Italy Space & Satellite Defense Programs Market Report: Trends, Growth and Forecast (2026-2032)

Capability (Space Situational Awareness, Space Domain Awareness, Military Satellite Communications, Protected & Secure SATCOM, Missile-Warning & Early Warning Support, Earth Observation & ISR, Defensive Counterspace, Space Cybersecurity & Ground Segment Protection, Dual-Use Space Services, NATO & EU Cooperative Space Defense Programs), Platform (Space Segment (COSMO-SkyMed, PRISMA, IRIDE, SICRAL), Ground Segment (Fucino, Vigna di Valle, Matera, Pratica di Mare, MoD centers), Launch Systems (VEGA, VEGA-C, ESA launch infrastructure), On-Orbit Services & Support (Satellite Servicing, Debris Tracking), Terrestrial / Integrated Sensors (Radar, Optical SSA Sensors, Maritime/Border ISR)), Orbit Type (Low Earth Orbit, Medium Earth Orbit, Geostationary Orbit, Highly Elliptical Orbit), Technology (Kinetic Counterspace (NATO-level, no national systems), Non-Kinetic Counterspace (Cyber operations, Electronic warfare / Anti-Jam / Anti-Spoof, Directed-energy R&D), AI / Data-Enabled SSA & ISR Processing, Secure Communications Technologies (Anti-Jam SATCOM, Quantum/Optical Research), Autonomous On-Orbit Operations & Robotics), Component (Payloads & Sensors (SAR, Hyperspectral, Satcom Payloads), Command, Control & ISR Software, Satellite Buses & Platforms, Ground Terminals & Communications Networks, Cybersecurity & EW Protection Systems, AI/ML Data Processing Infrastructure), Application (Military Command & Control (C2), Intelligence, Surveillance & Reconnaissance (ISR), Missile Tracking & NATO Ballistic Missile Defense Support, Positioning, Navigation & Timing (PNT) Resilience, Space Traffic Management (EUSST), Strategic Deterrence & Attribution, Maritime, Border & Civil Protection Surveillance, Disaster Response & Crisis Monitoring), End User (Italian Ministry of Defence / Italian Armed Forces, ASI (Agenzia Spaziale Italiana), National Cybersecurity Agency, NATO Space & SATCOM Structures, EU Agencies (IRIS², GOVSATCOM, Galileo PRS users), Prime Contractors & System Integrators, Commercial / NewSpace Operators), Procurement Model (CapEx Procurement (satellites, payloads, ground infrastructure), Services / OPEX Models (ISR-as-a-Service, SSA-as-a-Service, Managed SATCOM), Public-Private Partnerships (PPP), Hosted Payload Programs, EU/NATO Co-Financed Programs, Capacity Leasing & Shared Satellite Services)

- Aerospace & Defense

- Feb 2026

- VI0921

- 110

-

Italy Space & Satellite Defense Programs Market Statistics and Insights, 2026

- Market Size Statistics

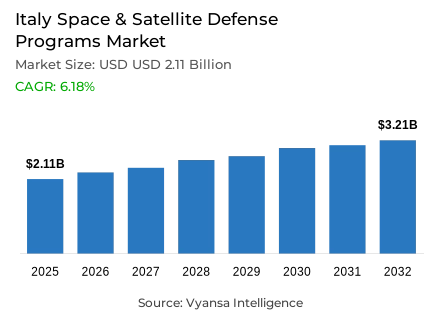

- Space & satellite defense programs in Italy is estimated at USD 2.11 billion in 2025.

- The market size is expected to grow to USD 3.21 billion by 2032.

- Market to register a cagr of around 6.18% during 2026-32.

- Capability Shares

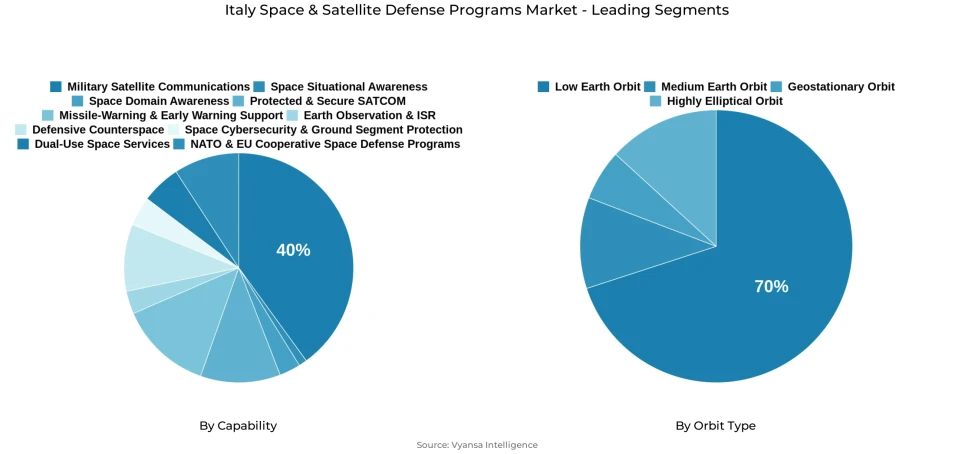

- Military satellite communications grabbed market share of 40%.

- Competition

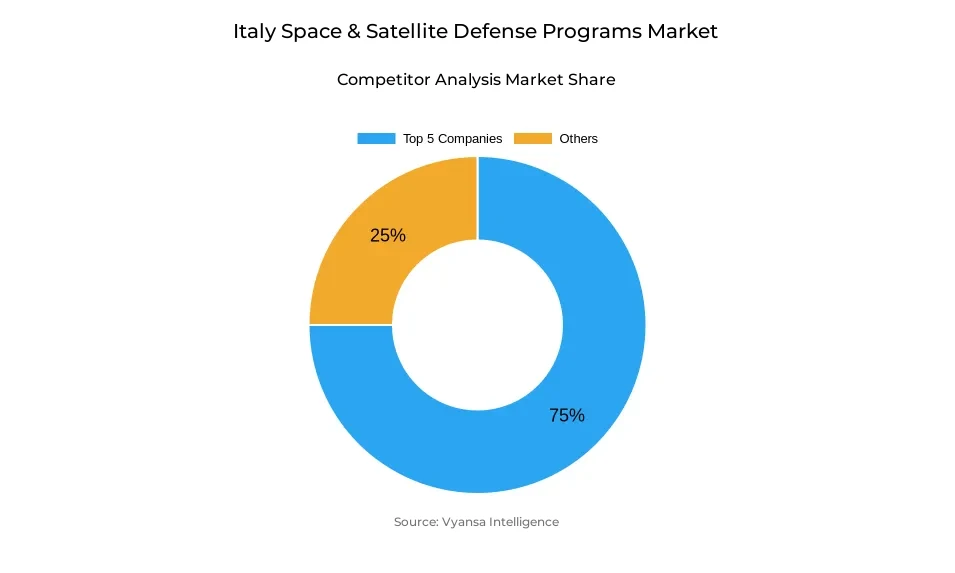

- Space & satellite defense programs in Italy is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 75% of the market share.

- e-GEOS; D-Orbit; SITAEL; Thales Alenia Space; Telespazio etc., are few of the top companies.

- Orbit Type

- Low earth orbit (leo) grabbed 70% of the market.

Italy Space & Satellite Defense Programs Market Outlook

The Italy Space & Satellite Defense Programs Market was valued at $2.11 billion in 2025 and is forecasted to reach $3.21 billion in 2032, growing at a CAGR of 6.18% from 2026–2032. Notably, the market is driven by significant government spending on defense satellite communication, Earth observation, and space-based surveillance capabilities. The key driver in the market is military satellite communication, accounting for 40% of the market, indicating that Italy prioritizes secure and reliable communication networks for defense and NATO operations. Initiatives such as SICRAL 3 emphasize the importance of secure communication networks operating on multi-bands.

LEO satellites are a major driving force for growth, with a projected overall share of 70% in the market. The overall adoption of LEO satellites has low latency and high-speed connections that are necessary for commands, unmanned systems, and missions that are time-sensitive in nature. The country's overall national programs and collaborations with commercial LEO satellite companies such as OneWeb and SpaceX ensure that there are no gaps in global coverage, as a consequence of terrestrial restrictions.

Earth observation/surveillance satellite projects, such as the IRIDE constellation satellite program and its leadership role in EU projects like Copernicus, contribute to the growth of the market. Italy has earmarked funding of €1.1 billion to launch 68 multi-sensor satellites; hence, the country has strengthened its capabilities in sharing key data with end users. Its integration into EU projects like Space Situational Awareness and Space Surveillance & Tracking projects enhances its system readiness and space traffic management capabilities.

Factors such as strong government support, partnerships between Italy and EU/NATO projects, and a developing domestic industry chain with companies like Leonardo, Thales Alenia Space, and Telespazio form the basis for future growth and developments for long-term success in a rapidly increasing Italy Space & Satellite Defense Programs Market that is expected to see continued growth by 2032.

Italy Space & Satellite Defense Programs Market Growth Driver

Expanding Investment in Secure Military Communications Strengthens Sector Growth

The government of Italy is making profound upgrades in its military communications and space defenses. The Italian Ministry of Defense allocated an amount of €80 million in 2025 for a new communications satellite aimed at upgrading military defenses in the country. This is within an overall increase of 7.2% of the country’s normal budget, raising allocations to a total of €31.3 billion and reflecting commitment to NATO's targeted allocation of 2% of GDP and then its subsequent goal of achieving 5% by 2035. The SICRAL 3 secure communications system has been launched, and its subsequent A and B versions, scheduled for launch in 2026 and subsequent dates, incorporate Ka-band communications and existing UHF and SHF communications, serving for national and NATO military functions.

Besides communication, Italy is also developing Earth observation/surveillance. The IRIDE constellation, receiving support of €1.1 billion under Its National Recovery and Resilience Plan, will see the launch of 68 multi-sensor satellites by June 2026, with the launch of the first mission accomplished on January 14, 2025 (HEO Pathfinder), improving data delivery services to end users. Its role in Europe's Copernicus program with Thales Alenia Space and Telespazio utilizes knowledge in radar in Sentinel-1 mission programs. It is evident that all these programs place increased emphasis on space/satellite defense in Italy till 2032.

Italy Space & Satellite Defense Programs Market Challenge

Escalating Cybersecurity Threats and Vulnerabilities in Space Infrastructure

The Italian space and satellite military environment is threatened by increasingly escalating cyber threats that affect operation continuity and success. From January to August 2025, there were 117 recorded cyber events aimed at space agencies, denoting an 118% escalation in cyber threats when considering the same time in 2024. The country’s critical infrastructure continues to be threatened by Distributed Denial of Services and ransomware attacks across public and private sectors. High-profile cyber attacks such as the ViaSat/KA-SAT attack of February 24, 2022, which was eventually assigned to Russia operations by the EU/US/UK on May 10, 2022, showcased security gaps in the satellite environment that could affect the military and civil activities reliant upon the satellite communication environment.

Italy complies with the European Union’s cybersecurity resilience satellite certification requirements that cover secure booting mechanisms and hardware and software trust rooted on hardware security keys. Italian collaboration with the European Space Situational Awareness program and the European Space Situational Awareness Space Surveillance and Tracking program currently monitoring 543 satellites through March 2025 enhances the security of collective defense against cyberattacks and the risks of collisions within orbiting spacecraft and debris. The increasing number of objects above 1.2 million pieces larger than 1 cm through April 2025 and the projection of 43,000-50,000 satellites within the next 10-15 years poses significant security risks through congestion within the orbits and increases vulnerability through cybersecurity and traffic management.

Italy Space & Satellite Defense Programs Market Trend

Adoption of Low Earth Orbit Improves Real-Time Military Operations

Military operations in the European region have seen an expansion of Low Earth Orbit satellites for providing low latency, high-speed communications for tactical C2 operations. Low Earth Orbit satellites have latencies of 2 to 27 milliseconds, supporting real-time video, data, and machine-to-machine communications, which are essential for autonomous unmanned systems, thereby necessitating the use of Low Earth Orbit satellites, which have shorter latencies compared to traditional geostationary satellites.

This is being aided by the Italian initiatives within the national framework, commensurate with the NATO recognition of space as the fifth operational domain and the adoption of the NATO Space Policy in 2019, which emphasized low latency communications. The commercial LEO satellite constellation providers OneWeb and SpaceX have complementary capabilities in support of logistics and cyber security that are being leveraged by both NATO and European Union member states. The satellites provide assured communications in areas where communications infrastructure cannot be easily established on the ground. Italy’s collaborative activities in space with the United States, as ratified in the U.S.-Italy Space Dialogue event (October 10-11, 2024, Rome; joint statement on October 15, 2024), improve national security cooperation and space situational awareness. This strategic shift will serve Italy well in maximizing LEO satellite capabilities while ensuring strategic independence.

Italy Space & Satellite Defense Programs Market Opportunity

Industrial and Public-Private Collaborations Stimulate Market Growth

The Italian space industry, comprising companies like Leonardo S.p.A., Thales Alenia Space, and Telespazio, as well as small- and medium-scale enterprises and new-space firms, leverages growth from European defense spending. The IRIDE mission, supported by €1.1 billion investment, offers 68 multi-sensor satellites (25 HEO satellites for Argotec, 24 EAGLET satellites for OHB Italia, 5 PLATINO satellites for SITAEL/Leonardo, 12 SAR and 1 VHR satellite for Thales Alenia Space, 1 NOX satellite for D-Orbit) offering vast purchasing and integration opportunities for the Italian industry. NewSpace startup and university spin-off financial support goals aptly indicate the growing investors' interest in sectorial development until 2032. Examples of active companies include D-Orbit and Avio.

The Italian Space Economy Law defines a strategic plan with a five-year horizon to highlight the sectors' needs and investment opportunities for SMEs and new entrants developing space-related products. Italian Foreign Minister Antonio Tajani underlines Italy’s aerospace know-how as a strength for Europe as a whole, with its Galileo and EU program contributions. Support initiatives provided by the Italian Government and EU funding schemes promote industrial competitiveness and market sustainability for the end-users in the fields of satellite communications, earth observation, and space technology.

Italy Space & Satellite Defense Programs Market Segmentation Analysis

By Capability

- Space Situational Awareness

- Space Domain Awareness

- Military Satellite Communications

- Protected & Secure SATCOM

- Missile-Warning & Early Warning Support

- Earth Observation & ISR

- Defensive Counterspace

- Space Cybersecurity & Ground Segment Protection

- Dual-Use Space Services

- NATO & EU Cooperative Space Defense Programs

Military satellite communications dominates Italy’s space and satellite defense programs market, capturing an estimated approximately 40% of total market share based on defense spending patterns. Systems including SICRAL 1A, 1B, SICRAL 2, and the upcoming SICRAL 3 provide SHF and UHF-band secure communications, forming the backbone of national and allied defense operations. SICRAL 3, with electric propulsion, modular design, and Ka-band expansion, ensures NATO interoperability and continuity of command-and-control functions. The €80 million 2025 allocation emphasizes the sector’s strategic priority, reflecting operational and information security imperatives that guide procurement decisions.

The centrality of military communications underscores its foundational role in Italy’s defense space architecture. Multi-band integration and advanced modulation techniques position communications as the anchor capability, supported by complementary systems including Earth observation, navigation, and space situational awareness. Italy’s engagement in NATO cooperative satellite initiatives strengthens its strategic posture. Military communications’ sustained estimated approximately 40% share ensures reliable connectivity and secure operations for national and allied end users, reinforcing its critical position within the Italy Space & Satellite Defense Programs Market through 2032.

By Orbit Type

- Low Earth Orbit

- Medium Earth Orbit

- Geostationary Orbit

- Highly Elliptical Orbit

Low Earth Orbit satellites capture an estimated approximately 70% of Italy’s space and satellite defense market based on strategic allocation patterns and industry analysis, defining the sector’s orbital trajectory. LEO adoption delivers operational advantages, including reduced latency, lower ground terminal power requirements, and global coverage through constellation deployment. Participation in EU SSA and SST initiatives enhances satellite tracking, collision avoidance, and space situational awareness for LEO operations. Support for commercial LEO developers and integration into EU Earth observation programs positions Italy as a hub for constellation-based operations, enhancing operational flexibility and resilience for defense end users.

The dominant LEO share reflects their importance for modern military operations. Constellation redundancy, rapid adaptability, and reduced latency offer advantages unavailable from geostationary platforms. Italy’s collaboration with EU programs, commercial ventures, and national initiatives demonstrates institutional commitment to expanding LEO capabilities. Combined with NATO requirements and proven operational success, LEO is expected to retain its estimated approximately 70% market dominance, ensuring Italy’s strategic space and satellite defense architecture remains resilient and responsive through 2032.

List of Companies Covered in Italy Space & Satellite Defense Programs Market

The companies listed below are highly influential in the Italy space & satellite defense programs market, with a significant market share and a strong impact on industry developments.

- e-GEOS

- D-Orbit

- SITAEL

- Thales Alenia Space

- Telespazio

- Leonardo

- OHB Italia

- Avio

- Argotec

- Planetek Italia

Market News & Updates

- Thales Alenia Space, 2025:

Thales Alenia Space inaugurated its €100+ million Space Smart Factory in Rome on October 7, 2025. Spanning 21,000 square meters, the facility is funded through PNRR initiatives and investments from Thales (67%) and Leonardo (33%). Designed for highly automated, digitalized satellite production, it will manufacture more than 100 satellites annually up to the 300kg class. Operations will begin by late 2025, with initial work focused on SICRAL 3 secure communications satellites for the Italian Ministry of Defense.

- Leonardo, 2025:

Leonardo, holding a 33% stake in Thales Alenia Space, plays a strategic role including representation through Massimo Claudio Comparini as Chairman of the Supervisory Board. The company supplies advanced star sensors for the SICRAL 3 satellites, ensuring precise attitude control and positioning for secure geostationary defense communications. The newly inaugurated Space Smart Factory significantly enhances Italy’s satellite manufacturing ecosystem, positioning Leonardo and Thales Alenia Space as key European leaders supporting NATO-aligned space defense capabilities.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Italy Space & Satellite Defense Programs Market Policies, Regulations, and Standards

4. Italy Space & Satellite Defense Programs Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Italy Space & Satellite Defense Programs Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Capability

5.2.1.1. Space Situational Awareness- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Space Domain Awareness- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Military Satellite Communications- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Protected & Secure SATCOM- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Missile-Warning & Early Warning Support- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Earth Observation & ISR- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Defensive Counterspace- Market Insights and Forecast 2022-2032, USD Million

5.2.1.8. Space Cybersecurity & Ground Segment Protection- Market Insights and Forecast 2022-2032, USD Million

5.2.1.9. Dual-Use Space Services- Market Insights and Forecast 2022-2032, USD Million

5.2.1.10. NATO & EU Cooperative Space Defense Programs- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Platform

5.2.2.1. Space Segment (COSMO-SkyMed, PRISMA, IRIDE, SICRAL)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Ground Segment (Fucino, Vigna di Valle, Matera, Pratica di Mare, MoD centers)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Launch Systems (VEGA, VEGA-C, ESA launch infrastructure)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. On-Orbit Services & Support (Satellite Servicing, Debris Tracking)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Terrestrial / Integrated Sensors (Radar, Optical SSA Sensors, Maritime/Border ISR)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Orbit Type

5.2.3.1. Low Earth Orbit- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Medium Earth Orbit- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Geostationary Orbit- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Highly Elliptical Orbit- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Technology

5.2.4.1. Kinetic Counterspace (NATO-level, no national systems)- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Non-Kinetic Counterspace- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.1. Cyber operations- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.2. Electronic warfare / Anti-Jam / Anti-Spoof- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.3. Directed-energy R&D- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. AI / Data-Enabled SSA & ISR Processing- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Secure Communications Technologies (Anti-Jam SATCOM, Quantum/Optical Research)- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Autonomous On-Orbit Operations & Robotics- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Component

5.2.5.1. Payloads & Sensors (SAR, Hyperspectral, Satcom Payloads)- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Command, Control & ISR Software- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Satellite Buses & Platforms- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Ground Terminals & Communications Networks- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Cybersecurity & EW Protection Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.5.6. AI/ML Data Processing Infrastructure- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Application

5.2.6.1. Military Command & Control (C2)- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Intelligence, Surveillance & Reconnaissance (ISR)- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Missile Tracking & NATO Ballistic Missile Defense Support- Market Insights and Forecast 2022-2032, USD Million

5.2.6.4. Positioning, Navigation & Timing (PNT) Resilience- Market Insights and Forecast 2022-2032, USD Million

5.2.6.5. Space Traffic Management (EUSST)- Market Insights and Forecast 2022-2032, USD Million

5.2.6.6. Strategic Deterrence & Attribution- Market Insights and Forecast 2022-2032, USD Million

5.2.6.7. Maritime, Border & Civil Protection Surveillance- Market Insights and Forecast 2022-2032, USD Million

5.2.6.8. Disaster Response & Crisis Monitoring- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By End User

5.2.7.1. Italian Ministry of Defence / Italian Armed Forces- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. ASI (Agenzia Spaziale Italiana)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. National Cybersecurity Agency- Market Insights and Forecast 2022-2032, USD Million

5.2.7.4. NATO Space & SATCOM Structures- Market Insights and Forecast 2022-2032, USD Million

5.2.7.5. EU Agencies (IRIS², GOVSATCOM, Galileo PRS users)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.6. Prime Contractors & System Integrators- Market Insights and Forecast 2022-2032, USD Million

5.2.7.7. Commercial / NewSpace Operators- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Procurement Model

5.2.8.1. CapEx Procurement (satellites, payloads, ground infrastructure)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Services / OPEX Models- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2.1. ISR-as-a-Service- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2.2. SSA-as-a-Service- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2.3. Managed SATCOM- Market Insights and Forecast 2022-2032, USD Million

5.2.8.3. Public-Private Partnerships (PPP)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.4. Hosted Payload Programs- Market Insights and Forecast 2022-2032, USD Million

5.2.8.5. EU/NATO Co-Financed Programs- Market Insights and Forecast 2022-2032, USD Million

5.2.8.6. Capacity Leasing & Shared Satellite Services- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Competitors

5.2.9.1. Competition Characteristics

5.2.9.2. Market Share & Analysis

6. Italy Space Situational Awareness Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Platform- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Orbit Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Technology- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Component- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Procurement Model- Market Insights and Forecast 2022-2032, USD Million

7. Italy Space Domain Awareness Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Platform- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Orbit Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Technology- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Component- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Procurement Model- Market Insights and Forecast 2022-2032, USD Million

8. Italy Military Satellite Communications Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Platform- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Orbit Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Technology- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Component- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Procurement Model- Market Insights and Forecast 2022-2032, USD Million

9. Italy Protected & Secure SATCOM Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Platform- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Orbit Type- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Technology- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Component- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Procurement Model- Market Insights and Forecast 2022-2032, USD Million

10. Italy Missile-Warning & Early Warning Support Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Platform- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Orbit Type- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Technology- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Component- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.7. By Procurement Model- Market Insights and Forecast 2022-2032, USD Million

11. Italy Earth Observation & ISR Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Platform- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Orbit Type- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Technology- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Component- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Application- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.7. By Procurement Model- Market Insights and Forecast 2022-2032, USD Million

12. Italy Defensive Counterspace Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Platform- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Orbit Type- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Technology- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Component- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By Application- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

12.2.7. By Procurement Model- Market Insights and Forecast 2022-2032, USD Million

13. Italy Space Cybersecurity & Ground Segment Protection Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Platform- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Orbit Type- Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Technology- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Component- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By Application- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

13.2.7. By Procurement Model- Market Insights and Forecast 2022-2032, USD Million

14. Italy Dual-Use Space Services Market Statistics, 2022-2032

14.1. Market Size & Growth Outlook

14.1.1. By Revenues in USD Million

14.2. Market Segmentation & Growth Outlook

14.2.1. By Platform- Market Insights and Forecast 2022-2032, USD Million

14.2.2. By Orbit Type- Market Insights and Forecast 2022-2032, USD Million

14.2.3. By Technology- Market Insights and Forecast 2022-2032, USD Million

14.2.4. By Component- Market Insights and Forecast 2022-2032, USD Million

14.2.5. By Application- Market Insights and Forecast 2022-2032, USD Million

14.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

14.2.7. By Procurement Model- Market Insights and Forecast 2022-2032, USD Million

15. Italy NATO & EU Cooperative Space Defense Programs Market Statistics, 2022-2032

15.1. Market Size & Growth Outlook

15.1.1. By Revenues in USD Million

15.2. Market Segmentation & Growth Outlook

15.2.1. By Platform- Market Insights and Forecast 2022-2032, USD Million

15.2.2. By Orbit Type- Market Insights and Forecast 2022-2032, USD Million

15.2.3. By Technology- Market Insights and Forecast 2022-2032, USD Million

15.2.4. By Component- Market Insights and Forecast 2022-2032, USD Million

15.2.5. By Application- Market Insights and Forecast 2022-2032, USD Million

15.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

15.2.7. By Procurement Model- Market Insights and Forecast 2022-2032, USD Million

16. Competitive Outlook

16.1. Company Profiles

16.1.1. Thales Alenia Space

16.1.1.1. Business Description

16.1.1.2. Service Portfolio

16.1.1.3. Collaborations & Alliances

16.1.1.4. Recent Developments

16.1.1.5. Financial Details

16.1.1.6. Others

16.1.2. Telespazio

16.1.2.1. Business Description

16.1.2.2. Service Portfolio

16.1.2.3. Collaborations & Alliances

16.1.2.4. Recent Developments

16.1.2.5. Financial Details

16.1.2.6. Others

16.1.3. Leonardo

16.1.3.1. Business Description

16.1.3.2. Service Portfolio

16.1.3.3. Collaborations & Alliances

16.1.3.4. Recent Developments

16.1.3.5. Financial Details

16.1.3.6. Others

16.1.4. OHB Italia

16.1.4.1. Business Description

16.1.4.2. Service Portfolio

16.1.4.3. Collaborations & Alliances

16.1.4.4. Recent Developments

16.1.4.5. Financial Details

16.1.4.6. Others

16.1.5. Avio

16.1.5.1. Business Description

16.1.5.2. Service Portfolio

16.1.5.3. Collaborations & Alliances

16.1.5.4. Recent Developments

16.1.5.5. Financial Details

16.1.5.6. Others

16.1.6. e-GEOS

16.1.6.1. Business Description

16.1.6.2. Service Portfolio

16.1.6.3. Collaborations & Alliances

16.1.6.4. Recent Developments

16.1.6.5. Financial Details

16.1.6.6. Others

16.1.7. D-Orbit

16.1.7.1. Business Description

16.1.7.2. Service Portfolio

16.1.7.3. Collaborations & Alliances

16.1.7.4. Recent Developments

16.1.7.5. Financial Details

16.1.7.6. Others

16.1.8. SITAEL

16.1.8.1. Business Description

16.1.8.2. Service Portfolio

16.1.8.3. Collaborations & Alliances

16.1.8.4. Recent Developments

16.1.8.5. Financial Details

16.1.8.6. Others

16.1.9. Argotec

16.1.9.1. Business Description

16.1.9.2. Service Portfolio

16.1.9.3. Collaborations & Alliances

16.1.9.4. Recent Developments

16.1.9.5. Financial Details

16.1.9.6. Others

16.1.10. Planetek Italia

16.1.10.1.Business Description

16.1.10.2.Service Portfolio

16.1.10.3.Collaborations & Alliances

16.1.10.4.Recent Developments

16.1.10.5.Financial Details

16.1.10.6.Others

17. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Capability |

|

| By Platform |

|

| By Orbit Type |

|

| By Technology |

|

| By Component |

|

| By Application |

|

| By End User |

|

| By Procurement Model |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.