US Plant Based Dairy Market Report: Trends, Growth and Forecast (2025-2030)

By Product Type (Plant-Based Milk (Soy Drinks, Almond, Blends, Coconut, Oat, Rice, Other Plant-Based Milk), Plant-Based Yoghurt, Plant-Based Cheese), By Sales Channel (Retail Offline (Grocery Retailers, Convenience Retailers, Supermarkets, Hypermarkets), Retail Online)

- Food & Beverage

- Nov 2025

- VI0028

- 124

-

US Plant Based Dairy Market Statistics, 2025

- Market Size Statistics

- Plant Based Dairy in US is estimated at $ 4.32 Billion.

- The market size is expected to grow to $ 4.84 Billion by 2030.

- Market to register a CAGR of around 1.91% during 2025-30.

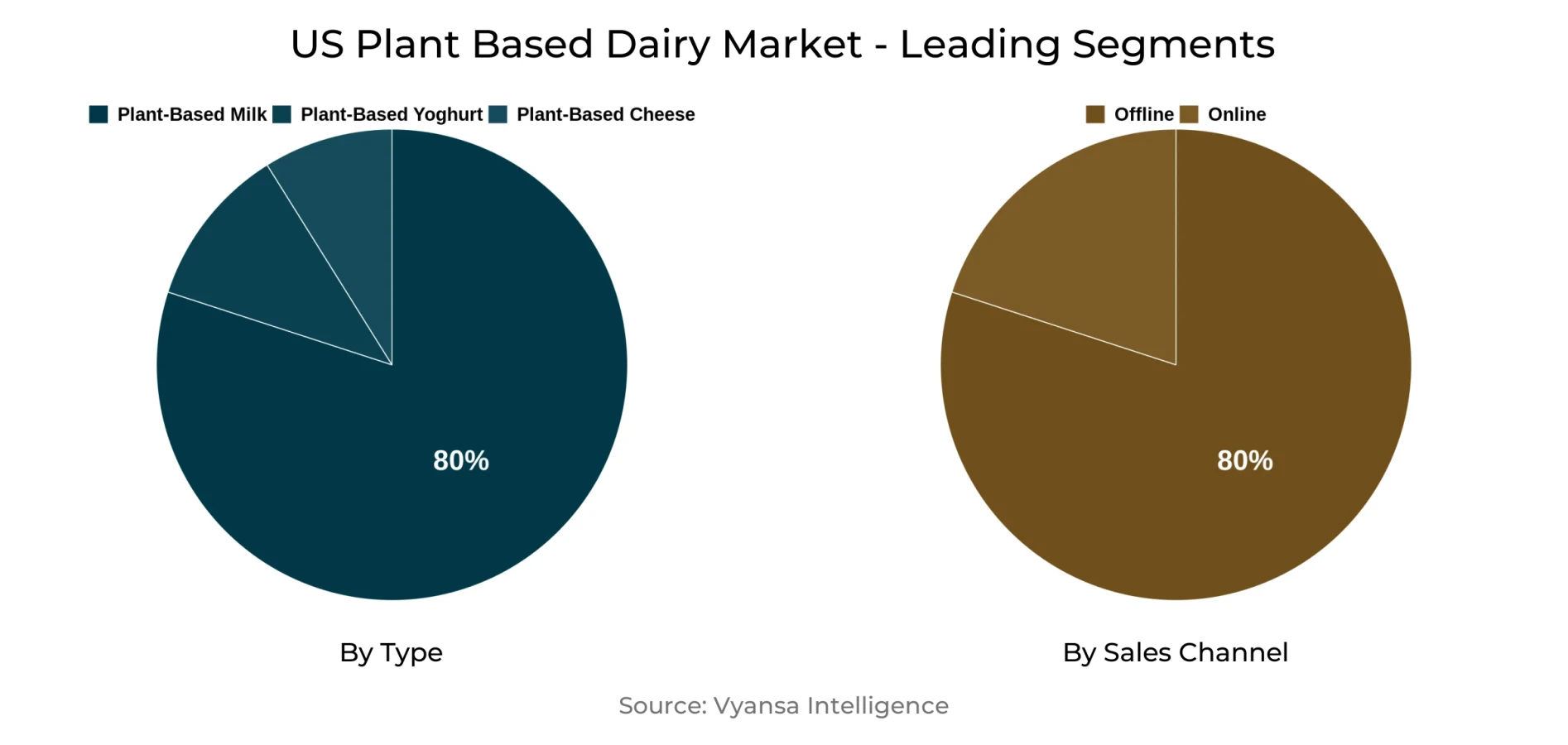

- Product Shares

- Plant-based Milk grabbed market share of 80%.

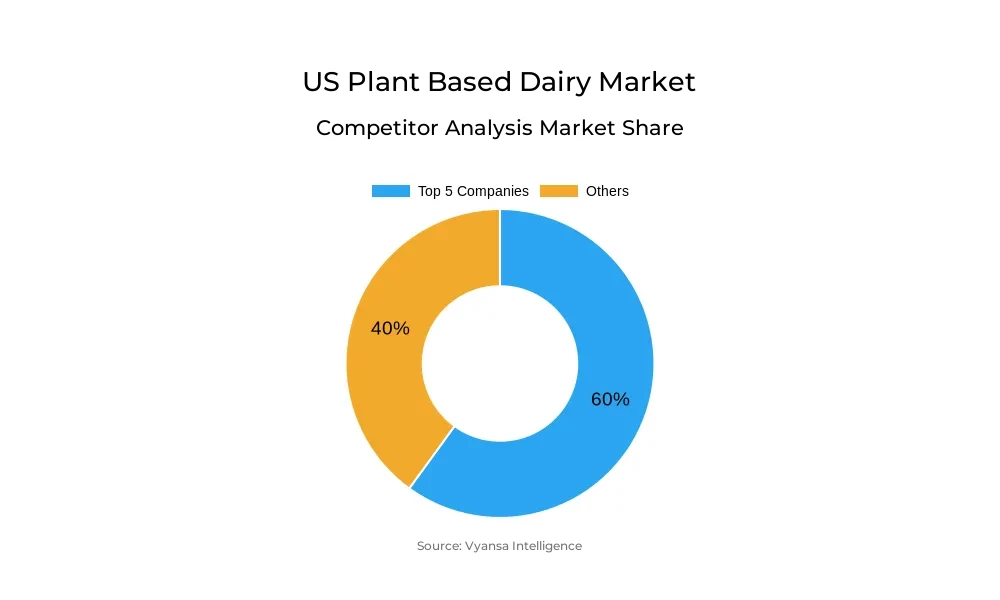

- Competition

- More than 15 companies are actively engaged in producing Plant Based Dairy in US.

- Top 5 companies acquired 60% of the market share.

- Ripple Foods Inc, Violife LLC, Pacific Foods of Oregon Inc, Danone North America PBC, Blue Diamond Growers etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 80% of the market.

US Plant Based Dairy Market Outlook

The US plant-based dairy market is poised for an active 2025-2030 period of both opportunities and challenges as the category reaches maturity. Plant-based milk will remain the most significant and stable sector, underpinned by a well-developed base of consumers interested in affordability and the benefits of sustainability and health. The resilience of this category speaks to its evolution from a niche trend to mainstream dairy alternative.

Despite this, plant yoghurt and cheese are set to continue experiencing challenges. Unit price inflation has curbed retail volumes, particularly in plant cheese where small-scale innovation and poor product differentiation constrain consumer attraction. Without significant price drops or product innovation breakthroughs, these categories will find it difficult to regain lost volumes, especially under economic constraints and attacks from new players such as precision-fermented products.

The total plant-based dairy market is seeing little innovation in 2023-2024, with widespread product recalls that impede consumer trust and category growth. To turn this around, there is a need for a longer-term, patient approach to innovation to develop sustained consumer interest.

Market players are more likely to turn to redefined product claims beyond vegan and plant-based, emphasizing health, wellness, sustainability, and gut health benefits. These values appeal to price-conscious consumers looking for more value, providing the potential to expand the market to consumers beyond traditional animal-free consumers. With the market becoming mature, consolidation based on acquisition and joint venture between industry leaders like General Mills, Danone, and Kraft Heinz will further heighten competition. In addition, new technologies such as precision fermentation can disrupt the market by delivering products with enhanced protein functionality. In order to stay competitive, plant-based milk brands will have to innovate on product quality, texture, and natural claims in sync with changing consumer tastes to capitalize on growth prospects in 2025-30.

US Plant Based Dairy Market Challenge

Since 2022, unit prices of plant-based dairy items have increased sharply, reflecting trends in packaged foods. Value sales are forecast to increase in 2024, though volumes are set to decrease as consumers, including flexitarians, switch to cheaper options. This trend is a major obstacle for volume recovery in the plant-based dairy category because increased prices discourage consumers under economic stress.

Emerging categories like plant cheese and yoghurt also have extra challenges from disruptive products like precision-fermented cheese. Consumers are unwilling to pay premium prices in the face of competitive pricing and budget constraints, so a hefty reduction in price would be needed to restore volumes. But under present market conditions, such price deflation seems unlikely, so there is continued challenge in drawing and retaining consumers for this category.

US Plant Based Dairy Market Opportunity

The plant dairy industry can expand substantially by moving away from the conventional vegan and plant-based positioning. In today's economic environment, consumers are looking for products that warrant premium prices via increased benefits including health, wellness, sustainability, and animal welfare. Plant dairy products are best placed to deliver these needs with benefits such as increased protein levels and gut-friendly fortification, which extend their reach beyond purely animal-free consumers.

By highlighting full nutritional advantages and sustainability, plant-based dairy can appeal to a broader segment of consumers concerned with both health and environmental issues. This changing positioning allows the category to reach an increased value/wellness-oriented market segment, offering a potentially significant growth path for plant-based dairy products through 2025-30.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 4.32 Billion |

| USD Value 2030 | $ 4.84 Billion |

| CAGR 2025-2030 | 1.91% |

| Largest Category | Plant-based Milk segment leads with 80% market share |

| Top Challenges | Sustained Unit Price Inflation Limiting Volume Growth |

| Top Opportunities | Expanding Consumer Appeal Through Enhanced Product Claims |

| Key Players | Ripple Foods Inc, Violife LLC, Pacific Foods of Oregon Inc, Danone North America PBC, Blue Diamond Growers, Califia Farms LP, Oatly AB, Chobani LLC, Lyrical Foods Inc, Daiya Foods Inc and Others. |

US Plant Based Dairy Market Segmentation Analysis

The most sizeable market segment in the US Plant-Based Dairy Market during 2025-30 is Plant-Based Milk. Even with increasing unit prices, plant-based milk retail volumes are anticipated to be strong during 2024, solidifying its status as the biggest category among plant-based dairy. This resilience is a consequence of a mature and well-established consumer base that appreciates both the affordability of the product and its benefits, distinguishing it from the trendier segments in the market.

Plant milk's lasting visibility indicates a transition from being an ephemeral fad to becoming a reputable and consequential category of dairy substitutes. With soy beverages and other plant milks persistently enticing price-savvy shoppers, this space is likely to remain resilient and strong. Its maturity and strength make plant milk a major force in the changing dynamic of dairy alternatives up to 2030.

Top Companies in US Plant Based Dairy Market

The top companies operating in the market include Ripple Foods Inc, Violife LLC, Pacific Foods of Oregon Inc, Danone North America PBC, Blue Diamond Growers, Califia Farms LP, Oatly AB, Chobani LLC, Lyrical Foods Inc, Daiya Foods Inc, etc., are the top players operating in the US Plant Based Dairy Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. US Plant Based Dairy Market Policies, Regulations, and Standards

4. US Plant Based Dairy Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. US Plant Based Dairy Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type

5.2.1.1. Plant-Based Milk- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Soy Drinks- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. Almond- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.3. Blends- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.4. Coconut- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.5. Oat- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.6. Rice- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.7. Other Plant-Based Milk- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Plant-Based Yoghurt- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Plant-Based Cheese- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Sales Channel

5.2.2.1. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.1. Grocery Retailers- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.1.1. Convenience Retailers- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.1.2. Supermarkets- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.1.3. Hypermarkets- Market Insights and Forecast 2020-2030, USD Million

5.2.2.1.2. Non-Grocery Retailers- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Competitors

5.2.3.1. Competition Characteristics

5.2.3.2. Market Share & Analysis

6. US Plant-Based Milk Market Outlook, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. US Plant-Based Yoghurt Market Outlook, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. US Plant-Based Cheese Market Outlook, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Danone North America PBC

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Blue Diamond Growers

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Califia Farms LP

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Oatly AB

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Chobani LLC

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Ripple Foods Inc

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Violife LLC

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Pacific Foods of Oregon Inc

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Lyrical Foods Inc

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Daiya Foods Inc

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.