India Animal Drugs Market Report: Trends, Growth and Forecast (2026-2032)

By Animal Type (Production, Companion), By Product (Biologics, Pharmaceuticals, Medicated Feed Additives), By Route of Administration (Oral, Injectable, Tropical, Others), By Distribution Channel (Veterinary Hospitals & Clinics, E-Commerce, Offline Retail Stores, Others)

- Healthcare

- Oct 2025

- VI0441

- 120

-

India Animal Drugs Market Statistics and Insights, 2026

- Market Size Statistics

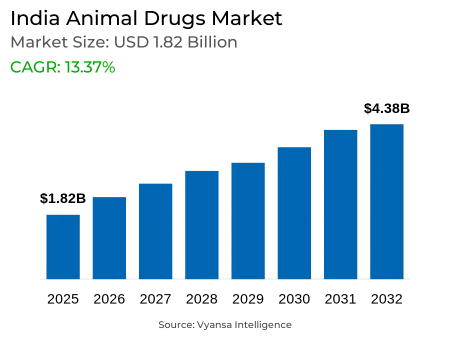

- Animal Drugs in India is estimated at $ 1.82 Billion.

- The market size is expected to grow to $ 4.38 Billion by 2032.

- Market to register a CAGR of around 13.37% during 2026-32.

- Product Shares

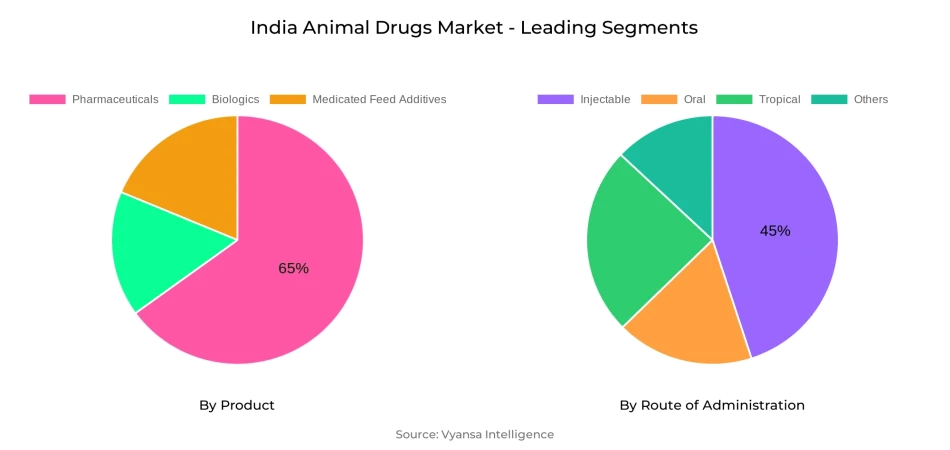

- Pharmaceuticals grabbed market share of 65%.

- Competition

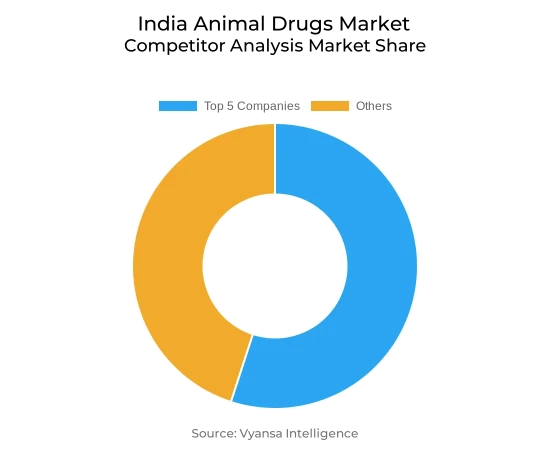

- More than 10 companies are actively engaged in producing Animal Drugs in India.

- Top 5 companies acquired 55% of the market share.

- Hester Biosciences Limited, Ceva Santé Animale, Phibro Animal Health Corporation, Boehringer Ingelheim International GmbH, Zoetis etc., are few of the top companies.

- Route of Administration

- Injectable grabbed 45% of the market.

India Animal Drugs Market Outlook

The India Animal Drugs Market size is estimated at USD 1.82 billion and is anticipated to reach USD 4.38 billion by the year 2032, fueled by increasing livestock population, pet population, and rising awareness on animal health. The growth in dairy, poultry, and aqua farming industries is also augmenting the demand for veterinary drugs for achieving enhanced productivity and disease management. Government policies like the National Animal Disease Control Programme (NADCP) and enhanced veterinary healthcare infrastructure are also facilitating this market growth in both urban and rural areas.

Within the Route of Administration, the Injectable segment shares the widest portion of 45%. The use of injectables is favored by veterinarians because of their rapid action, high bioavailability, and efficiency to heal acute infections among large animals and pet animals. Improved application of injectables among large animals, particularly buffaloes and cattle, is strengthening this segment's leadership in the overall market.

The market is fairly consolidated, with over 10 companies actively involved in the manufacture of animal drugs in India. The five leading players together hold 55% market share, an indication of their extensive distribution networks and wider ranges of products spanning antibiotics, vaccines, and nutritional supplements.

As per a survey, the Indian animal pharma industry is still growing steadily, backed by enhanced disease management measures, preventive care awareness, and adoption of digital veterinary services. All these combined are likely to provide good growth momentum to India's animal health market in the period 2026-2032.

India Animal Drugs Market Growth Driver

Increasing Livestock Population Driving Demand

India's animal husbandry sector is witnessing unprecedented growth based on the recent Livestock Census. The country has more than 535.78 million animals, a 4.6% rise from the previous census. This growth includes numerous species of animals like cattle, buffalo, goats, and poultry, reflecting overall growth in the sector. Such an upsurge necessitates improved veterinary care for ensuring well-being in animals, thus driving greater demand for veterinary drugs.

Moreover, India is the largest milk producer in the world, producing nearly 25% of the world's milk. This emphasizes the need for a healthy population of livestock to fulfill this high demand. The enhanced production of milk, meat, and eggs also emphasizes the need for proper preventive healthcare measures and disease control. Consequently, there is a heightened need for veterinary medicine to cure health issues, prevent the transmission of diseases, and ensure the productivity of the animal husbandry business. The rising need for animal healthcare products and services is a direct market growth driver for the Indian animal drugs industry.

India Animal Drugs Market Challenge

Use of Counterfeit Medicine Impeding Growth

The spread of spurious veterinary drugs is a major threat to India's animal medicine market, affecting animal health and consumer confidence. Spurious products are either devoid of active pharmaceutical ingredients or have toxic chemicals, which results in inefficient treatment and toxicity. For example, spurious veterinary formulations of nimesulide have been associated with vulture poisonings in Gujarat, and the regulatory authorities have imposed bans to safeguard wildlife.

In addition, the use of substandard veterinary products is a cause of antimicrobial resistance, reducing the effectiveness of genuine remedies. A study noted that fake and substandard veterinary drugs not only harm animal health but also have an impact on antimicrobial resistance, affecting agricultural productivity and food safety. These challenges undermine trust from consumers, especially farmers and owners of pets in rural communities, stifling the development and expansion of the animal healthcare business.

India Animal Drugs Market Trend

Digital Veterinary Services Shaping Market Dynamics

The merging of digital veterinary services is revolutionizing India's animal healthcare system, making it more accessible and efficient. Sites such as Shunya and NITIVeT are transforming rural veterinary care by providing remote consultations, diagnoses, and e-scripts, effectively closing the gap between farmers and veterinarians. Further, the initiative of the government to modernize veterinary hospitals with advanced diagnostic equipment, including X-rays, ultrasonography, and blood analyzers, along with the addition of telemedicine services and mobile veterinary clinics, is intended to enhance availability, particularly in remote regions, and increase efficiency, hygiene, and quality of treatment for animals.

Players in the market are taking advantage of this trend by creating AI-based platforms that enable online diagnostics and consultations. For example, the Dr.Pashu app features real-time video consultations, AI-driven health checks, and language support, making it accessible to multilingual populations. These innovations not only make services more efficient but also expand the animal drugs market through enhanced demand for pharmaceuticals driven by digital prescriptions and telemedicine services.

India Animal Drugs Market Opportunity

Growing Focus on Preventive Healthcare offering Lucrative Opportunity

India's animal health care industry is experiencing a dramatic transition towards preventive medicine, fueled by growing awareness among pet owners and livestock farmers regarding the merits of early detection of disease and vaccination. This can be seen from the government action, for example, the National Animal Disease Control Programme (NADCP), under which more than 500 million livestock will be vaccinated against Foot and Mouth Disease and Brucellosis by 2030. These large-scale vaccination campaigns not only improve the health of animals but also create demand for vaccines and associated pharma products.

Market participants are taking advantage of this trend by creating and marketing preventive health solutions. Zoetis and Hester Biosciences are adding vaccines, dewormers, and nutritional supplements specific to different animal species to their portfolios. The increase in pet ownership, especially in urban regions, is also causing more demand for preventive care, such as vaccination and check-ups for wellness. This increasing focus on preventive care should propel long-term growth in India's animal drugs market, providing attractive opportunities to industry players.

India Animal Drugs Market Segmentation Analysis

By Product

- Biologics

- Pharmaceuticals

- Medicated Feed Additives

The most dominant segment in the Product Segment is Pharmaceuticals, which commands a market share of 65% in the India Animal Drugs Market from 2026 to 2032. This is largely due to the increasing demand for antibiotics, antiparasitics, and anti-inflammatory medication used in companion animals and livestock. The rising consciousness regarding the health of animals, pet care, and growth in the dairy and poultry industries all have contributed to accelerating the demand for quality pharmaceutical products. A survey states that government initiatives for large-scale vaccination and disease control campaigns are also showing a consistent demand for veterinary medicines in rural and urban areas.

Other important segments, including biologics and medicated feed additives, are also growing as farmers implement preventive healthcare practices to enhance productivity and animal health. Growing emphasis on preventive treatments and enhanced veterinary facilities is projected to drive sustained growth for all product categories through the forecast period.

By Route of Administration

- Oral

- Injectable

- Tropical

- Others

The segment with the highest market share under the Route of Administration is Injectable, which accounted for 45% of the India Animal Drugs Market during 2026–2032. Injectables are preferred in veterinary treatment due to their fast action, higher bioavailability, and effectiveness in treating severe infections or emergencies. According to a survey, the growing cases of bacterial and parasitic infections in livestock and companion animals have led to increased adoption of injectable formulations to ensure quick recovery and reduced mortality rates.

Other routes, such as oral and topical administrations, are also expanding as farmers and veterinarians use them for preventive and long-term treatments. However, the reliability and precision of injectables make them the preferred choice among veterinarians, particularly for large animals like cattle and buffalo. The ongoing focus on improving animal health outcomes and expanding veterinary healthcare infrastructure continues to strengthen the demand for injectable animal drugs in India.

Top Companies in India Animal Drugs Market

The top companies operating in the market include Hester Biosciences Limited, Ceva Santé Animale, Phibro Animal Health Corporation, Boehringer Ingelheim International GmbH, Zoetis, IDEXX Laboratories, Inc., Merck & Co., Inc., Elanco, Virbac, Dechra Pharmaceuticals Plc, etc., are the top players operating in the India Animal Drugs Market.

Frequently Asked Questions

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. India Animal Drugs Market Policies, Regulations, and Standards

4. India Animal Drugs Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. India Animal Drugs Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Animal Type

5.2.1.1. Production- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Companion- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Product

5.2.2.1. Biologics- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Pharmaceuticals- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Medicated Feed Additives- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Route of Administration

5.2.3.1. Oral- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Injectable- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Tropical- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Distribution Channel

5.2.4.1. Veterinary Hospitals & Clinics- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. E-Commerce- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Offline Retail Stores- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

1.1.1.1. Competition Characteristics

1.1.1.2. Market Share & Analysis

6. India Production Animal Drugs Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

7. India Companion Animal Drugs Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Route of Administration- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Boehringer Ingelheim International GmbH

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Zoetis

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.IDEXX Laboratories, Inc.

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Merck & Co., Inc.

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Elanco

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Hester Biosciences Limited

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Ceva Santé Animale

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Phibro Animal Health Corporation

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Virbac

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Dechra Pharmaceuticals Plc

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Animal Type |

|

| By Product |

|

| By Route of Administration |

|

| By Distribution Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.