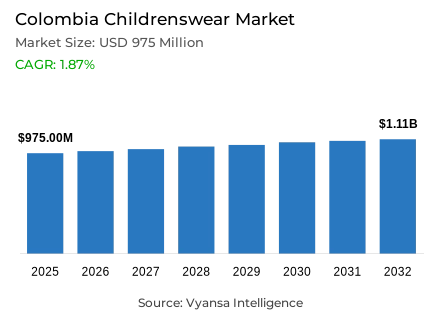

- Childrenswear in Colombia is estimated at USD 975 million in 2025.

- The market size is expected to grow to USD 1.11 billion by 2032.

- Market to register a cagr of around 1.87% during 2026-32.

- Product Type Shares

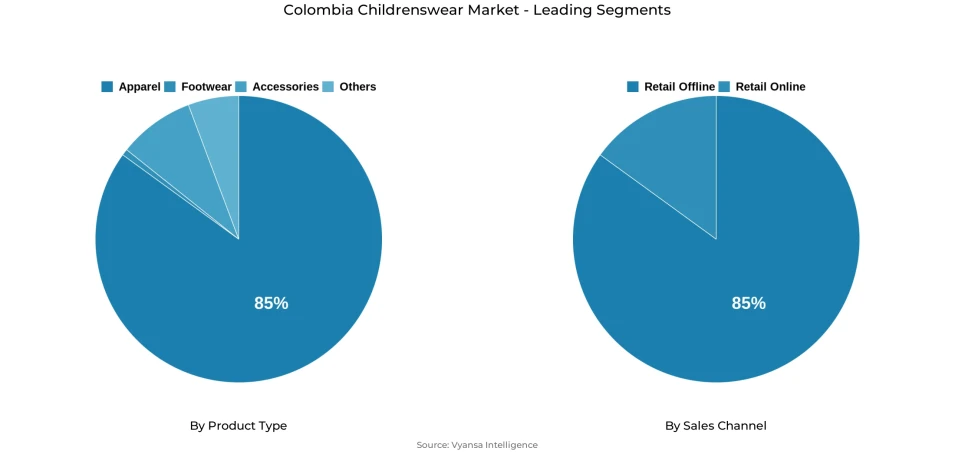

- Apparel grabbed market share of 85%.

- Competition

- Childrenswear in Colombia is currently being catered to by more than 15 companies.

- Top 5 companies acquired around 15% of the market share.

- Pash SA; EPK Kids Smart SAS; CI Conindex SA; CI Hermeco SA; Crystal SAS etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Colombia Childrenswear Market Outlook

The Colombia childrenswear market is projected to expand at a moderate pace over the forecast period, rising from USD 975 million in 2025 to approximately USD 1.11 billion by 2032, reflecting a CAGR of around 1.87%, driven by the growing popularity of low-priced house brands and increasing emphasis on sustainability. With inflation and high-interest rates persistently straining the household budgets, value-based products are likely to become popular among parents, which will enable the growth of the presence of the brands of private labels and low-cost clothing retailers in the market.

The apparel is the most dominant segment, it suffices approximately 85% of the entire market share. Sports collection and fast fashion that reflects the adult fashion trends are expected to remain popular even to digitally active pre-teens and fashion-conscious parents. The competition, however, is fragmented with the largest five players owning a mere 15 percent of the total market share suggesting there is room of both local and international brands to grow by innovating, collaborating and engaging with the digital community.

In the future, sustainability will be a trend that will determine the future growth. The events like the CO2ZERO Sustainable Fashion Seal (SMS) are becoming more and more popular as the key brands implement greener approaches into their work. Shoppers are becoming more interested in recycled materials and green production processes as well. The growing popularity of the second-hand segment due to the generation of millennial and Gen z parents will further support sustainable consumption trends in childrenswear.

The market will be controlled by the retail offline channels, but e-commerce and social commerce are expected to record high growth. Mutual live shopping platforms together with platforms such as Instagram and TikTok are changing how parents shop and find children clothes. The trend of sustainability and affordability will be coupled with this digital development to shape the future of the Colombia childrenswear market

Colombia Childrenswear Market Growth DriverGrowing Adoption of Private Label Offerings

The increasing financial constraints caused by the constant rate of inflation and high interests are influencing the buying behavior of the Colombia market in childrenswear. As inflation is projected to be approximately 7.3 percent in 2024, a large portion of parents are willing to spend less but get quality apparel, which increases the popularity of the private label brand. The retailers like Grupo Éxito are also competing by offering competitive prices, regular promotions and availability of collections accessible to value-driven households.

Most brand partnerships with local influencers, such as People cooperating with Marcela García, have increased the brand presence and interaction among young families. This low prices and powerful marketing are holding the consumer confidence and triggering repeat buying. With price sensitivity remaining, the percentage of the growth in the Colombia childrenswear market is now shifting to the emergence of the private label lines due to the increasing retail outlets and the changing fashion senses.

Colombia Childrenswear Market ChallengeDeclining Birth Rate Affecting Baby and Toddler Wear

The birth rate in Colombia is also on the downward slope, which is still drawing the baby and toddlers end of the childrenswear market. DANE stated that the fertility rate had fallen to 1.6 births per woman in 2024, which is a prolonged demographic transition. The reduced number of babies are born demands the infant clothes less rapidly and prevents the increase in the market volumes in general.

The retailers are also diversifying and entering older child lines, including casual and school uniforms to maintain sales. The effect of the low birth rate however is still in the structural sense as companies have to rethink production cycles, inventory and approaches to promotion. To stay profitable in the face of declining performances of the babywear industry, the company will need to diversify its products and get more involved into the middle-income families that put more emphasis on practical use and low cost.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Colombia Childrenswear Market TrendInfluence of Adult Fashion on Childrenswear

Colombia childrenswear market is becoming more exposed to the influence of fashionable ways among adults and parents, and pre-teens are moving towards the trend of using modern designs that reflect the fashionable designs in adults. The exposure to online fashion trends has escalated with more than 80 per cent of parents aged 25-40 years old being active in the social media. Children are now adopting athleisure, street and style based apparel that resonates with the trends of style in the world.

Such brands like Offcorss embrace such a change by holding campaigns like Be cool, Be free, in which they encourage self-expression and creativity in the clothing. Higher sales of coordinated collections are coming as the popularity of mini-me clothes (where by children dress like their parents) continues to rise. This trend to the adult fashion is positive contributor to innovation in product design as well as enhancing the aspirational nature of the contemporary childrenswear among the Colombia market.

Colombia Childrenswear Market OpportunityExpansion of Sustainable and Circular Fashion

The increase in environmental awareness of Colombia families is generating high potential in sustainable childrenswear growth. A NielsenIQ survey revealed that approximately 65 percent of Colombia customers would like fashion products in their eco-friendly form. Domestic brands like the Arkitect of Grupo Eixito are integrating the CO2ZERO Sustainable Fashion Seal to emphasize on responsible production methods and mitigating on environmental effects.

Simultaneously, the second hand fashion is being promoted by online resale stores such as Go Trendier, which posted a 30 percent growth in listings in 2024. Millennials and Gen Z parents are specifically attracted to cheap, quality used clothes in the brands such as Zara Kids and H&M Kids. This increased interest in sustainability and cyclic should alter the childrenswear environment in Colombia in the future and provide the brands with new opportunities to differentiate and develop over the long term.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Colombia Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Baby and Toddler Wear

- Boys Apparel

- Girls Apparel

- Footwear

- Boys Footwear

- Girls Footwear

- Accessories

- Boys Accessories

- Girls Accessories

- Others

The segment with the highest share under the product type category in the Colombia Childrenswear Market is Apparel, holding around 85% of the market. Apparel continues to dominate the category as parents prioritise clothing essentials such as t-shirts, jeans, dresses, and outerwear for daily wear and school needs. The growing trend of mimicking adult fashion has further boosted demand for stylish and versatile designs, especially among boys and girls. Fast fashion brands like Zara Kids and H&M, along with local players such as Offcorss, are offering trendy, affordable collections that align with the evolving preferences of Colombia’s younger demographics.

Moreover, strong retail presence, frequent promotional campaigns, and the launch of private label ranges by retailers like Grupo Éxito have enhanced apparel accessibility and affordability. Rising fashion consciousness among pre-teens, supported by social media influence, will continue to drive growth in this dominant segment over the forcast period.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel category in the Colombia Childrenswear Market is Retail Offline, accounting for about 85% of the market. Physical stores remain the preferred destination for parents, who value the ability to evaluate product quality, fabric comfort, and sizing before purchasing. Department stores, brand outlets, and multi-brand chains like Offcorss, EPK, and Falabella continue to attract steady in-store traffic through attractive displays, loyalty programs, and seasonal discounts.

Additionally, offline stores provide a trusted and convenient shopping experience, particularly for families seeking reliability and immediate product availability. Many brands have also expanded their presence across malls and retail clusters, ensuring greater accessibility. The tactile nature of apparel shopping, combined with personalized service and frequent in-store promotions, keeps retail offline the dominant and most trusted sales channel in the Colombia childrenswear market.

List of Companies Covered in Colombia Childrenswear Market

The companies listed below are highly influential in the Colombia childrenswear market, with a significant market share and a strong impact on industry developments.

- Pash SA

- EPK Kids Smart SAS

- CI Conindex SA

- CI Hermeco SA

- Crystal SAS

- Estrategia Comercial de Colombia SAS

- Cía de Inversiones Textiles de Moda

- Root & Co Ltda

- adidas Colombia Ltda

- H&M Hennes & Mauritz Colombia SAS

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Colombia Childrenswear Market Policies, Regulations, and Standards

4. Colombia Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Colombia Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Colombia Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Colombia Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Colombia Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.CI Hermeco SA

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Crystal SAS

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Estrategia Comercial de Colombia SAS

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Cía de Inversiones Textiles de Moda

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Root & Co Ltda

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Pash SA

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.EPK Kids Smart SAS

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.CI Conindex SA

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.adidas Colombia Ltda

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. H&M Hennes & Mauritz Colombia SAS

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.