Germany Pacemakers Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Implantable Pacemakers (Single-Chamber Pacemakers, Dual-Chamber Pacemakers, Biventricular/CRT Pacemakers, Leadless Pacemakers), External Pacemakers (Temporary Pacemakers, Transcutaneous Pacemakers)), By Technology (Conventional Pacemakers, MRI-Compatible Pacemakers, Rechargeable Pacemakers, Remote Monitoring-Enabled Pacemakers), By Patient Demographics (Pediatric Population (<18 years), Adult Population (18–64 years), Geriatric Population (65+ years)), By Application (Arrhythmias, Congestive Heart Failure, Bradycardia, Tachycardia, Heart Block, Others), By End User (Hospitals, Cardiac Centers, Ambulatory Surgical Centers, Others)

|

Major Players

|

Germany Pacemakers Market Statistics and Insights, 2026

- Market Size Statistics

- Pacemakers in Germany is estimated at USD 890 million in 2025.

- The market size is expected to grow to USD 1.35 billion by 2032.

- Market to register a cagr of around 6.13% during 2026-32.

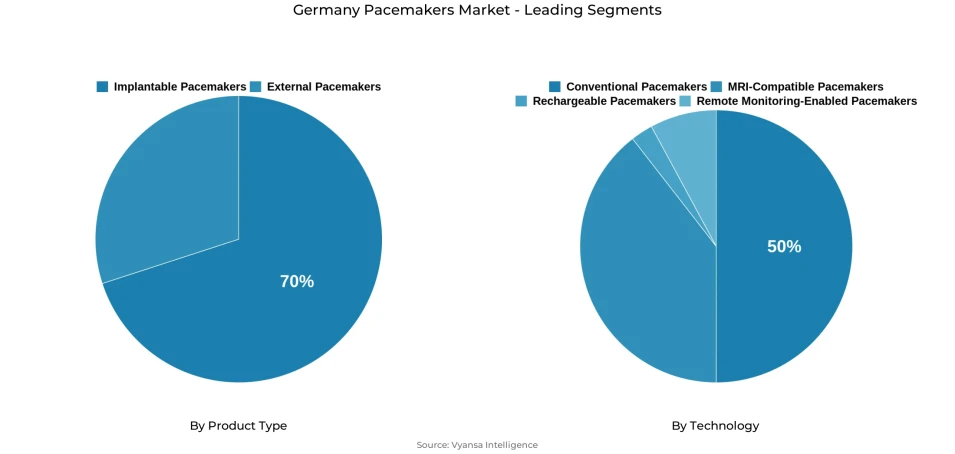

- Product Type Shares

- Implantable pacemakers grabbed market share of 70%.

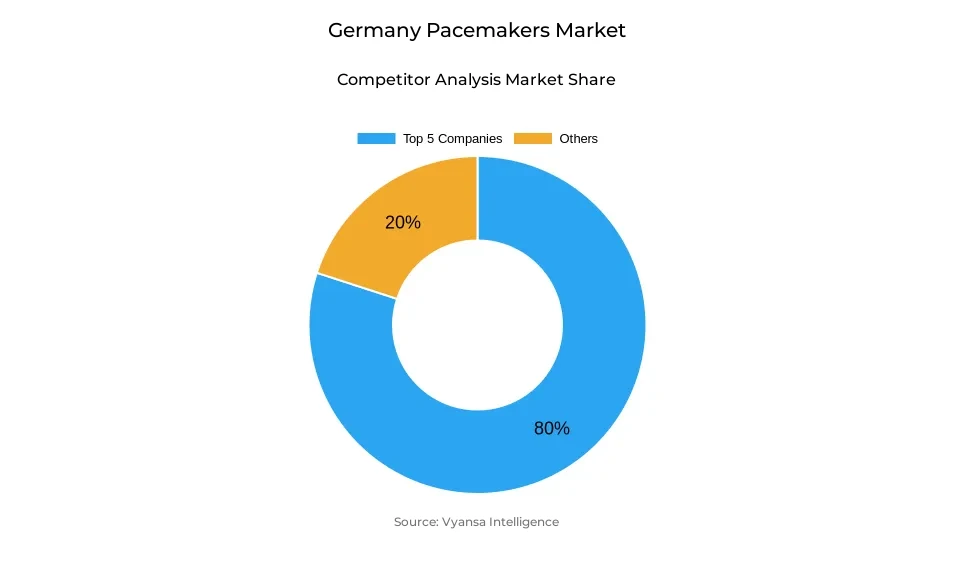

- Competition

- More than 10 companies are actively engaged in producing pacemakers in Germany.

- Top 5 companies acquired around 80% of the market share.

- Lepu Medical; OSYPKA MEDICAL (Osypka AG); Medico International Inc; Medtronic; Abbott (St. Jude Medical) etc., are few of the top companies.

- Technology

- Conventional pacemakers grabbed 50% of the market.

Germany Pacemakers Market Outlook

Germany pacemaker market, in terms of value, is estimated to be around USD 890 million in 2025 and is expected to grow to approximately USD 1.35 billion by the end of 2032, at a CAGR of about 6.13% from 2026 to 2032. This largely boils down to the aging population, where more than 22% of the population falls within the age bracket of 65 years and above, and the increasing chances of cardiovascular disorders among the middle-aged group.

The European Union’s Medical Device Regulation (MDR) criteria have raised the bar for the approval of high-risk implantable devices, with the approval process extending to 13 to 18 months and thus reducing the time to market innovative technology. Nevertheless, the challenges offered by the regulations and the development time and cost involved, as mentioned, have not diminished the rich healthcare structure accessible in Germany, ensuring that there is quality technology accessible to the heart centers and hospitals.

Germany is seeing a rising adoption of patient monitoring and integration in cardiology. This is due to the Digital Healthcare Act, which makes telehealthcare applications eligible for reimbursement, making it possible to track and detect arrhythmia in the heart in real time. There is growth in leadless pacemakers and those that are MRI-compatible due to their minimally invasive technology, increased patient safety, and comfort.

In the products considered, Implantable Pacemakers dominate with a market share of 70%. This is due to the trust and trustworthiness doctors have in them. Then, with respect to technologies, Traditional Pacemakers dominate with a market share of 50%. They have already tested the waters, and their results have turned out satisfactory with respect to safety, effectiveness, and cost. They form the strong foundation of Germany's Pacemaker market.

Germany Pacemakers Market Growth Driver

Expanding Elderly Population Intensifying Demand for Cardiac Rhythm Management

A rising geriatric population is also leading to a large market demand for pacemakers and cardiac rhythm management devices in Germany. As of 2024, persons aged 65+ account for approximately 22.4% of the total population of Germany, consisting of approximately 18.7 million people. This is the highest share within the European Union. This trend remains one of the major factors responsible for the rising demand for pacemakers. With the working population continually declining, the presence of such devices in the market is becoming a crucial aspect with regards to the overall German healthcare infrastructure.

Apart from the older population, a considerable portion of the middle-aged population is also at risk for cardiovascular disease, solidifying the varied list of potential users for pacemakers. From the Robert Koch Institute's GEDA 2022 study, a total of 12.8% of the adult population aged 35 to 69 years is at a high risk for cardiovascular disease. The varied risk pattern proves the pacemaker market in Germany is a multi-generational market.

Germany Pacemakers Market Challenge

Regulatory Framework Slowing Market Entry and Innovation

The Medical Device Regulation (MDR) in the European Union has raised vigilance in approval requirements for high-risk implant devices like pacemakers, thus raising significant barriers for manufacturers in Germany. The enactment of these regulations in 2021 has disturbed already existing approval procedures and increased approval timescales, thus preventing timely entry into the market of innovative cardiac devices. A shortage in Notified Body capacity has emerged as a significant issue because now their approval needs have exceeded their capacity many folds. The average approval under MDR in high-risk categories takes 13-18 months.

This not only has a great impact on small and mid-sized innovative companies who would like to bring leadless and remotely monitorable products to the market, but also creates costs for the development of products and the time to market, which benefits large companies with the necessary support in the authorities. This creates an environment of incremental innovation in the field of technology, with possible delays in the upgrade of technology available in the hospital networks of Germany.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Germany Pacemakers Market Trend

Digital Integration Transforming Cardiac Care Practices

The German healthcare system is quickly opening up to remote patient monitoring and digital integration in heart care, including pacemakers. The Digital Healthcare Act (DVG) has made possible the reimbursement of telemedicine solutions, such as allowing doctors to prescribe and integrate remote monitoring into their standard treatments. Consequently, cloud-based solutions for pacemaker management, which involve cloud platforms transferring constant heart information, have become popular and have gained much traction among Germans, including seniors.

With remote monitoring becoming more common, there are changes being introduced into devices as well. Pacemakers need to have more advanced sensors, longer battery life, and secure wireless connectivity. Instead of periodic in-office reviews, remote digital monitoring will allow for more precision in treatments and increased clinic efficiency as well. For patients, this is enabling more effective long-term results, but for companies, this is creating a market for more innovative devices with analytics and adaptive pacing functionality to meet the precision medicine needs of Germany.

Germany Pacemakers Market Opportunity

Minimally Invasive and MRI-Compatible Systems Driving Growth Potential

A conducive environment for embracing minimally invasive pacemakers in Germany has been identified for its compatibility to the safety standards and preferences of patients. The new technology is completely free from surgical pockets and transvenous leads, which makes it ideal as it does not pose the risk of infection and lead failure as in the previous technology. The technology is ideal as it is convenient to use and patients will find it attractive in terms of aesthetics and appearance. There is already promising adoption of the technology in academic hospitals and specialized institutions.

MRI-compatible pacemakers are also finding popularity because they are compatible with one of the most commonly utilized diagnosis modalities found in Germany. The traditional pacemakers were quite restrictive for MRI, and therefore, the diagnosis modalities were limited for people with two or more diseases. The increased utilizability and compatibility for the magnetic resonance imaging modalities along with the intelligent pacing algorithms have opened new areas for the growth of advanced pacemakers, making them a prominent growth area for the industry to penetrate the high-value health care industry of Germany.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Germany Pacemakers Market Segmentation Analysis

By Product Type

- Implantable Pacemakers

- External Pacemakers

Implantable pacemakers is the leading segment, accounts for around 70% of Germany’s total pacemaker market, cementing their role as the gold standard for long-term cardiac rhythm management. Their dominance reflects a combination of established clinical protocols, durable performance, and strong physician confidence in their therapeutic reliability. Implantable systems support sustained monitoring and intervention for arrhythmias and bradycardia, ensuring dependable performance over lifespans typically extending 8–10 years. Germany’s robust hospital infrastructure and skilled electrophysiology specialists further reinforce this segment’s continued growth trajectory.

Demand is amplified by demographic pressures and the country’s comparatively high cardiovascular disease burden, which sustains procedural volumes year over year. With proven outcomes and long-established reimbursement frameworks, implantable pacemakers remain indispensable for chronic disease management. While new technologies are emerging, the clinical predictability and system familiarity of implantable pacemakers ensure their continued leadership, providing manufacturers with a stable, high-volume base across both public and private healthcare institutions.

By Technology

- Conventional Pacemakers

- MRI-Compatible Pacemakers

- Rechargeable Pacemakers

- Remote Monitoring-Enabled Pacemakers

Conventional pacemakers continue to command approximately 50% of Germany’s total pacemaker technology market, underscoring the enduring reliance on proven single- and dual-chamber systems. Their widespread use stems from decades of clinical validation, streamlined surgical procedures, and comprehensive reimbursement under Germany’s statutory health insurance. Physicians’ familiarity with these devices contributes to their ongoing preference, especially for standard arrhythmia and bradycardia cases where cost-effectiveness and reliability remain critical decision factors.

Despite technological advancements, conventional systems remain economically advantageous, offering a balanced combination of performance, safety, and affordability. Hospitals continue to favor these devices for their predictable implantation workflows and well-documented outcomes. As leadless and MRI-compatible innovations expand in specialist settings, conventional pacemakers will maintain strong market presence through established clinical pathways and consistent reimbursement coverage, securing their place as the backbone of Germany’s pacemaker technology landscape.

List of Companies Covered in Germany Pacemakers Market

The companies listed below are highly influential in the Germany pacemakers market, with a significant market share and a strong impact on industry developments.

- Lepu Medical

- OSYPKA MEDICAL (Osypka AG)

- Medico International Inc

- Medtronic

- Abbott (St. Jude Medical)

- Boston Scientific

- BIOTRONIK

- MicroPort Scientific

- Integer Holdings Corp

- ZOLL Medical Corporation

Market News & Updates

- Medtronic, 2025:

Launched a global study including European sites exploring conduction system pacing to improve outcomes for heart failure patients with preserved ejection fraction.

- ZOLL Medical Corporation, 2025:

Recognized key player in the Germany pacemaker market with emphasis on advanced external and implantable devices to meet rising cardiac arrhythmia cases.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Germany Pacemakers Market Policies, Regulations, and Standards

4. Germany Pacemakers Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Germany Pacemakers Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Implantable Pacemakers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Single-Chamber Pacemakers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Dual-Chamber Pacemakers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Biventricular/CRT Pacemakers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Leadless Pacemakers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. External Pacemakers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Temporary Pacemakers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Transcutaneous Pacemakers- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Technology

5.2.2.1. Conventional Pacemakers- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. MRI-Compatible Pacemakers- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rechargeable Pacemakers- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Remote Monitoring-Enabled Pacemakers- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Patient Demographics

5.2.3.1. Pediatric Population (<18 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Adult Population (18–64 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Geriatric Population (65+ years)- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Application

5.2.4.1. Arrhythmias- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Congestive Heart Failure- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Bradycardia- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Tachycardia- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Heart Block- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By End User

5.2.5.1. Hospitals- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Cardiac Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Ambulatory Surgical Centers- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Germany Implantable Pacemakers Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Patient Demographics- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Germany Single-Chamber Pacemakers Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Patient Demographics- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Germany Dual-Chamber Pacemakers Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Patient Demographics- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

9. Germany Biventricular/CRT Pacemakers Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Patient Demographics- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

10. Germany External Pacemakers Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Technology- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Patient Demographics- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By End User- Market Insights and Forecast 2022-2032, USD Million

11. Germany Temporary Pacemakers Market Statistics, 2022-2032

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in USD Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Technology- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Patient Demographics- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By End User- Market Insights and Forecast 2022-2032, USD Million

12. Germany Transcutaneous Pacemakers Market Statistics, 2022-2032

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in USD Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Technology- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Patient Demographics- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By End User- Market Insights and Forecast 2022-2032, USD Million

13. Germany Leadless Pacemakers Market Statistics, 2022-2032

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in USD Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Technology- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Patient Demographics- Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Application- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By End User- Market Insights and Forecast 2022-2032, USD Million

14. Competitive Outlook

14.1. Company Profiles

14.1.1. Medtronic

14.1.1.1. Business Description

14.1.1.2. Product Portfolio

14.1.1.3. Collaborations & Alliances

14.1.1.4. Recent Developments

14.1.1.5. Financial Details

14.1.1.6. Others

14.1.2. Abbott (St. Jude Medical)

14.1.2.1. Business Description

14.1.2.2. Product Portfolio

14.1.2.3. Collaborations & Alliances

14.1.2.4. Recent Developments

14.1.2.5. Financial Details

14.1.2.6. Others

14.1.3. Boston Scientific

14.1.3.1. Business Description

14.1.3.2. Product Portfolio

14.1.3.3. Collaborations & Alliances

14.1.3.4. Recent Developments

14.1.3.5. Financial Details

14.1.3.6. Others

14.1.4. BIOTRONIK

14.1.4.1. Business Description

14.1.4.2. Product Portfolio

14.1.4.3. Collaborations & Alliances

14.1.4.4. Recent Developments

14.1.4.5. Financial Details

14.1.4.6. Others

14.1.5. MicroPort Scientific

14.1.5.1. Business Description

14.1.5.2. Product Portfolio

14.1.5.3. Collaborations & Alliances

14.1.5.4. Recent Developments

14.1.5.5. Financial Details

14.1.5.6. Others

14.1.6. Lepu Medical

14.1.6.1. Business Description

14.1.6.2. Product Portfolio

14.1.6.3. Collaborations & Alliances

14.1.6.4. Recent Developments

14.1.6.5. Financial Details

14.1.6.6. Others

14.1.7. OSYPKA MEDICAL (Osypka AG)

14.1.7.1. Business Description

14.1.7.2. Product Portfolio

14.1.7.3. Collaborations & Alliances

14.1.7.4. Recent Developments

14.1.7.5. Financial Details

14.1.7.6. Others

14.1.8. Medico International Inc

14.1.8.1. Business Description

14.1.8.2. Product Portfolio

14.1.8.3. Collaborations & Alliances

14.1.8.4. Recent Developments

14.1.8.5. Financial Details

14.1.8.6. Others

14.1.9. Integer Holdings Corp

14.1.9.1. Business Description

14.1.9.2. Product Portfolio

14.1.9.3. Collaborations & Alliances

14.1.9.4. Recent Developments

14.1.9.5. Financial Details

14.1.9.6. Others

14.1.10. ZOLL Medical Corporation

14.1.10.1.Business Description

14.1.10.2.Product Portfolio

14.1.10.3.Collaborations & Alliances

14.1.10.4.Recent Developments

14.1.10.5.Financial Details

14.1.10.6.Others

15. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Technology |

|

| By Patient Demographics |

|

| By Application |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.